Food and Beverages Disinfection Market Overview:

The global food and beverages disinfection market is estimated to reach $2,387.9 million by 2025 growing at a CAGR of 4.4% during the forecast period. Food disinfection can be achieved by means of chemical disinfectants or physical methods in the environment without compromising the food safety and quality. The selection criteria for a sanitizer/disinfectant vastly depends on the type of food products to be sanitized, the hardness of the water, the efficacy of disinfectants under site conditions, and cost of sanitizer.

Growth in incidence of food borne disease due to unknown species (bacteria, viruses, fungi, prions, parasites), chemicals, radioactive substances are increasing healthcare burden on service provider & government authorities. According to WHO, 1 in 10 people suffer from contaminated food consumption annually with mortality of approximate 420,000 globally. Africa and Southeast Asia have prominent incidence rate of food borne illness and death. The incidence of food borne illness is high among new borne and pediatric population of Africa. The significant growth in food borne disease patient population due to contaminated raw vegetables, ready-to-eat meals, processed meats, and other packaged food products is expected to boost the growth of the food and beverages disinfection market.

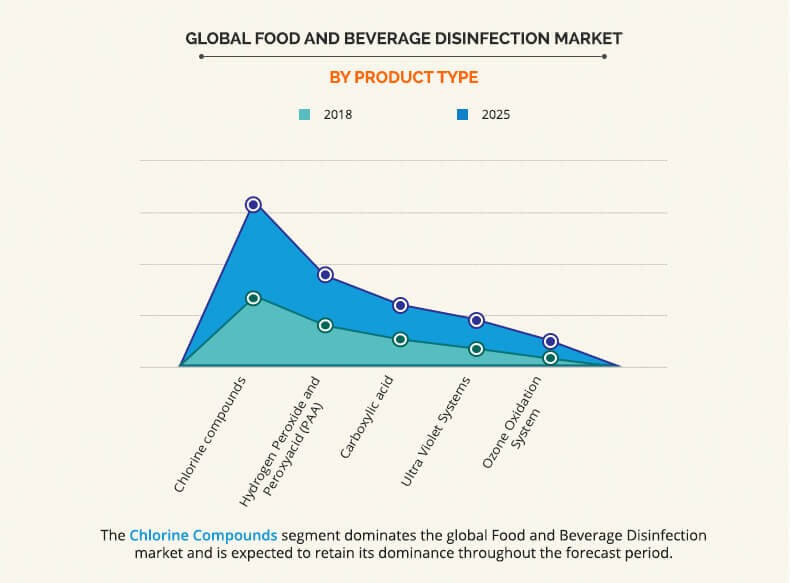

The chlorine compound segment exhibits highest revenue share in 2017 and is anticipated to remain dominant during the forecast period. The primary rational behind the significant growth of the segment in the market includes diversified application of various chlorine compounds. This is expected to boost the revenue growth of chlorine compound segment during the forecast period. Chlorine compound offers reliable and effective measure against various pathogens such as Campylobacter, Salmonella, E. coli, Protozoa, and others.

Ozone oxidation systems are largely used across retail food chains and large scale food processing companies in Europe region. European Food Safety Authority (EFSA) regulates the consumption and usage of chemical disinfectants in food and beverage industry. Food and food ingredients authorized for irradiation treatment are listed by Directive 1993/3/EC. EU5 countries holds maximum revenue share in overall Europe Food and Beverages Disinfection market owing to large consumption of packaged food products and local cuisine at full service restaurants.

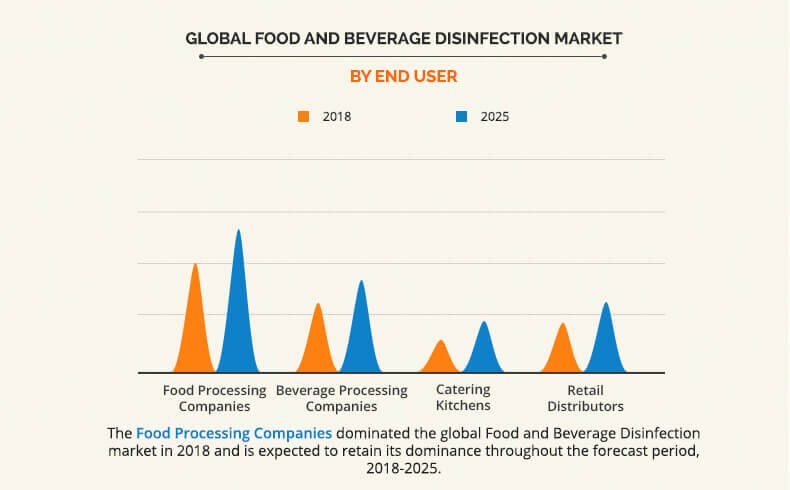

In 2017, the food processing companies segment accounts for the highest revenue share in the Food and Beverages Disinfection market. The segment is anticipated to exhibit significant revenue growth owing to rise in consumer awareness toward hygienic packaged food products and extensive focus from food safety authorities during supply chain and retail distribution during the forecast period. The companies currently operating in the food processing industry are now focusing on the implementation of more advance and next generation disinfection and sanitation technologies.

Emergence of e-Commerce distribution in packaged food industry has provided a competitive edge for food and beverage manufactures. These companies are suppling their products in global market which requires strict compliance in term of product hygiene during processing and transportation. The growing consumption of processed food from international market would be primary factor driving the adoption of disinfection technologies in retail food and distribution end user in Food and Beverages Disinfection market analysis.

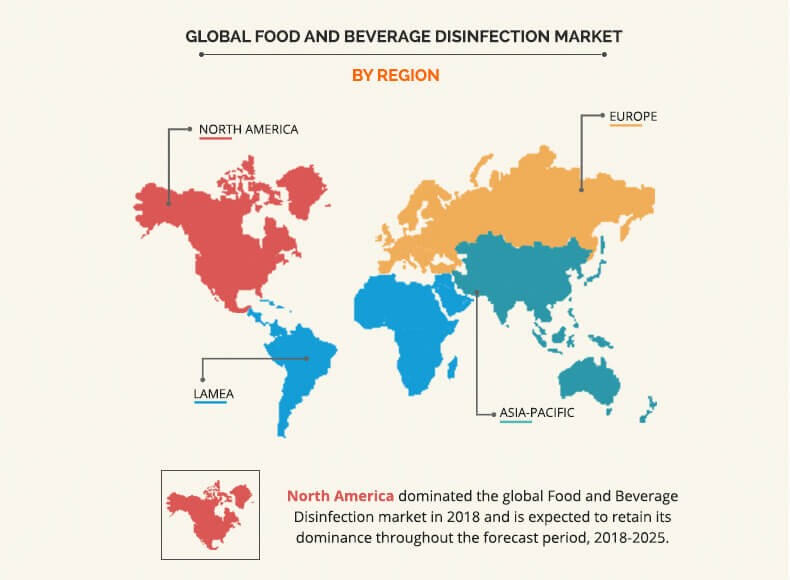

Asia-Pacific is expected to remain dominant in terms of growth with a CAGR of XX% during the forecast period in the Food and Beverages Disinfection market followed by LAMEA. The significant revenue growth in Asia-Pacific is attributed to the increase in expenditure on packaged food and beverages and fine dining services. Disposable income on fine dining in India and China is higher than other countries of the Asia-Pacific region. Most of the fine diners visiting premium restaurant in Asia-Pacific are millennials aged between 18 and 29. Such increase in popularity of fine dining has created a need to provide hygienic service to consumer. Moreover, increase in tourism activities in the ASEAN region has significantly increased the consumption of packaged food products in the region, which is expected to boost the revenue growth of the Food and Beverages Disinfection market in Asia-Pacific.

Beverage processing companies followed by quick service restaurants are the major end users of UV radiation systems in Europe market. Commission Regulation (EC) No 2073/2005 on microbiological criteria for foods has enforced food safety criteria for foodborne (toxins and metabolites). These criteria had defined the acceptability of a food product or a batch of food placed in the retail market. The regulatory imposition for food safety is expected to fuel Food and Beverages Disinfection market growth in Europe region

The key players profiled in the report include Toshiba, Evoqua Water Technologies, UV-Guard Australia, Evonik, Trojan Technologies, Entaco, Solvay, CCL Pentasol, Halma, and Xylem

Key Benefits for Food and Beverages Disinfection Market:

- This report provides a quantitative analysis of the current Food and Beverages Disinfection market trends, estimations, and dynamics from 2017 to 2025 to identify the prevailing food and beverages disinfection market forecast and opportunities.

- The key countries in all the major regions are mapped based on their market share.

- Porters five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplierbuyer network.

- In-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global algae products industry. Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of market players.

- The report includes the analysis of the regional as well as global market, key players, market segments, application areas, and Food and Beverages Disinfection market growth strategies.

Food and Beverages Disinfection Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Xylem, UV-Guard Australia, Halma, Evoqua Water Technologies, CCL Pentasol, Toshiba, Trojan Technologies, Solvay, Evonik, Entaco |

Analyst Review

Stringent regulatory guidelines for the use of chemical disinfectants at food premises enable suppliers to cater with novel product line of chemical disinfectants. Manufacturers/suppliers of disinfectants are targeting retail food courts/small scale food and beverage processing plants through their strong distribution network. However, lower profit margins and predominant position of existing competitors limit the revenue growth of local suppliers in the chemical food disinfectants market

Adoption of food disinfectant equipment is expected to gain traction in large scale food processing companies. The manufactures of UV disinfection systems and ozone oxidation systems are currently focusing on large scale food and beverage processing industry. However, commercialization of portable UV disinfectant systems in food and beverage disinfection is expected to boost the market growth during the forecast period.

The global food and beverages disinfection market is estimated to reach $2,387.9 million by 2025

The global Food and Beverages Disinfection market is projected to grow at a compound annual growth rate of 4.4%

Toshiba, Evonik, Xylem, UV-Guard Australia, Evoqua Water Technologies, Trojan Technologies, CCL Pentasol, Halma, Solvay, Entaco

Asia-Pacific

The rise in incidences of myriad foodborne diseases, increased penetration of UV disinfection devices, and the availability of alternatives to chemical disinfectants drive the growth of the global food and beverages disinfection market.

Loading Table Of Content...