Flywheel Energy Storage Systems Market Research, 2033

The global flywheel energy storage systems market size was valued at $353.0 million in 2023, and is projected to reach $744.3 million by 2033, growing at a CAGR of 7.8% from 2024 to 2033.

Market Introduction and Definition

Flywheel energy storage (FES) systems are a type of mechanical energy storage device that uses the kinetic energy of a rotating mass (the flywheel) to store energy. They deliver and absorb power very quickly, making them suitable for applications requiring fast charge and discharge cycles. Also, these systems are capable of a large number of charge and discharge cycles with minimal degradation. Flywheel energy storage systems offer a robust and efficient solution for certain energy storage needs, particularly where high power output and rapid response are critical.

FES systems do not involve hazardous chemicals or materials, resulting in lower environmental impact both during operation and at the end of their lifecycle. This makes them a greener alternative to many traditional energy storage systems. With fewer moving parts and advanced technologies such as magnetic bearings and vacuum enclosures, FES systems generally require less maintenance than other mechanical and electrochemical energy storage systems.

Key Takeaways:

Over 1, 500 product literatures, industry releases, annual reports, and various documents from major flywheel energy storage systems market participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

The flywheel energy storage systems market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and flywheel energy storage systems market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Flywheel energy storage systems market news and key industry trends are also included in the report.

Market Dynamics

Advancements in flywheel technologies are playing a pivotal role in driving the growth of the flywheel energy storage systems market. These technological developments are enhancing the efficiency, performance, and versatility of flywheel-based energy storage solutions, making them increasingly attractive for a wide range of applications in the evolving energy landscape. In addition, developments in magnetic bearings and vacuum encasement technologies have reduced friction and energy losses within flywheel systems. Lowering these losses enhances the efficiency of energy storage and retrieval processes, making flywheel systems more competitive in comparison to other energy storage technologies.

Further, rise in demand for electricity globally, coupled with the need for grid stability, renewable energy integration, and reliable backup power solutions, accelerates the adoption of flywheel energy storage systems across diverse sectors, thereby fueling the market expansion. For instance, India ranks as the world's third-largest producer and consumer of electricity, boasting an installed power capacity of 429.96 GW as of January 31, 2024. Also, in the same year, India's installed renewable energy capacity, inclusive of hydro, reached 182.05 GW, constituting 42.3% of the total installed power capacity. Specifically, solar energy accounted for 72.31 GW, trailed by wind power at 44.95 GW, biomass at 10.26 GW, small hydropower at 4.99 GW, waste-to-energy at 0.58 GW, and hydropower at 46.93 GW.

During the fiscal year 2022-2023, non-hydro renewable energy capacity increased by 15.27 GW, surpassing the previous year's addition of 14.07 GW. FY23 marked a significant milestone for India's power generation sector, experiencing its highest growth rate in over three decades. Power generation surged by 6.80% to 1, 452.43 billion kilowatt-hours (kWh) by January 2024. According to the Ministry of Power data, India's power consumption reached 1, 503.65 BU in April 2023. Moreover, China's electricity generation increased 2.2% per annum to 8, 388.6 TWh in 2022, according to the National Bureau of Statistics (NBS) on January 17. Also, the country's thermal production of electricity, which includes coal and natural gas, increased 0.9% to 5, 853.1 TWh in 2022, accounting for over 70% of total generation.

However, the upfront capital investment for FES systems can be relatively high as compared to other energy storage technologies, such as lithium-ion batteries. The costs associated with advanced materials, precision engineering, and installation can be prohibitive for some potential users, especially smaller-scale applications. Flywheels generally have lower energy densities (20-80 Wh/kg) as compared to chemical batteries (150-250 Wh/kg) . This makes them less suitable for applications requiring long-duration energy storage, as they are better suited for short-term, high-power applications. All these factors hamper the growth of the flywheel energy storage systems market.

Technological advancements in flywheel design have become a significant catalyst for creating opportunities in the flywheel energy storage systems market. These advancements are reshaping the landscape of energy storage by addressing key challenges and enhancing the overall performance, efficiency, and applicability of flywheel systems. In addition, advancements in magnetic bearings and control systems are enhancing the efficiency of flywheel energy storage. Magnetic bearings reduce friction, resulting in lower energy losses and allowing for longer spin times. Combined with sophisticated control algorithms, these technological developments enhance the precision and stability of flywheels, making them more reliable for various grid support functions, such as frequency regulation and energy smoothing. All these factors are anticipated to offer new growth opportunities for the flywheel energy storage (FES) systems industry during the forecast period.

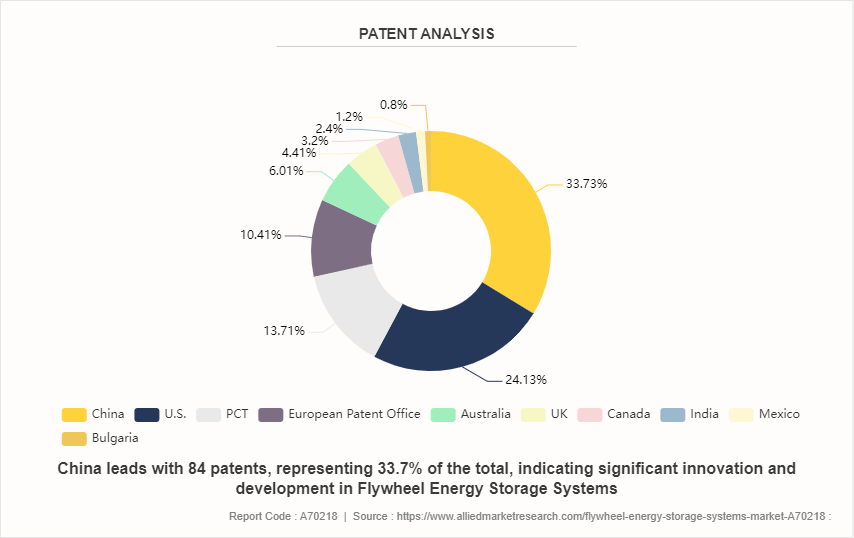

Patent Analysis of Global Flywheel Energy Storage Systems Market, 2024

Market Segmentation

The flywheel energy storage systems market is segmented on the basis of component, application, and region. By component, the market is classified into flywheel rotor, motor-generator, magnetic bearings, and others. By application, the market is classified into uninterrupted power supply, distributed energy generation, transport, data centers, and others. Region-wise the flywheel energy storage systems market share is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

Key players in the flywheel energy storage systems market include Langley Holdings plc, Amber Kinetics, Inc., Stornetic GmbH, Energiestro, VYCON, Beacon Power Systems, Kinetic Traction Systems, Inc. Langley Holdings plc, Tesla, ABB Ltd. Other players in Flywheel Energy Storage Systems market includes Piller Power Systems, Calnetix Technologies, Temporal Power, Teraloop and so on.

Key Companies Overview

- Beacon Power has been a pioneer in developing and deploying flywheel energy storage systems. Their focus is on providing sustainable, high-performance solutions for grid stability and energy management. The company’s technology is designed to help balance electricity supply and demand, enhance grid reliability, and support the integration of renewable energy sources. The Smart Energy 25 system offers high energy efficiency with minimal energy loss over time. This makes it ideal for applications requiring frequent and rapid energy discharge and recharge cycles. The system provides almost instantaneous response times, making it well-suited for grid frequency regulation and other applications requiring quick energy delivery. With a long cycle life, the Smart Energy 25 flywheel system can handle numerous charge-discharge cycles without significant performance degradation, reducing maintenance and replacement costs.

- Amber Kinetics is a notable player in the field of flywheel energy storage systems, recognized for its innovative approach to long-duration energy storage. Their key products, the M32 and M160 flywheel systems, offer substantial advancements in energy storage technology. These systems provides reliable energy storage for industrial operations, ensuring continuous power supply and operational efficiency.

- Stornetic is a German company that specializes in the development and production of high-efficiency flywheel energy storage systems. Their flagship product, the DuraStor flywheel system, is designed to provide efficient and low-maintenance energy storage solutions, making it a compelling choice for a variety of applications. The DuraStor flywheel system is engineered to deliver high efficiency in energy storage and retrieval. This efficiency ensures minimal energy loss, making the system highly effective for applications requiring frequent energy exchanges.

Key Industry Trends:

Construction of China's inaugural grid-level flywheel energy storage facility commenced in June 2023 in the city of Changzhi, located in Shanxi Province. Backed by Shenzhen Energy Group, the primary investor, this project utilizes cutting-edge solutions crafted by BC New Energy, a startup dedicated to pioneering advanced energy storage technology. Founded in December 2017, BC New Energy concentrates on research, development, manufacturing, deployment, and industrialization of large-scale flywheel energy storage solutions.

In April 2024, U.S.-based startups Torus and Alysm Energy raised a combined S$145 million to scale up their non-lithium energy storage technology businesses. Torus deployed residential and commercial-sited energy storage systems using flywheel technology and offered virtual power plant (VPP) solutions in collaboration with utilities such as Rocky Mountain Power in Utah through its Wattsmart programme. It also had an energy management system (EMS) which it said allowed it to connect to third-party products like inverters and batteries. The company claimed its flywheel-based technology was differentiated from chemical batteries by being 95% recyclable, unaffected by temperature fluctuations, and having a 25-year service life.

Regional/Country Market Outlook

North America has been experiencing a significant increase in interest and investment in energy storage technologies due to factors such as the integration of renewable energy sources, grid modernization efforts, and the need for grid resilience and stability. Energy storage projects, while federal programs like the Investment Tax Credit (ITC) and the Advanced Energy Storage Tax Credit have incentivized investment in energy storage technologies. The U.S. FES market includes a mix of established companies, startups, and research institutions involved in the development, manufacturing, and deployment of FES systems. Competition exists not only among FES providers but also with other energy storage technologies such as lithium-ion batteries and pumped hydro storage.

The U.S. Department of Energy (DOE) allocates funding for research, development, and demonstration projects related to energy storage technologies, including FES systems. Programs such as the Advanced Research Projects Agency-Energy (ARPA-E) and the Office of Electricity focus on advancing innovative energy storage solutions. Federal tax incentives, such as the Investment Tax Credit (ITC) and the Advanced Energy Storage Tax Credit, provide financial support for energy storage projects, including FES systems. These incentives can help reduce the upfront costs of deploying FES technologies. Also, many states have implemented policies, regulations, and incentive programs to support energy storage deployment, often including FES systems. These may include mandates for energy storage procurement, financial incentives, streamlined permitting processes, and support for grid modernization efforts. Overall, government support for FES systems in the U.S. aims to accelerate innovation, reduce barriers to deployment, and promote the integration of energy storage into the electric grid to enhance reliability, resilience, and sustainability.

Key Sources Referred

- International Journal of Innovative Research in Electrical, Electronics, Instrumentation and Control Engineering

- California Energy Commission

- International Journal of Engineering Research & Technology

- University of South Australia

- NITI Aayog

- Sandia National Laboratories

- Office of Scientific and Technical Information

- Ministry of Power data

Key Benefits For Stakeholders

- This flywheel energy storage systems market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flywheel energy storage systems market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flywheel energy storage systems market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flywheel energy storage systems market trends, market statistics, key players, market segments, application areas, and market growth strategies.

Flywheel Energy Storage Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 744.3 Million |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Stornetic GmbH, VYCON, Amber Kinetics, Inc., ABB Ltd., Beacon Power Systems, Energiestro, Kinetic Traction Systems, Inc., Langley Holdings plc, Langley Holdings Plc, Tesla |

Loading Table Of Content...