Floating Photovoltaics (FPV) Market Research, 2031

The global floating photovoltaics (FPV) market was valued at $32.3 million in 2021, and is projected to reach $106.0 million by 2031, growing at a CAGR of 12.9% from 2022 to 2031.

A type of solar array that floats on top of water is referred to as floating solar, also known as floating photovoltaic (FPV) or floatovoltaics. Under the floating plants, the photovoltaic panels are deployed on the surface of water bodies with various components attached. Floating photovoltaics (FPV) systems are an emerging form of PV systems which float on the surface of drinking water reservoirs, quarry lakes, irrigation canals or remediation, natural water bodies and tailing ponds.

The report includes the study of the floating photovoltaics (FPV) market with respect to the growth prospects and restraints based on the regional analysis. The study includes Porter’s five forces analysis of the floating photovoltaics (FPV) industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth. In addition, floating photovoltaics (FPV) have environmental benefits such as reduced evaporation from water reservoirs, easy installation and deployment at sites which is expected to support the growing floating photovoltaics (FPV) market share in the coming years.

Benefits of floating solar systems include increased energy production due to the cooling effect of water, reduced evaporation, and the utilization of underutilized bodies of water. This boosts the growth of the global floating photovoltaics (FPV) market size during the forecast period. The cooling effect feature of FPV improves the performance of solar photovoltaic panels by 5–10%. The potential for further growth in floating solar photovoltaic power generation is significant, as systems offer several advantages over traditional ground-mounted solar panels. As per floating photovoltaics (FPV) market forecast, the future of floating photovoltaics (FPV) systems looks promising as FPV is expected to play a dominant role in the transition to renewable energy sources.

According to floating photovoltaics (FPV) market analysis, systems are gaining popularity in low- and middle-income countries which hold a greater number of water bodies. Prices for different type of solar panels have decreased by around 80% in the past 6 years and are expected to decline even further which is driving the growth of the floating photovoltaics (FPV) market. Governments and other organizations accelerating the adoption of floating photovoltaics (FPV) products through tax cuts and subsidies which is creating more favorable opportunity for floating photovoltaics (FPV) market growth in the near future.

Floating photovoltaics (FPV) projects are attractive as panels can be built on bodies of water adjacent to hydropower plants with existing transmission lines which drive the growth of the global floating photovoltaics (FPV) market. Floating photovoltaics (FPV) systems mitigate the risk of droughts situation in hydropower plant also help in fulfilling the power required during peak hours. In coal-based power plant, producing energy through FPV improves local air pollution in several regions. There is an increase in the demand for floating photovoltaics (FPV) in the power industry as a result of their ability to increase energy production capacity.

The gradually growing requirement of energy and the limited resource of traditional energy sources are challenging for both developed and developing countries. Floating photovoltaics (FPV) provide a clean, cost-effective, environment-friendly solution to provide households and industries with access to lighting. Awareness related to clean energy is increasing in the developing nations boosts the global floating photovoltaics (FPV) market trends in near future.

Switching to solar power products, means taking an active part in conserving the environment. Countries around the world are adapting new ways to make positive changes in community. Power sector is focusing on investing in future with solutions which are smarter, greener, and more adaptable to the ever-changing landscape. Adoption of renewable energy source in residential and industrial helps to overcome the increasing environmental issues.

The floating photovoltaics (FPV) systems come with several environmental benefits that are attracting various energy producers toward floating photovoltaics (FPV) systems. High authorities are particularly concerned about the rise in global warming and changes in climatic conditions. As mentioned, using floating photovoltaics (FPV) plays a significant role in reducing carbon footprint which has been created by producing energy from using non-renewable energy sources. Floating photovoltaics (FPV) eliminates the need for non-renewable energies and helps boost the adoption of sustainability initiatives in the power industry.

There is an increase in the adoption of eco-friendly energy production systems globally. Large international commercial banks as well as multilateral developments banks which were only supporting small-scale studies, are now moving toward financing FPV projects resulting in the development of large-scale projects. Manufacturers in the solar PV sector are expanding their business investments quickly and are coming up with new technology which drives the demand for floating photovoltaics (FPV) products in the coming years.

Several components are used in the FPV systems. These include PV modules, inverters, floating structure, anchoring, and mooring systems cables and transformers. The component can be adapted to meet the specific needs of different water bodies. Manufacturers are introducing an innovative sun tracker and panel movement system using hydraulic mechanism which will move the solar panels as per sun position and generate more power and creating a floating photovoltaics (FPV) market opportunities in coming years. Various components are going through technological developments which is projected to create opportunities for the floating photovoltaics (FPV) market in new applications.

The inflated cost of FPV is a result of module and floating platform costs. The anchoring and mooring system's design arrangement is also determined by experts in power projects. The high initial cost of installing FPV is due to high price of floats. Installation of the anchoring and mooring system could be quite complicated, which also adds up to the cost of FPV. Floating photovoltaics (FPV) installations are at risk of degradation and corrosion due to moisture, especially in more aggressive coastal environments. The maintenance of FPV is on frequent basis which also tends to cost more due to the need of special boats and professional divers which restrain the global floating photovoltaics (FPV) market growth in the coming years.

Engineering and construction costs of floating photovoltaics (FPV) are higher than those of a ground-mounted solar farm. Floating photovoltaics (FPV) systems have additional safety issues related to floating structure and power transmission sources. Since floating photovoltaics (FPV) involves water and electricity, so more consideration must be given to cable management and insulation testing than on land, especially when cables are in contact with water which is creating a challenge for the global floating photovoltaics (FPV) market.

The need for solar panels has increased due to developments in the global renewable power industry. A surge in the investigation of new renewable energy sources has grown over the past five years, aside from the pandemic period. The report further outlines the details about the revenue generated through the sale of floating photovoltaics (FPV) across North America, Europe, Asia-Pacific, and LAMEA. Major players operating in the floating photovoltaics (FPV) market include SUNGROW., SolarisFloat, Profloating, NRG ISLAND s.r.l, ISIFLOATING, Oceans of Energy, Swimsol, Ocean Sun AS, SCOTRA CO, LTD. and Mibet Energy.

The floating photovoltaics (fpv) market is segmented into system, product, panel type, application, and region.

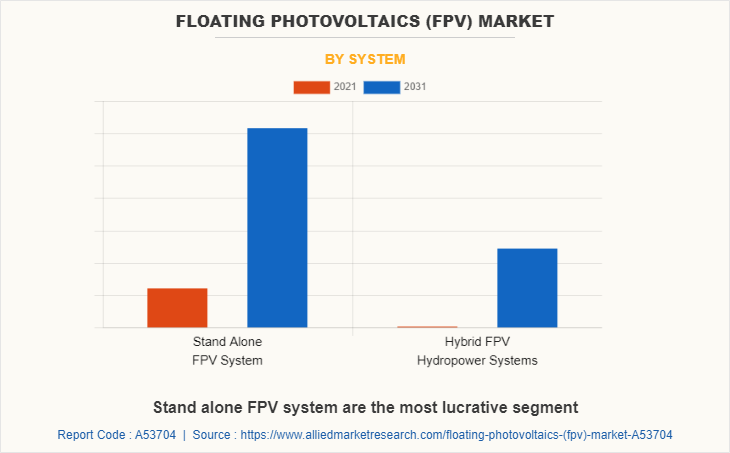

By system, the market is classified into stand-alone FPV system and hybrid FPV-hydropower system. In 2021, the stand-alone FPV system segment dominated the market owing to easy installation of stand-alone FPV system. The energy production capacity of stand-alone FPV system can easily increase according to the size of waterbodies. The key factors influencing the rise in demand for stand-alone FPV system are affordability, better efficiency, and government support.

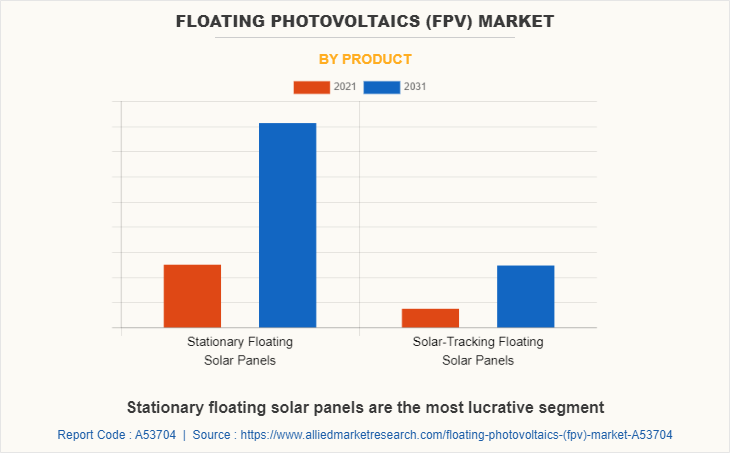

By product, the market is classified into stationary floating solar panels and solar-tracking floating solar panels. In 2021, the stationary floating solar panels segment dominated the market as stationary floating solar panels products are cost effective and withstand in hard climate. The stationary floating solar panels can be installed on any floating structure material which drive its demand in the market.

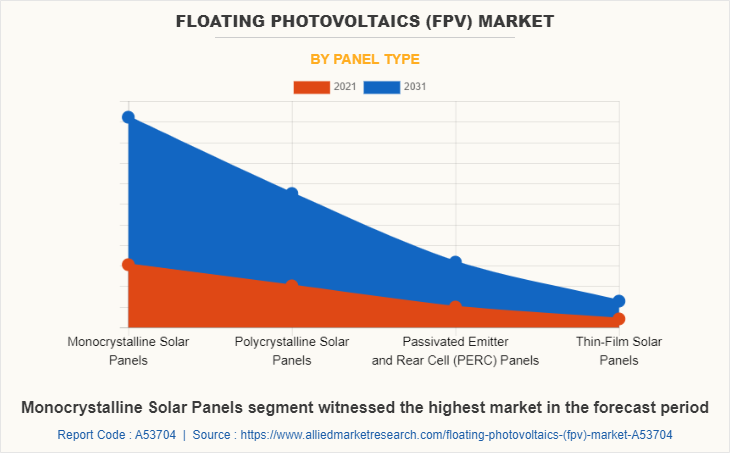

By panel type, the market is classified into monocrystalline solar panels, polycrystalline solar panels, passivated emitter and rear cell (PERC) panels and thin-film solar panels. In 2021, the monocrystalline segment dominated the market as monocrystalline solar panel is the most predominant panel for the solar energy products. The monocrystalline panel performs better in low light conditions and offers a higher temperature coefficient and high-power density which drives its demand in the market.

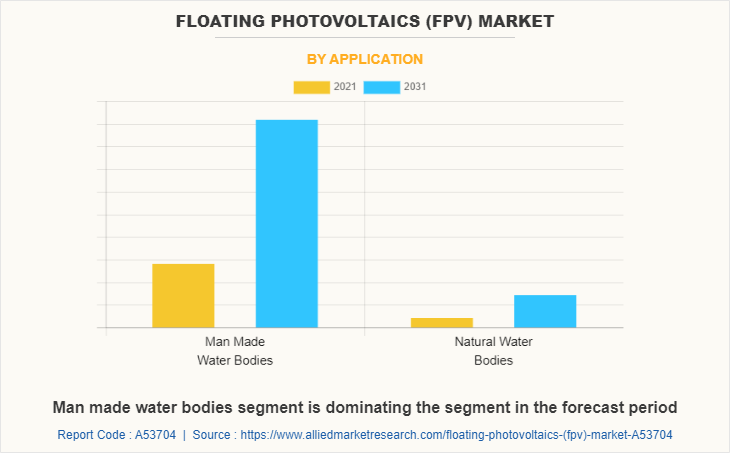

By application, the market is classified into man-made water bodies and nature water bodies. In 2021, man-made water bodies segment dominated the market as government is focusing on new infrastructure projects and new policies for adoption of renewable power production plant. Manufacturers are developing well-designed solar products to operate continuously with compact maintenance, which is driving the growth of the man-made water bodies segment.

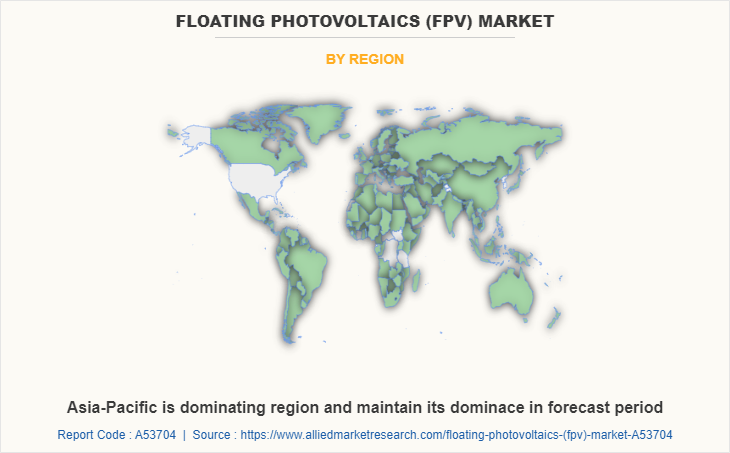

By region, the market is classified into North America, Europe, Asia-Pacific and LAMEA. In 2021, Asia-Pacific dominated the market owing to increased production of solar panels products. Large companies have already entered into the production of floating photovoltaics (FPV) products in China and Japan. There is a rise in demand for floating photovoltaics (FPV)in the southeast Asia countries which is expected to be the key factor for driving the floating photovoltaics (FPV) market growth during the forecast period.

The conflict between Russia and Ukraine has a significant impact on the energy sector. Russia's invasion of Ukraine has created shock waves in the global energy markets, leading to price volatility, supply shortages, and security issues. The global solar industry was on the rise before the Russia-Ukraine war. The war has a major impact on the solar industry, both in terms of production and demand. The cost of producing batteries and solar panel products was impacted by the war.

Industries and power houses are hesitant to invest in the solar energy and floating photovoltaics (FPV) market with the increase in instability factors for manufactures in the EU region. The war can significantly decline the renewable energy transition of Europe. The Russia-Ukraine war has a major impact on the global solar industry and floating photovoltaics (FPV) market. Production has decreased sharply, while demand has also declined.

Various non-renewable sources are depleting which are used to produce power. Power plants and industries are investing in the floating photovoltaics (FPV) systems for clean power generation and to reduce the dependence on the fossil fuels. Hydropower plants are opting for hybrid floating photovoltaics (FPV) systems which help increase the energy yield from power plant. Companies are investing in business expansion, production capacity, agreement, patents and approval for new products for the floating photovoltaics (FPV) market.

- In March 2023, Sungrow, the global leading inverter and energy storage system solution supplier, announced that the Company signed the Memorandum of Understanding (MOU) with Amp Co., Ltd., at PV Expo in Japan for the supply of floating photovoltaics (FPV) in several renewable projects. This development will help the company to increase the customer base and global presence

- In January 2023, Oceans of Energy company received approval in principle from Bureau Veritas for their high wave offshore solar farm system. The Oceans of Energy’s offshore solar farm system is the world’s first offshore solar farm proven in high waves, operating in the North Sea since 2019. FPV system is modular and scalable to any size. This development helps the company to increase revenue

- In July 2022, Ocean Sun AS company and Keppel company has signed an agreement for a 1.5 MWp floating PV project to be deployed near Jurong Island in Singapore. Keppel Energy Nexus (KEN) is the developer, owner and operator of a network of integrated utilities and sustainable energy solutions. This development helps the company to increase revenue in near future

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the floating photovoltaics (fpv) market analysis from 2021 to 2031 to identify the prevailing floating photovoltaics (fpv) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the floating photovoltaics (fpv) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global floating photovoltaics (fpv) market trends, key players, market segments, application areas, and market growth strategies.

Floating Photovoltaics (FPV) Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 106 million |

| Growth Rate | CAGR of 12.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 350 |

| By System |

|

| By Panel Type |

|

| By Application |

|

| By Product |

|

| By Region |

|

| Key Market Players | SUNGROW., ISIFLOATING, Profloating, SCOTRA CO, LTD., Oceans of Energy, Mibet Energy., Swimsol, Ocean Sun AS, SolarisFloat, NRG ISLAND s.r.l |

Analyst Review

The CXOs of major corporations claim that the spread of COVID-19 caused a considerable and quick reduction in the global economic activity. Pandemic had a detrimental effect on the market. Other pandemic consequences include decreased client spending, negative net income and revenue impact the growth of the floating photovoltaics (FPV) market. There has been a decrease in the manufacturing of solar panel equipment and other components during the period of severe economic disruption. Post COVID-19 manufacturers of solar panels and floating photovoltaics (FPV) equipment are anticipated to enhance their manufacturing capacity and mergers to broaden their customer base and global presence. Rise in investment in the renewable power generation projects is driving the floating photovoltaics (FPV) market growth. Government support and increase in manmade water reservoirs is projected to drive the growth of the global floating photovoltaics (FPV) market in the near future. Long term adoption of the floating photovoltaics (FPV) in the power sector helps lower the income risk to producer and expand the production of floating photovoltaics (FPV) systems in the near future.

Inclination towards the eco-friendly and energy-efficient solutions is the upcoming trends of floating photovoltaics (FPV) market

The global floating photovoltaics (FPV) market was valued at $32.3 million in 2021, and is projected to reach $106 million by 2031, growing at a CAGR of 12.9% from 2022 to 2031.

Man Made water bodies is the leading application of floating photovoltaics (FPV) market

Asia-Pacific is the largest regional market for floating photovoltaics (FPV) market

SUNGROW., SolarisFloat, Profloating, NRG ISLAND s.r.l, ISIFLOATING, Oceans of Energy, Swimsol, Ocean Sun AS, SCOTRA CO, LTD. and Mibet Energy are top companies to hold the market share in floating photovoltaics (FPV) market

Loading Table Of Content...

Loading Research Methodology...