Food Safety Testing Market Summary

The global food safety testing market size was valued at $22.5 billion in 2023, and is projected to reach $44.1 billion by 2033, growing at a CAGR of 7% from 2024 to 2033. Strict government regulations, growing consumer awareness, and the globalization of food supply chains are expected to positively impact the growth of the food safety testing market.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2022.

The global food safety testing market share was dominated by the pathogen segment in 2023 and is expected to maintain its dominance in the upcoming years

The processed segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 22.5 Billion

- 2033 Projected Market Size: USD 44.1 Billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 7%

- North America: Generated the highest revenue in 2022

Food safety testing refers to the scientific analysis and examination of food products to ensure that they are safe for consumption and free from harmful contaminants, pathogens, and adulterants. This testing involves a range of procedures and techniques designed to detect and quantify biological, chemical, and physical hazards in food. This market involves the analysis of food samples to detect harmful contaminants such as pathogens, pesticides, and genetically modified organisms (GMOs) , which can pose significant health risks. Advanced technologies like PCR (polymerase chain reaction) , immunoassays, and chromatography are commonly used for accurate and rapid detection of contaminants. The food safety testing market is divided into various segments, including meat, poultry, dairy, processed foods, and fruits and vegetables, with each segment requiring specific testing protocols. The increasing incidences of foodborne illnesses, along with recalls of contaminated food products, have further highlighted the importance of strong food safety testing mechanisms.

Key Takeaways

The food safety testing market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major food safety testing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increasing frequency of food contamination incidents is a significant driver for the food safety testing market. Outbreaks caused by pathogens like E. coli, Salmonella, and Listeria have raised public awareness and concern over food safety. For instance, as per the U.S. Food and Drug Administration, the Federal government estimates that there are about 48 million cases of foodborne illness annually. These incidents not only cause health risks but also lead to substantial economic losses for the food industry owing to recalls, legal liabilities, and damage to brand reputation. Moreover, according to the World Health Organization (WHO) , 1 in 10 people fall ill from contaminated food annually, highlighting the critical need for food safety measures and testing. This increased demand for safety measures and testing is further sustained by stricter government regulations and standards aimed at preventing contamination and ensuring food quality. As a result, there is a growing demand for precise testing to ensure food products are safe for consumption.

The high cost of advanced food safety testing equipment significantly restrains the food safety testing market's growth. Advanced testing instruments such as mass spectrometers, chromatographs, and molecular analyzers are critical for accurate and comprehensive food safety analysis. However, their substantial initial investment and ongoing maintenance costs are excessive, especially for small and medium-sized enterprises (SMEs) . These companies struggle to afford the latest technology, limiting their ability to comply with strict safety standards and regulations. Moreover, the financial burden of purchasing and maintaining expensive testing equipment prevents new entrants from entering the market, restraint competition and innovation. This cost barrier is expected to lead to inadequate testing practices, potentially compromising food safety and quality. Consequently, the high cost of testing equipment slows the overall adoption of advanced food safety testing technologies, delaying the market's growth despite the increasing demand for safe and high-quality food products.

Automation in the food processing sector is creating significant food safety testing market growth in Australia. The future of food safety testing depends on combining automation and artificial intelligence. Automated systems make testing processes more efficient and analyze large amounts of data to detect patterns and potential risks, improving the effectiveness and precision of food safety protocols. Further, technologies such as Machine Learning, AI, Sensors and IoT (Internet of Things) are utilized in testing.

Machine Learning: Machine learning algorithms analyze extensive datasets to predict contamination risks, identify patterns, and provide actionable insights. This enables proactive measures, reducing the likelihood of foodborne illnesses and improving overall food safety.

Artificial Intelligence (AI) : AI automates data analysis in food safety testing, increasing efficiency and reducing human error. It accelerates the detection of potential threats, ensuring quicker responses and enhancing the effectiveness of safety protocols.

Sensors: Sensors monitor critical parameters like temperature, humidity, and contamination levels in real-time throughout the food supply chain. This continuous monitoring allows for immediate intervention when safety standards are breached, preventing potential contamination.

Internet of Things (IoT) : IoT devices integrate with sensors to provide real-time data and connectivity across the food supply chain. This connectivity enables seamless tracking and management of food safety parameters, ensuring proactive risk management and enhanced safety standards.

These technologies collectively contribute to a more robust and responsive food safety testing market, ensuring higher safety standards and fostering consumer trust and food safety testing market share.

The number of food items recalled during 2019 to 2023

The total number of units recalled under the authority of the FDA increased by 700% in 2022 compared to 2021. The report, from the Sedgwick organization, quarterly collects and analyzes data and also compiles yearly totals. The organization uses data from the U.S. Food and Drug Administration and the U.S. Department of Agriculture. The FDA oversees 80% of the country’s food supplies with the USDA responsible for the other 20%. In addition to food safety testing market forecast, the FDA oversees drugs, medical devices, and cosmetics. The food side of the agency has a much smaller budget than the medical side. For instance, according to USDA, Food Safety and Inspection Service, Following is the summary of each year's recalls including total number (2019-2023) .

The number of food items recalled during 2019 to 2023

Year | 2019 | 2020 | 2021 | 2022 | 2023 |

No of Recall | 124 | 31 | 47 | 45 | 65 |

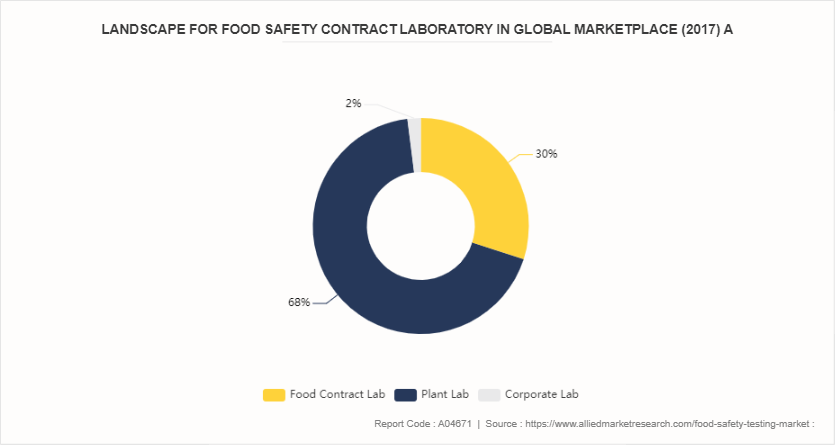

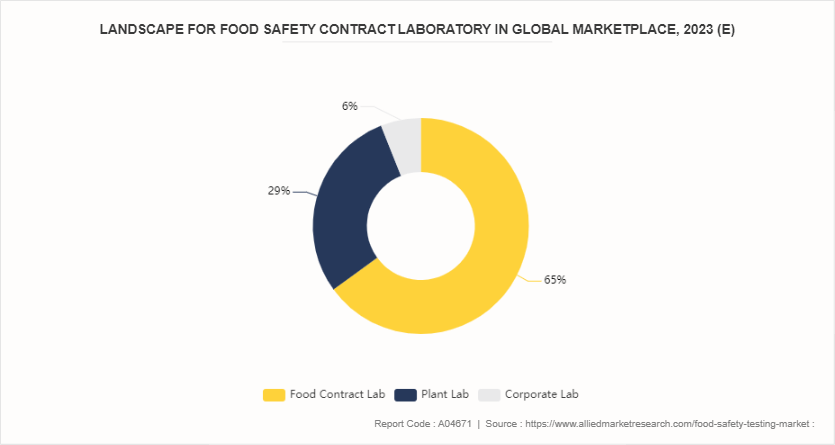

Changing Landscape for Food Safety Contract? Laboratory in Global Marketplace, 2017 & 2023 (E)

The volume of microbiology testing worldwide is growing significantly. However, the study data shows that microbiology testing at food contract labs is growing at a decent growth rate annually. As a result, food contract labs are capturing a larger share of the microbiology testing market each year. The trend is even more pronounced in pathogen testing. While two-thirds of food processors surveyed conduct routine microbiology testing in-house, the number willing to perform in-house pathogen analysis has dropped to one-third. These factors collectively contribute to the increased reliance on food contract labs for microbiology testing, driving their significant food safety testing market size from 2017 to 2023.

Market Segmentation

The food safety testing market is segmented into type, technology, food tested and region. On the basis of type, the market is divided into pathogen, genetically modified organism (GMO) , chemical and toxin, heavy metals, radioactivity, others. As per technology, the market is bifurcated into agar culturing, PCR-based Assay, immunoassay-based, scintillation counters and geiger counters, AAS And ICP-MS/OES and Others. Based on food tested, the market is divided into meat and meat products, seafood, dairy and dairy product, cereals, grains, and pulses, processed food and others. Region wise, the food safety testing market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North American food safety testing market is set for significant growth, driven by stringent regulatory standards, technological advancements, and high consumer awareness. The Food Safety Modernization Act (FSMA) implemented by the FDA emphasizes preventive measures, requiring rigorous testing protocols to ensure food safety??. Additionally, technological innovations such as PCR and immunoassays have enhanced the accuracy and efficiency of contaminant detection, further propelling market growth??. Consumer demand for transparency and high-quality food products is another critical driver. With increasing incidences of foodborne illnesses and recalls, consumers are more vigilant and expect robust food safety measures??. Moreover, North America's leading position in the food safety testing market is supported by substantial investments in research and development, as well as the presence of major industry players committed to advancing food safety technologies?.

Food Safety Testing Industry Trends

Consumer Awareness: Consumer awareness regarding food safety has significantly increased over the past decade. This trend is driven by a combination of factors, including widespread media coverage of foodborne illness outbreaks, increased public access to information, and rising health consciousness among consumers. According to the U.S. Food and Drug Administration (FDA) , the number of food recalls due to contamination or safety concerns has risen, which has increased consumer careful observation. For instance, the FDA and the Centers for Disease Control and Prevention (CDC) publish data on foodborne illness outbreaks, that is 48 million illnesses, 128, 000 hospitalizations, and 3, 000 deaths highlighting the need for stringent food safety measures?.

Technological Advancements: Technological advancements are revolutionizing the food safety testing industry, enabling faster, more accurate, and more efficient detection of contaminants. Techniques such as Polymerase Chain Reaction (PCR) , next-generation sequencing (NGS) , and immunoassays have become standard practices due to their high sensitivity and specificity. PCR, for instance, can detect minute quantities of pathogens by amplifying their DNA, making it a powerful tool for identifying contamination in food products.

Regulatory Changes: Regulatory changes are a significant driver of the food safety testing market, as governments worldwide implement stricter food safety standards to protect public health. In the United States, the Food Safety Modernization Act (FSMA) approved by the FDA is one of the most comprehensive reforms in food safety laws. The FSMA focuses on preventing contamination rather than responding to it, requiring food producers to implement preventive controls and maintain detailed records of their safety practices. The European Union also maintains strong food safety regulations through the European Food Safety Authority (EFSA) , which sets standards for food contaminants, additives, and labeling. Recent updates in EU regulations include strict limits on pesticide residues and enhanced measures to prevent antimicrobial resistance?

Increased Focus on Traceability: Traceability has become a critical focus in the food safety landscape, driven by the need to quickly identify and address sources of contamination. The FDA’s Final Rule on Requirements for Additional Traceability Records for Certain Foods, part of the Food Safety Modernization Act (FSMA) , mandates comprehensive record-keeping for foods identified as high-risk, such as leafy greens and certain dairy products??. This rule aims to enhance the traceability of these foods through the supply chain, ensuring that contamination can be swiftly identified and managed. The implementation of blockchain technology is a notable advancement in enhancing traceability. Blockchain provides a decentralized and immutable ledger of transactions, offering transparent and real-time tracking of food products from farm to table. This technology is being adopted by major retailers and food companies to improve supply chain transparency and ensure compliance with regulatory standards?.

Competitive Landscape

The major players operating in the food safety testing market include Eurofins Scientific, AsureQuality Ltd, Bureau Veritas SA, DNV AS, TUV SUD AG, Bio-Rad Laboratories, Thermo Fisher, Scientific, Inc., ALS Limited, SGS SA and Intertek Group plc.

Recent Key Strategies and Developments

On June 03, 2024, ALS Limited has completed the acquisition of Wessling Group, an independent environmental, pharmaceutical and food testing group with a strong presence across 26 locations across Germany, France, Switzerland and Romania.

On November 16, 2023, The Eurofins Scientific network of companies which are in food, environment, pharmaceutical and cosmetic product testing and in discovery pharmacology, forensics, advanced material sciences and agroscience contract research services, completed the acquisition of Labor 3.

On April 03, 2023, Intertek Group plc, a announced that it has acquired Controle Analítico Análises Técnicas Ltda, a leading provider of environmental analysis, with a focus on water testing, based in Brazil.

On March 17, 2023, SGS SA, the testing, inspection and certification company, has completed the acquisition of the testing business and assets of ASMECRUZ, SOCIEDAD COOPERATIVA GALLEGA (“Asmecruz”) , a cooperative of mussel producers based in Boiro, Spain.

Key Sources Referred

Department of Agriculture, Fisheries and Forestry

Envirotech

Innovative Publishing Co. Inc.

Food Beverage Insider

Chromatography Today

United Nations

Lexplosion Solutions Private Limited

Marler Clark, Inc

BNP Media

Vitafoods Insights

Center for Science in the Public Interest

SmartScrapers

FoodChain ID

Test Needs Laboratory

Journal of Food: Microbiology, Safety & Hygiene

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food safety testing market analysis from 2024 to 2033 to identify the prevailing food safety testing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the food safety testing market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global food safety testing market trends, key players, market segments, application areas, and market growth strategies.

Food Safety Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 44.1 Billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Type |

|

| By Technology |

|

| By Food Tested |

|

| By Region |

|

| Key Market Players | ALS Limited, TUV SUD AG., Thermo Fisher Scientific, Inc., AsureQuality Ltd, DNV AS, Intertek Group plc, Bio-Rad Laboratories, Inc. , SGS SA (Société Générale de Surveillance SA), Bureau Veritas SA, Eurofins Scientific SE |

Analyst Review

Food fraud has been a major concern for the food industry since decades; for instance, the adulteration of imported tea with iron filings in the nineteenth century. At present, meat adulteration, substitution of alternative species of fish, use of chemicals such as formalin in meat & fish products, and others are expected to be dominant in the market. As detection of food fraud is difficult, it is necessary to develop advanced analytical techniques, such as molecular biology, isotopic analysis, and a range of classic physical, chemical, and biological methods, to test for food safety and detect the noncompliance in food products.

Economically motivated adulteration (EMA) has rapidly increased in the market, which is a major health threat for consumers. Meat and processed food product segments are expected to witness the highest growth rate during the forecast period.

The Asia-Pacific region is expected to witness significant growth on account of increase in processed food production and rise in food safety concerns among consumers. Furthermore, supportive government policies in countries, such as China and India, coupled with foreign investments in the food & beverage industry are anticipated to boost the food safety testing market during the forecast period.

The global food safety testing market size was valued at USD 22.5 billion in 2023, and is projected to reach USD 44.1 billion by 2033

The global food safety testing market is projected to grow at a compound annual growth rate of 7% from 2024-2033 to reach USD 44.1 billion by 2033

The key players profiled in the reports includes Eurofins Scientific, AsureQuality Ltd, Bureau Veritas SA, DNV AS, TUV SUD AG, Bio-Rad Laboratories, Thermo Fisher, Scientific, Inc., ALS Limited, SGS SA and Intertek Group plc.

North America dominated in 2023 and is projected to maintain its leading position throughout the forecast period.

Increasing Frequency of Food Contamination Incidents, Stricter Government Regulations and Standards, Technological Advancements, Automation in Food Processing majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...