Fly Ash Market Overview

The global fly ash market size was valued at $7.1 billion in 2022, and is projected to reach $12.9 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Report Key Highlighters

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The fly ash market is fragmented in nature among prominent companies such as CEMEX, S.A.B. de C.V, Lafarge North America, Holcim Ltd., Salt River Materials Group, Boral Limited, Charah Solutions, FlyAshDirect, Cement Australia Pty Limited, and Tarmac Holdings Limited.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), public policies, pricing analysis, and Porter Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global fly ash market such as undergoing R&D activities, green initiatives, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,000 fly ash-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global fly ash market.

Introduction

Fly ash is a byproduct produced during the combustion of pulverized coal in coal-fired power plants. It consists of fine, powdery particles that are carried up into the air along with the flue gases generated by the combustion process. When these gases cool, the particles solidify and form what is known as fly ash. The composition of fly ash can vary depending on the type of coal burned, the combustion conditions, and the collection methods. There are two types of fly ash namely class C and class F.

The properties of fly ash make it a valuable and versatile material with various applications in construction and other industries. It is known for its pozzolanic characteristics, which means it can react with lime in the presence of water to form cementitious compounds. This property is particularly useful in enhancing the performance of concrete and other construction materials.

Market Dynamics

The fly ash market is expanding rapidly due to several key drivers, including increased infrastructure development, environmental regulations, and the demand for sustainable building materials. Fly ash, a byproduct of coal combustion, is used extensively in cement and concrete manufacturing due to its strength-enhancing properties. The global push for sustainable construction is a major factor in the market's growth. Governments are promoting fly ash utilization to reduce carbon emissions from cement production. For instance, the Indian government, under its Fly Ash Notification 2021, mandates 100% fly ash utilization by thermal power plants, a move designed to minimize environmental waste and encourage its use in the construction industry. As of 2023, India's Ministry of Power reported that fly ash utilization had reached over 80%, a significant improvement driven by government policies and infrastructure demands.

Furthermore, in the U.S., the Environmental Protection Agency (EPA) has regulations promoting the beneficial reuse of coal combustion residuals like fly ash, encouraging its use in construction to reduce landfill waste. Additionally, federal infrastructure spending, including the Bipartisan Infrastructure Law passed in 2021, is fueling demand for fly ash in large-scale projects. The American Coal Ash Association reported that fly ash utilization in concrete grew by 8% in 2022, driven by such government initiatives. Similarly, China’s 13th Five-Year Plan emphasized the recycling of industrial waste, leading to increased fly ash use in cement and road construction projects.

However, the quality of fly ash can vary depending on the source of coal, combustion process, and storage conditions. Inconsistent quality may pose challenges for manufacturers and end-users, impacting the reliability and performance of concrete and other products.

On the contrary, the growing emphasis on sustainable and environmentally friendly construction practices aligns with the use of fly ash as a recycled byproduct. Green building certifications and initiatives promote the adoption of materials like fly ash that contribute to energy efficiency and reduced environmental impact.

Segments Overview

The fly ash market is segmented on the basis of class, application, and region. On the basis of class, the market is categorized into class C and class F. On the basis of application, it is divided into cement and concrete, bricks and blocks, mining, water treatment, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

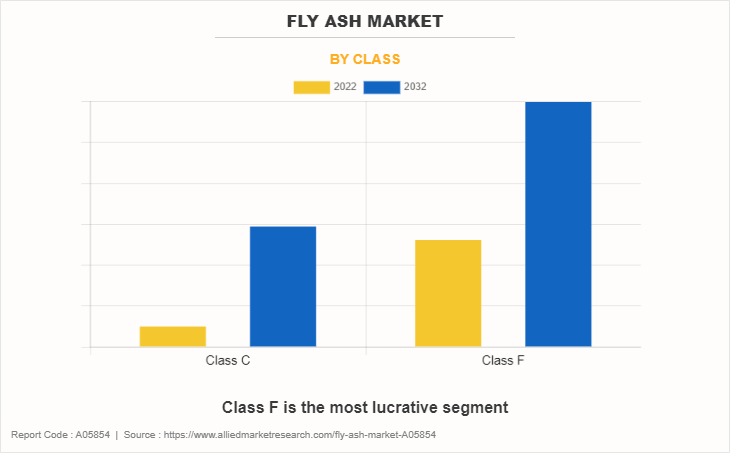

Fly Ash Market By Class

In 2022, the class F segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.7% during the forecast period. The construction industry is increasingly focused on sustainability and environmentally friendly practices. Class F fly ash, as a recycled industrial byproduct, aligns with these sustainability goals. Its use in concrete reduces the need for Portland cement, contributing to lower greenhouse gas emissions associated with cement production.

Furthermore, class F fly ash exhibits pozzolanic activity, which makes it a valuable additive in concrete. Its ability to react with calcium hydroxide in the presence of water contributes to improved concrete strength, durability, and resistance to chemical attacks. Additionally, the production of Portland cement is a significant source of carbon dioxide emissions. By incorporating class F fly ash into concrete mixtures, construction projects can achieve a reduction in carbon emissions. This reduction in the carbon footprint aligns with global efforts to address climate change.

Moreover, some regions have implemented regulations or guidelines that encourage or mandate the use of fly ash in construction projects. Such regulatory support has contributed to the growth in demand for class F fly ash, particularly in areas where the use of supplementary cementitious materials is encouraged. These factors altogether may boost the demand for class F fly ash across various end-use sectors; thus, boosting the growth of the fly ash market.

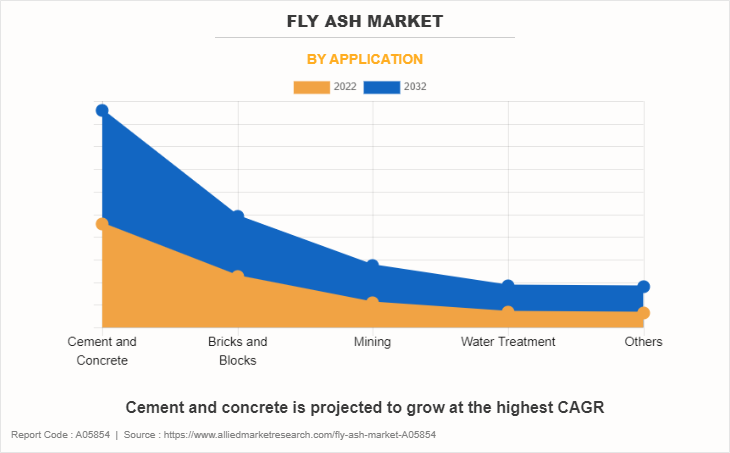

Fly Ash Market By Application

By application, the cement and concrete segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 6.6% during forecast period. The production of Portland cement, a key component in concrete, is energy-intensive and contributes to significant carbon dioxide emissions. By using fly ash as a supplementary cementitious material, the demand for Portland cement is reduced, leading to a lower carbon footprint in concrete production. Moreover, fly ash is a byproduct of coal combustion in power plants. Utilizing fly ash in concrete provides a sustainable and environmentally friendly solution for managing this industrial waste, turning it into a valuable construction material.

Furthermore, the use of fly ash in concrete reduces the reliance on virgin materials, such as clinker, a primary component in Portland cement. This contributes to the conservation of natural resources, as fly ash is a recycled industrial byproduct. Additionally, fly ash reduces the permeability of concrete, making it less susceptible to water ingress. This is beneficial for protecting embedded steel reinforcement from corrosion and enhancing the durability of concrete structures. These factors altogether may surge the demand for fly ash for cement and concrete applications; thus, fueling the fly ash market growth.

Fly Ash Market By Region

The Asia-Pacific fly ash market size is projected to grow at the highest CAGR of 6.7% during the forecast period and accounted for 50.9% of the fly ash market share in 2022. The Asia-Pacific region has been experiencing rapid urbanization and substantial infrastructure development. This has driven a significant demand for construction materials, including fly ash for use in concrete. Additionally, urbanization and population growth in countries across the Asia-Pacific region have led to increased construction activities. Fly ash, with its use in concrete and other construction applications, has been a key beneficiary of this trend.

Furthermore, many countries in the Asia-Pacific region, including China and India, have been making substantial investments in infrastructure projects. These investments in roads, bridges, airports, and other construction projects contribute to the demand for fly ash. Moreover, the regulatory environment regarding the use and disposal of fly ash varies across countries in the region. Some countries have specific regulations encouraging or mandating the use of fly ash in construction to promote sustainable practices.

Competitive Analysis

The global fly ash market profiles leading players that include CEMEX, S.A.B. de C.V, Lafarge North America, Holcim Ltd., Salt River Materials Group, Boral Limited, Charah Solutions, FlyAshDirect, Cement Australia Pty Limited, and Tarmac Holdings Limited. The global fly ash industry report provides in-depth competitive analysis as well as profiles of these major players.

Industry Trend

The fly ash market is experiencing significant growth, largely driven by government initiatives promoting sustainable construction practices. In India, the Fly Ash Notification 2021 mandates thermal power plants to achieve 100% utilization of fly ash, aiming to reduce environmental pollution and promote its use in construction. The Ministry of Power reported in 2023 that fly ash utilization had surpassed 80%, driven by increased demand in the cement and infrastructure sectors.

In the United States, the Environmental Protection Agency (EPA) actively encourages the beneficial reuse of coal combustion byproducts like fly ash to minimize landfill waste. The Bipartisan Infrastructure Law, passed in 2021, is accelerating demand for fly ash in major construction projects. According to the American Coal Ash Association, fly ash usage in concrete production increased by 8% in 2022, reflecting the growing emphasis on green building materials.

China's focus on industrial waste recycling, as outlined in the 13th Five-Year Plan, is another key trend. The plan promotes the use of fly ash in road construction and cement production, aligning with the country’s goals for environmental sustainability.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fly ash market analysis from 2022 to 2032 to identify the prevailing fly ash market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the fly ash market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global fly ash market trends, key players, market segments, application areas, and market growth strategies.

Fly Ash Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.9 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 420 |

| By Class |

|

| By Application |

|

| By Region |

|

| Key Market Players | HOLCIM, U S B Chemicals, CEMEX, S.A.B. de C.V., Boral, Charah Solutions, Inc., Ankitraj Expo Trade Pvt. Ltd., Salt River Materials Group, Ashtech India Pvt. Ltd., Cement Australia, Kumaraswamy Industries |

Analyst Review

Utilizing fly ash in construction aligns with sustainability goals, which is increasingly important for corporate social responsibility. Executives can leverage this as a market differentiator and a way to meet environmental regulations. Fly ash, as a byproduct, can often be obtained at a lower cost compared to traditional construction materials. This presents a cost-saving opportunity for companies, especially in large-scale construction projects. Furthermore, identifying new applications and markets for fly ash can contribute to revenue growth. Exploring innovative uses or partnering with other industries are expected to open new opportunities beyond traditional construction applications.

Additionally, building strategic partnerships with suppliers, construction companies, and research institutions can enhance the supply chain, ensure a consistent quality of fly ash, and facilitate innovation in its applications. Moreover, managing the transportation and logistics of fly ash from power plants to construction sites can be complex. Executives need to optimize the supply chain to ensure a reliable and cost-effective flow of materials.

Infrastructure development, increase in urbanization, environmental regulations, cost-effective alternative, and growing energy demand are the upcoming trends of the fly ash market in the world.

Cement and concrete is the leading application of the fly ash market.

Asia-Pacific is the largest regional market for fly ash.

The fly ash market valued for $7.1 billion in 2022 and is estimated to reach $12.9 billion by 2032, exhibiting a CAGR of 6.2% from 2023 to 2032.

CEMEX, S.A.B. de C.V, Lafarge North America, Holcim Ltd., Salt River Materials Group, Boral Limited, Charah Solutions, FlyAshDirect, Cement Australia Pty Limited, and Tarmac Holdings Limited are the top companies to hold the market share in fly ash.

Loading Table Of Content...

Loading Research Methodology...