Floating Liquefied Natural Gas (FLNG) Market Research, 2032

The global floating liquefied natural gas (FLNG) market was valued at $19.2 billion in 2022, and is projected to reach $51.6 billion by 2032, growing at a CAGR of 10.8% from 2023 to 2032. Floating liquefied natural gas (FLNG) is a technology that enables the extraction, liquefaction, storage, and offloading of natural gas directly from offshore gas fields, without the need for an onshore facility. FLNG vessels are floating liquefaction plants that are positioned above offshore gas reserves, providing a flexible and cost-effective solution for gas monetization. FLNG consists of various components, such as FLNG vessels, liquefaction process, storage tanks, and offloading facilities.

Introduction

FLNG vessels are large floating structures equipped with liquefaction facilities, storage tanks, and offloading capabilities. They are converted from existing LNG carriers or are purpose-built. Natural gas is extracted from offshore wells and processed on the FLNG vessel. The gas is then cooled to extremely low temperatures, transforming it into liquefied natural gas (LNG) for ease of storage and transportation. FLNG vessels have storage tanks to hold the produced LNG. These tanks are designed to keep the LNG at cryogenic temperatures to maintain it in a liquid state. Offloading systems are integrated into the vessel to transfer the produced LNG to LNG carriers or other transport vessels for delivery to markets.

Key Takeaways:

- The Floating Liquefied Natural Gas Market Report has been analyzed in terms of value ($Billion). The analysis in the report is provided on the basis of technology, capacity, 4 major regions, and more than 15 countries.

- The floating liquefied natural gas (FLNG) market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the FLNG industry are Eni S.p.A., Shell plc, Hoegh LNG, Golar LNG Limited., EXMAR, Woodside Energy Group Ltd., Mitsui O.S.K. Lines.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as Australia, Malaysia, the U.S., and Indonesia hold a significant share in the floating liquefied natural gas (FLNG) market.

FLNG is particularly suitable for developing offshore gas fields, especially those located in remote or challenging environments. It eliminates the need for constructing expensive onshore infrastructure. FLNG vessels offer flexibility in terms of deployment. They be moved to different locations, allowing operators to exploit multiple gas fields over the vessel's operational life.

FLNG projects typically have shorter development timelines compared to onshore facilities. This rapid time to market is advantageous for countries looking to capitalize quickly on their gas reserves. Standardized designs and modular construction contribute to cost efficiency in FLNG projects. They provide a competitive edge in terms of capital and operational costs. FLNG projects enable countries to access the global liquefied natural gas (LNG) market. They export LNG to various destinations, contributing to economic growth and energy security.

FLNG projects require significant upfront investment, and financing is a challenge due to the capital-intensive nature of the technology. The technology involved in FLNG is complex, and operational challenges arise. Ensuring the safe and efficient operation of FLNG facilities requires advanced engineering and operational expertise. Despite certain environmental benefits, FLNG projects must address concerns related to potential impacts on marine ecosystems and emissions during the liquefaction process. FLNG reduces the need for extensive onshore infrastructure, minimizing disturbances to coastal ecosystems and communities. FLNG helps reduce the need for gas flaring, as it allows for the monetization of associated gas that might otherwise be flared during oil production. Continuous advancements in FLNG technologies contribute to improved safety features, reducing the risk of environmental incidents.

Several new FLNG projects have been proposed or are in the development phase globally. In addition, some existing projects are undergoing expansions to increase capacity. Ongoing advancements in liquefaction technologies and offloading systems aim to enhance the overall efficiency and competitiveness of FLNG projects.

Market Dynamics

FLNG technology allows for the economic development of offshore gas fields by eliminating the need for extensive onshore infrastructure. This is particularly significant in remote or challenging offshore environments where traditional onshore facilities are impractical. FLNG projects open opportunities for the exploration and exploitation of offshore gas reserves that would have been considered economically unfeasible with traditional development methods. The absence of the need for onshore infrastructure reduces the barriers to entry for operators, encouraging them to explore and develop untapped resources.

FLNG enables the cost-effective development of offshore gas fields, making previously untapped resources economically viable. By providing a solution that is both cost-effective and flexible, FLNG projects unlock the economic potential of offshore gas reserves. This is particularly relevant for gas fields in remote or challenging locations where the costs associated with onshore development, including infrastructure construction and logistics, might outweigh the economic benefits. The elimination of extensive onshore infrastructure reduces the overall costs associated with developing offshore gas fields using FLNG. Cost reduction is a crucial factor in making offshore gas development economically viable. FLNG's ability to minimize infrastructure costs by liquefying and storing natural gas directly at the offshore site contributes to the economic feasibility of projects that might have been considered too costly using traditional onshore facilities.

The mobility of FLNG vessels allows operators to explore and develop various offshore gas fields using a single unit. The mobility of FLNG enables the optimization of resource utilization. Operators deploy a single FLNG vessel to multiple gas fields, extracting and processing gas at each location. This capability minimizes the need for duplicate infrastructure investments and enhances the efficiency of gas field development. The flexibility to move FLNG vessels provides operators with the capability to adapt to changing market conditions, including shifts in demand or pricing. FLNG projects respond to fluctuations in the global energy market. Operators redirect FLNG vessels to locations with higher demand or more favorable economic conditions. This adaptability helps maximize the economic benefits of gas production and LNG exports.

FLNG projects often involve significant upfront capital investment. The costs associated with the design, construction, and deployment of FLNG vessels are substantial. High capital intensity acts as a barrier to entry for some operators and countries. Financing large-scale FLNG projects is challenging, particularly for those with limited financial resources. FLNG technology is technically sophisticated, involving complex liquefaction processes, storage systems, and offloading facilities. Ensuring the safe and reliable operation of such complex systems is challenging. The technological complexity of FLNG leads to increased project risks, operational challenges, and the need for specialized expertise. This complexity results in longer lead times for project development.

Operating in offshore environments presents inherent challenges, including harsh weather conditions, potential for equipment corrosion, and safety considerations. FLNG facilities must adhere to strict safety standards. Meeting and maintaining high safety standards in offshore locations requires advanced engineering and operational expertise. Unforeseen challenges related to safety and operations impact project timelines and costs. While there have been efforts to standardize certain aspects of FLNG design, each project often involves unique considerations based on the characteristics of the gas field and regional conditions. Limited standardization contributes to longer lead times and higher costs, as each project requires tailored engineering solutions. Standardization could enhance cost-effectiveness and streamline project development.

The increase in global demand for LNG, driven by factors such as the transition to cleaner energy sources and the growth of emerging economies, provides a significant opportunity for FLNG projects. FLNG enables countries to participate in the global LNG market and capitalize on the rising demand. FLNG technology allows for the economic development of remote or stranded gas reserves that would be uneconomical to develop with traditional onshore infrastructure. It provides a solution for countries with offshore gas resources in challenging locations.

Collaboration and partnerships between governments, energy companies, and technology providers enhance the feasibility and success of FLNG projects. Joint ventures and shared infrastructure lead to mutual benefits. Integrating FLNG with other offshore field developments, such as oil production, create synergies and optimize infrastructure use. This integrated approach enhances project economics.

Segments Overview

The Floating Liquefied Natural Gas Market Size is studied on the basis of technology, capacity, and region.

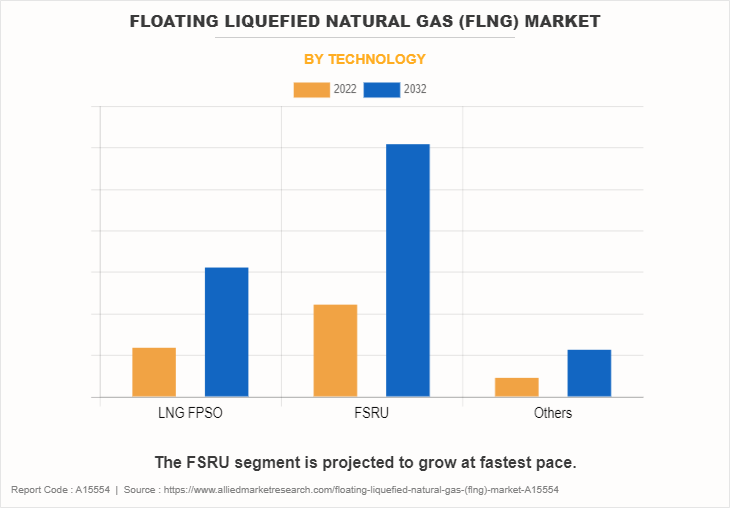

Depending on the technology, the Floating Liquefied Natural Gas (FLNG) Market is categorized into LNG FPSO, FSRU, and others. The FSRU segment dominated the Floating Liquefied Natural Gas Market Share in 2022. The same is projected to dominate the growth during the forecast period. LNG FSRUs is mobile and be relocated to different locations based on changing LNG demand or supply considerations. This mobility provides a high degree of flexibility, allowing FSRUs to be strategically positioned to meet shifting energy demands in various regions. FSRUs be deployed quickly compared to the time it takes to construct traditional onshore LNG terminals. Rapid deployment is particularly valuable in emergency situations, during peak demand periods, or as a temporary solution while more permanent infrastructure is developed.

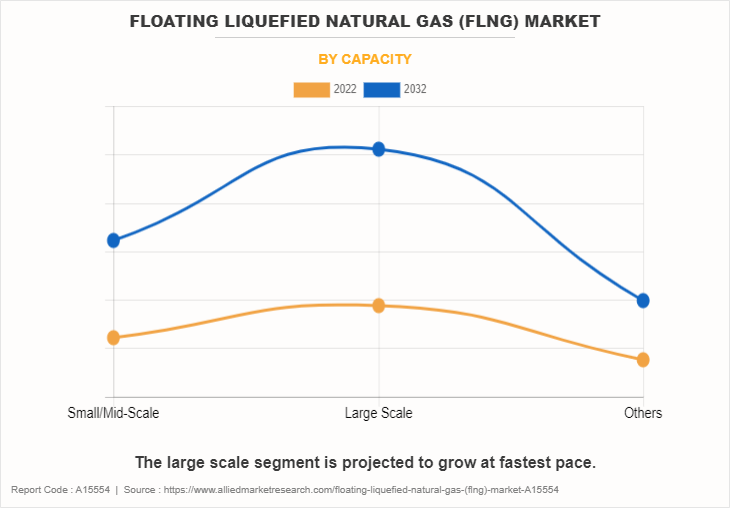

By capacity, the Floating LNG Market is classified into small/mid-scale, large scale, and others. The large scale segment is projected to maintain its dominance during the floating liquefied natural gas (FLNG) market forecast period growing at a CAGR of 11.0%. Large-scale FLNG projects are strategic initiatives that significantly impact the global LNG industry. They involve cutting-edge technologies, extensive infrastructure, and substantial investments, aiming to provide a stable and substantial supply of liquefied natural gas to meet global energy demands. The development and operation of such projects require careful consideration of economic, environmental, and social factors to ensure sustainable and responsible practices. Such factors contribute to the floating liquefied natural gas (FLNG) market growth.

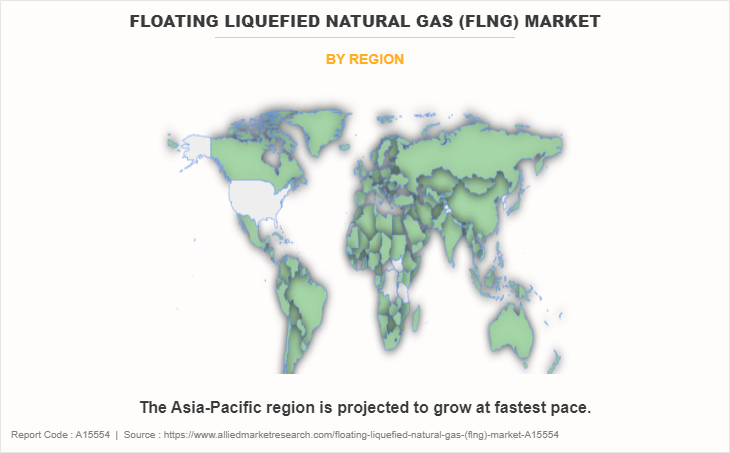

By region, the Floating Liquefied Natural Gas Market Analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific region garnered the highest market share in 2022 and is also projected to dominate the Floating Liquefied Natural Gas Market Growth during the forecast period. The region is also set to provide numerous floating liquefied natural gas (FLNG) market opportunities owing to many new and under construction FLNG projects. Australia has been a major contributor to the Asia-Pacific FLNG market. Several operational projects, such as Prelude FLNG and Ichthys LNG, have established the country as a leader in the sector. Malaysia, with its pioneering Petronas FLNG project (PFLNG Satu), has played a key role in shaping the FLNG market. Malaysia continues to explore further opportunities for FLNG developments. Indonesia has been actively exploring FLNG solutions to develop its offshore gas fields.

Competitive analysis

The major players operating in the floating liquefied natural gas (FLNG) industry are Eni S.p.A., Shell plc, Hoegh LNG, Golar LNG Limited., EXMAR, Woodside Energy Group Ltd., Mitsui O.S.K. Lines., Excelerate Energy, Inc., BASF SE, ABB Ltd., and Petroliam Nasional Berhad (PETRONAS). The companies adopted key strategies such as agreements and contracts to increase their market share.

In November 2023, Excelerate Energy, Inc. has entered into a lengthy liquefied natural gas ("LNG") sale and purchase agreement ("SPA") with the Bangladesh Oil, Gas & Mineral Corporation ("Petrobangla"). According to the SPA terms, Petrobangla has committed to buying between 0.85 to 1.0 million tons per annum ("mtpa") of LNG from Excelerate for a duration of 15 years, starting from January 2026.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the current Floating Liquefied Natural Gas Market Trends, segments, estimations, and dynamics of the floating liquefied natural gas market statistics from 2022 to 2032 to identify the prevailing floating liquefied natural gas market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the floating liquefied natural gas (FLNG) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players in Floating LNG Industry.

- The report includes the analysis of the regional as well as global Floating Liquefied Natural Gas (FLNG) Market Overview, key players, market segments, application areas, and market growth strategies.

Floating Liquefied Natural Gas (FLNG) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 51.6 billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 266 |

| By Technology |

|

| By Capacity |

|

| By Region |

|

| Key Market Players | EXMAR, Hoegh LNG, ABB Ltd., Golar LNG Limited, BASF SE, Mitsui O.S.K.Lines, Shell plc, Petroliam Nasional Berhad (PETRONAS), Excelerate Energy, Inc., Woodside Energy Group Ltd, Eni S.p.A. |

Analyst Review

According to the insights from the CXO’s, the FLNG market is closely tied to the overall growth of the global LNG market. Increasing demand for cleaner energy sources, particularly in Asia and other emerging markets, has driven the growth of LNG consumption. FLNG projects vary in scale, from large-scale facilities to mid-scale and small-scale projects. This diversity reflects the adaptability of FLNG technology to different project sizes and geographic locations, catering to a range of market demands. Ongoing technological advancements in FLNG technology aim to enhance efficiency, safety, and environmental performance. Innovations in liquefaction processes, materials, and control systems contribute to the continuous improvement of FLNG facilities. FLNG plays a crucial role in the monetization of stranded or remote gas reserves that lack access to traditional infrastructure. This includes gas fields offshore and challenging environments where onshore development is impractical.

Financing remains a critical aspect of FLNG projects. The market has seen the exploration of various financing models, including project financing, public-private partnerships, and collaborations between multiple stakeholders to address the capital-intensive nature of FLNG projects. Some FLNG projects involve collaboration between multiple stakeholders, including international energy companies, national oil companies, and financial institutions. Collaborative efforts and joint ventures aim to leverage expertise, share risks, and optimize project development.

$51.6 billion is the estimated industry size of Floating Liquefied Natural Gas (FLNG) by 2032.

Monetization of offshore gas and increase in flexibility and mobility are the upcoming trends of Floating Liquefied Natural Gas (FLNG) Market in the world.

FSRU is the leading technology of Floating Liquefied Natural Gas (FLNG) Market.

Asia-Pacific is the largest regional market for Floating Liquefied Natural Gas (FLNG).

Eni S.p.A., Shell plc, Hoegh LNG, Golar LNG Limited., EXMAR, Woodside Energy Group Ltd., Mitsui O.S.K. Lines., Excelerate Energy, Inc., BASF SE, ABB Ltd., and Petroliam Nasional Berhad (PETRONAS) are the top companies to hold the market share in Floating Liquefied Natural Gas (FLNG).

Loading Table Of Content...

Loading Research Methodology...