Fire Protection System Pipes Market Research, 2032

The global fire protection system pipes market size was valued at $20.2 billion in 2022, and is projected to reach $34.7 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032. Fire protection system pipes are specialized channels essential for fire safety purposes, designed to convey and distribute fire suppressants or water during emergencies across various sectors. Available in diverse materials like steel, CPVC, and others, these pipes serve specific functions in fire suppression and fire sprinkler systems. They cater to a wide array of users including commercial, industrial, governmental, institutional, and other sectors, forming an indispensable part of fire safety infrastructure. Their primary role within fire protection systems involves efficiently transporting firefighting agents to control, suppress, or extinguish fires, ensuring safety across buildings, facilities, and structures in different industries and establishments.

Market dynamics

Fire suppression pipes are mostly used in commercial and industrial settings to ensure employee safety. The sector is growing because of the rising risk of property loss as well as worries about public safety brought on by fire mishaps. For instance, the European Government spent over $35 billion a year on fire safety services in 2021. Building fire safety is a significant social concern as, according to the Fire Safe Europe (FSEU), a European society for fire safety, there are at least 5,000 fire occurrences in Europe every day. Therefore, it is projected that increased awareness of fire safety will contribute to the market expansion for fire protection system pipes market growth.

The growth of the market for fire protection system pipes heavily relies on investments in residential and commercial construction. Increased demand for constructing homes and commercial buildings, driven by rising disposable incomes and new product introductions, fuels this growth. Government initiatives promoting green building concepts, focusing on energy efficiency, have further influenced this sector. The construction growth, evident in Canada's $349 billion industry output in 2022 and the projected $8 trillion global construction industry by 2030, underscores its significance. Developing nations like China, Vietnam, Brazil, and India contribute to this growth due to economic expansion and urbanization. Notably, commercial construction in Brazil, Eastern Europe, and the infrastructure development surge in Asia-Pacific, particularly in India and China, are pivotal factors. This construction surge worldwide is expected to propel the global fire protection system pipes industry.

Nevertheless strict government laws governing the use of natural resources like metals and price fluctuations for raw materials are expected to stifle the market's expansion for fire prevention system pipes globally. For example, beginning in 2023, the United States government imposed 25% tariffs on steel imports and 10% tariffs on aluminum imports, considerably raising the prices of these metals in the United States. Therefore, it is projected that the volatile and growing prices of metal and other materials will limit the industry's growth throughout the forecast period for fire prevention systems pipes.

Conversely, a number of government projects pertaining to the advancement of infrastructure have been implemented. Demand for fire protection system pipes in infrastructure projects across several sectors is driven by an increase in real estate investment. The government of the United States is expressed it would invest $1.2 trillion in the infrastructure of the country by 2021, with funds coming from private as well as public funding. Therefore, it is anticipated that government spending in the building infrastructure industry will present profitable chances for market expansion. Future market expansion and significant financial potential are anticipated as a result of these tendencies.

Segmental Overview

The global fire protection system pipes market is classified into material type, application, end user, and region. Based on material type, the market is categorized into steel, CPVC and others. Depending on application, the market is segmented into fire suppression systems and fire sprinkler systems pipes. By end user, the market is bifurcated into commercial, industrial, governmental, institutional, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

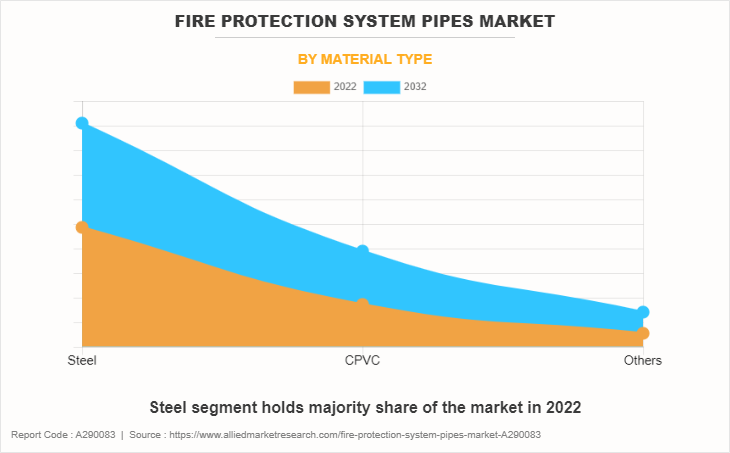

By material type: The fire protection system pipes market is divided into steel, CPVC and others. Steel fire protection system pipes are specialized conduits integrated into fire safety systems. Constructed from durable steel, these pipes transport water or fire suppressants during emergencies. CPVC (Chlorinated Polyvinyl Chloride) fire protection system pipes are specialized conduits utilized in fire safety systems within buildings or structures. These pipes are made from CPVC, a thermoplastic material known for its fire-resistant properties and high temperature tolerance. CPVC fire protection system pipes are engineered to transport water or fire suppressants during fire emergencies. The steel segment dominated the fire protection system pipes market share in 2022, owing to associated benefits of steel such as high strength, robustness, and enhanced chemical resistance. The CPVC segment is expected to exhibit the highest CAGR share in the material type segment in the fire protection system pipes market during the forecast period.

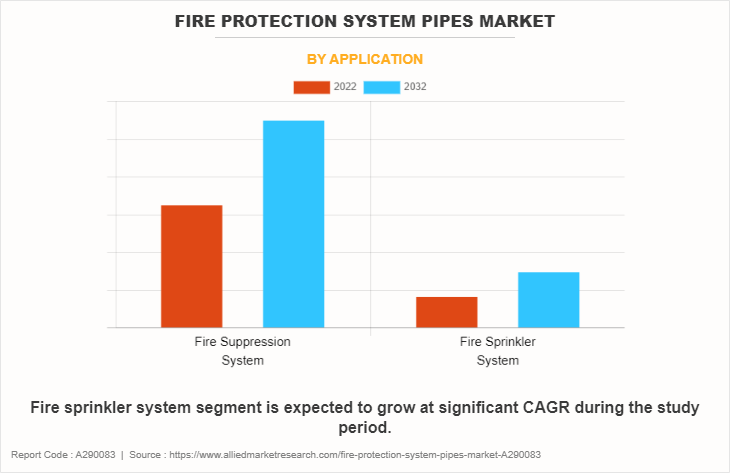

By application: The fire protection system pipes market is divided into fire suppression systems and fire sprinkler systems pipes. The segment includes fire protection systems which use fire suppression agents such as carbon dioxide, wet chemical fire suppression, and dry chemical suppression. The fire sprinkler segment includes a piping system for wet pipe sprinklers, dry pipe sprinklers, deluge sprinklers, and pre-action sprinklers. The fire suppression systems segment led the global fire protection system pipes market in 2022. The fire sprinkler systems pipes segment is expected to exhibit the highest CAGR share in the application segment in the fire protection system pipes market during the forecast period.

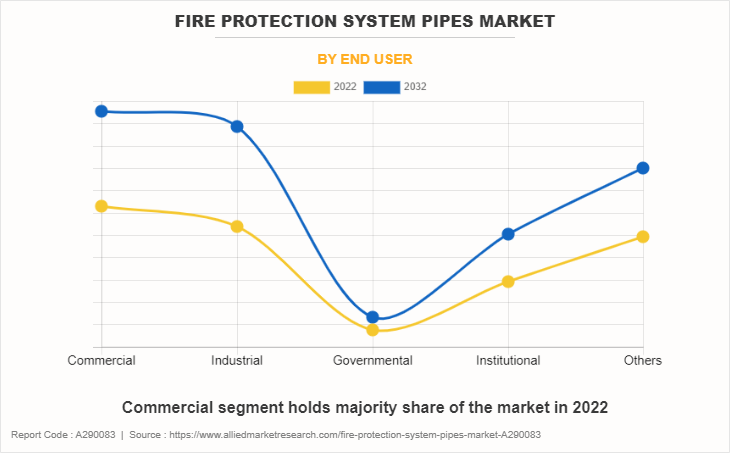

By end user: The fire protection system pipes market is divided into commercial, industrial, governmental, institutional, and others. The commercial segment is expected to be the largest revenue contributor during the forecast period, owing to rise in commercial construction industry such as malls, hospitals, and others. The industrial segment is expected to exhibit the highest CAGR share in the end user segment in the fire protection system pipes market during the forecast period.

By region: - Region wise, the fire protection system pipes market forecast is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is expected to govern the market during the forecast period, owing to rise in industrialization and rapid urbanization.

Competition Analysis

Key market players profiled in the report include Anvil International, LLC., ASTRAL LIMITED, China Lesso Group Holdings Limited, Gf Piping Systems, HALMA PLC, Johnson Controls International plc, Minimax Viking GmbH, Mueller Industries, Inc., Simona AG and TPMC STEEL (Tianjin Profound Multinational Trade Co., Ltd.).

Major companies in the market have adopted product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the fire protection system pipes market.

Some examples of expansion product launch and other strategies on the market.

In October 2022, Johnson Controls, a worldwide frontrunner in creating intelligent, healthy, and eco-friendly buildings, declared its recent acquisition of Rescue Air Systems. This company is known for its provision of firefighter air replenishment systems (FARS), which facilitate the refilling of breathing air bottles within buildings for firefighters during emergency responses. This acquisition is expected to strengthen the fire suppression portfolio of the company.

In February 2021, Johnson Controls unveiled the Tyco RM-2 Riser Manifold alongside the Model TD-2 Test and Drain Valve. This setup streamlines testing, and usage for fire protection contractors by offering a pre-assembled, compact unit encompassing crucial components. Featuring an innovative linear shut-off function, it ensures top-notch sealing design. The RM-2 Riser Manifold targets wet pipe sprinkler systems, catering especially to compact commercial buildings in both new constructions and retrofit projects.

In March 2023, Halma announced the acquisition of Fire Pro company which is based in Limassol, Cyprus. The Fire Pro company offers aerosol fire suppression system. This acquisition is expected to strengthen the product portfolio and presence of Halma company.

In February 2023, Halma, the conglomerate of life-saving technology firms, revealed the acquisition of Thermocable (Flexible Elements) Ltd. for its fire detection company, Apollo Fire Detectors Limited (Apollo). Thermocable, situated in Bradford, UK, specialized in producing Linear Heat Detectors (LHDs), cables that sense temperature changes in fire-prone zones, prompting alerts when detecting overheating.

In August 2023, GF Piping Systems got approval from DNV, BV, ABS, and LR for fire-retardant pipe jacket solution called HEAT-FIT a corrosion-free, lightweight thermoplastic piping system.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fire protection system pipes market analysis from 2022 to 2032 to identify the prevailing fire protection system pipes market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fire protection system pipes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fire protection system pipes market trends, key players, market segments, application areas, and market growth strategies.

Fire Protection System Pipes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 34.7 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By Material Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | China Lesso Group Holdings Limited, Mueller Industries, Inc., Minimax Viking GmbH, Simona AG, HALMA PLC, ASTRAL LIMITED, TPMC STEEL (Tianjin Profound Multinational Trade Co., Ltd.), Anvil International, LLC., Johnson Controls International plc, Gf Piping Systems |

Analyst Review

Asia-Pacific is a major adopter of fire protection systems pipes, due to growth of the construction sector and rise in awareness related to the fire protection. Rise in urbanization in the developing countries such as India, China, and Brazil have significantly boosted the growth of the fire protection system pipes market. The surge in demand for fire protection systems pipes in the oil & gas industry is a key factor contributing toward the growth of the market.

In addition, rise in investments in residential construction around the globe drives the market growth. LAMEA is expected to grow at the highest CAGR during the forecast period, with notable growth in the developing countries such as China and India, which have become a favorable destination for fire protection equipment manufacturers.

Players operating in the fire protection systems pipe market have adopted merger and acquisition as their key growth strategies to gain a stronger foothold. For instance, in March 2023, Halma announced the acquisition of Fire Pro company. The company offers aerosol fire suppression system, company is based in Limassol, Cyprus. Thus, all these factors together are anticipated to significantly contribute toward the growth of the global fire protection systems pipe market.

The global fire protection system pipes market was valued at $20,229.8 million in 2022, and is projected to reach $34,744.2 million by 2032, registering a CAGR of 5.68% from 2023 to 2032.

The forecast period considered for the global fire protection system pipes market is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global fire protection system pipes market report can be obtained on demand from the website.

The base year considered in the global fire protection system pipes market report is 2022.

The major players profiled in the fire protection system pipes market include Anvil International, LLC., ASTRAL LIMITED, China Lesso Group Holdings Limited, Gf Piping Systems, HALMA PLC, Johnson Controls International plc, Minimax Viking GmbH, Mueller Industries, Inc., Simona AG and TPMC STEEL (Tianjin Profound Multinational Trade Co., Ltd.).

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on material type, the steel segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...