Forex Brokers Market Research, 2032

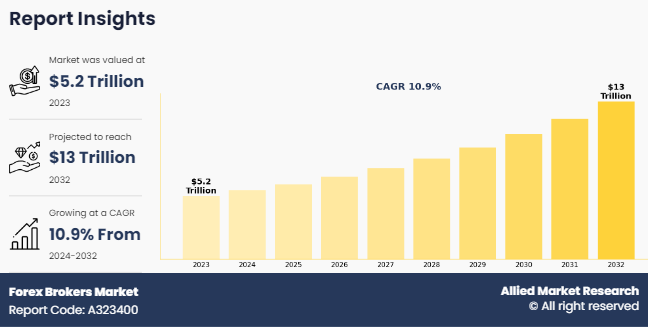

The global forex brokers market was valued at $5,233.47 billion in 2023, and is projected to reach $13,038.5 billion by 2032, growing at a CAGR of 10.9% from 2024 to 2032.

The forex brokers market, also known as the forex or FX market for short, is the global market for trading in the world’s currencies. Rather than being a market with central exchange, the market is an informal over-the-counter marketplace. Over-the-counter exchanges are exchanges made between two parties without any form of supervision. The market is a completely open market. Any activity related to the buying, selling, or exchanging of currencies is said to be taking place in the forex brokers market.

Key Takeaways

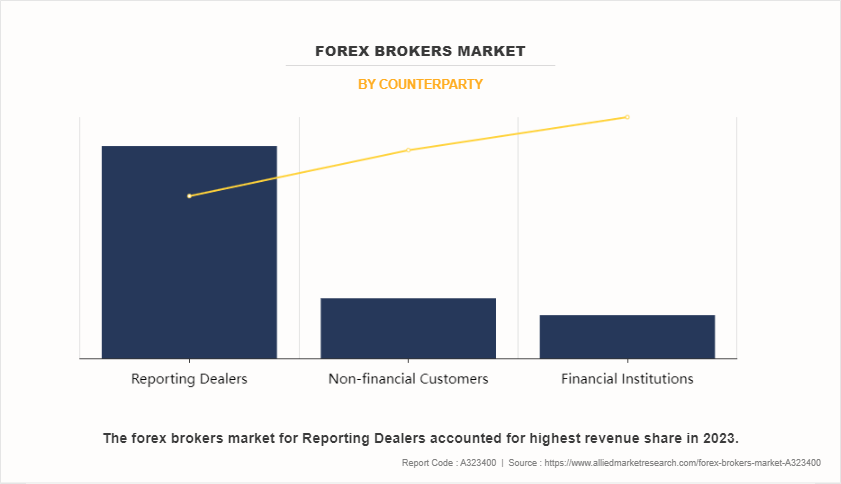

By counterparty, the reporting dealers segment accounted for the largest forex brokers market growth in 2023.

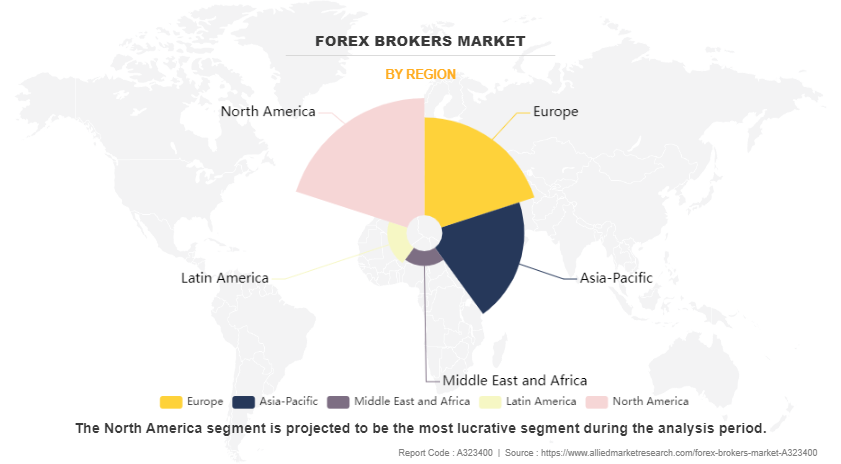

Region-wise, North America generated the highest revenue in 2023.

By type, the currency swap segment accounted for the largest forex brokers market share in 2023.

High accessibility and liquidity and the considerable growth in global economic developments boost the growth of the global forex brokers market. In addition, the surge in the number of strategic partnerships and acquisitions among key players has positively influenced the growth of the forex brokers market. However, privacy and data security concerns and regulatory compliance costs and complexity are expected to hamper market growth. On the contrary, the rising consumer awareness toward the numerous benefits of forex brokers, such as minimal trading costs, high liquidity, forex brokers adoption and transactional transparency is expected to offer remunerative opportunities for the expansion of the market during the forecast period. Each of these factors is projected to have a definite impact on the growth of the global forex broker market.

Forex Brokers Market Segment Review

The global forex brokers market is segmented by counterparty, type, and region. In terms of counterparty, the market is fragmented into reporting dealers, financial institutions, and non-financial customers. Depending on the type, it is bifurcated into currency swaps, outright forward and FX swaps, and FX options. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By counterparty, the global forex brokers market was led by the reporting dealers segment in 2023 and is projected to maintain its dominance during the forecast period, owing to technological advancement and a rise in awareness among the people are projected to attract many new consumers, which boost the global market. However, the financial institutions segment is expected to grow at the highest rate during the forecast period owing to the enhanced data reporting providing insights into forex brokers market trends, leading to more informed decision-making. Technology advancements and the globalization of financial services have further encouraged participation with forex brokers companies.

Region-wise, the global forex brokers market size was dominated by North America in 2022 and is expected to retain its position during the forecast period. This is attributed to rising income levels and trading expectancies. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to consumer awareness and major players of the market targeting developing countries of Asia-Pacific.

The key players that operate in the global forex brokers market are Barclays, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs, HSBC Holdings plc, JPMorgan Chase & Co., The Royal Bank of Scotland, UBS AG, Standard Chartered PLC, State Street Corporation, and XTX Markets Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the forex brokers industry.

Market Landscape and Trends

The forex broker market is witnessing dynamic growth and transformation, driven by a combination of technological innovation, regulatory changes, shifting investor preferences, and global forex brokers market dynamics. With the global forex market exceeding average daily trading volume, brokers are capitalizing on increasing retail participation, institutional trading activity, and globalization. Moreover, increase in technological advancements, including artificial intelligence, machine learning, and mobile trading apps, are revolutionizing trading capabilities and accessibility, empowering traders with sophisticated tools and real-time connectivity. However, regulatory oversight remains stringent, with authorities imposing stricter standards to enhance transparency, protect investors, and mitigate systemic risks. Compliance with regulatory requirements, such as licensing, capital adequacy, and anti-money laundering measures, is essential for brokers to maintain market credibility and trust.

Furthermore, there is a notable shift in trading preferences among retail and institutional clients, driven by market volatility, economic uncertainty, and evolving investor action in forex brokers domain. Brokers are adapting to these trends by diversifying their product offerings, exploring alternative asset classes, and leveraging algorithmic trading strategies to gain a competitive edge in forex brokers service. Globalization and market integration are also reshaping the competitive landscape, as brokers expand their global footprint and forge strategic partnerships to tap into emerging markets' growth potential. In essence, success in the forex broker market requires brokers to navigate a complex landscape of technological innovation, regulatory compliance, changing market dynamics, and evolving client needs effectively in forex brokers policy.

Competition Analysis

Recent Strategies in the Global Forex brokers Market:

April 11, 2024, EBC Financial Group partnered with FC Barcelona, this partnership designates EBC as FC Barcelona’s official Partner in Forex brokers, with coverage extending to regions including APAC, LATAM, the Middle East, and Africa.

October 25, 2023, BNY Mellon launched Universal FX, a new forex brokers (FX) platform that meets client needs to manage execution across their entire portfolio and access market-leading price transparency. Universal FX supports BNY Mellon clients across all market segments, such as investment managers, corporates, hedge funds and wealth managers, as well as helping them navigate the industry transition to T+1 settlement.

On July 07, 2023, ATFX acquired Rakuten Securities Australia Pty Ltd ("RSA"), a subsidiary of Rakuten Securities, Inc., further strengthening its position in the Australian market and expanding its global footprint. This strategic move has marked as a significant milestone for ATFX as it continues to solidify its position as a global trusted online broker with innovative trading solutions. By acquiring RSA, ATFX gains access to a well-established customer base and a talented team of industry professionals.

Top Impacting Factors

High accessibility and liquidity

The high accessibility and liquidity of forex serve as pivotal drivers of its growth and prominence. Operating 24 hours a day during weekdays, forex brokers market allows participants from around the globe to engage in currency trading without time constraints. It accommodates various participants, from individual investors and small businesses to multinational corporations and central banks. This constant accessibility has fostered a high degree of liquidity, meaning that large volumes of currency are bought and sold without significant price fluctuations. The ready availability of major currency pairs ensures that transactions are executed promptly, which further adds to the appeal of the market. In addition to this, modern online trading platforms have made it even more accessible to retail traders, enabling participation from virtually anywhere in the world. This amalgamation of accessibility and liquidity collectively fosters an environment that is both attractive and conducive to a wide array of market participants.

Considerable growth in global economic developments

Global economic developments have a profound influence on the market, shaping its dynamics and dictating currency values. Factors such as shifts in trade balances, variations in interest rates, inflationary trends, and unexpected economic events all play a significant role in determining currency exchange rates. For example, an increase in a country's exports relative to imports may lead to a strengthening of its currency. Conversely, economic uncertainties or financial crises in a region lead to a depreciation of the local currency. Moreover, decisions by central banks regarding interest rates lead to immediate reactions in the forex brokers market. Traders and investors must continuously monitor global economic indicators and news, as these factors have the potential to create both opportunities and risks. The complexity and interconnectedness of global economic developments make them paramount in shaping the market.

Restraint

Privacy and data security concerns

Despite the benefits of wearable technology and health monitoring devices, privacy and data security concerns remain significant challenges for the forex brokers market. Consumers are increasingly wary of sharing sensitive data with financial companies, forex brokers companies and third-party providers due to concerns about data breaches, online trading services, unauthorized access, and misuse of personal information. Addressing these concerns and implementing robust data protection measures is essential to foster trust and encourage widespread adoption of forex programs.

Forex Brokers Market Opportunity

Rise in number of strategic partnerships and acquisitions among key players

Strategic corporate activities such as mergers, acquisitions, and international expansion are vital components contributing to the dynamics of the forex brokers market. Multinational corporations engaging in foreign trade frequently navigate transactions involving various currencies. As companies expand their operations across borders, they require currency conversion and often engage in hedging strategies to mitigate potential currency risks. These transactions necessitate a deep understanding of the market and often involve substantial sums of money. Furthermore, international acquisitions or mergers may require considerable currency exchange, leading to significant market activity. Such corporate activities underline the essential role of the forex brokers market in global business operations and reflect the market's responsiveness to the strategic decisions of corporations. The interplay between corporate strategy and currency management underscores the market's complexity and its critical function in the global business landscape.

Report Coverage & Deliverables

The report on the forex brokers market offers comprehensive insights into the industry's growth dynamics, covering key market drivers, restraints, opportunities, and challenges. It includes an in-depth analysis of regional trends, market segmentation, competitive landscape, and regulatory environments. Deliverables include market size estimates, forecasts, and qualitative assessments of technological advancements and emerging trends, ensuring a detailed view of the forex trading landscape.

Regional Insights:

Regionally, North America and Europe dominate the forex brokers market, driven by the presence of leading financial institutions and high trading volumes. Asia-Pacific is emerging as a key growth region, particularly in countries like China and India, due to increasing retail participation in forex trading. Latin America and the Middle East are also witnessing growing interest in forex trading, driven by favorable regulatory developments and digital trading platforms in forex brokers size.

Solution Insights:

Forex brokers offer a range of solutions including trading platforms in forex brokers market, account management services, and analytical tools. Web-based and mobile trading solutions are gaining traction, offering flexibility and real-time trading experiences. Additionally, automated trading and copy trading solutions are seeing increased demand as traders seek efficiency and convenience.

Key Companies & Market Share Insights:

Key companies in the forex brokers market include IC Markets, XM Group, IG Group, and CMC Markets. These firms have captured significant market share through technological innovations, user-friendly trading platforms, and competitive pricing strategies. Their global presence, coupled with strong regulatory compliance, ensures their dominance in the forex trading industry.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global Forex brokers market analysis from 2024 to 2032 to identify the prevailing global forex brokers market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the global Forex brokers market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global forex brokers market forecast.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players and forex brokers market outlook.

The report includes the analysis of the regional as well as global Forex brokers market trends, key players, market segments, application areas, and market growth strategies.

Forex Brokers Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2032 |

| Report Pages | 245 |

| By Counterparty |

|

| By Type |

|

| By Region |

|

| Key Market Players | Barclays, BNP Paribas, JPMorgan Chase & Co, UBS AG, Citibank, Deutsche Bank AG, HSBC Holdings plc, Standard Chartered PLC, The Royal Bank of Scotland, Goldman Sachs |

Analyst Review

The forex brokers market, commonly known as Forex, is a global decentralized or over the counter (OTC) marketplace that deals with the trading of currencies. This market is responsible for determining the forex brokers rates for every currency. It includes all aspects of buying, selling, and exchanging currencies at current or determined prices. In terms of trading volume, it is the largest market in the world, offering continuous operation and providing a crucial role in the global economy. Forex operates through a network of banks, corporations, and individuals trading one currency against another. The complex interbank network and electronic platforms ensure a fluid market, where exchange rates fluctuate based on various economic factors.

Furthermore, the global market is primarily driven by the rising integration of modern technology in trading platforms, enhancing efficiency and transparency. In line with this, the globalization of businesses resulting in the consequent need for currency exchange services to conduct cross-border transactions is providing an impetus to the market. With the growth in demand for wellness activity-based health solutions, various companies have established partnership strategies to increase their solutions offerings in AI solutions. For instance, in January 2024, FP Markets partnered with TradingView to provide superior trading tools for traders. The incorporation of Trading View is an exciting addition for FP Markets for trading platforms which includes MT4, MT5 and cTrader. Further, such strategies drive forex brokers market growth.

In addition, with the surge in demand for tax software, several companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in December 2023, CME Group launched the new spot FX trading platform to provide better liquidity across a wider pool of currency pairs, connecting cash and futures forex brokers market.

For instance, in November 2023, Banyan Software acquired FXCubic to strengthen its position in the financial technology (fintech) sector and expand its product portfolio. The acquisition of FXCubic, a provider of trading technology solutions for the forex industry, offers several strategic advantages for Banyan Software.

The global forex brokers market was valued at $5,233.47 billion in 2023 and is projected to reach $13,038.5 billion by 2032, growing at a CAGR of 10.9% from 2024 to 2032.

The forex brokers market, also known as the FX market, is a global decentralized or over-the-counter (OTC) marketplace for currency trading. It involves buying, selling, and exchanging currencies without a central exchange and operates through banks, financial institutions, and individual traders.

Key players in the forex brokers market include JPMorgan Chase & Co., Goldman Sachs, Citibank, Deutsche Bank AG, HSBC Holdings plc, UBS AG, The Royal Bank of Scotland, Barclays, BNP Paribas, Standard Chartered PLC, and XTX Markets Limited.

North America generated the highest revenue in the forex brokers market in 2023, driven by rising income levels, trading expectancies, and the presence of major financial institutions.

High accessibility and liquidity, growth in global economic developments, and an increase in strategic partnerships and acquisitions among key players are major factors driving market growth. Additionally, technological advancements and the rising adoption of forex brokers contribute to market expansion.

Privacy and data security concerns, along with regulatory compliance costs and complexities, are key challenges hindering market growth. Stricter regulations, licensing requirements, and anti-money laundering measures add to operational difficulties for forex brokers.

Loading Table Of Content...

Loading Research Methodology...