Fluoroscopy Equipment Market Research, 2028

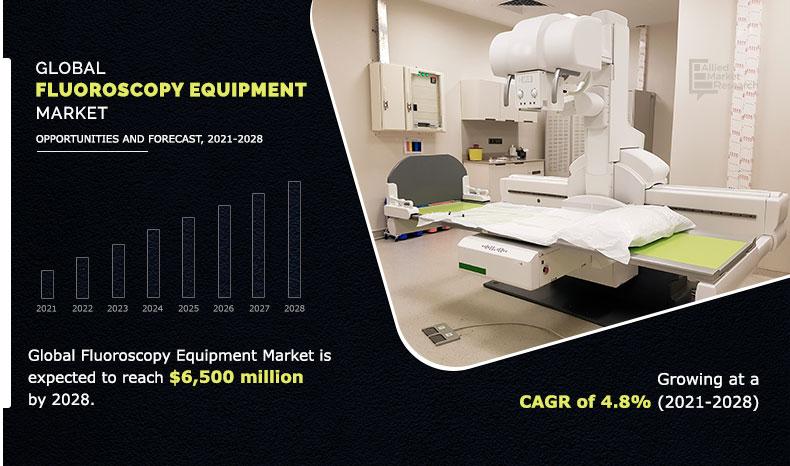

The fluoroscopy equipment market size was valued at $4,072.80 million in 2020, and is projected to reach $6,500.20 million by 2028, registering a CAGR of 4.8% from 2021 to 2028. Fluoroscopy is a form of medical imaging that shows continuous X-ray image on a monitor. During a fluoroscopy operation, an X-ray pulse is passed through the body and the image is sent to a camera, which allows detailed analysis of movement of a body part, an instrument, or a contrast agent around the body. Fluoroscopy is a form of imaging that helps doctors diagnose illnesses and guide them through certain treatment procedures. Several fluoroscopy operations may be performed as outpatient procedures while patient is awake.

For instance, a barium enema or an upper gastrointestinal series is done to investigate esophagus, liver, and small intestine. Other treatments are performed the same day or as inpatient procedures in a hospital, typically when patient is sedated. For instance, heart and coronary arteries that provide blood to heart muscle are examined using a procedure called cardiac catheterization. During surgery, other fluoroscopy operations can be done under general anesthesia.

Increase in incidences of pain management and trauma, gastrointestinal disorders, urological disorders, and other conditions, visualization of the targeted area with fluoroscopy equipment, and surge in geriatric population are the key factors that fuel growth of the global fluoroscopy equipment market. According to the International Osteoporosis Foundation, globally, osteoporosis causes more than 8.9 million fractures annually, which means that an osteoporosis fracture occurs in every 3 seconds. Moreover, growth in adoption of fluoroscopy equipment by patients, rise in awareness among healthcare professionals for use of fluoroscopy, and surge in incidences of cardiovascular diseases are other factors that contribute toward growth of the market. However, complications and side-effects associated with contrast agents and high cost associated with fluoroscopic equipment are expected to hinder growth of the market.

The World Health Organization (WHO) on January 30, 2021 declared COVID-19 outbreak a public health emergency of international concern. COVID-19 has affected around 210 countries across the globe. Nationwide lockdowns, government regulations, and continuous increase in infection rate across various countries have created a widespread financial impact on neurology hospitals and clinics. Large number of hospitals and clinics have witnessed a drop in number of patient visits amid COVID-19 ultimately reducing client contact. Furthermore, many diagnostic procedures through fluoroscopic equipment have been delayed due to the COVID-19 crisis. Moreover, to free-up limited space for people being treated for the virus, hospitals across the world have cancelled or postponed many diagnostic procedures, especially those deemed to be non-essential or non-urgent. At the same time, limited availability of healthcare staff across the globe is another factor that has an undesirable effect on the fluoroscopy equipment market.

Global Fluoroscopy Equipment Market Segmentation

The fluoroscopy equipment market is segmented on the basis of product, application, and region to provide a detailed assessment of the market. By product, the market is bifurcated into fluoroscopy devices and c-arm. The c-arm segment is further divided into full size c-arm, and mobile c-arm. On the basis of application, the market is segregated into orthopedic, cardiovascular, pain management and trauma, neurology, gastrointestinal, urology, general surgery, and others. Region wise, it is analyzed across North America (U.S., Canada, Mexico) Europe (Germany, France, UK, Italy, Spain, Rest of Europe) Asia-Pacific (Japan, China, Australia, India, South Korea, Taiwan and rest of Asia-Pacific) and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

By Product

Presently, on the basis of product, the fluoroscopic devices segment is the major revenue contributor, and is projected to grow significantly during the forecast period. Increase in adoption of fluoroscopic devices, surge in prevalence of cardiovascular diseases, need for pain management, rise in R&D investments over advancements in fluoroscopic equipment, increase in geriatric population, introduction of technologically advanced products, and surge in launch of new and advanced fluoroscopic devices are the key factors that boost growth of the segment.

By Product

Fluoroscopic devices segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By Application

Depending on application, the cardiovascular diseases segment is the expected to be a major shareholder in the fluoroscopy equipment market during the forecast period, owing to surge in prevalence of stroke, heart related diseases, government initiatives to modernize healthcare infrastructure, technological advancements in diagnostic equipment, and increase in product approvals of fluoroscopic equipment for better diagnosis of cardiovascular diseases than conventional diseases.

By Application

Cardiovascular segment is projected as one of the largest revenue contributor

By Region

On the basis of region, North America gained highest market share in the fluoroscopy equipment market in 2020, owing to the surge in target diseases in the region such as cardiovascular diseases, orthopedic conditions, lung diseases and other conditions, and rise geriatric population who are susceptible to develop chronic conditions.

By Region

North America was holding a dominant position in 2020 and would continue to maintain the lead over the analysis period.

Competition Analysis

The key players profiled in this report include ADANI Systems Inc., Agfa-Gevaert Group, Canon Medical Systems, GE Healthcare, Hitachi Ltd., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers, Toshiba Medical Systems Corporation and Ziehm Imaging GmbH.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the fluoroscopy equipment market size along with current trends and future estimations to elucidate imminent investment pockets.

- It offers fluoroscopy equipment market analysis from 2020 to 2028, which is expected to enable stakeholders to capitalize on prevailing opportunities in the market.

- A comprehensive analysis of factors that drive and restrain the growth of the fluoroscopy equipment market is provided.

- Profiles and growth strategies of key players are thoroughly analyzed to understand the competitive outlook and fluoroscopy equipment market growth.

Key Market Segments

By Product

- Fluoroscopy devices

- C-arm

- Full size C-ARM

- Mobile C-ARM

By Application

- Orthopedic

- Cardiovascular

- Pain Management and Trauma

- Neurology

- Gastrointestinal

- Urology

- General Surgery

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Fluoroscopy Equipment Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Siemens Healthcare GmbH, GE Electric (GE Healthcare), Koninklijke Philips N.V., Hitachi, Ltd., Ziehm Imaging GmbH, Adani Systems Inc., Canon Medical Systems, Agfa-Gevaert Group, Medtronic, Inc., Shimadzu Corporation |

Analyst Review

Fluoroscopy equipment is used to diagnose and even monitor progression of disease. This device is mainly used to visualize live pictures to check whether surgical procedure is accurately performed and assists healthcare professionals to make quick corrections while performing a surgery. Moreover, it can be used to diagnose severity of conditions such as cardiovascular diseases, urology disorders, orthopedic condition, and other chronic conditions.

Increase in awareness toward usage of fluoroscopy, increase in prevalence of orthopedic conditions, surge in incidences of sports injuries and cardiovascular diseases, technological advancements in fluoroscopic equipment, rise in demand for fluoroscopic devices, and rise in geriatric population are expected to drive growth of the fluoroscopy equipment market. Furthermore, introduction of advanced fluoroscopy equipment and favorable reimbursement policies associated with these equipment are expected to propel the market growth. However, side-effects associated with usage of contrasting agents and higher cost associated with fluoroscopic equipment are expected to hinder growth of the market.

North America is expected to remain dominant during the forecast period, owing to increase in demand for fluoroscopy equipment, rise in incidences of chronic orthopedic conditions, and presence of major key players along with R&D centers. Moreover, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to key players during the forecast period, owing to increase in number of hospitals equipped with advanced medical facilities along with surge in utilization of fluoroscopy equipment.

The total market value of Fluoroscopic Equipment Market is $4072.8 million in 2020

The forecast period in the report is from 2021 to 2028

The market value of Fluoroscopic Equipment Market in 2020 was $4683.7 Million

The base year for the report is 2020

Yes, Fluoroscopic Equipment companies are profiled in the report

The top companies that hold the market share in Fluoroscopic Equipment Market are ADANI Systems Inc., Agfa-Gevaert Group, Canon Medical Systems, GE Healthcare, Hitachi Ltd., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers, Toshiba Medical Systems Corporation, and Ziehm Imaging GmbH.

No, there is no value chain analysis provided in the Fluoroscopic Equipment Market report

The key trends in the Fluoroscopic Equipment Market are increase in incidences of cancer, and other chronic conditions and surge in R&D of fluoroscopic equipment.

Loading Table Of Content...