Firefighting Aircraft Market Research, 2040

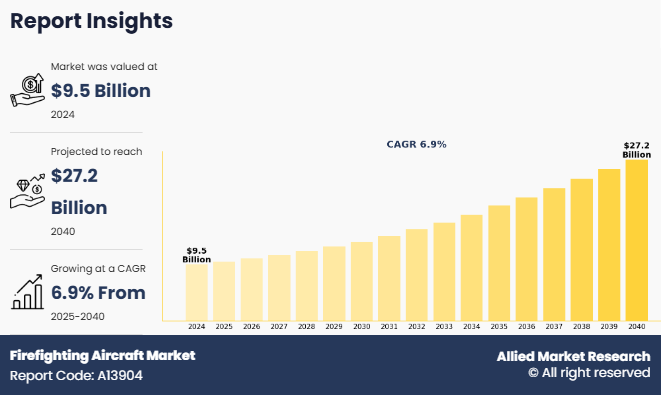

The global firefighting aircraft market was valued at $9.5 billion in 2024, and is projected to reach $27.2 billion by 2040, growing at a CAGR of 6.9% from 2025 to 2040.

Report Key Highlighters

• The firefighting aircraft market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value available from 2022 to 2032.

• The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

• The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

• The firefighting aircraft market share is marginally fragmented, with players such as SAAB, ShinMaywa Industries, Ltd., COULSON GROUP, Conair Aerial Firefighting, Lockheed Martin Corporation, Kaman Corporation, AIRBUS, Textron, Inc., Leonardo S.p.A., and De Havilland Aircraft of Canada Limited. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Definition and Introduction

A firefighting aircraft is a specialized aircraft designed or modified for aerial firefighting operations to combat wildfires and other large-scale fires. These aircraft play a crucial role in wildfire suppression by delivering water, fire retardants, or foam to affected areas, often in remote or inaccessible locations. Firefighting aircraft include fixed-wing planes such as air tankers, scooper aircraft, and multi-mission aircraft, as well as rotary-wing helicopters equipped with Bambi Buckets or internal tanks. In addition, these aircraft are deployed by government agencies, private contractors, and military forces worldwide. Their capabilities vary, with large air tankers carrying thousands of gallons of retardant, while smaller helicopters provide precision drops. Advancements in satellite tracking, AI-based fire detection, and modernized dispersal systems have enhanced firefighting efficiency. With the increasing frequency of wildfires, nations are expanding their aerial firefighting fleets, integrating newer technologies, and fostering international cooperation to improve wildfire management and disaster management.

Market Dynamics

Use of Aircraft to Extinguish Wildfire

The increase in frequency and intensity of wildfires worldwide have significantly driven the demand for firefighting aircraft. Traditional groundbased firefighting methods often struggle to contain large-scale wildfires, especially in remote or inaccessible areas. Aircraft provide a crucial advantage by rapidly reaching affected locations, delivering large volumes of water or fire retardant, and preventing the spread of fires more effectively. Governments and firefighting agencies are expanding their aerial firefighting fleets to enhance response capabilities, leading to a rise in procurement and modernization efforts. For instance, in March 2025, the Canadian Commercial Corporation (CCC) finalized a government-to-government (G2G) contract with France’s Directorate General of Armaments (DGA) under the French Ministry of Armed Forces for the procurement of two De Havilland Canadair 515 aircraft. This acquisition strengthens France’s aerial firefighting fleet, enhancing its ability to respond to escalating wildfire threats. The Canadair 515, known for its large water-carrying capacity and rapid deployment capabilities, will improve France’s fire suppression efforts, ensuring greater efficiency in combating wildfires. In addition, advancements in firefighting aircraft technology, such as improved tank capacity, autonomous operations, and enhanced maneuverability, are driving the market demand. Public-private partnerships and international collaborations are also playing a key role in fleet expansion. With climate change increasing the risk of wildfires, investment in aerial firefighting solutions is expected to rise, reinforcing the demand for firefighting aircraft across several regions

Increase in Fire-related Incidents in the Oil & Gas Industry

The rise in fire-related incidents within the oil and gas industry has significantly increased the demand for firefighting aircraft. For instance, in February 2025, Boeing partnered with HPCL to develop a sustainable aviation fuel (SAF) ecosystem, enhancing SAF production and distribution. This collaboration supports commercial and firefighting aircraft operations, reduces emissions, and promotes eco-friendly fuel alternatives in the aviation and oil & gas industries. Moreover, oil refineries, offshore drilling platforms, and storage facilities are highly vulnerable to fires, which can escalate rapidly due to the presence of flammable substances. Traditional firefighting aircrafts often prove insufficient in such hazardous environments, making aerial firefighting aircraft essential for rapid response and large-scale fire suppression. Fixed-wing and rotary-wing aircraft equipped with advanced fire retardants and water-dropping systems play a crucial role in mitigating damage and preventing catastrophic losses. Governments and private sector players are increasingly investing in specialized firefighting aircraft to enhance their emergency response capabilities in high-risk industrial zones. In addition, the adoption of unmanned aerial vehicles (UAVs) for monitoring and assessing fire hazards in oil and gas infrastructure is further driving market growth, ensuring improved safety measures and operational resilience in the industry.

Delayed Delivery of Aircraft

Delayed aircraft deliveries are significantly hampering the demand for firefighting aircraft, affecting wildfire globally. Procurement delays arise due to supply chain disruptions, manufacturing challenges, and regulatory approvals, causing setbacks in fleet expansion and modernization. Moreover, governments and firefighting agencies face operational gaps, limiting their ability to respond efficiently to increasing wildfire incidents. As demand for high-capacity, advanced firefighting aircraft grows, delivery delays result in extended lead times, higher costs, and restricted availability of essential aerial firefighting resources. These factors impact disaster preparedness, forcing agencies to rely on aging fleets or temporary leasing solutions, which may not be as effective. Furthermore, prolonged delays discourage potential buyers from investing in new firefighting aircraft, thereby slowing market growth. Addressing these issues through streamlined production, faster approvals, and stronger supply chain resilience is crucial to ensuring timely aircraft availability and improving wildfire response capabilities globally.

Segment Review

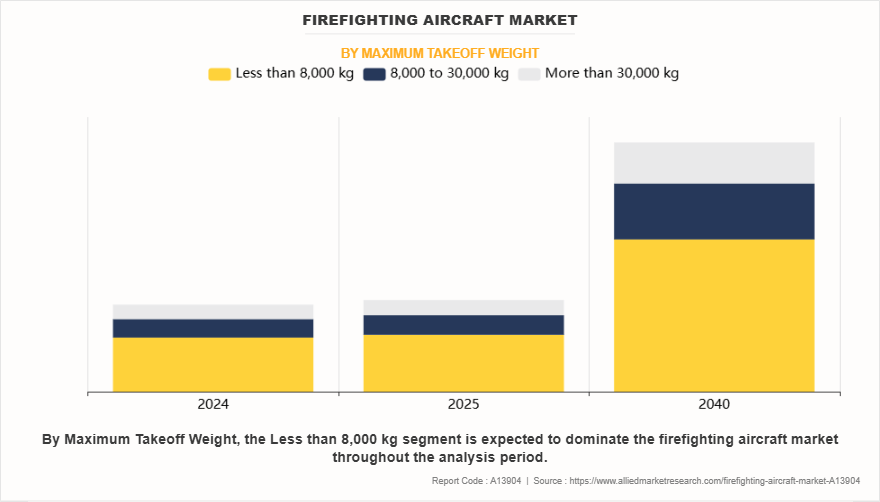

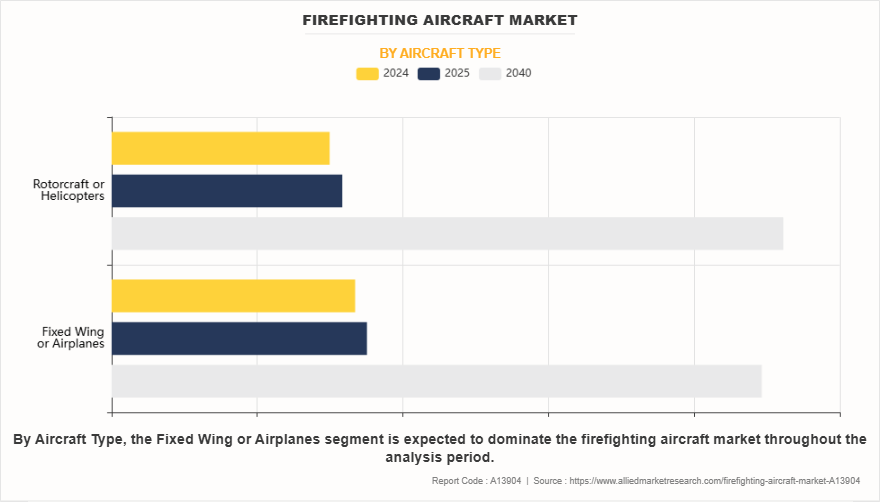

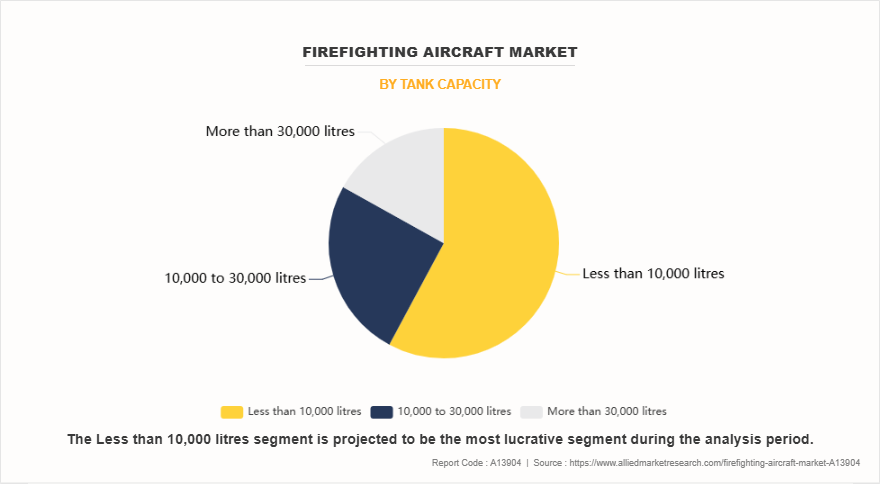

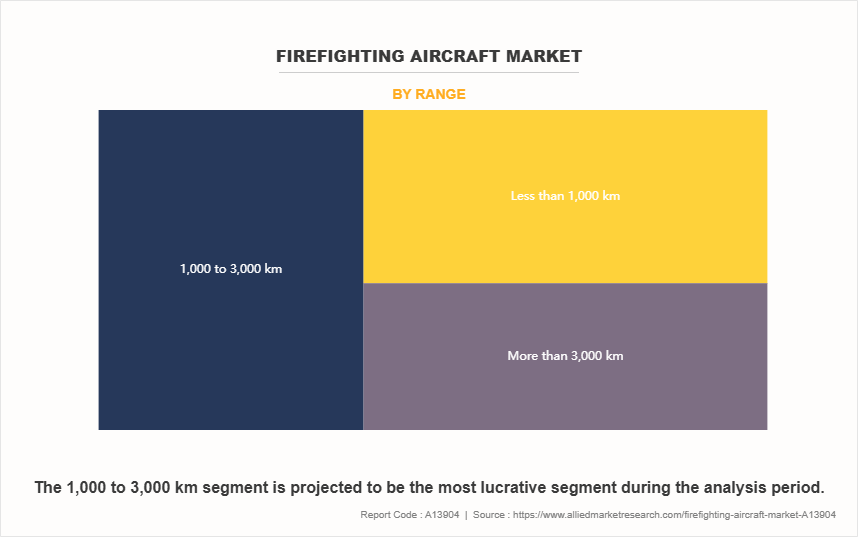

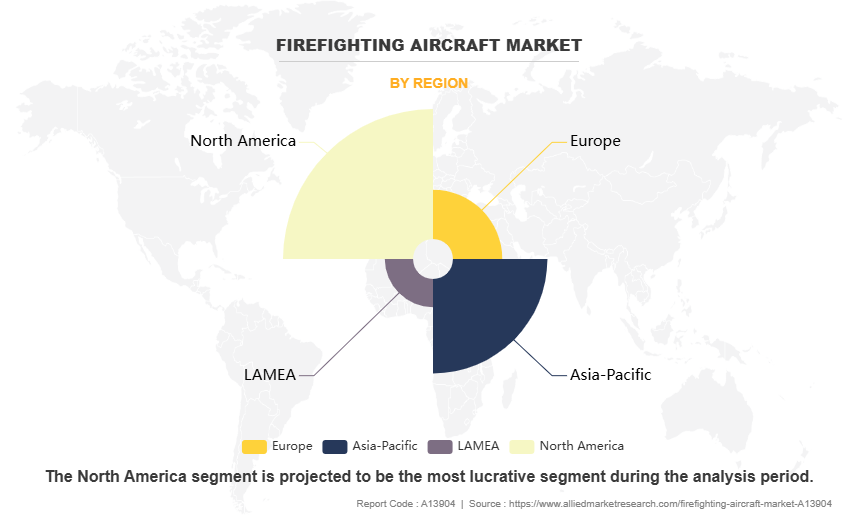

The firefighting aircraft market is segmented on the basis of aircraft type, tank capacity, maximum takeoff weight, range, and region. On the basis of aircraft type, the market is segmented into fixed-wing or airplanes, and rotary-wing or helicopters. By tank capacity, the market is divided into less than 10,000 liters, 10,000 to 30,000 liters, and more than 30,000 liters. On the basis of maximum takeoff weight, the firefighting aircraft industry is classified into less than 8,000 KG, 8,000 to 30,000 KG, and more than 30,000 KG. By range, the market is divided into less than 1,000 KM, 1,000 to 3,000 KM, and more than 3,000 KM. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Competitive analysis and profiles of the major global firefighting aircraft market players that have been provided in the report include SAAB, ShinMaywa Industries, Ltd., COULSON GROUP, Conair Aerial Firefighting, Lockheed Martin Corporation, Kaman Corporation, AIRBUS, Textron, Inc., Leonardo S.p.A., and De Havilland Aircraft of Canada Limited. The key strategies adopted by the major players of the global firefighting aircraft market are product launch and mergers & acquisitions.

Top Impacting Factors

The global firefighting aircraft market is expected to witness notable growth registering a CAGR of 6.9% from 2025 to 2040. The firefighting aircraft market is expected to witness notable growth owing to rise in need for new generation engines and transmission units, growing adoption of lightweight aircraft components and increasing military expenditure and spending. Moreover, increasing integration of firefighting aircraft airframe and surge in aircraft fleet and technological advancements are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, technical issues associated with firefighting aircraft and stringent aircraft components regulation limit the firefighting aircraft market demand.

Historical Data & Information

The global firefighting aircraft market is competitive, owing to the strong presence of existing vendors. Vendors in the global firefighting aircraft market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in Firefighting Aircraft Market

- In January 2025, Conair acquired the Daher TBM 960 to strengthen its wildfire suppression capabilities. The aircraft's speed, efficiency, and advanced avionics make it a valuable asset for rapid aerial firefighting operations. Its ability to quickly reach fire zones and support firefighting teams enhances response time, thereby improving overall wildfire containment and mitigation efforts.

- In November 2023, Saab has signed a new contract with the Swedish Civil Contingencies Agency (MSB) to continue providing aerial firefighting aircraft, along with crew and logistical support. This agreement ensures a strong firefighting capability, enabling rapid response to wildfires through well-equipped aircraft and experienced personnel.

Key Benefits of Stakeholders

- This study comprises analytical depiction of the global firefighting aircraft market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global firefighting aircraft market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global firefighting aircraft market forecast is quantitatively analyzed from 2022 to 2033 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in firefighting aircraft market opportunities.

- The report includes the market share of key vendors and the global market.

Firefighting Aircraft Market Report Highlights

| Aspects | Details |

| Market Size By 2040 | USD 27.2 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2040 |

| Report Pages | 391 |

| By Maximum Takeoff Weight |

|

| By Aircraft Type |

|

| By Tank Capacity |

|

| By Range |

|

| By Region |

|

| Key Market Players | Conair Aerial Firefighting, COULSON GROUP, AIRBUS, Textron, Inc., Leonardo S.p.A., Kaman Corporation, Lockheed Martin Corporation, SAAB, De Havilland Aircraft of Canada Limited, ShinMaywa Industries, Ltd. |

North America is the largest regional market for firefighting aircraft.

The upcoming trends of Firefighting Aircraft Market include increase in fire-related incidents in the oil & gas industry and increase in wildfire incidents.

The firefighting aircraft market was valued at $9,511.0 million in 2024.

The 1,000 to 3,000 km is the leading range of Firefighting Aircraft Market.

SAAB, ShinMaywa Industries, Ltd., COULSON GROUP, Conair Aerial Firefighting, Lockheed Martin Corporation are some of the top companies to hold the market share in Firefighting Aircraft.

Loading Table Of Content...

Loading Research Methodology...