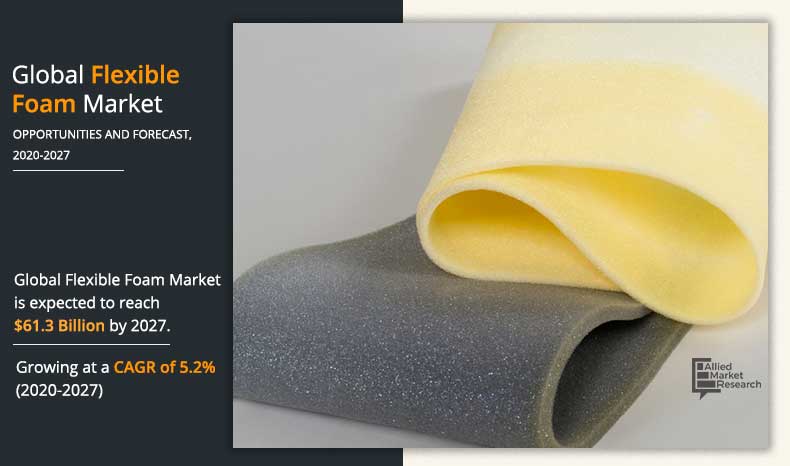

Flexible Foam Market outlook - 2027

The global flexible foam market was valued at $44.0 billion in 2019, and is projected to reach $61.3 billion by 2027, growing at a CAGR of 5.2% from 2020 to 2027.

The growth of the global flexible foam market is driven by infrastructural development, expansion of residential & commercial sector, and favorable public–private partnerships as they provide better infrastructure solutions. In addition, continuous technological advancements and penetration of international infrastructure players into emerging economies influence the construction market positively. Rise in residential construction activities is expected to fuel the demand for furniture. The furniture industry is key consumer of flexible foam, as it is used as a cushioning material for upholstered furniture. In addition, flexible polyurethane foam makes furniture more durable and comfortable. As a result, furniture industry expected to create positive impact on the flexible foam market in the near future.

The economic development in emerging economies is responsible for the rapid growth of the mining and construction industries. Flexible foam is used for rock consolidation and sealing in mining and tunnel construction activities. Mining industries are rapidly growing in African market, whereas many foreign countries are investing in Asia-Pacific through industrial sector.

Increase in impact of construction activities on environment and health gives rise to the need for green buildings. According to the U.S. Green Building Council’s study of Environmental Impact of Buildings (2007), buildings in the U.S. contribute 38.9% of the nation’s total carbon dioxide emissions, including 20.8% from the residential sector and 18.0% from the commercial sector. Green buildings involve the incorporation of environment-friendly and resource-efficient processes at each stage of construction. The concept of green building focuses majorly on increase in the efficiency with which buildings use energy, water, and materials. Polyurethane foam is one of the most efficient insulators available in the market, and is considerably used in buildings to achieve low energy needs. This serves both the immediate owner by lowering energy costs and the environmental goal of reducing greenhouse gasses. This factor acts as a potential opportunity for the manufacturers operating in the global flexible foams market.

The global flexible foam market is segmented into type, Application, and region. Depending on type, the market is segregated into polyurethane (PU) foam, polyethylene (PE) foam, polypropylene (PP) foam, ethylene-vinyl acetate (EVA), and others. The applications covered in the study include furniture & bedding, transportation, packaging, construction, and consumer goods. Region wise, the flexible foam market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the market include BASF SE, Covestro AG, The Dow Chemical Company, Huntsman Corporation, INOAC Corporation, Sekisui Chemical Co. Ltd., Recticel NV, The Woodbridge Group, and Rogers Corporation.

By Product Type

Polypropylene foam is projected as the fastest growing segment

Flexible foam market, by type

By type, the polyurethane foam segment accounted for the largest flexible foam market share in 2019, and is anticipated to continue this trend during the forecast period. This is attributed to the fact that polyurethane foam is widely applicable across the automotive industry in manufacturing vehicles and their numerous parts.

The preference for flexible foams among consumers has increased the adoption of polyurethane foams in construction and automotive applications. Moreover, increase in industrialization propels the demand for flexible foams across various industries such as automobile, interior decor, transportation, and packaging.

By Application

Packaging is projected as the fastest growing segment

Flexible foam market, by application

Flexible foams are used in various industries such as construction, furniture & bedding, packaging, and consumer goods. They are witnessing increased popularity, as they significantly cut energy costs, thereby making residential and commercial properties energy-efficient and comfortable. To maintain uniform temperature and lower noise levels in residential and commercial properties, constructers majorly make use of flexible polyurethane foam. In the furniture sector, flexible polyurethane foams help to make furniture stylish, durable, comfortable, and supportive. Other applications of flexible polyurethane foam in furniture sector include carpet, transportation, bedding, packaging, textile & fibers, and others. Among this, furniture & bedding is key segment, in terms of value and volume.

By Region

Asia Pacific would exhibit an CAGR of 5.6% during 2020-2027

Flexible foam market, by region

Region wise, Europe garnered 30.7% share of the global flexible foam market in 2019. This was attributed to the presence of key economies such as the UK and Germany. Furthermore, furniture producers and suppliers have steadily recovered from the economic downturn due to moderated growth in housing industry since 2014 in the region, which contributed toward the growth of the market.

However, Asia-Pacific is a lucrative market for flexible foams, and is expected to grow at the highest CAGR, in terms of both volume and value during the forecast period. This is attributed to the fact that the Government of China invested in various industries, including construction materials (iron, steel & cement), automobiles, textiles, and ship building, which are major consumers of flexible foams. In addition, India’s growing economy is expected to increase industrialization and urbanization over the next few years, which is likely to make it a lucrative market for flexible foams.

Impact Of Covid-19

The COVID-19 crisis presents an excellent opportunity to the packaging industry due to the increased awareness towards safe packaged products. This will be driven by various factors such as growth in domestic demand, safe consumer goods, and others. On other hand, the major market of flexible foam i.e. construction industry declined their revenue growth during corona crisis which expected to hamper the flexible foam market growth.

Key Benefits For Stakeholders

- The report provides an in-depth analysis of the flexible foam market forecast along with the current trends and future estimations.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the global flexible foam industry for strategy building.

- A comprehensive flexible foam market analysis covers the factors that drive and restrain the market growth.

- The qualitative data about market dynamics, trends, and developments is provided in the report.

Flexible Foam Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Recticel NV, Sekisui Chemical Co. Ltd., Covestro AG, Rogers Corporation, The Woodbridge Group, Huntsman Corporation, INOAC Corporation, Ube Industries, Ltd, BASF SE, The DOW Chemical Company |

Analyst Review

Rise in investments in the construction industry and increase in housing & construction projects especially in developing countries coupled with continuous technological advancements are the factors that majorly boost the growth of global flexible foam insulation market. Flexible foam is a leading type of polyurethane foam, which is extremely lightweight and highly durable, and can be molded into different shapes. It is commonly used for cushioning automotive interiors and provides thermal insulation in residential construction sector. The flexible foam market is anticipated to significantly in Asia-Pacific and LAMEA. This is attributed to rise in construction activities in China, India, and various the Middle East countries. However, stringent government regulations on emission of volatile organic compounds (VOCs) hamper the market growth.

Owing to the outbreak of the COVID-19 pandemic, the global flexible foam market is expected to witness a sluggish growth during the next couple of years. Implementation of stringent government regulations to restrict movement has led to shutdown of factories in scores of cities and provinces across the world, leading to predictions of a lowered investment in industrialization. Recent decline in end-use industries is one of the key factors that is expected to negatively impact the growth of flexible foam market. On other hand, owing to the outbreak of COVID-19, the concern toward safe food packaging products and other packaged consumer goods has increased significantly. PU foams and PP foams are majorly used in the packaging industry, as they are non-toxic; thus, the demand for flexible foam in packaging sector is anticipated to augment in the near future.

Infrastructure development, prolonged expansion of residential and commercial buildings and favorable public private partnerships are major factors driving the market growth across globe

Major players in the market are BASF SE, Covestro AG, The Dow Chemical Company, Huntsman Corporation, INOAC Corporation, Sekisui Chemical Co. Ltd., Recticel NV, The Woodbridge Group , and Rogers Corporation and among others.

Lowering energy costs and the greater environmental goal of reducing greenhouse gasses. This is one of the key opportunity for global flexible foams manufactures especially polyurethane flexible foams.

Furniture industry is projected to increase the demand for flexible foam Market

The economic development in emerging economies is responsible for the rapid growth in number of industries. Which contribute to eise standard of living style, act as key trend for furniture industry and indirectly for flexible foam market

Polyurethane foam is the most influencing segment in the global flexible foam market report

Furniture & Bedding expected to drive the adoption of flexible foam

COVID-19 has uneven impact on the flexible foam market. Global flexible foam market is expecting a slowdown during the starting couple of years of the forecast period owing to the COVID-19 pandemic.

Loading Table Of Content...