Flood Insurance Market Research, 2032

The global flood insurance market was valued at $12 billion in 2022, and is projected to reach $50 billion by 2032, growing at a CAGR of 15.6% from 2023 to 2032.

Flood insurance is a type of property insurance that protects the insurer's home and belongings from flood damage. Flood insurance is different from common homeowners' or renters' insurance policies, which do not cover flood damage. A flood is an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties. Flood insurance policies are based on the flood risk determined by the Federal Emergency Management Agency (FEMA).

One of the key drivers of the flood insurance market is an increase in the frequency and severity of floods. Furthermore, people are becoming more aware of the risks of flooding and the importance of flood insurance. This is because of better education and awareness campaigns by government agencies, insurance companies, and community organizations. Thus, the growing awareness is driving the demand for flood insurance and contributing to the flood insurance market growth.

However, one of the significant factors hindering the growth of the market is the high premium costs of flood insurance policies. Moreover, lack of awareness and misconceptions about flood risks and coverage are limiting the growth of the flood insurance market. On the contrary, increasing urbanization and infrastructure development in many regions, and climate change and extreme weather events are expected to provide lucrative growth opportunities to the flood insurance market in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the flood insurance market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the flood insurance market outlook.

Segment Review

The flood insurance market is segmented into coverage, application, and region. By coverage, the market is differentiated into building property coverage, and personal contents coverage. Depending on application, it is fragmented into residential and commercial. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

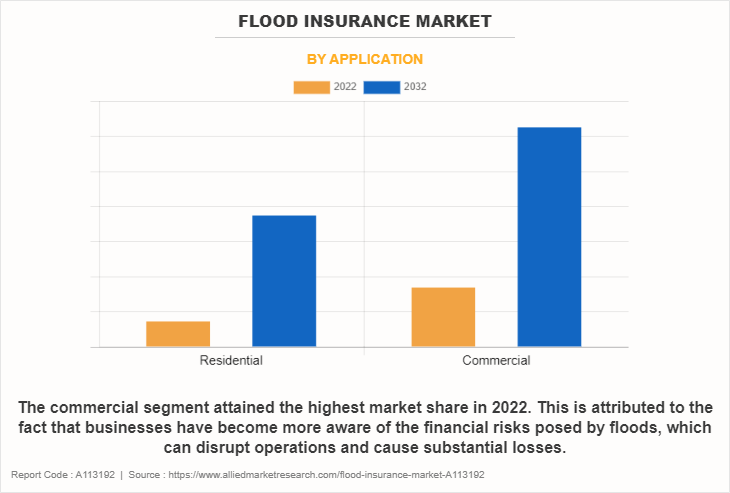

By application, the commercial segment acquired a major share in 2022. The growth of the commercial segment is being propelled by businesses that have become more aware of the financial risks posed by floods, which can disrupt operations and cause substantial losses. However, the residential segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the increasing frequency and severity of flooding events due to climate change which has raised awareness among homeowners about the need for protection. Furthermore, government regulations and mortgage requirements in flood-prone areas often mandate flood insurance for residential properties, pushing more homeowners to seek coverage.

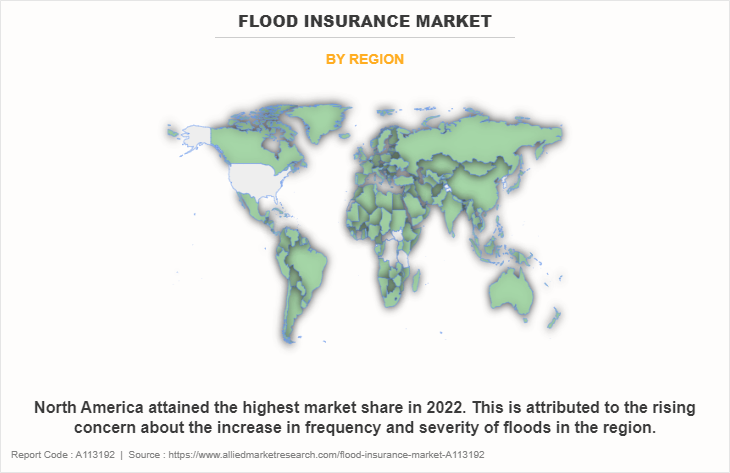

Region-wise, North America dominated the flood insurance market share in 2022. This is attributed to the rising concern about the increasing frequency and severity of floods in the region. Furthermore, the diversity in weather patterns increases the risk of flooding events, prompting more residents and businesses to seek flood insurance coverage. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the increase in awareness of flood risks.

The key players operating in the flood insurance market include GEICO, USAA, Neptune Flood, Allstate Insurance Company, Tokio Marine Highland Insurance Services, Inc., Berkshire Hathaway, Progressive Casualty Insurance Company, AXA, Chubb, and Assurant, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the flood insurance industry.

Market Landscape and Trends

The flood insurance providers in the market launched digital flood marketplace and private market flood with a mission to enable agents to match policyholders with the best coverage. For instance, in October 2022, Flow Insurance launched their flood insurance marketplace with the help of INSTANDA’s complete digital platform. Flow and INSTANDA built a flood marketplace where agents can compare quotes from up to six insurers side-by-side, along with the NFIP rates. Furthermore, AI-driven flood insurtech Neptune Flood formed a partnership with SIAA (Strategic Insurance Agency Alliance), a U.S. alliance of independent insurance agencies. The partnership allows SIAA members to have access to Neptune solutions for flood risk through SIAA MarketFinder, SIAA’s online member-only portal for difficult-to-place and specialty risk markets. Therefore, these strategies adopted by key market players provide growth opportunities to the flood insurance industry.

The COVID-19 has had a significant impact on the flood insurance market size. The pandemic increased awareness about the importance of insurance coverage for unexpected events such as floods. Many people realized that they needed protection not only from health emergencies but also from natural disasters. This led to more interest in flood insurance, causing a rise in policy purchases. However, the economic uncertainty caused by the pandemic strained the finances of both individuals and governments which made it challenging for people to afford flood insurance premiums.

Top Impacting Factors

Increasing Frequency and Severity of Floods

One major reason due to which the flood insurance market is growing is that floods are happening more often and becoming more severe. This is due to various factors such as climate change, which leads to more rain and stronger storms. When floods occur, they cause a lot of damage to homes and businesses. Without flood insurance, people might have to pay for these repairs out of their own pockets, which are expensive. Hence, more people are adopting flood insurance to protect themselves from the financial burden of flood-related damage.

In addition, FEMA announced a reinsurance program to manage future flood risk in 2023. Its traditional reinsurance placement for the National Flood Insurance Program (NFIP) continues its risk management practice against catastrophic flood losses. It covers portions of NFIP losses above $7 billion arising from a single flooding event. FEMA paid a total premium of $90.2 million for the coverage. Thus, these factors drive the market growth.

Increased Awareness and Education Regarding Flood Insurance Policy

People have become more aware of the risks of flooding and the importance of flood insurance. This is due to better education and awareness campaigns by government agencies, insurance companies, and community organizations. As more people learn about the potential harms of floods and how flood insurance help them recover from such disasters, they are more likely to purchase flood insurance policies. This growing awareness is driving the demand for flood insurance and contributing to the growth of flood insurance industry.

In addition, key players in the market adopt key strategies such as partnerships and product launches to improve their product portfolios. For instance, in August 2023, Wright National Flood Insurance Services introduced FocusFlood, the company’s extension of its popular ResiFlood program, in Florida, Texas, New Jersey, South Carolina, and Louisiana. FocusFlood is the latest proprietary private flood product offered exclusively through Wright Flood agents.

Increase in Urbanization and Infrastructure Development

One significant growth opportunity for the flood insurance market is the increasing urbanization and infrastructure development in many regions. As more people move to cities and urban areas expand, there is a rise in construction and development. However, this led to changes in land use and drainage patterns, which increased the risk of flooding. With more properties and assets at risk, there is a growing need for flood insurance to protect these investments. This trend provides a lucrative opportunity for the market to expand its customer base and offer coverage to individuals and businesses in these urban areas. In addition, insurance companies tap into this opportunity by tailoring flood insurance policies that address the specific needs of urban areas. By aligning their offerings with the demands of these expanding urban regions, insurance providers seize this growth opportunity.

For instance, in November 2022, FloodFlash launched a new coverage option that pay catastrophic flood claims in hours after a flood event. The new business focuses on supporting clients with the content and platforms they need to mitigate risk in an increasingly complex, politicized, and unstable business risk environment. Therefore, these factors are expected to provide lucrative growth opportunities for the flood insurance market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flood insurance market analysis from 2022 to 2032 to identify the prevailing flood insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flood insurance market segmentation assists to determine the prevailing flood insurance market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as flood insurance market trends, key players, market segments, application areas, and market growth strategies.

Flood Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 50 billion |

| Growth Rate | CAGR of 15.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 125 |

| By Coverage |

|

| By Application |

|

| By Region |

|

| Key Market Players | Allstate Insurance Company, GEICO, AXA, Chubb, Neptune Flood, Assurant, Inc., Tokio Marine Highland Insurance Services, Inc., USAA, Berkshire Hathaway, Progressive Casualty Insurance Company |

Analyst Review

Advancements in technology have played a significant role in expanding the flood insurance market. With more people relying on digital channels, insurance companies improved their online services, making it easier for customers to research, purchase, and manage policies online. This digital transformation enhanced customer convenience as well as allowed insurers to reach a broader audience, including those who might not have considered flood insurance before. Therefore, the adoption of digital tools provides growth opportunities for the flood insurance market.

Furthermore, in November 2021, Neptune Flood, the first AI-driven flood insurance company to provide faster, easier, and better flood insurance, partnered with Indium, a national independent agency network. Indium agency partners have access to an instant flood solution that provides greater and broader coverage than the traditional National Flood Insurance Program (NFIP) under FEMA.

The COVID-19 pandemic increased awareness about the importance of insurance coverage for unexpected events such as floods. Many people realized that they needed protection not only from health emergencies but also from natural disasters. This led to more people getting interested in flood insurance, causing a rise in policy purchases. However, the economic uncertainty caused by the pandemic strained the finances of both individuals and governments which made it challenging for people to afford flood insurance premiums.

The key players in the flood insurance market include GEICO, USAA, Neptune Flood, Allstate Insurance Company, Tokio Marine Highland Insurance Services, Inc., Berkshire Hathaway, Progressive Casualty Insurance Company, AXA, Chubb, and Assurant, Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With an increase in awareness & demand for flood insurance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The flood insurance market is segmented into coverage, application, and region. By coverage, the market is divided into building property coverage and personal contents coverage. Depending on application, it is fragmented into residential and commercial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Flood Insurance Market.

The flood insurance market size was valued at $12,036.49 million in 2022 and is projected to reach $49,966.37 million by 2032, growing at a CAGR of 15.6% from 2023 to 2032.

The key players operating in the flood insurance market include GEICO, USAA, Neptune Flood, Allstate Insurance Company, Tokio Marine Highland Insurance Services, Inc., Berkshire Hathaway, Progressive Casualty Insurance Company, AXA, Chubb, and Assurant, Inc.

Loading Table Of Content...

Loading Research Methodology...