Food Stabilizer Marke Overview:

Global Food Stabilizer Market size was valued at $7,580 million in 2016, and is anticipated to grow at a CAGR of 4.1% to reach $10,100 million during 2017 to 2023. Food stabilizers are substances or chemicals that allow unblended food ingredients to remain homogenous. It maintains the physio-chemical state of a foodstuff to ensure homogeneous dispersion. It helps to retain the color, shape, texture, consistency, and stability of food products. The benefits have increased the use of food stabilizers, in a wide range of food products such as, bakery, confectionery, dairy product, beverage & convenience food, sauce, and others. Pectin, carrageenan, gelatin, agar-agar, and calcium chloride are some of the commonly used stabilizers used in food products. Presently, the use of food stabilizers has increased in the recent years, owing to the emergence of convenience food & organic food and influence of westernized food habits. The market is driven by rise in disposable income, growth in the convenience food sector, and increased demand for food stabilizers in the dairy & confectionery industry. However, limitations on the usage of certain stabilizer blends, stringent government regulations on usage & quantity, and consumer preference for fresh food hamper the market growth.

The report emphasizes on the different types of food stabilizers, which include pectin, gelatin, carrageenan, xanthan gum, guar gum, and others. Based on function, the market is classified into stability, texture, and moisture retention. On the basis of application, it is categorized into bakery, confectionery, dairy product, sauce & dressing, beverage & convenience food, meat & poultry product, and others. Geographically, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In addition, the report highlights various factors that impact the growth of the global market, such as key drivers, restraints, growth opportunities, as well as the role of different key players. It presents the quantitative data, in terms of both value and volume, which have been obtained from the secondary sources such as company publications, Factiva, Hoovers, OneSource, and others.

Global Food Stabilizer Market Segmentation

Europe dominates the global food stabilizer market, in terms of both value and volume. However, Asia-Pacific is expected to witness the highest growth rate during 2017-2023, owing to increase in population, rise in disposable income, reforms in food preferences, and increase in demand for convenience food.

Food Stabilizer Market Share,By Geography, 2016 (%)

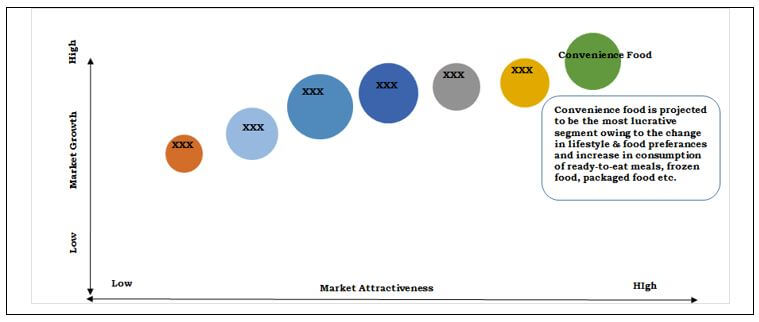

Food Stabilizer Market Top Investment Pockets

The convenience food segment is the most lucrative in the market, followed by sauces & dressings. There is an increase in acceptance among consumers for convenient food, such as ready-to-eat meals, frozen meals, packaged food, and commercialized fruit juices. Furthermore, change in lifestyle and food preferences are expected to increase the demand for convenience food in near future.

Top Investment Pocket

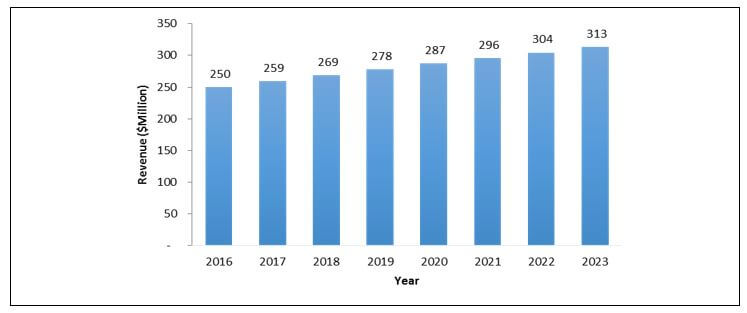

Europe Food Stabilizer Market Size

Europe witnessed the highest demand for food stabilizer, owing to the support of European Food Safety Authority and other government agencies for the approval of safe food additives & stabilizers. Germany dominated the Europe food stabilizer market in 2016, in terms of both value and volume.

Germany Food Stabilizer Market Growth, 2016-2023 ($Million)

The key players profiled in the report are Glanbia Nutritionals, E. I. DuPont de Nemours and Company, Kerry Inc., Cargill, Inc., Ashland Inc., Associated British Foods Plc., Koninklijke DSM N.V., Chemelco International B.V., Archer Daniels Midland Company, and Advanced food systems.

The other major players (not profiled in report) in the market include Palsgaard, Tate & Lyle, Celanese Corporation, Chr. Hansen A/S, and Nexira, Eurogum A/S, Unipektin Ingredients AG, Holton Food Products, Deosen Biochemical Ltd., and Naturex SA.

Key Market Benefits

This report provides an extensive analysis of the current and emerging market trends & dynamics of the global food stabilizer market.

The food stabilizer market analysis for all the regions is done by constructing estimations for key segments between 2015 and 2023 to identify the prevailing opportunities.

- The report assists to understand the strategies adopted by the leading companies in the industry.

- This study evaluates competitive landscape of the food stabilizer industry to understand the market scenario globally.

- Extensive analysis is conducted by key player positioning and monitoring the top competitors within the global market.

Food Stabilizer Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Functions |

|

| By Application |

|

| By Geography |

|

| Key Market Players | E. I. DUPONT DE NEMOURS AND COMPANY, ASHLAND INC., ADVANCED FOOD SYSTEMS, CHEMELCO INTERNATIONAL B.V., KONINKLIJKE DSM N.V., ARCHER DANIELS MIDLAND COMPANY, KERRY INC., CARGILL, INC., GLANBIA NUTRITIONALS, ASSOCIATED BRITISH FOODS PLC. |

Analyst Review

Food stabilizers are food additives that are added to food items to smoothen the texture of the food and provide shape to the food. It helps to maintain color, shape, texture, consistency, and stability of food products. Pectin, carrageenan, gelatin, agar-agar, xanthan gum, and calcium chloride are some of the commonly used stabilizers in food products. These food stabilizers are used in a wide range of food applications, such as bakery, confectionery, beverage, convenience food, and meat & poultry product including many others. In 2016, the gelatin segment accounted for one-third share of the global market.

The pectin food stabilizer segment is expected to witness the highest growth rate, registering a CAGR of 4.9% during the forecast period. Pectin occurs naturally in citrus fruits and are able to form a gel at varying conditions. Pectin is commonly used in highly sugared, low-pH frozen desserts such as sherbets, water ices, and sorbets. Moreover, in protein beverages, pectin provides suspension and stability when combined with thickeners, such as guar gum and xanthan gum. The bakery application segment accounted for the highest share in 2016, with almost one-fifth share in global market. The texture by function segment dominated the global market in 2016, with almost half of the market share.

Europe is the most significant market for food stabilizers, in terms of both revenue and volume. Germany dominated the European food stabilizer market in 2016, in terms of both value and volume. The support of European Food Safety Authority and other government agencies for the approval of safe food additives & stabilizers are the major factors driving the global food stabilizers market.

Loading Table Of Content...