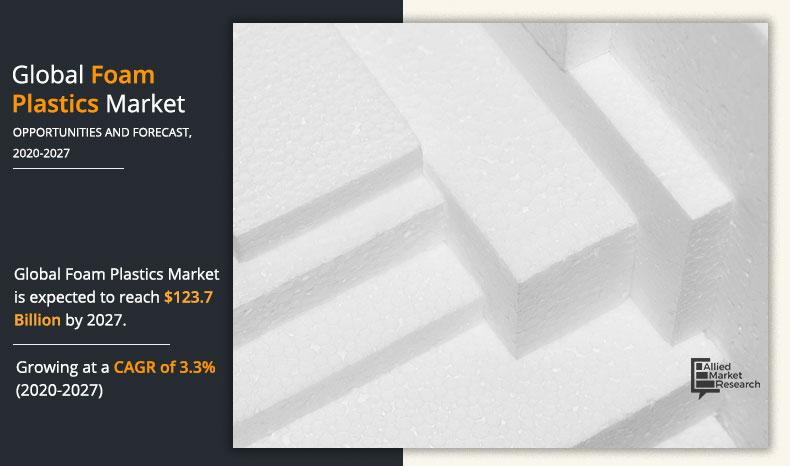

Foam Plastics Market Outlook - 2020–2027

The global foam plastics market was valued at $102.0 billion in 2019, and is projected to reach $123.7 billion by 2027, growing at a CAGR of 3.3% from 2020 to 2027.

Foam plastics are extended cell structure products with different identification names such as plastic foams, cellular foams, expandable foams, structural foams, blown foams, sponges, and microcellular foams. They can be versatile, semi-rigid, or stiff. The usual process involves the introduction of a dispersed gas and subsequently cooling or curing. Foaming technique can make the majority of plastics into foams. Many distinct products are manufactured from film or sheet to form molded shapes.

The global foam plastics market is witnessing high growth due to growing end-use industries. Economic growth in developing countries and growth in major end-use industries, such as building & construction, automotive, packaging, and furniture & bedding industries, are contributing to the market growth. Manufacturers and retailers are looking for packaging solutions that are able to keep the product safe while maintaining reasonable overall packaging & transportation costs. In recent years, this factor has escalated the demand for foam plastics. In addition, foam plastics can be disposed of by incineration. They produce water and carbon dioxide in municipal incinerators, which can be used as a fuel source for waste-to-energy programs that capture heat and convert it for useful purposes. Furthermore, despite the positive outlook for foam plastics, a few regions have restrictions on the use of expanded polystyrene (EPS) foam, such as North America and Europe, which may hinder the market growth.

The global foam plastics market is segmented into type, application, and region. Depending on type, the market is divided into polyurethane, polystyrene, polyolefin, phenolic, and others. On the basis of application, it is differentiated into building & construction; packaging; automotive; furniture & bedding; footwear, sports, & recreational; and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global market include Alchemie Ltd., BASF SE, Covestro, Hexion Inc., Huntsman International LLC, Repsol, Sabic, the Dow Chemical Company, Total S.A., and Wanhua Chemical Group Co., Ltd.

Foam Plastics Market, by Type

By type, the polyurethane segment accounted for the largest market share in 2019, and is anticipated to continue this trend during the forecast period. This is attributed to the fact that polyurethane foam is widely applicable across the automotive industry in manufacturing vehicles and their parts. Moreover, increase in industrialization propels the demand for flexible foams across various industries such as automobile, interior decor, transportation, and packaging.

By Type

Polyurethane is projected as the most lucrative segment.

Foam Plastics Market, by Application

The building & construction segment accounted for the largest share of the foam plastics market in 2019. Foam plastics are used to create foams for forging, doors, roof board, and slabs used in the building & construction industry. The dominant resin used for insulation in the building & construction industry is polyurethane (PU). It has a low coefficient of heat conduction, low density, low absorption of water, and relatively good mechanical strength & insulating properties, which are helpful in the construction & construction industry.

By Application

Building & Construction is projected as the most lucrative segment.

Foam Plastics Market, by Region

Region-wise, Asia-Pacific is a lucrative market for foams plastics, and is expected to grow at the highest CAGR, in terms of both volume and value during the forecast period. Study predicts that increasing developments in automotive, building & construction, and food serving industries in the region are contributing to the foam plastics market.

By Region

Asia-Pacific holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

- The report provides in-depth analysis of the global foam plastics market along with the current trends and future estimations.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the global foam plastics market for strategy building.

- A comprehensive market analysis covers the factors that drive and restrain the global foam plastics market growth.

- The qualitative data about market dynamics, trends, and developments is provided in the report.

Impact Of Covid-19 On The Global Foam Plastics Market

- The world is battling the contagious COVID-19 pandemic, which has spread across the globe.

- Some of the major economies suffering from the COVID-19 crises include Germany, France, Italy, Spain, the UK, and Norway.

- Foam plastics are primarily used in building & construction, furniture & bedding, packaging, and automotive. In addition, due to the impact of national lockdown, these sectors were experiencing slight decline in growth rates.

- In many countries, the economy has dropped due to the halt of several industries, especially transport and supply chain. Demand for the product has been hindered as there is no development due to the lockdown.

- The demand supply gap, disruptions in raw material procurement, and price volatility are expected to hamper the growth of the building & construction industry during the COVID-19 pandemic.

- The markets in North America and Europe are expected to undergo a period of decline in the midst of the COVID-19 crisis. However, the production of foam plastics is expected to increase steadily as the demand for protective packaging solutions increases across industries.

- Until the end of 2020, the demand for foam plastics is expected to remain weak. However, manufacturers are resuming work in a few countries, such as China, Canada, and India, with strategic planning to rapidly rebound from the losses. Analysts forecast that the demand for foam plastics is projected to gain considerable traction by 2021.

Foam Plastics Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | The Dow Chemical Company, BASF SE, Total SE, Hexion Inc., COVESTRO AG, HUNTSMAN CORPORATION, Alchemie Ltd., Wanhua Chemical Group Co., Ltd., SABIC, Repsol |

Analyst Review

The global foam plastics market is moving toward growth stabilization phase in its industry life cycle. The factors driving the growth of the foam plastics market are surge in demand from the building & construction; packaging; automotive; furniture & bedding; and footwear, sports, & recreational sectors. In 2019, the polyurethane (PU) segment garnered the largest market share of 29.6%. As the construction industry is growing rapidly in APAC, PU resin plays a dominant role in the growth of the overall foam plastics market in the region. During the forecast period, the building & construction segment is expected to witness the highest growth rate of 36.4%. Moreover, in the building industry, foam plastics are used extensively. They are an appealing choice for the construction industry due to their flexibility, versatility, cost-effectiveness, durability, and low maintenance. However, in terms of market sales, APAC is the leading market for foam plastics. The region's growth is fueled by China, India, Indonesia, and Vietnam's booming economies. In the building & construction industry in APAC, PU resin-based foams are the preferred option.

Infrastructure development, prolonged expansion of residential and commercial buildings and favorable public private partnerships are major factors driving the market growth across globe

The market value of foam plastics in the forecast period is anticipated to be $123.7 Billion.

Major players in the market are BASF SE, Covestro, Hexion Inc., Huntsman International LLC, Repsol, Sabic, the Dow Chemical Company, and Total S.A. among others.

Construction industry is projected to increase the demand for foam plastics market

Asia-Pacific region accounted for the largest foam plastics market share

New infrastructure growth and major investments in new housing projects & renovation of non-residential buildings are expected to drive the global foam plastics market during the forecast period

Building & Construction expected to drive the adoption of foam plastics.

As the manufacturing units across the globe were shutdown due to the COVID-19 pandemic, the market has been impacted negatively.

Loading Table Of Content...