Food Service Equipment Market Research, 2035

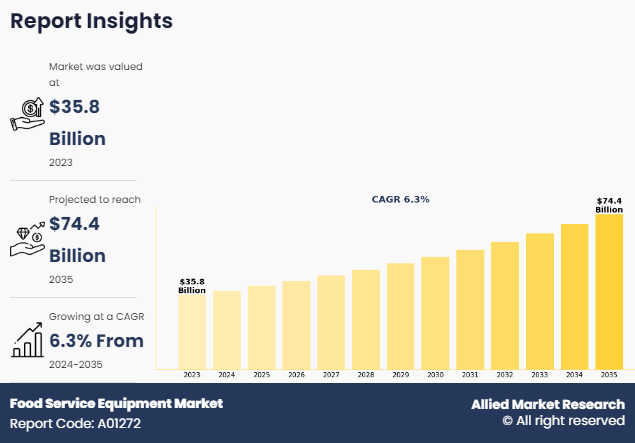

The global food service equipment market size was valued at $35.8 billion in 2023, and is projected to reach $74.4 billion by 2035, growing at a CAGR of 6.3% from 2024 to 2035.

The rise in concern about environment sustainability, integration of IOT and smart technology, and increased health and safety standards compliance have driven the market growth. Food service equipment provide ease of food preparation, in addition to food safety in commercial kitchens. It consists of cookware and wash ware; and preparation, storage, & serving equipment, which are used to cook and preserve food products for commercial purposes. This equipment are widely adopted in hotels, restaurants, commercial institutes, and budgetary hotels for preparation and storage of various cuisines. Rise in business-related travel and increase in number of food joints such as hotels & restaurants fuel the growth of the hospitality industry, which, in turn, drives the food service equipment market demand.

Key Takeaways

By product type, the cooking equipment segment dominated the global market in 2023.

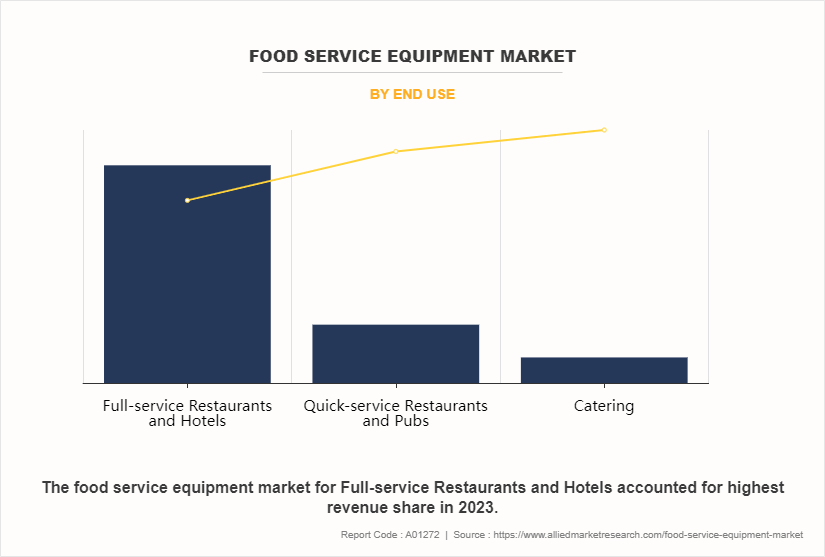

By end use, the full-service and hotel segment dominated the global market in 2023.

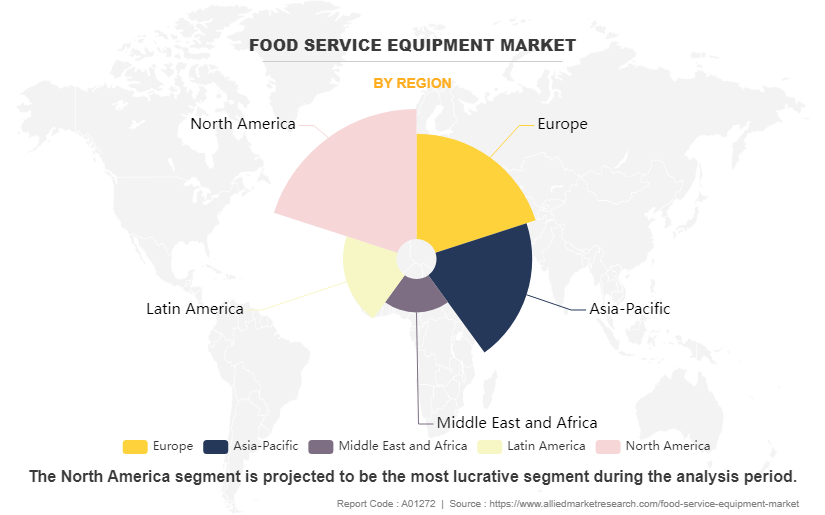

By region, North America dominated the global food service equipment market in 2023.

Market Dynamics

Growth in food service industry

Rise in business-related travel and increase in number of food joints such as hotels & restaurants fuel the growth of the food service equipment market. According to the National Restaurant Association’s Restaurant Performance Index, the U.S. restaurant industry is expected to reach $863 billion in 2019 with over 1 million restaurants operating in the U.S. Cross-border investments, experiments & innovations in varieties of cuisines, and growth in travel & tourism industry are anticipated to provide lucrative opportunities for the market expansion. However, the COVID-19 outbreak has led to the closure of significant proportion of food service industry, including hotels & restaurants, pubs, and bars. This, in turn, has hampered the growth of the food service equipment industry during the pandemic.

Rise in preference for quick-service restaurants

Change in food habits and busy lifestyle of consumers have led to increase in demand for ready-to-eat meals. Rapid changes in the supporting factors such as disposable income, consumer preferences, increase in working women population, and digitization result in rise in number of quick service, pop & shop, and other types of restaurants. Moreover, upsurge in demand for processed food increases the number of supermarkets, hypermarkets, and retail shops, thereby boosting the demand for refrigeration and storage products.

High capital requirement

High installation cost and integration capabilities required for the initial setup of kitchen equipment act as a restraining factor for the adoption of food service equipment. Initial investment and maintenance costs of cooking and refrigeration equipment are high, due to integration of high-quality hardware coupled with efficient condensers and compressors installed in baking and refrigeration equipment.

Moreover, food service equipment can often come with a significant upfront cost, which may act as a deterrent for small businesses or startups with limited capital. The initial investment required for purchasing commercial-grade appliances, especially for specialized equipment, can be substantial and may strain budgets.

Space Limitations

Many food service establishments, especially in urban areas, face constraints regarding available space. Limited kitchen space can restrict the types and sizes of equipment that can be installed, potentially impacting operational efficiency and menu offerings. Space-efficient designs and modular solutions are increasingly important to address this constraint.

Regulatory benefits

Government agencies and environment activists promote the production of eco-friendly refrigerators and ovens to address the concerns of global warming. These equipment have other associated benefits such as enhanced human safety, low heat discharge, efficient utilization of refrigerants, and less emission. Leadership in Energy and Environmental Design (LEED) has collaborated with numerous manufacturing companies, globally, to develop sustainable products and reduce the harmful effects of these equipment on the environment. In addition, implementation of stringent government regulations related to emission controls and refrigeration devices creates growth opportunities for the replacement of food service equipment devices.

Surge in demand for energy-efficient and cost-effective products

Increase in awareness to save water and electricity contributes toward the growth in demand for low-energy consuming products have provided food service equipment market opportunities. The refrigerators used in hotels and retail stores release greenhouse gases, such as hydrofluorocarbons (HFCs) and chlorofluorocarbons (CFCs) as refrigerants, which have a negative impact on the environment. In addition, rise in consumption of such refrigerants lead to low performance of compressors, which incur additional costs. European Union’s F-Gas Regulation and EPA standards mandate to limit the use of chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) in refrigerators.

In addition, improved productivity and minimal emissions of greenhouse gases are vital factors expected to drive the adoption of commercial ovens and refrigerators. Natural refrigerants, such as CO2, solar power, and others, have gained popularity for usage in compressors and condensers in different cooling devices in commercial kitchens. These have a positive impact on the environment. The manufacturers have focused on the use of wood and metal as insulation foams to reduce thermal emissions from the electronic kitchen appliances. Thus, the R&D activities carried out by manufacturers and researchers to develop eco-friendly kitchen products are anticipated to provide potential growth opportunities for the food service equipment market.

Segmental Overview

The global food service equipment market segments are categorized into product type, end use, and region. By product type, it is classified into cooking equipment, storage & handling equipment, food & beverage preparation equipment, ware washing equipment, and serving equipment. As per end use, it is divided into full service restaurants and hotels, quick service restaurants, and catering. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Australia, Japan, and rest of Asia-Pacific), and LAMEA (Brazil, UAE, South Africa and Rest of LAMEA).

By product type

By product type, the cooking equipment segment dominated the global food service equipment market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the forecast period. The usage of food service equipment helps reduce labor cost, improve food safety, and minimize operational cost. Restaurants and restaurant kitchen equipment are gaining increased popularity owing to changes in lifestyle and influence of outside food. Moreover, rise in popularity of creative cooking and baking among consumers results in variety of dine out options for consumers.

Thus, to offer best services to the customer, restaurants invest in different types of cooking equipment, which further fuel the market growth. Increase in trend for bigger, open kitchen spaces has been witnessed in the fast-food chains to show consumers the process of preparation of food and also the type of food equipment used during the process. Furthermore, increase in investments in cooking equipment and replacements in Europe and Asia-Pacific are expected to foster the growth of the food service equipment market size.

By End Use

By end use, the full-service restaurant and hotel segment dominated the global food service equipment market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the food service equipment market forecast period. Inclination of consumers toward new cuisines at a reasonable cost boosts the adoption of new technologies for preparing quick-served foods among full-service restaurants. For instance, in October 2020, Greg Malouf opened Clé Dubai, a full-service restaurant, which offers contemporary and delicacies of traditional Arabian dishes. In 2021, Vikas Khanna launched his full-service restaurant chain, Junoon, in the Asian market. Similarly, Sergi Arola launched P&C in the European market in the same year. Ongoing trends of luxury dining and tourism are expected to drive the market for full-service restaurants. In addition, high disposable income boosts the spending capacity of consumers on luxury amenities.

Furthermore, upsurge in shopping centers at business hubs across the globe leads to the proliferation of full-service restaurants. However, the outbreak of COVID-19 has enforced full-service restaurants to close or adopt home delivery and pick-up trend accelerated. Moreover, full-service restaurants are resuming their businesses with capacity cut to 50% and by adhering to the hygiene guidelines and safety regulations. This, in turn, is expected to drive the growth of the food service equipment market share during the global health crisis.

By Region

By region, the North America dominated the global food service equipment market, registering a CAGR of 6.0% in 2023 and is anticipated to maintain its dominance during the forecast period. Over the past years, the food service industry has witnessed significant growth in terms of technology and affordability of products. Commercial food joints, including cafes, pubs, and restaurants prefer using automated equipment. Belshaw Adamatic Bakery Group (a subsidiary of Ali Group North America) introduced divider rounder, donut systems, and makeup lines to be used in the industry for producing donuts and bread rolls. Market players have heavily invested in food equipment solutions for automating their processes and delivering high-quality products to cater to the growing needs of the customers. In terms of growth, the fast food chain & restaurant segment dominates the North American food service market.

According to food service equipment market trends, key factor driving the growth of the North America market is early adoption of automation in commercial kitchens. Availability of affordable, high-quality, and safe equipment in the market allows small companies to explore and implement kitchen solutions for various applications. In addition, rise in cost of skilled labor drives companies toward adoption of food service equipment and have increased the food service equipment market growth.

Competitive Analysis

The major players profiled in the food service equipment market report include Duke Manufacturing Co. Inc., Electrolux, Dover Corporation, Illinois Tool Works (ITW), Inc., Ali Group S.r.l. a Socio Unico, Welbilt, Inc., Middleby Corporation, Alto-Shaam, Inc., Comstock-Castle Stove Co., Inc., and Cambro Manufacturing Co. Inc.

According to food service equipment industry is anticipated to expand due to a rise in the number of internet users, surge in hybrid model of professionals, and a shift toward skill development. In addition, factors such as innovation, collaboration, product launch, partnership, and expansion are opportunistic for market growth.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the food service equipment market share, segments, current trends, estimations, and dynamics of the food service equipment market analysis from 2023 to 2035 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the food service equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and food service equipment market growth strategies.

Food Service Equipment Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 290 |

| By End Use |

|

| By Product |

|

| By Region |

|

| Key Market Players | COMSTOCK-CASTLE STOVE CO., INC., ALTO-SHAAM, INC, ELECTROLUX, DUKE MANUFACTURING CO. INC., CAMBRO MANUFACTURING CO. INC., MIDDLEBY CORPORATION, ALI GROUP S.R.L. A SOCIO UNICO, ILLINOIS TOOL WORKS (ITW), INC., Dover Corporation, Welbilt, Inc. |

Analyst Review

The market players have adopted key developmental strategies such as new product launch and acquisition to maintain their position in the food service equipment market, in terms of value sales. They also emphasize on continuous innovations in their products to keep a strong foothold in the market and to boost the sales of food service equipment. According to the key market players, kitchen space constraints encourage restaurants, hotels, bars, and others to seek for effective solutions for their commercial kitchens. Therefore, players are investing in R&D activities and making continuous efforts to launch new and improved food service equipment, which are space saving and can perform multiple functions. Thus, providing consumers effective solutions for their problems, which promotes the growth of the food service equipment market.

Moreover, as per the key players, the increasing adoption of automation in the industry has contributed in driving the growth of the market amidst the COVID-19 pandemic. For instance, products such as automated cooking & beverage systems, touchless pick-up & delivery equipment, cloud-based IoT solution, and other automated equipment are in demand as they are addressing the evolving foodservice environment accelerated due to the COVID-19 pandemic. This, in turn, is also anticipated to offer immense opportunity for the growth of the industry in terms of sales value even after the adverse effects of the COVID-19 pandemic. Key players in the market have adopted new product launch, continuous innovation, and acquisition as their key developmental strategies to fulfill the rising demand for advanced and improved food service equipment in the food service industry. However, high installation costs and integration capabilities required for the initial setup of the food service equipment are anticipated to hamper the market growth.

The global food service equipment market was valued at $35.8 billion in 2023, and is projected to reach $74.4 billion by 2035

The global Food Service Equipment market is projected to grow at a compound annual growth rate of 6.3% from 2024 to 2035 $74.4 billion by 2035

The key players profiled in the reports includes Welbilt, Inc., ILLINOIS TOOL WORKS (ITW), INC., ELECTROLUX, DUKE MANUFACTURING CO. INC., MIDDLEBY CORPORATION, Dover Corporation, CAMBRO MANUFACTURING CO. INC., ALTO-SHAAM, INC, COMSTOCK-CASTLE STOVE CO., INC., ALI GROUP S.R.L. A SOCIO UNICO

North America dominated and is projected to maintain its leading position throughout the forecast period.

Growth in food service industry, Rise in preference for quick-service restaurants, Regulatory benefits, Surge in demand for energy-efficient and cost-effective products majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...