Fire Hydrants Market Research, 2031

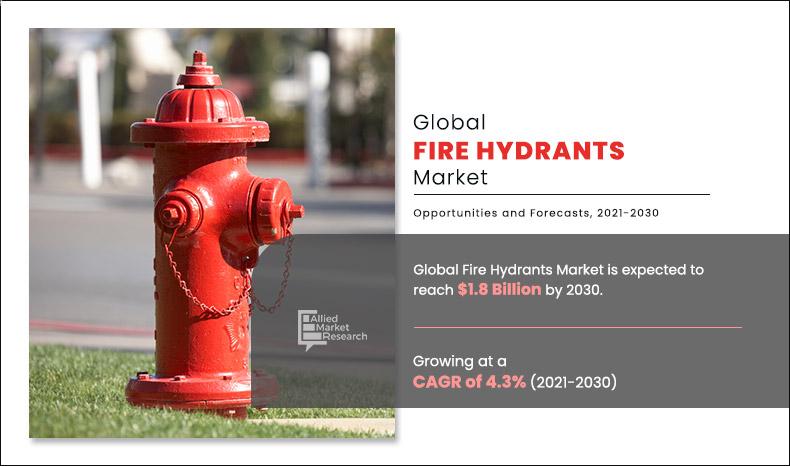

The global fire hydrants market size was valued at $1,133.3 million in 2020, and is projected to reach $1,775.1 million by 2030, registering a CAGR of 4.3% from 2021 to 2030. Fire hydrants are mechanical devices normally placed outside a building. However, internal fire hydrants may be mounted if certain portion of a building cannot be safeguarded by an exterior one. In addition, multiple fire hydrants may be needed in a building structure based on reach of hoses and size of a property.

Increase in commercial and industrial building construction has generated a rise in sales of fire hydrants, which, in turn, is expected to boost growth of the market. Owing to increase in population, there is increase in demand for more and more industries, hospitals, and commercial complexes, which is expected to garner of the fire hydrants market Growth . In addition, industries such as oil & gas and several manufacturing industries involve flammable materials such as crude oil, petroleum, and flammable gases, hence, to evade any fire accidents, cutting-edge fire protection systems are required in such industries.

Increase in industrialization and urbanization, surge in commercial and industrial construction, and rise in awareness toward protection of assets drive of the fire hydrants market. In addition, major players provide fire hydrants for commercial and industrial sectors. For instance, in June 2018, Mueller, a fire hydrant company based in the U.S., launched Super Centurion A-403 Fire Hydrant. This hydrant features two-piece ductile iron upper barrel with a nozzle section. Hence, surge in commercial and industrial construction activities are anticipated to drive growth of the market.

Strict norms by governments to install fire protection systems in residential and non-residential buildings globally is expected to fuel growth of the market. However, high installation and maintenance cost of fire hydrants hinders the market growth.

Moreover, smart fire hydrants provide lucrative opportunities for facility management service providers. Fire hydrants can be operated using sensors or artificial intelligence (AI). IoT technology is being used by key players to detect fire by use of sensors.

The COVID-19 pandemic has forced many companies in the global fire hydrants market to halt their business operations for a short term to comply with new government regulations to curb spread of the disease. This halt in operations directly impacts revenue flow of the global market growth . In addition, there is a halt in manufacturing of fire hydrants, owing to lack of raw materials and manpower in the lockdown period. Further, no new consignments are being received by companies operating in this sector. Hence, stop in construction activities and lockdowns for several months have affected the global fire hydrants market analysis and is anticipated to have a slow recovery is anticipated during the forecast period.

Furthermore, number of COVID-19 cases are expected to reduce in the near term as vaccine for the same is introduced in 2021. This is further expected to lead to re-initiation of fire hydrant companies at their full-scale capacities, which, in turn, would aid the fire hydrant market to recover in 2022.

Segment Review

On the basis of product type, the market is divided into dry barrel and wet barrel. On the basis of product type, the dry barrel segment generated the highest revenue in 2020 and wet barrel segment is projected to grow at a significant CAGR from 2021 to 2030. Based on operating type, the market is divided into conventional, and smart. By operating type, the smart segment is projected to grow at a significant CAGR during the forecast period.

By Operating Type

Conventional segment holds dominant position in 2020

Based on construction, the market is divided into underground and above ground. The above ground segment is projected to grow at a significant CAGR from 2021 to 2030. On the basis of end user, the market is divided into commercial and industrial. The industrial segment is projected to grow at a significant CAGR during the forecast period.

Region wise, the global fire hydrants market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific is expected to exhibit highest growth during the forecast period, owing to commercial and industrial construction activities in the region. For instance, the government of China is planning to invest around $394 billion in 2020, in both commercial and industrial buildings, which is expected to garner to growth of the market.

By End User

Commercial segment holds dominant position in 2020

Competition Analysis

The key players profiled in the Fire Hydrants Market report include American Cast Iron Company AVK International A/S, Compagnie De Saint -Gobain S.A., EJ Group, Inc, Grundfos Holding A/S, Kupferle Foundry Company, McWane, Inc, Mueller Water Products, Inc, Talis Management Holding GmbH, Terminal City Iron Works Ltd, Bocciolone Antincendio S.P.A., CSA S.R.L., HAWLE BETEILIGUNGSGESELLSCHAFT m.b.H., IMP Armature D.O.O., Rapidrop Global Ltd, Newage Fire Fighting Co. Ltd, NT Agni Solutions Pvt Ltd, Shaoxing Shangyu Hongye Fire Protection Equipment Factory (HONGYE), Smith & Sharks Projects Pvt Ltd, Steel Recon Industries SDN. BHD., Torvac Solutions PTY Ltd, ALBILAD Fire Fighting Systems Company, Ltd, Bristol Fire Engineering, NAFFCO FZCO, and SFFECO Global.

The major players operating in the global fire hydrants market share have adopted key strategies such as business expansion to strengthen their market outreach and sustain the stiff competition in the market. For instance, in May 2019, AMERICAN Flow Control, a subsidiary of AMERICAN Cast Iron Pipe Company announced to open a new research & development center named AMERICAN Innovation, LLC mainly for design and research for fire hydrants and fire valves in the U.S. The new innovation center will be built in an area of 30,000-square-foot and will cost nearly $9 to $12 million for its formation.

By Region

North America holds a dominant position in 2020 and is expected to grow at a significant rate during the forecast period.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging fire hydrants Market trends and dynamics.

- In-depth market analysis is conducted by constructing estimations for the key segments between 2020 and 2030.

- Extensive of the fire hydrants market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global fire hydrants market forecast analysis from 2021 to 2030 is included in the report.

- The key market players operating in the market are profiled region-wise in this report, and their strategies are analyzed thoroughly, which help understand the competitive outlook of the fire hydrants market industry.

Fire Hydrants Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By OPERATING TYPE |

|

| By CONSTRUCTION |

|

| By END USER |

|

| By Region |

|

Analyst Review

The fire hydrants market has witnessed a notable growth in past few years. Developing countries such as India, China, Africa, and South Korea have witnessed increase in demand for fire hydrants. The growth in demand for fire hydrants in the commercial sector is an important factor that boosts growth of the market. Moreover, rise in demand for technologically advanced fire hydrants such as remote monitoring fire hydrants propels the market to expand in developed regions.

Leading companies in the fire hydrants market such as Mueller, Saint Gobain, and others have witnessed significant growth in past few years. Innovative products, such as smart fire hydrants with pressure & temperature sensors, launched by these companies have augmented their overall customer base. Moreover, other players operating in the market such as Mueller, Grundfos, and others are expected to strengthen their product line with higher technological products to cater to increase in requirements from consumers. Players operating in the fire hydrants market focus on development and launch of high-quality products, depending on needs and preferences of consumers to keep up with recent technological advancements. Moreover, innovative marketing and positioning strategies of players have helped to increase the overall market size.

The global fire hydrants market size was $1.1 billion in 2020 and is projected to reach $1.8 billion in 2030, growing at a CAGR of 4.3% from 2021 to 2030.

The forecast period considered for the fire hydrants market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

The base year considered in the fire hydrants market is 2020.

The report for global fire hydrants market doesn’t provides Value Chain Analysis, but if there is a requirement for the same, it could be added as an additional customization.

On the basis of operating type, the conventional segment is expected to be the most influencing segment growing in the facility management services market report.

Based on the end-user, in 2020, the industrial segment generated the highest revenue, accounting for over half of the market, and is projected to grow at a CAGR of 4.8% from 2021to 2030.

The report contains an exclusive company profile section, where leading 25 companies in the market are profiled. These profiles typically cover company overview, geographical presence, and market dominance (in terms of revenue).

The market value of global fire hydrants market is $1.2 billion in 2021.

Loading Table Of Content...