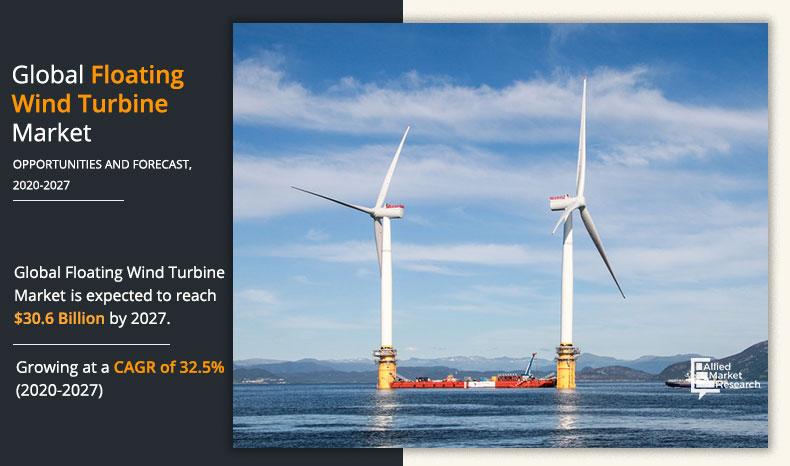

Floating Wind Turbine Market Outlook - 2027

Global floating wind turbine market size was valued at $3.2 billion in 2019, and is projected to reach $30.6 billion by 2027, growing at a CAGR of 32.5% from 2020 to 2027. Floating wind turbine, a type of offshore wind turbine, is supported by a floating foundation where most of the mass is underwater. The mounted structure allows the wind turbine to generate electricity in water depth where fixed foundation is not applicable. The turbine is connected to the sea bed with the help of multiple mooring lines and anchors. Floating wind turbine is effective anywhere in deep water where depth is more than 60 meter. In addition, due to consistent wind flow at seashore, floating wind turbine is capable to generate electricity at steady rate unlike onshore wind turbine.

Significant surge in demand for renewable power sources is expected to drive the floating wind turbine market growth. In addition, floating wind turbine is cost effective and reduces carbon emission unlike conventional power sources. Furthermore, the floating wind turbine technology removes the constraint of water depth which aids in selecting the best site possible for power generation. For instance, in June 2017, Statoil, a Norwegian energy company invested $268 million for its Hywind turbine project. The project involved installation of floating wind turbines at 78 meter sea depth in north-east coast of Scotland. Additionally, floating wind turbine has a higher capacity factor than that of other onshore wind turbines. This is attributed to consistent power generation of floating wind turbine. For instance, the capacity factor for floating offshore wind turbine is 0.5-0.7 where the onshore wind turbine has capacity factor of around 0.25-0.3. However, installation of wind turbine with multiple mooring lines and anchors can be expensive. In addition, during heavy storms or hurricanes, the wind turbine may face severe damage. Nonetheless, technological advancements in wind turbine structure, such as “Twisted Jacket” foundation with fewer nodes and components may be permanent solution against heavy storm. The inward battered guide structure provides robust and secure structure, and also reduces installation cost. Such new development will create further opportunities in the market.

The global floating wind turbine market is segmented on the basis of foundation and depth. On the basis of foundation, it is divided into spar-buoy, semi-submersible, and others. Based on depth, it is categorized into shallow water (less than 60 meter depth) and deep water (higher than 60 meter depth). Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA, with country level analysis of each region.

Major players have adopted product launch, business expansion, and acquisition to sustain the intense market competition. The key players profiled in the report include Siemens Gamesa Renewable, MHI Vestas Offshore Wind, Senvion SA, ABB group, GE Renewable Energy, and NORDEX SE.

Global Floating Wind Turbine Market, By Region

Europe accounted for highest revenue share and highest market growth, owing to rise in investments in countries like France, UK, and Norway. In addition, presence of major manufacturers, such as Siemens Gamesa Renewable, MHI Vestas Offshore Wind, Senvion SA, Adwen GmbH, and ABB group operating 75% of the global floating turbine projects will positively impact the market growth.

By Region

Asia-Pacific exhibits CAGR of 33.9% during 2020-2027

Global Floating Wind Turbine Market, By Foundation

The spar-buoy segment accounted for significant market share, owing to its simple design which can be easily fabricated. In addition, spar-buoy involves few number of welds and complicated components unlike semi-submersible-platform.

By Foundation

Semi-submersible foundation Floating Wind Turbine is projected as the most lucrative segment

Global Floating Wind Turbine Market, By Depth

The deep water (>60 meter) is anticipated to dominate the floating wind turbine market during the forecast timeframe. The installation of deep water turbine offers large area with no constraint of water depth which aids in selecting the best site for power generation. Additionally, in some cases, due to narrow continental shelf, floating foundation is the only option for deployment of floating wind turbines.

By Depth

Shallow water segment is projected as the most lucrative segment

COVID-19 scenario analysis:

- The Covid-19 pandemic severely impacted the wind turbine manufacturing in countries like China, Germany. For instance, Germany's Nordex SE reported negative EBITDA of $86.5 million down from positive EBITDA $21 million in previous

- Additionally, limited availability of spares and manpower for maintenance is a major problem affecting the growth of the floating wind turbine market. During high wind season, planned maintenance became a major issue for industry players, owing to reduced labor force and social distancing norms.

- Furthermore, project delays and cancellation of orders further affected the key markets for both blade production and wind turbine installations. For instance, Siemens Gamesa Renewable Energy SA accounted for a net loss of $577 million during its fiscal third quarter in 2020.

- Average time for project completion is around 6-9 months for wind energy. But, due to unavailability of large labor force and permitting delays, most of these projects are at standstill position or pushed to the second half of the financial year

- However, shifting trend towards domestic supply chain may reduce the dependency on foreign imports encouraging domestic production of wind turbines. Furthermore, implementation of digitization will aid in remote monitoring for project execution; thus, limiting the labor force as much as possible.

Key benefits for stakeholders:

- The global floating wind turbine market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides in-depth analysis of the global floating wind turbine market for the period 2020–2027.

- The report outlines the current floating wind turbine market trends and future estimations of the market from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- Key drivers, restraints, & opportunities and their detailed impact analysis of the global floating wind turbine market are explained in the study.

Floating Wind Turbine Market Report Highlights

| Aspects | Details |

| By FOUNDATION |

|

| By DEPTH |

|

| By Region |

|

| Key Market Players | Senvion SA, MHI Vestas Offshore Wind, Mingyang Smart Energy Group Co., Ltd., General Electric Company, Envision Energy, Siemens Gamesa Renewable, Hitachi, Goldwind, ABB Group, Nordex SE |

Analyst Review

The floating wind turbine market is expected to witness considerable growth. This is attributed to a significant surge in demand for renewable and clean energy. Floating wind turbine utilizes zero natural resources for power generation unlike conventional power generation. In addition, rise in concern from governments across emerging nations, such as China, India, and South Korea, regarding zero emission norms is expected to drive the market growth. Furthermore, installation of new floating wind turbine infrastructure may create new opportunities in the coastal regions involving more local economic activities in the market

Surge in demand for renewable sources, high-capacity factor of floating wind turbines and substantial government policies promoting wind turbine are the key factors boosting the Floating Wind Turbine market growth.

Deep water segment would steer the Floating Wind Turbine market ahead.

To get latest version of floating wind turbine market report can be obtained on demand from the website.

Floating Wind Turbine market worth $30.6 billion in 2027.

Advancements in floating wind turbine structure such as “Twisted Jacket” foundation with fewer nodes and components is projected to create lucrative opportunities in the market.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Siemens Gamesa Renewable, MHI Vestas Offshore Wind, Senvion SA, ABB Group, General Electric Company, Nordex SE, and Mingyang Smart Energy Group Co., Ltd. are the top companies in the Floating Wind Turbine industry.

Semi-submersible foundation is projected to increase the demand for Floating Wind Turbine Market.

• The Covid-19 pandemic severely impacted the wind turbine manufacturing in countries like China, Germany.For instance, Germany's Nordex SE reported negative EBITDA of $86.5 million down from positive EBITDA $21 million in previous • Additionally, availability of spares and manpower for maintenance is a major problem affecting the market growth. During high wind season, planned maintenance became a major issue for industry players, owing to reduced labor force and social distancing norms. • Furthermore, project delays and cancellation of orders further affected the key markets for both blade production and wind turbine installations. For instance, Siemens Gamesa Renewable Energy SA accounted for a net loss of $577 million during its fiscal third quarter in 2020. • Average time for project completion is around 6-9 months for wind energy. But, due to unavailability of large labor force and permitting delays, most of these projects are at standstill position or pushed to the second half of the financial year

Loading Table Of Content...