Footwear Market Summary, 2032

The global footwear market size was valued at $409.5 billion in 2022, and is projected to reach $725.1 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032. Footwear is apparel that is worn on the feet and frequently serves as protection from environmental risks such as temperature variations and wear from various ground textures.

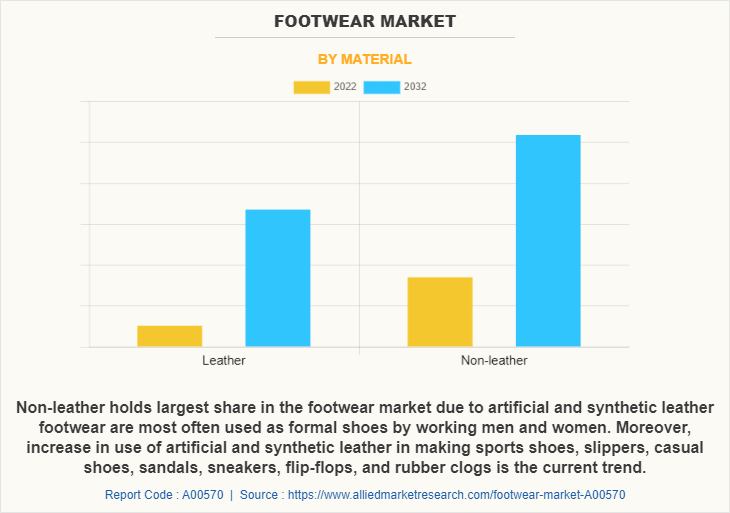

Footwear aid in covering and protecting the foot from ground textures, temperatures, and gravel roads. Footwear is made up of different materials such as leather, plastic, rubber, and fabric. Leather is one of the prominent materials used for the first version of footwear. Companies such as Nike are using eco-friendly raw materials such as recycled car tires, recycled carpet padding, organic cotton, and vegetable-dyed leather for manufacturing footwear products.

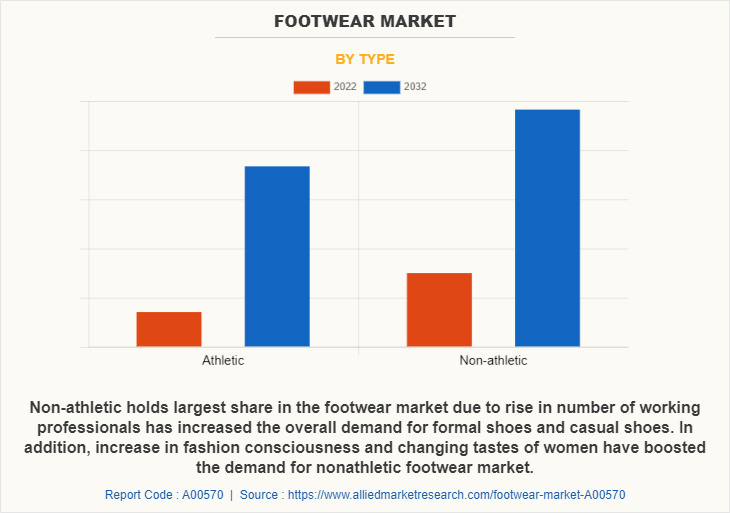

Moreover, the rise in the number of working professionals has increased the overall demand for formal shoes and casual shoes. In addition, the increase in fashion consciousness and changing tastes of women have boosted the demand for the nonathletic footwear market. The nonathletic footwear market is dominated by the presence of a wide range of footwear encompassing sandals, heels, and wedges.

The rise in demand among children for a wide variety of footwear, including flip-flops, sandals, and boots augments the growth of the global market. In addition, the increase in the number of working professionals paired with the rise in fashion consciousness and the need to look stylish & trendy fueled the overall growth of the nonathletic footwear market.

However, high prices and the rise in popularity of footwear brands such as Nike, Adidas, and Puma have led to the advent of counterfeit brands. Counterfeit brands are usually available in developing economies where customers are highly price-sensitive. This factor hampers the sale of the existing original footwear brands in these economies.

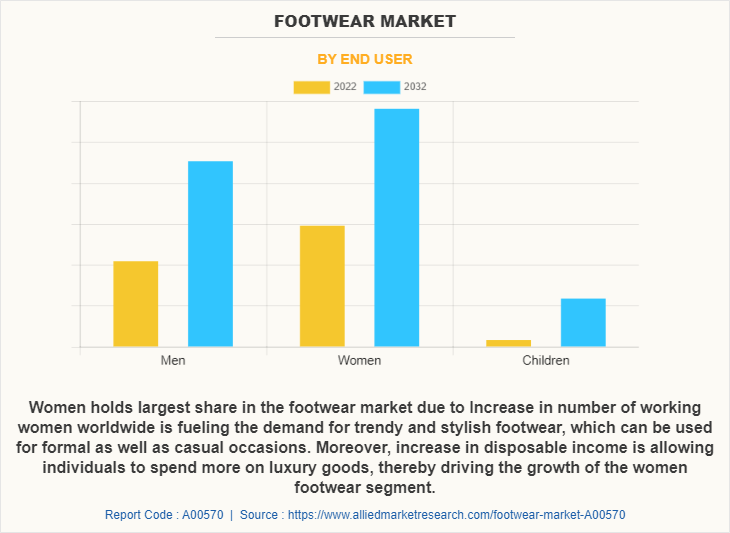

The footwear market has been significantly impacted by changes in consumer habits. Leading Asia-Pacific retailer Bata conducted a survey to determine how people's fashion preferences are evolving. In contrast to women, who purchase shoes every two months, the survey found that men buy a pair every four months. This element has a sizable impact on the expansion of the worldwide market.

Additionally, when picking the right footwear, buyers take comfort into account. Additionally, people are buying fashionable and cozy shoes, which helps the market expand. Children's need for fashionable and colorful shoes, which is similar to that of men and women, is a major driver of the global market's expansion.

Currently, people all around the world are becoming more cognizant of their health. This has compelled people to go to fitness centers and engage in both indoor and outdoor exercise activities, which has in turn increased demand across all age groups for athletic footwear. To maintain a healthy and active lifestyle, working people also choose exercise regimens like swimming, running, and exercising. All age groups now have a need for footwear as a result of this, which is promoting market expansion.

Government funding for competitive sports like the Olympics, Formula 1, Cricket World Cups, and FIFA has increased. The government officials' encouragement of the athletes to join has increased the number of athletes participating in the domestic sporting events that are being organized. As a result of the rise in participants, there is a rising need for sports accessories such as clothing, sunglasses, and footwear.

Children today want fancy, stylish, colorful, and sports-inspired footwear, just like men and women do. The number of kids participating in sports has increased, which is driving up demand for athletic footwear. Children now have a much greater demand for footwear for sports including football, basketball, hockey, tennis, baseball, and more. Children have a big desire for fashionable trainers, flip-flops, slip-ons, boots and casual shoes in addition to athletic footwear, which is what is driving the expansion of the global footwear industry.

However, the rise in popularity of footwear brands like Nike, Adidas, and Puma as well as their high prices have prompted the emergence of knockoff names. In underdeveloped nations with price-conscious consumers, counterfeit products are frequently offered. The selling of the current original footwear brands in these economies is hampered by this problem. Since counterfeit goods are of poor quality and frequently cause inconveniences and safety concerns, consumers tend to have negative impressions of them.

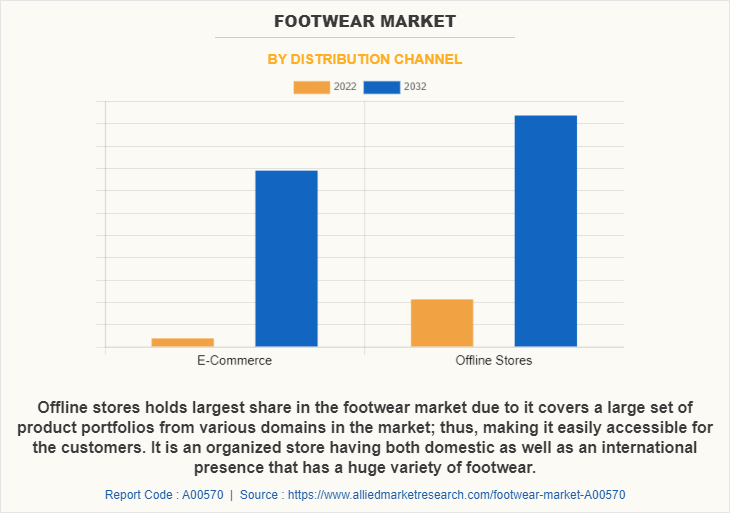

One of the main platforms where the sale of fake brands can be easily camouflaged is the online distribution channel. Therefore, it is projected that the growth of the market will be hampered by the development of the counterfeit sector.

The footwear sector currently faces a shortage of leather due to the restriction on cow slaughter and the leather goods that go along with it. The insufficient supply of hide or skin, which are necessary raw materials for leather footwear goods, has led to high leather costs all around the world.

Furthermore, leather shoes are in high demand because they are valued highly in this industry. However, the Council for Leather Exports, India's ban on the use of leather in the manufacture of footwear has ultimately decreased the production of leather footwear in India, a significant hub for industrialized countries' exports. Individuals are hesitant to purchase leather shoes because of the expensive cost of the material, which is limiting market expansion.

On the other hand, Local businesses that sell cheap, low-quality shoes dominate the market. On the other hand, foreign manufacturers emphasize comfort while creating footwear items, which are typically sold at high prices. The overall expansion of the business is anticipated to be boosted by the rise in demand for stylish yet comfortable footwear, affordable pricing, and improved designs of footwear at lower prices.

Additionally, a number of athletic companies, including Nike, New Balance, and Under Armour, are utilizing 3D printing technology in the manufacture of footwear. Customers are drawn to these attributes, which are predicted to offer profitable potential for market expansion over the course of the projection period.

The number of people using social media has greatly expanded with the surge in internet usage. In light of this, the majority of the industry's major players develop strategies for promoting their goods and services on these social media channels.

One of the main tactics used by many businesses and sectors to spread knowledge about their product offerings among target clients on social media platforms is social media marketing. Therefore, the global footwear industry sees a crucial potential through its social media marketing approach to establish momentum and expand its client base among its target demographics.

Segmental Overview

The footwear market is segmented on the basis of type, material, end users, distribution channel, and region. By type, the market is classified into athletic and non-athletic. Depending on the material, the market is categorized into leather and non-leather. By end users, it is categorized into men, women, and children. Depending on the distribution channel, the market is categorized into E-Commerce and offline channel. By region, the market is analyzed in North America, Europe, Asia Pacific, and LAMEA.

By Type

Depending on the type, the non-athletic segment dominated the footwear market share in 2022, garnering more than half of the market share; moreover, the athletic is expected to grow at the highest CAGR of 6.1% from 2023 to 2032. In addition, the overall demand for formal shoes and casual shoes has increased due to the rise in the number of working professionals.

The demand for non-athletic footwear has also increased due to changing tastes of women and a rise in fashion consciousness. The enormous variety of footwear available, including sandals, heels, and wedges, dominates the non-athletic footwear market. The rise in popularity of flip-flops, sandals and boots among children is contributing to the footwear market demand globally.

Additionally, the market for non-athletic footwear expanded as a result of an increase in the number of working professionals, together with a rise in fashion consciousness and the desire to dress fashionably.

By Material

Depending on the material, the non-leather segment dominated the market in 2022, garnering more than half of the market share; moreover, leather is expected to grow at the highest CAGR of 6.2% from 2023 to 2032. In addition, working men and women most frequently wear artificial and synthetic leather shoes as formal shoes.

Additionally, the current fashion is for more fake and synthetic leather to be used in the production of sports shoes, slippers, casual shoes, sandals, sneakers, flip-flops, and rubber clogs. The footwear market growth is expanding due to the accessibility of fancy, fashionable, and elegant boots, sandals, heels, and wedges.

By End User

Depending on the end user, the women segment dominated the market in 2022, garnering around half of the market share. Moreover, children is expected to grow at the highest CAGR of 6.6% from 2023 to 2032. In addition, an increase in the number of working women around the world is driving up demand for fashionable footwear that can be worn both formally and casually.

Additionally, a rise in disposable income is enabling people to spend more on luxury items, which is fueling the expansion of the women's footwear market. Additionally, the market for new fancy and contemporary shoes, slip-ons, and flip-flops is constantly expanding, which is anticipated to support the expansion of the women's footwear market forecast year.

By Distribution Channel

Depending on the distribution channel, the offline channel segment dominated the market in 2022, garnering the majority of the market share; however, e-commerce is expected to grow at the highest CAGR of 6.1% from 2023 to 2032.

In addition, the offline channel offers a broad range of product portfolios from numerous market sectors, making it simple for clients to access. It is a well-organized store with a large selection of winter shoes and a presence both domestically and internationally. These kinds of stores provide customers with access to niche products that are available on the market. As a result, the development of offline channels in several regions creates profitable openings for the expansion of the footwear market.

Footwear sales are greatly boosted by the manufacturers' special discounts offered through these channels, which also encourage hypermarket and supermarket chains to sell their own goods, hence creating various footwear market opportunities across the globe.

By Region

Region wise, Asia-Pacific dominated the market in 2022, garnering a market share of 41.4%. The Asia-Pacific market offers growth opportunity for businesses selling cutting-edge and novel footwear goods.

Additionally, as urbanization and the number of middle-class customers has grown in both developing and developed countries, more individuals of all ages are being attracted to convenient lives. A big demand for chunky trainers, stilettos, colorful sandals, and high heels is also being seen in the footwear market in Asia Pacific region, which has fueled the expansion of the industry.

Competitive Analysis

Some of the major players analyzed in this report are Adidas AG, Nike Inc, Puma SE, Under Armour, Inc, Skechers USA, Inc., Geox S.P.A., VF Corporation, Crocs, Inc., ECCO Sko A/S and Wolverine World Wide, Inc.

Some Examples of Expansion in the Global Footwear Market

In January 2023, VF Corporation established a new regional office in Harajuku district, Tokyo in order to drive innovative product design and support expanded business growth across Asia-Pacific.

In December 2022, Skechers USA, Inc., established its new flagship store in Grafton Street, Ireland in order to expand its presence in Ireland.

In July 2022, Skechers USA, Inc. opened its new superstore in New Jersey. This new superstore its biggest East Coast retail destination.

In June 2021, ECCO Sko A/S opened four outlet shops across the U.S., in Dolphin Mall, Miami; Opry Mills, Tennessee; Denver, Colorado; and Mebane, North Carolina.

In May 2021, ECCO Sko A/S opened its new flagship shop in Shanghai to expand its customer reach.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the footwear market analysis from 2022 to 2032 to identify the prevailing footwear market.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the footwear market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global footwear market trends, key players, market segments, application areas, and market growth strategies.

Footwear Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 725.1 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 518 |

| By Material |

|

| By Distribution Channel |

|

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | ECCO Sko A/S, Skechers USA, Inc., Nike Inc., VF Corporation, Geox S.p.A., Wolverine World Wide, Inc., Adidas AG, Under Armour, Inc., Puma SE, Crocs, Inc. |

Analyst Review

Footwear industry is experiencing a speedy expansion, owing to rise in demand for trendy and comfortable footwear among all age groups. Rapid urbanization, demographics changes along with increase in demand of middle class population, and surge in disposable income fuel the growth of the footwear market. In addition, increase in demand for sports shoes and branded footwear among all age groups is expected to boost the demand for sports footwear and branded footwear category products. Consumers are seeking to include sport-styled designs into their everyday wardrobe. Furthermore, increase in number of working women and increase in their fashion consciousness drive the growth of the footwear industry.

Change in lifestyle of individuals has drastically affected the footwear industry. A survey by leading Asia-Pacific retailer, Bata shows changing fashion trends among individuals. The survey indicated that a man buys a pair of shoes after every four months compared to women, who purchase footwear after every two months. Consumers consider comfort as an important parameter while choosing appropriate footwear. In addition, consumers presently are ready to indulge in stylish and comfortable footwear. Non-leather products dominate the men’s footwear segment. Another factor that influences the demand for footwear is the rise in demand for effective footwear that protects from intensive physical activities such as sports, hiking and outdoor traveling across the globe. There is an increase in the demand for footwear as customers seek efficient, secure, and lucrative design for their use. Consequently, the demand for footwear has seen a multifold increase in the past four years, especially in the developed countries of North America and Europe regions including but not limited to the U.S., Canada, The UK, and Germany. Hence, the growth of footwear is expected across the globe in the forecast period.

The global footwear market size was valued at $409.5 billion in 2022, and is projected to reach $725.1 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032.

The global footwear market is growing at a CAGR of 5.9% from 2023 to 2032.

Some of the major players analyzed in this report are Adidas AG, Nike Inc, Puma SE, Under Armour, Inc, Skechers USA, Inc., Geox S.P.A., VF Corporation, Crocs, Inc., ECCO Sko A/S and Wolverine Worldwide, Inc.

Region wise, Asia-Pacific region accounted for the footwear market share.

The global footwear market is expected to witness significant growth due to evolving athleisure trends and 3D printing & customization of footwear. Moreover, rise in trend of online sale of footwear products is anticipated to boost the overall revenue of the industry.

Loading Table Of Content...

Loading Research Methodology...