Forex Prepaid Cards Market Research, 2032

The global forex prepaid cards market was valued at $120.5 billion in 2022, and is projected to reach $492.8 billion by 2032, growing at a CAGR of 15.3% from 2023 to 2032.

A forex card (also known as a travel card) is one of the most affordable, most secure, and least expensive mediums to carry foreign exchange and pay expenses overseas. A forex card is a prepaid card that allows customers to load one or more foreign currencies for easy transactions on foreign travel in a hassle-free manner. The forex prepaid cards market is propelled by the growth in globalization of organizations and travel which has led to a surge in cross-border transactions. This has created a need for convenience and secure payment solutions, which prepaid cards can fulfill.

Furthermore, prepaid cards are in high demand as a convenient payment method for international transactions due to the rise in online purchasing. In addition, the increasing benefits of prepaid cards, such as lower foreign exchange fees and better exchange rates, have fueled their adoption in the forex prepaid cards market. However, the forex card charges ATM withdrawal charges while withdrawing money from any foreign country ATM restrain the growth of the market. Moreover, the chances of getting the physical card stolen are limiting the growth of the forex prepaid cards market. On the contrary, the increase in penetration of smartphones and internet access in emerging economies provides an extensive untapped market for foreign exchange prepaid card vendors.

The report focuses on growth prospects, restraints, and trends of the forex prepaid cards market forecast. The study provides Porter's five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the forex prepaid cards market outlook.

Segment Review

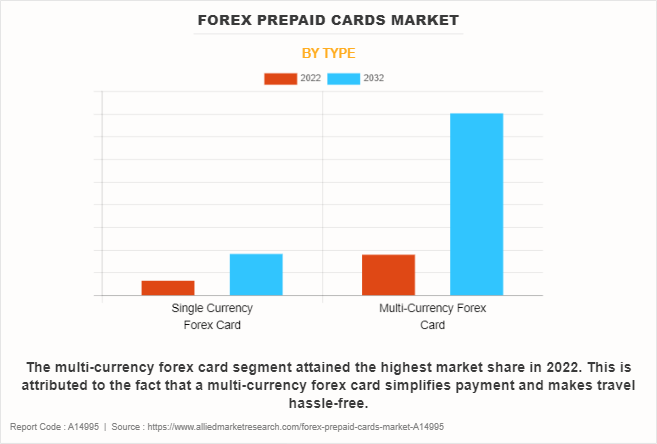

The forex prepaid cards market is segmented into type, enterprise size, distribution channel, and region. On the basis of type, the market is bifurcated into single currency forex card and multi-currency forex card. On the basis of end user, the forex prepaid cards market is categorized into retail, corporate, financial institutions, government, and others. On the basis of region, the forex prepaid cards market is studied across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

On the basis of type, the multi-currency forex card segment acquired a major forex prepaid cards market share in 2022 and is considered to be the fastest-growing segment during the forecast period. This is attributed to the fact that a multicurrency forex card simplifies payment and makes travel hassle-free. In addition, a multi-currency forex card usually gets a better exchange rate than other options such as cash or traveler's check (TC). Besides better rates, users stand to benefit from features such as waived off ATM access fee withdrawals, zero cross-currency charges, and lower transaction charges than international credit or debit cards, with a host of exclusive discounts.

On the basis of, North America dominated the forex prepaid cards market in 2022. This is attributed to the fact that as consumer travel spending increases, it will open up a huge market in North America for banks and forex prepaid card issuers to work with travel companies and improve the consumer experience. Many issuers are AI-enabling customer onboarding to balance the need for these compliance requirements with growth in cardholder expectations for a quick and frictionless onboarding process. However, Asia-Pacific is considered the fastest-growing region during the forecast period. This is attributed to the growth in tourism industry and increase in disposable income in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the forex prepaid cards market include American Express Company, Axis Bank, HSBC Group, Revolut Ltd, Qantas Airways Limited, Mastercard, HDFC Bank Ltd., Thomascook.in, Travelex International Limited, and Wise Payments Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the forex prepaid cards industry.

Recent Partnerships in the Forex Prepaid Cards Market

In September 2023, Leading omnichannel forex services company Thomas Cook (India) Ltd partnered with National Payments Corporation of India (NPCI) to launch a RuPay prepaid forex card for Indians travelling to the UAE as a pilot project. RuPay card of Thomas Cook is loaded in UAE Dirhams (AED) offering usage across the UAE for both transactions and ATM withdrawals.

In March 2023, the financial services arm of e& partnered with Mastercard for a pre-paid card, which allows users to make international fund transfers, peer-to-peer payments, and others.

Recent Product Launch in the Forex Prepaid Cards Market

In September 2023, Travelex introduced its prepaid foreign currency card to the Asian market with the launch of the Travelex Travel Money Card in Japan. Designed exclusively for overseas use and available to customers aged 12 and above, the contactless-equipped card enables customers to load multiple currencies for use at any Mastercard-affiliated shop or restaurant in more than 210 counties and regions worldwide.

Recent Acquisition in the Forex Prepaid Cards Market

In February 2022, Revolut India, the Indian arm of British fintech giant Revolut, acquired international money transfers company, Arvog Forex, as it draws up a plan to launch its cross-border remittance product for Indian users in 2022.

In July 2021, Nium, a leading global payments platform, acquired Wirecard Forex India Pte. Ltd, a foreign currency exchange, pre-paid card, and remittance service provider in India.

Market Landscape and Trends

In June 2023, in India, in order to expand payment options for Indians travelling abroad, the Reserve Bank of India decided to allow the issuance of RuPay Prepaid Forex cards by banks in India for use at ATMs, PoS machines, and online merchants overseas. Furthermore, RuPay Debit, Credit, and Prepaid Cards enabled for issuance in foreign jurisdictions, which can be used internationally, including in India.

In addition, the UAE-based payments processing and acquiring company, Mint Middle East, launched a multi-currency prepaid card solution with a mobile app, which supports up to 25 currencies. The app provides customers the flexibility to open and link 5 multiple accounts each supporting up to six currencies.

Top Impacting Factors

Growth in International Travel

There has been a corresponding increase in customer demand for prepaid cards with the growth in the international travel market. A key advantage of using a prepaid forex card over cash, traveller's cheques, credit or debit cards is the ability to lock the currency exchange rate at the time when the money is loaded on the card, protecting customers from currency fluctuations. Hence, in a depreciating currency market, prepaid forex cards enable consumers to save money. Prepaid forex travel cards also serve as a money management tool to help with budgeting, tracking, and controlling travel expenses. Furthermore, contrary to debit cards, criminals cannot access bank account of a customer through the misuse of a prepaid forex card.

In addition, forex prepaid cards are fast emerging as a preferred transaction instrument among international travelers, and with growth in adoption, the role of these cards has expanded from being a mere store of value to a multi-utility card with add-on functions such as loyalty, card controls, expense management, and budgeting. Such adaptational transformation needs financial institutions to have the right underlying infrastructure to bring new prepaid products and services and develop their digital capabilities. Therefore, these factors drive the forex prepaid cards market size.

Rise in Demand for Cash Alternatives

The forex card is the most convenient and inexpensive way to carry money abroad. A forex card allows the holder to store and transfer money electronically when travelling abroad. In addition, this helps a holder to make cashless payments instead of looking for ATMs or banks abroad while travelling, which makes their travel experience much smoother. Furthermore, millennials have rapidly adopted cashless and contactless payments, which makes forex card the best option for them. In addition, the holder gets monthly statements giving an idea of how much balance is left on the card. Moreover, the rapid adoption of cashless payment methods to reduce the usage of cash is expected to provide major lucrative opportunities for the growth of the forex prepaid cards market in the upcoming years.

Forex card charges ATM Withdrawal Fees

Forex cards charge different fees, such as activation fees, foreign ATM usage fees, inactivity charges, and redemption fees when balance of the card is redeemed. In addition, these charges compel people to avoid using forex cards and use cash instead, to avoid paying such fees. Moreover, forex cards take a long load time for reloaded funds to get credited to the forex card. Therefore, this is a major factor hampering the forex prepaid cards market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the forex prepaid cards market analysis from 2022 to 2032 to identify the prevailing forex prepaid cards market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the forex prepaid cards market segmentation assists to determine the prevailing forex prepaid cards market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as forex prepaid cards market trends, key players, market segments, application areas, and market growth strategies.

Forex Prepaid Cards Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 252 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Mastercard, Travelex International Limited, HSBC Group, Axis Bank, American Express Company, Revolut Ltd, Qantas Airways Limited, Thomascook.in, Wise Payments Limited, HDFC Bank Ltd. |

Analyst Review

Increase in consumer travel spending is expected to open up a huge market for banks and card issuers to work with travel companies and improve the consumer experience. Forex prepaid cards have emerged rapidly as a preferred transaction method among international travelers and with growth in adoption, the role of these cards has expanded from being a mere store of value to a multi-utility card with add-on functions such as loyalty, card controls, expense management, and budgeting.

Key players in the forex prepaid cards market adopt partnership, acquisition, and product launch as their key development strategy to sustain their growth in the market. For instance, in September 2023, Travelex introduced its prepaid foreign currency card to the Asian market with the launch of the Travelex Travel Money Card in Japan. Designed exclusively for overseas use and available to customers aged 12 and above, the contactless-equipped card enables customers to load multiple currencies for use at any Mastercard-affiliated shop or restaurant in more than 210 counties and regions across the globe. Therefore, such strategies adopted by key players propel the growth of the forex prepaid cards market.

The COVID-19 pandemic had a slightly negative impact on the forex prepaid cards market since the nationwide lockdown imposed all over the world, resulted in a decrease in travel across the countries. Furthermore, airlines and marine businesses were totally restricted during the pandemic, thus resulting in low demand for foreign currency exchange services and forex card prepaid services. Moreover, in the wake of the COVID-19 situation, the demand for forex prepaid cards increased due to growth in online payment to avoid physical interaction, which prevented the transmission of coronavirus. These were the major factors that impacted the forex prepaid cards market size during the COVID-19 pandemic.

The key players in the forex prepaid cards market include American Express Company, Axis Bank, HSBC Group, Revolut Ltd, Qantas Airways Limited, Mastercard, HDFC Bank Ltd., Thomascook.in, Travelex International Limited, and Wise Payments Limited. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the forex prepaid cards market.

The size of the global forex prepaid cards market was valued at $120,458.70 million in 2022 and is projected to reach $492,795.05 million by 2032.

The key players operating in the global forex prepaid cards market include American Express Company, Axis Bank, HSBC Group, Revolut Ltd, Qantas Airways Limited, Mastercard, HDFC Bank Ltd., Thomascook.in, Travelex International Limited, and Wise Payments Limited.

Partnership, product launch, and acquisition are the key strategies opted by the operating companies in this market.

The increase in penetration of smartphones and internet access in emerging economies, and the increase in globalization of businesses and travel which has led to a surge in cross-border transactions presents a vast untapped market for forex prepaid card providers.

Loading Table Of Content...

Loading Research Methodology...