Fluorescent Paint Market Research, 2031

The global fluorescent paint market was valued at $357.3 million in 2021 and is projected to reach $677.9 million by 2031, growing at a CAGR of 6.8% from 2022 to 2031.The fluorescent paints market is expanding due to rise in demand from the automotive and aerospace sectors, where these paints are valued for enhancing vehicle aesthetics and improving safety through high visibility. In addition, the building and construction industry's growth further drives market demand, as fluorescent paints are used for vibrant signage, safety markings, and decorative applications in infrastructure projects.

Report key highlighters

- Quantitative information mentioned in the global fluorescent paint market includes the market numbers in terms of value (USD Million) and volume (Kilolitres) with respect to different segments, pricing analysis, annual growth rate, CAGR (2022-31), and growth analysis.

- The analysis in the report is provided on the basis of type and application. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Radiant Color N.V., LuminoChem, Ronan Paints, Glow Paint Industries, GLOWTEC LTD, hold a large proportion of the fluorescent paint market.

- This report makes it easier for existing market players and new entrants to the sonochemical coatings business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Fluorescent paint is a form of a coating that emits visible or colored light when exposed to light. Fluorescent paints are utilized in paints and coatings, plastics, fabrics, paper goods, and leather goods, among others. It comprises two components, fluorescent paint that absorbs ultraviolet or blue light and re-emits it as visible light with a different wavelength (color). This sort of paint color emits light without the aid of an external source.

Fluorescent paint refers to paint that can absorb both visible and non-visible electromagnetic waves and radiation and then swiftly release the absorbed energy at the required wavelength. When the light of the expected wavelength is released onto this paint, it also emits a very particular hue. On a commercial scale, fluorescent paint has been utilized in a variety of applications, including the formulation of paint and coating solutions, inks, and textiles, to mention a few. There are two forms of fluorescent paint used commercially: organic and inorganic, which are derived from distinct sources. Organic fluorescent paint is made from natural and synthetic basic materials, while inorganic fluorescent paint is synthesized by combining various metal oxides. Both varieties are commercially accessible in powder and dispersion form, with formulations tailored to the requirements of the end-user industry.

Most fluorescent paints can withstand demanding applications due to their remarkable properties, such as resilience to adverse weather conditions, high temperatures, heat, and other chemicals. These characteristics facilitate the use of this fluorescent paint in a variety of applications. Similarly, this fluorescent paint is used as a colorant for engineering plastics in the automotive industry.

Increasing demand from building and construction industry

The construction industry’s demand for fluorescent paint for applications such as building paints, coatings, sign markings, and road lines is increasing. In commercial structures, luminous pigments or paints are utilized for coatings, markings, ornamentation, and sign marks. Fluorescent paints have applications in the construction industry for artificial lighting such as stage lighting, posters, and others. According to the U.S. Census Bureau, construction spending in the United States increased by 1.3% from December 2021 to January 2022, reaching $1,677 billion. Moreover, the increase in construction and infrastructure projects is boosting the market for fluorescent paint, creating development potential for market participants.

Fluorescent Paints provide superior features such as resistance to oil, water, grime, and corrosion. In developing regions, the number of new roadways and infrastructure projects has led to a rise in the use of fluorescent paints for a variety of applications, such as regulatory, emergency, and warning signs. Numerous countries around the globe have begun to work on the design and implementation of smart cities. China alone has around 300 smart city projects in development, with substantial industry and government participation. India has also allocated trillions of dollars for the development of more than 100 smart cities. In India, the smart cities mission is a major project undertaken by the government, which will construct more than 100 smart cities all over the country to achieve rapid urbanization in the country. In the budget 2021-2022, the smart cities mission was given $864.5 million as compared to $455.7 million in 2020-2021

Surge in demand in automotive and aerospace sectors

Rise in demand in the automotive and aerospace sectors is a significant driver for the fluorescent paints market. India's automotive industry is worth around $222 billion, while the EV market in India is estimated to be valued at $2 billion by 2023 and $7.09 billion by 2025. Further, the automotive industry accounts for 8% of all national exports. This sector accounts for 40% of the total $31 billions of global research and development spend. In the automotive industry, fluorescent paints are used to enhance vehicle aesthetics and improve visibility, especially in high-performance and custom vehicles. Their bright, vibrant colors are employed in both decorative and functional applications, such as safety markings and branding.

Similarly, the aerospace sector utilizes fluorescent paints for safety and visibility purposes, including on aircraft markings and components to enhance visibility in low-light conditions. These sectors value fluorescent paints for their durability and ability to perform under various environmental conditions. According to the Aerospace Industries Association (AIA), the aerospace and defense industry’s workforce generated $952 billion in combined sales in 2022, a 6.7% increase from the prior year. In addition, the A&D industry generated $418 billion in economic value, which represented 1.65% of total nominal GDP in the U.S. In addition, the technological advancements in paint formulations have led to improved performance and application ease, further boosting their adoption in these industries. As both automotive and aerospace industries continue to grow and evolve, the demand for high-quality, high-visibility fluorescent paints is expected to rise, driving market expansion.

Innovation is the key to generating new items, and as a result, alternatives begin to hamper market expansion. Increased use of phosphors with no radium content, such as copper-magnesium, copper, and silver, in conjunction with activators such as copper, copper-magnesium, and silver, is impacting the growth of the fluorescent paint market. The thin layer is utilized so that light can absorb itself. Fluorescent paints are expensive due to their lengthy illuminating life and hazardous due to their use of radioactive materials.

The invention of fluorescent paints led to their application in various industries and for various reasons. The use of gadgets that do not require additional electrical power for visibility in all conditions is expanding, and these can be utilized in remote places where the electrical power supply is limited. The helicopter's primary and tail rotors are painted with fluorescent paint to improve its visibility. The tail rotors are hazardous due to their rapid rotation and invisibility, especially when the vision limit is reached. According to the International Air Transport Association (IATA), the total aircraft fleet reached 24,500 by the end of the year, up from approximately 8,000 at the year's low point in April, but 18% lower than in 2019. The global fleet is not expected to return to pre-COVID levels until at least the end of 2022, but long-term projections show a recovery for the industry. Thus, expanding applications in the military and aviation sectors will create lucrative market opportunities for fluorescent.

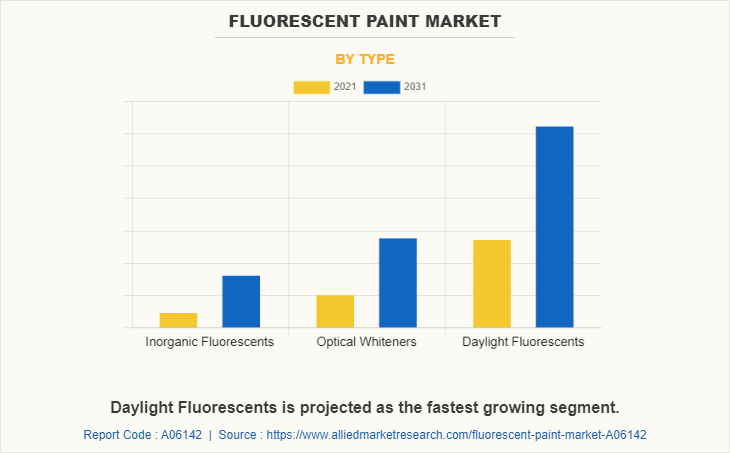

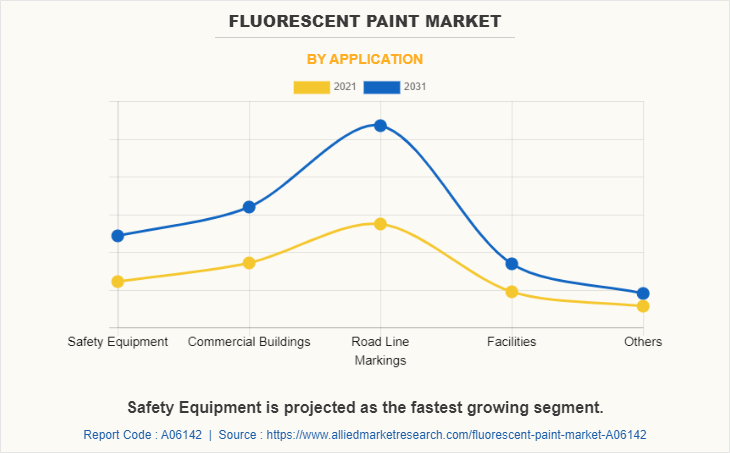

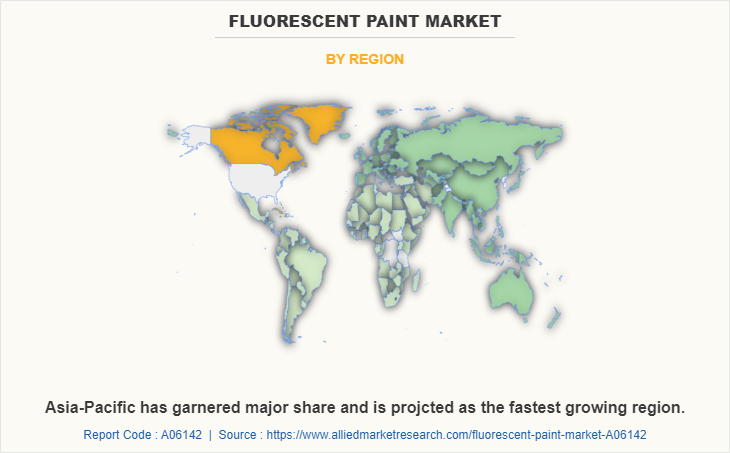

The fluorescent paint market is segmented into type, application, and region. Depending on the type, the market is divided into Inorganic fluorescents, optical whiteners, and daylight fluorescents. On the basis of application, it is categorized into safety equipment, commercial buildings, road line markings, facilities, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global fluorescent paint market are Radiant Color N.V., LuminoChem, Ronan Paints, Glow Paint Industries, GLOWTEC LTD, Krylon Products Group, DayGlo Color Corp, Brilliant Group, Inc., Aron Universal Limited, and Vicome Corp. Other players operating in the market are Midstar, Xcolor, DANE Color Group and Solar Color Dust.

Fluorescent Paint Market, By Type

The daylight fluorescents segment accounted for the largest share and is the fastest-growing segment with a CAGR of 7.0%, The characteristic of luminosity is provided by the daylight fluorescent material when the fluorescent color emits light. Daylight fluorescent paints are non-toxic and are utilized due to their ability to attract attention and provide extremely high visibility. These pigments are utilized in advertising, protective gear, documentation, inks, and several biomedical applications.

Fluorescent Paint Market, By Application

The road line markings segment accounted for the largest share, due to raising awareness through signals, sign boards, and important messages, mandating respect to traffic laws, and other approaches such as organizing awareness camps are all examples of road safety initiatives. Signboards are the most commonly used approach, mostly for preventing traffic accidents and mishaps. Because roads are the most common mode of transportation, users such as bicycles, pedestrians, and motor vehicle drivers are in danger of collisions. Because of measures such as sidewalks, safe crossing sites, bike lanes, rumble strips, and other traffic calming measures, the demand for road line marking has significantly increased.

The safety equipment segment is the fastest-growing segment with a CAGR of 7.4%, Fluorescent paints are used to paint or paint clothing that is subsequently worn as safety equipment. Fluorescent-coated clothing helps to decrease workplace accidents and injuries by making workers visible to one another. The usage of worker safety equipment on construction sites or in dangerous conditions, such as those near roadways, in the dark, or where personnel may be obstructed by trees and traffic barriers, is becoming more common in the industrial sector.

Fluorescent Paint Market, By Region

Asia-Pacific garnered the largest share. China and India are boosting demand in Asia-Pacific due to the expansion of transportation and infrastructure developments. Strong and healthy growth in the infrastructural sector is related with the expansion of government projects, such as the Indian government's plan to construct highways worth Rs. 15 lakh crore ($204,000 million) over the next two years. Numerous infrastructure development projects necessitate the use of fluorescent paints for road safety signs, markings, emergency signs, and others. This has resulted in the expansion of the market for fluorescent paint in the Asia-Pacific region.

Key Market Trends:

- The European countries are concentrating on mergers and acquisitions for product development and launches that will aid in the expansion of businesses in the region by the conclusion of the forecast period.

- Manufacturers from the Asia-Pacific region are concentrating heavily on the growth of fluorescent paint market applications in the area's growing and developed economies.

- The Latin American register is in the process of reviving the economy and using the prospects accessible to businesses operating in both Brazil and Mexico.

- As part of the North American market, the U.S. market focuses on creating demand through packaging materials, entertainment sources, and educational and safety-related product content.

- With its Limelight i8 vehicle, BMW made tremendous progress. They have discovered a new approach to combine fluorescent pigment into their car models to give them a glossy appearance. This strategy of BMW Italia has assisted the corporation in giving their automobile a futuristic appearance.

Recent developments undertaken by key players

- In January 2022, Luminochem developed and manufactured unique luminescent photoactive materials and markers, with a focus on organic fluorescent security pigments and dyes and near infra-red absorbing materials. This launch improves the growth of the product portfolio.

- In October 2020, Brilliant Group, Inc., the leader in providing a simple, end-to-end experience for manufacturers and distributors to implement fluorescent pigments, announces that their new warehouse location in The Netherlands is fully operational. This expansion will improve the growth of the fluorescent paint market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fluorescent paint market analysis from 2021 to 2031 to identify the prevailing fluorescent paint market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fluorescent paint market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fluorescent paint market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

According to the insights of the CXOs of leading companies, the global market for fluorescent paint has shown significant expansion in recent years, and the same trajectory is expected to be followed in the next 8-10 years. Key market drivers for fluorescent paint include the expanding paints and coatings market and its application in various end-use industries, rapid urbanization, the construction sector, the textile industry, the plastics industry, and the building material industry. In addition, the global manufacturers of fluorescent paint are prioritizing the use of considerable amounts of colorants, functional pigments, and extenders to formulate pigments that may be used in a variety of industries. Emerging economies, such as India and China, are anticipated to have a significant need for fluorescent paint. Due to its durability, this fluorescent paint is also used in the automotive industry. The automobile industry in developing nations, as well as the coatings and plastics industries, are thriving at a rapid rate, particularly in growing economies such as India and China. As a result, the need for fluorescent paint is anticipated to increase in these nations. However, the adverse and harmful environmental impacts of fluorescent paint may act as a barrier to its global adoption.

Fluorescent Paint Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 677.9 million |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 420 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Radiant Color N.V., DayGlo Color Corp, Krylon Products Group, Vicome Corp., Glow Paint Industries, Ronan Paints, LuminoChem, Brilliant Group, Inc., GLOWTEC LTD, Aron Universal Limited |

Analyst Review

According to the insights of the CXOs of leading companies, the global market for fluorescent paint has shown significant expansion in recent years, and the same trajectory is expected to be followed in the next 8-10 years. Key market drivers for fluorescent paint include the expanding paints and coatings market and its application in various end-use industries, rapid urbanization, the construction sector, the textile industry, the plastics industry, and the building material industry. In addition, the global manufacturers of fluorescent paint are prioritizing the use of considerable amounts of colorants, functional pigments, and extenders to formulate pigments that may be used in a variety of industries. Emerging economies, such as India and China, are anticipated to have a significant need for fluorescent paint. As a result of its durability, this fluorescent paint is also utilized in the automotive industry. The automobile industry in developing nations, as well as the coatings and plastics industries, are thriving at a rapid rate, particularly in growing economies such as India and China. As a result, the need for fluorescent paint is anticipated to increase in these nations. However, the adverse and harmful environmental impacts of fluorescent paint may act as a barrier to its global adoption.

The fluorescent paint market attained $357.3 million in 2021 and is projected to reach $677.9 million by 2031, growing at a CAGR of 6.8% from 2022 to 2031.

The fluorescent paint market is segmented into type, application, and region. Depending on the type, the market is divided into Inorganic fluorescents, optical whiteners, and daylight fluorescents. On the basis of application, it is categorized into safety equipment, commercial buildings, road line markings, facilities, and others.

Radiant Color N.V., LuminoChem, Ronan Paints, Glow Paint Industries, GLOWTEC LTD, Krylon Products Group, DayGlo Color Corp, are the top companies to hold the market share in Fluorescent Paint.

The daylight fluorescents segment is the leading type of the Fluorescent Paint Market.

Increasing use of optical whiteners in coated and uncoated paper industry and increasing demand from building and construction industry are the driving factors of Fluorescent Paint Market .

Asia-Pacific is the largest regional market for Fluorescent Paint.

The safety equipment segment is the leading application of Fluorescent Paint Market.

Loading Table Of Content...