Fish Finders Market Statistics - 2031

The global fish finders market was valued at $503.8 million in 2021, and is projected to reach $958.4 million by 2031, growing at a CAGR of 6.8% from 2022 to 2031.

Fish finder equipment are based on Compressed High Intensity Radar Pulse (CHIRP) sonar technology, which allows fishers to identify fish and other objects underwater. Fish finders are equipped with color screen display, which allows novice anglers to locate and catch the fish. As Compressed High Intensity Radar Pulse (CHIRP) sonar technology is an open-source technology it becomes challenging for manufacturers to provide customers with better products than their competitors. Fish finder majorly finds its application in recreational, commercial, and professional fishing. Major market competitors now provide Compressed High Intensity Radar Pulse (CHIRP) sonar, down imaging, side imaging, and GPS, which caters to the combination of high-quality technology that enables the skilled anglers to find fishing locations easily. In the past, fishers or anglers by their gut feelings used to spend days or weeks trying to find the fish.

Increase in global level competitions where high precision tools, rods, reels, chartplotters, autopilot motors and waterproof rotors are required will help propel the growth of the global fish finders market. However, intense competition, owing to surge in penetration of IoT devices, high manufacturing cost of radars, sonar, and high precision interactive displays act as the key deterrent factors of the global market.

In addition, government policies on designated on-shore and off-shore fishing will be a key factor to maintain the biodiversity of near-extinct fishes. On the contrary, a fish finder is used in research-based geological studies to check the different terrains of contours using a C-map, which comes with a networked system.

Segment Overview

The fish finders market is segmented into Product Type, Equipment Type and Application.

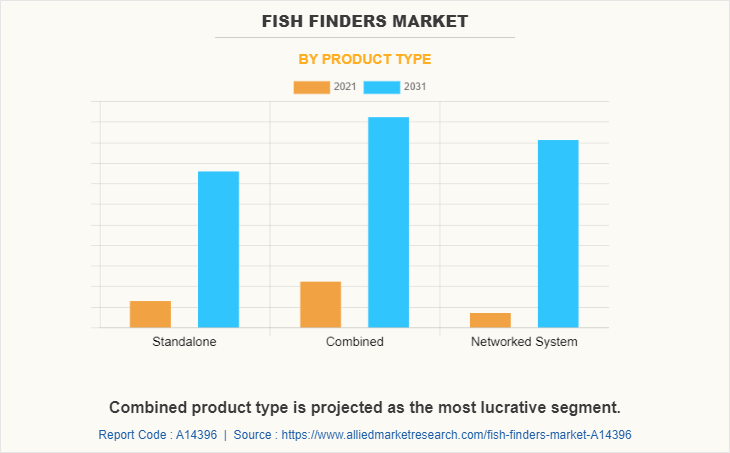

By product type into standalone, combined and networked systems. Combined segment was the highest revenue contributor to the market.

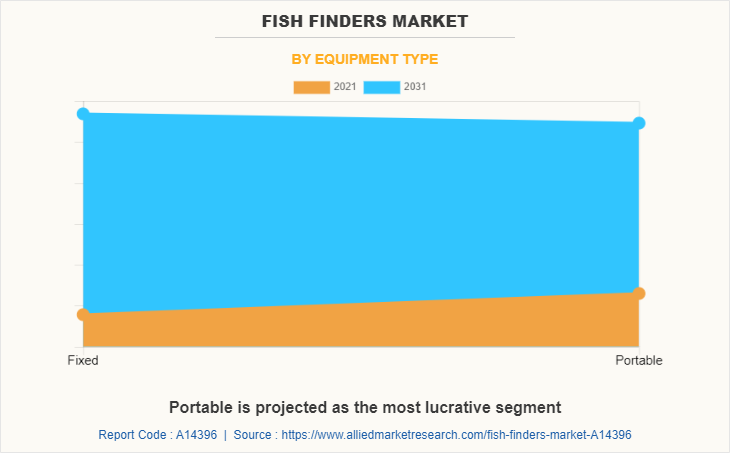

By equipment type into fixed and portable. The portable segment was the highest revenue contributor to the market in 2021.

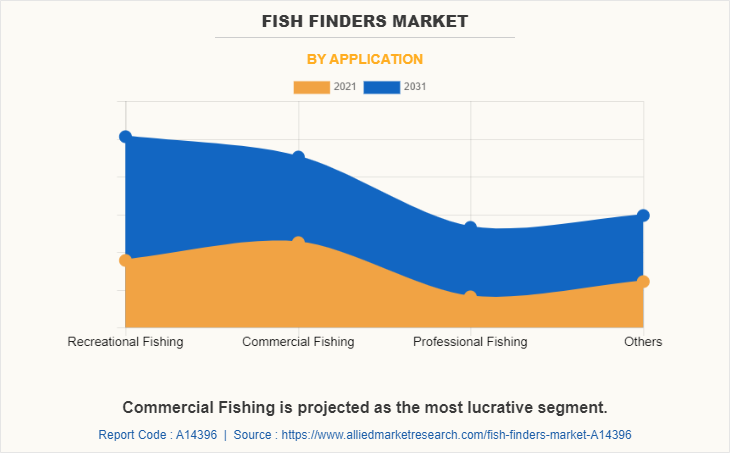

By application into recreational fishing, commercial fishing, professional fishing and others. The commercial fishing and recreational fishing segments hold the major fraction of the market in 2021.

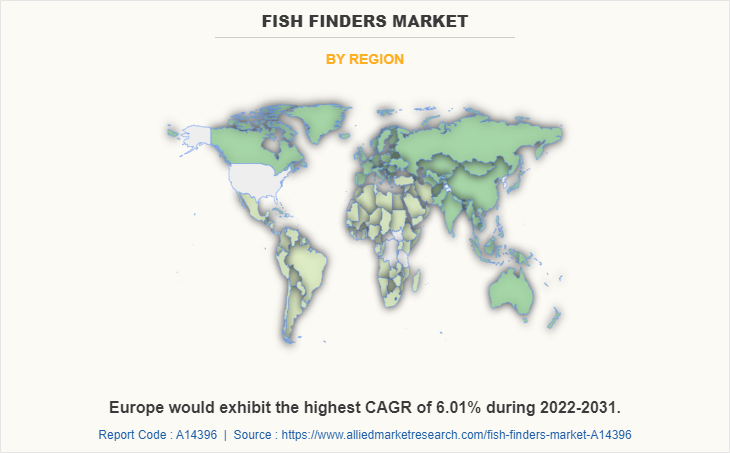

Region-wise, the satellite modem market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, and the rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and the rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the global satellite modem industry. Major organizations and government institutions in the country are intensely putting resources into technology to grab fish finders market opportunity.

Rise in living standards of people around the globe and significant increase in consumption of fish products owing to their high nutritional value have played a major role in fueling the demand for fish finders industry in the market. In addition, the growing concerns regarding the well-being of the marine ecosystem has led to rise in demand for noise-free fish finders around the world. Furthermore, aquaculture for fish finders industry is regulated with stringent government regulations in the global economy which has a direct impact on the fish finders market share. Moreover, an opportunity lies ahead of various organizations and manufacturers for product innovation and technological developments in fish finders companies coupled with integration of GPS fish finder system such as deeper fish finder, REVEAL Lowrance and others which are projected to provide a better experience for recreational and commercial fishing and is expected to be lucrative for the fish finders market growth in the coming years.

Competitive Analysis

Competitive analysis and profiles of the major satellite modem market players, such as Brunswick Corporation, Deeper UAB, Furuno Electric Co. Ltd., Garmin Ltd., GME Pty Ltd, Simrad, Humminbird, Johnson Outdoors Inc., Lowrance, NorCross Marine Products, Inc., Samyung ENC. And Teledyne Technologies Inc. are provided in this report.

Key Benefits for Stakeholders

- This study comprises analytical depiction of the fish finders market size along with the current trends and future estimations to depict the fish finders market opportunity.

- The overall fish finders market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and fish finders market opportunities with a detailed impact analysis.

- The current fish finders market forecast is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the fish finders market outlook.

- The report includes the market share of key vendors and fish finders market trends.

Fish Finders Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Equipment Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Johnson Outdoors Inc., Humminbird, Samyung ENC., Garmin Ltd., Brunswick Corporation, simrad, GME Pty Ltd, Furuno Electric Co. Ltd., Teledyne Technologies Inc., NorCross Marine Products, Lowrance, Deeper UAB |

Analyst Review

The fish finders’ market is highly competitive, owing to strong presence of existing vendors. Fish finder technology vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals as they have the capacity to cater to the global market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The fish finders market exhibits high growth potential in commercial and recreational fishing. The current business scenario is witnessing an increase in demand for chartplotters, particularly in developing regions such as China and India, owing to surge in population and rise in consumption of fish. Companies in this industry are adopting various innovative techniques such as mergers and acquisitions, to strengthen their business position in the competitive matrix.

The market growth is supplemented by proactive surge in manufacturing output, owing to technological advancements. These factors have allowed emerging markets to evolve as largest markets during the forecast period, both from the demand as well as the supply side. Public & private organizations have substantially invested in R&D activities and fabrication techniques to develop cost-effective fish finders. North America is the major revenue contributor to the global market, followed by Asia-Pacific. The market growth in Asia-Pacific and Europe is expected to significantly increase during the forecast period.

The key players profiled in the report include Brunswick Corporation, Deeper UAB, Furuno Electric Co. Ltd., Garmin Ltd., GME Pty Ltd, Simrad, Humminbird, Johnson Outdoors Inc., Lowrance, NorCross Marine Products, Inc., Samyung ENC. And Teledyne Technologies Inc.

North America is the largest regional market for Fish Finders Market.

The industry size for Fish Finders Market was valued at $503.8 million in 2021.

Humminbird, Garmin Ltd., Furuno Electric Co. Ltd., Johnson Outdoors Inc. and Deeper UAB are the top companies to hold the market share in Fish Finders Market.

By product type, equipment type and applications.

Networked systems under by product type would grow at a highest CAGR during the forecast period.

Loading Table Of Content...