Fire Protection Coating Market Research, 2032

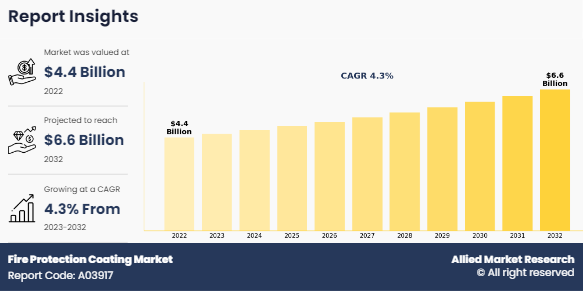

The global fire protection coating market size was valued at $4.4 billion in 2022, and is projected to reach $6.6 billion by 2032, growing at a CAGR of 4.3% from 2023 to 2032. Fire protection coatings are essential for safeguarding structures against the harmful effects of fires. These coatings serve as a crucial line of protection, preventing the spread of flames and minimizing damage to buildings and their contents. Through advanced technologies and formulations, fire protection coatings offer unparalleled resilience and efficacy in the face of extreme heat and fire hazards. These coatings are particularly engineered to adhere to various surfaces, including steel, concrete, wood, and other construction materials, forming a durable barrier that inhibits the ignition and propagation of flames.

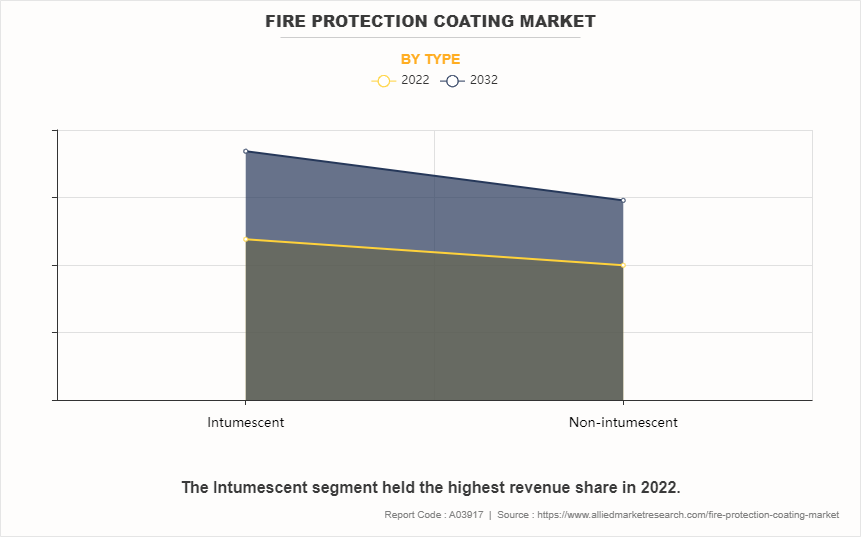

Moreover, fire protection coatings come in diverse forms, such as intumescent coatings, ablative coatings, and cementitious coatings, each tailored to specific applications and performance requirements. They undergo thorough testing and certification processes to ensure compliance with industry standards and regulatory mandates, providing assurance of their reliability and effectiveness in real-world fire scenarios.

Governments of various countries across the globe are putting greater emphasis on fire safety regulations, resulting in a surge in demand for advanced fire protection coatings. This growth in the market is due to a growing number of building codes requiring the implementation of such coatings. Some of the major standards of fire protection coatings are ASTM E84, ASTM E119, UL 263, and UL 1709. With a focus on safeguarding lives and property, authorities are prioritizing measures to mitigate fire hazards effectively. Consequently, industries and construction sectors are compelled to adhere to these stringent standards, driving the adoption of advanced coatings adapted for fire protection.

The obligation for compliance with regulatory standards has become a driving force behind the expansion of the fire protection coating industry. These regulations, crafted to enhance fire safety, necessitate the integration of innovative coatings that offer superior fire resistance properties. As governments worldwide intensify their efforts to enhance fire safety measures, businesses and infrastructure developers are supporting these advancements in coatings technology to ensure compliance with mandated standards. The increasing demand for fire protection coatings can be attributed to the global demand for enhanced fire safety measures. This trend highlights the critical role that advanced coatings play in mitigating fire risks and ensuring compliance with regulatory frameworks aimed at safeguarding the infrastructure and would simultaneously secure fire protection coating market forecast.

Manufacturers face a formidable challenge in meeting stringent fire safety standards, as it necessitates coatings with extraordinary technical performance. These coatings must exhibit durability, ensuring long-term protection against various environmental factors. Adhesion is equally crucial, as coatings must firmly adhere to surfaces to maintain their efficacy over time. Moreover, heat resistance is a paramount requirement to withstand high temperatures without compromising performance. Manufacturers must accurately formulate coatings that achieve an optimal equilibrium, where durability, adhesion, and heat resistance are enhanced to meet regulatory requirements effectively.

Furthermore, cost-effectiveness adds another layer of complexity, as achieving superior technical performance while remaining economically viable demands innovative approaches and efficient production processes. Overcoming these challenges requires a combination of advanced materials science, rigorous testing methodologies, and strategic collaboration between researchers, engineers, and manufacturers. Moreover, the successful development of coatings that represent these attributes is important in enhancing fire safety across various industries and safeguarding lives and property from the devastating consequences of fires.

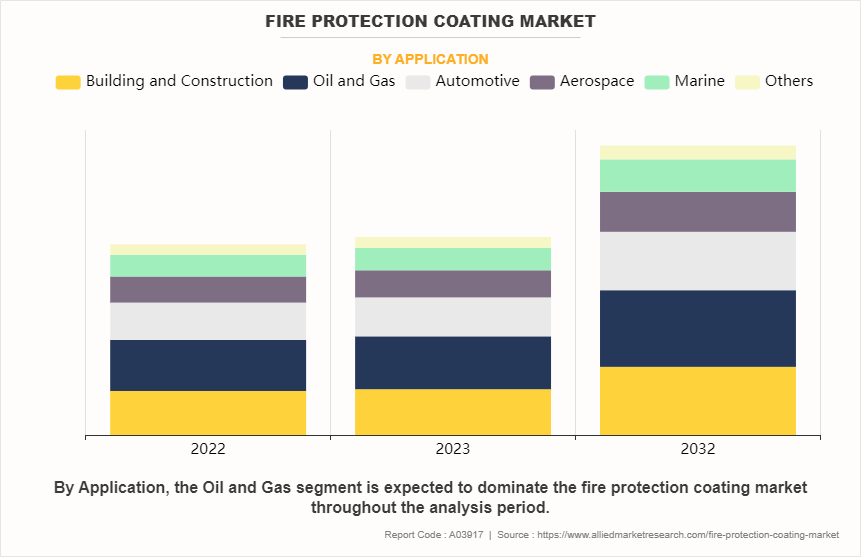

The developing oil and gas industry is anticipated to provide a significant opportunity for the fire protection coating market players in the upcoming years. As global energy demands continue to increase, particularly in emerging economies, the exploration, extraction, and transportation activities within the oil and gas sector are experiencing a significant increase. With such expansion comes an increased need for robust fire protection measures to safeguard critical infrastructure, equipment, and personnel from the risk of fire hazards. Fire protection coatings play a major role in mitigating the impact of potential fires by providing heat resistance and insulation properties to various surfaces, including pipelines, storage tanks, and drilling equipment.

The increasing investments in oil and gas infrastructure development across both onshore and offshore locations create a conducive environment for the proliferation of fire-resistant coatings solutions. For instance, in the wake of recent advancements in offshore drilling technologies, companies operating in the oil and gas sector are increasingly investing in innovative fire protection coatings designed specifically for offshore platforms and equipment. Moreover, stringent regulatory requirements and safety standards within the oil and gas industry further drives the adoption of advanced fire protection coatings. Manufacturers operating in this market are poised to capitalize on this rising demand by innovating and offering solutions that meet the unique challenges and specifications of the oil and gas sector. Therefore, the fire protection coating market growth is anticipated to witness robust surge in the upcoming years, driven by the increasing opportunities within the flourishing oil and gas industry.

Competitive Landscape

The key players profiled in this report are Pyrotech, Nullifire, No-Burn, Inc., Akzo Nobel N.V., Sherwin-Williams Company, Jotun AS, Nippon Paint Co., Ltd., Hempel A/S, Contego International, Inc., and BASF SE.

Product launch and strategic partnership are common strategies followed by major market players. For instance, in February 2023, PPG introduced an innovative solution with the launch of PPG Steelguard 951 coating, specifically engineered to address the evolving needs of modern architectural steel. This innovative epoxy intumescent fire protection coating offers performance, capable of providing up to three hours of cellulosic fire protection. In the event of a fire, the coating undergoes a transformative process, expanding from a thin, lightweight film into a dense, foam-like layer. This expanded layer acts as insulation for the steel, preserving its structural integrity and affording crucial additional time for safe evacuation while minimizing damage to buildings and assets. PPG Steelguard 951 coating offers dual benefits by also delivering effective corrosion protection in highly corrosive atmospheric environments, meeting ISO 12944 C5 standards without requiring a topcoat.

This feature not only streamlines project timelines but also reduces costs, enhancing overall project efficiency. With the capability to achieve up to 3,500 microns dry film thickness in a single coat and rapid curing properties, this coating ensures accelerated project completion, allowing surfaces to be handled the day after application. PPG's commitment toward innovation and performance is evident in the development of PPG Steelguard 951 coating, offering a comprehensive solution for fire protection and corrosion resistance in architectural steel applications.

Segment Analysis

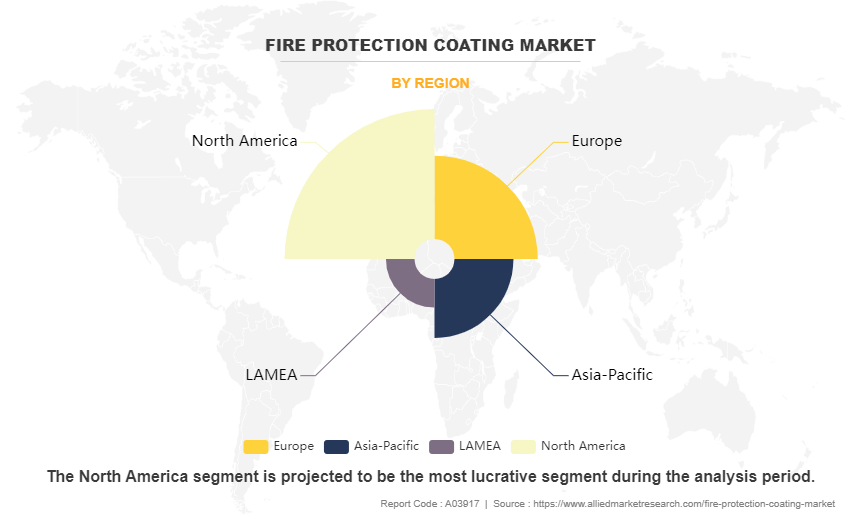

The fire protection coating market share is segmented on the basis of type, application, and region. By type, the market is classified into intumescent and non-intumescent. By application, the market is divided into building and construction, oil and gas, automotive, aerospace, marine, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The fire protection coating market is segmented into Type and Application.

By type, the intumescent sub-segment dominated the global fire protection coating market in 2022. Intumescent coatings have emerged as a major segment in global fire protection strategies, commanding a substantial market share due to their quality performance. These coatings possess a unique capability to expand upon exposure to heat, creating a robust insulating layer that significantly retards the spread of fire. Their effectiveness in fortifying structures against fire hazards has led them to the forefront of the market. With increased emphasis on fire safety regulations by industries and governments worldwide, the demand for intumescent coatings has witnessed a promising surge. Architects, builders, home owners, and facility managers are increasingly turning to these coatings as a dependable solution for augmenting fire resistance across diverse applications, spanning residential, commercial, and industrial domains.

By application, the oil and gas sub-segment dominated the global fire protection coating market in 2022. Fire protection coatings find extensive utilization within oil refineries, gas processing plants, and offshore drilling platforms, among other critical infrastructure within the oil and gas sector. This dominance is owing to the inherent risks associated with oil and gas operations, where fire hazards pose severe threats to personnel safety, operational continuity, and asset protection. Thus, the demand for effective fire protection solutions remains essential in safeguarding these facilities against potential disasters. Moreover, stringent regulations and safety standards imposed by regulatory authorities further boost the adoption of fire protection coatings within the oil and gas industry. Compliance with these standards necessitates the implementation of robust fire safety measures, thereby driving the demand for specialized coatings designed to the unique requirements of the oil and gas sector.

By region, North America dominated the fire protection coating market in 2022. North America's dominance in the fire protection coatings industry highlights its technological advancement, market ingenuity, and alignment with consumer preferences. This leadership position not only signifies the region's major role in shaping global trends but also highlights its influence in advancing innovations within the industry. Factors such as advanced infrastructure, stringent safety standards, and proactive fire prevention initiatives contribute to North America's dominance. The region's proactive approach towards fire prevention and mitigation further solidifies its position as a key player in driving the evolution of fire protection coatings worldwide. Thus, North America's dominance highlights its significant contribution to the advancement and trajectory of fire protection technology on a global scale.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fire protection coating market analysis from 2022 to 2032 to identify the prevailing fire protection coating market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fire protection coating market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fire protection coating market trends, key players, market segments, application areas, and market growth strategies.

Fire Protection Coating Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.6 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hempel A/S, Nippon Paint Co., Ltd., BASF SE, No-Burn, Inc., Nullifire, Contego International, Inc., Pyrotech, Sherwin-Williams Company, Akzo Nobel N.V., Jotun AS |

The global fire protection coating market is experiencing significant growth attributed to the stringent regulatory guidelines.

The major growth strategies adopted by the fire protection coating market players are product launches and partnership agreements.

Asia-Pacific will provide more business opportunities for the global fire protection coating market in the future.

Pyrotech, Nullifire, No-Burn, Inc., Akzo Nobel N.V., Sherwin-Williams Company, Jotun AS, Nippon Paint Co., Ltd., Hempel A/S, Contego International, Inc., and BASF SE are the major players in the fire protection coating market.

The intumescent sub-segment of the type segment acquired the maximum share of the global fire protection coating market in 2022.

The oil and gas industry is one of the major customers in the global fire protection coating market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global fire protection coating market from 2022 to 2032 to determine the prevailing opportunities.

Fire protection is crucial in the oil and gas industry, where the application of specialized systems is vital. From refineries to drilling operations, fire protection measures are extensively utilized to safeguard against potential hazards, ensuring the safety of personnel, equipment, and the environment amidst the volatile nature of these operations.

The rising application of passive fire protection presents an expanding opportunity for growth within the fire protection coating industry. As industries increasingly prioritize safety measures and regulatory standards become more stringent, the demand for effective passive fire protection solutions is projected to increase.

Loading Table Of Content...

Loading Research Methodology...