Fossil Fuel Energy Market Research, 2031

The global fossil fuel energy market size was valued at $6.3 trillion in 2021, and is projected to reach $10.7 trillion by 2031, growing at a CAGR of 5.3% from 2022 to 2031. A fossil fuel is a hydrocarbon-containing substance that is extracted and burned as fuel. Examples of fossil fuels include coal, oil, and natural gas.

Fossil fuels can be burned to produce energy, power engines, or provide heat for immediate use. Before burning some fossil fuels are refined to produce compounds such as kerosene, gasoline, and propane.

The demand for fossil fuels such as oil and natural gas is driven by a number of factors, including population growth, economic expansion, and rising energy requirements. As developing countries continue to urbanize and expand, their energy needs are anticipated to increase, boosting the demand for fossil fuels. Currently, fossil fuels are the main energy source for many sectors, including transportation, manufacturing, and electricity generation. Therefore, the demand for fossil fuels is closely related to industrial output and economic activity. All these are the primary factors projected to drive the market revenue growth during the forecast period.

However, a decline in demand for energy, including fossil fuels, could result from consumers' rising knowledge of the value of energy conservation and their adoption of energy-efficient goods and services. The amount of energy needed to complete a job or maintain a certain level of comfort can be decreased through the use of energy-efficient measures. Therefore, less energy is required to meet the same amount of energy demand, which may result in less fossil fuel consumption. This is a major factor predicted to hamper the fossil fuel energy market growth in the upcoming years.

The surge in usage of natural gas for power production and the increase in need for energy efficiency in industry are the primary drivers of the global fossil fuel energy market. The market for energy derived from fossil fuels remains to be crucial in meeting the world's energy needs. The demand for fossil fuels is anticipated to remain high for the foreseeable future despite the increasing interest in renewable energy sources. The infrastructure linked to fossil fuels, such as pipelines, storage facilities, and other related infrastructure, are expected to present investment opportunities for the key players operating in the market. Investment opportunities in fossil fuel infrastructure are likely to emerge in the U.S., Russia, and the Middle East as there is substantial fossil fuel production. These factors are anticipated to create better fossil fuel energy growth opportunities in the market.

The key players profiled in this report include Iberdrola, SA, Huaneng Power International, Inc, Engie SA, Enel SpA, State Power Investment Corporation Limited., AGL Energy Limited, Origin Energy Limited, Energy Australia Holdings Limited, Stanwell Corporation Limited, and American Electric Power.

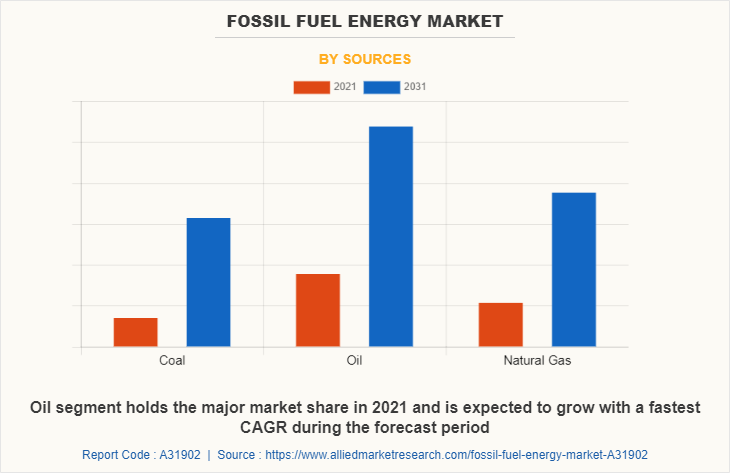

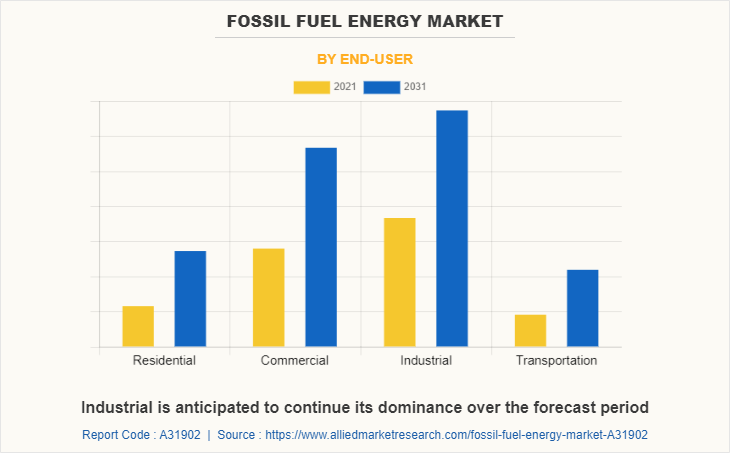

The fossil fuel energy market share is segmented on the basis of source, end user, and region. By source, the market is divided into natural gas, coal, and others. By end user, the market is categorized into residential, commercial, industrial, and transportation. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The fossil fuel energy market is segmented into Sources and End-user.

By source, the oil sub-segment dominated the market in 2021 owing to the rising desire for oil as an energy source. Oil is an important commodity for several countries and businesses as it is a vital source of energy for heating, industrial production, and transportation. A number of factors, such as the expansion of the world economy, geopolitical developments, and technological advancements, have an impact on the desire for oil. For instance, as more goods are created and transported when the world economy is expanding, there is typically a higher demand for oil. This factor is expected to drive the segment growth in the upcoming years.

By end user, the industrial segment dominated the global fossil fuel energy market share in 2021. The increase in use of fossil fuel energy in various sectors such as the petrochemical, pharmaceutical, manufacturing, and others are anticipated to boost the segment growth. In addition, the rapid growth in the industrialization across the globe are the key factors driving the global market.

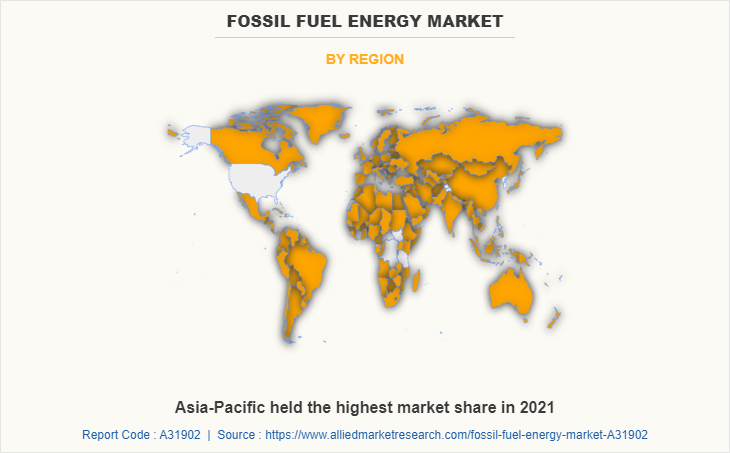

Asia-Pacific is predicted to experience the fastest growth during the forecast period. The market for fossil fuel energy is largely driven by Asia-Pacific, both in terms of production and consumption. China, India, Japan, South Korea, and Australia are few of the countries in the region with some of the biggest economies in the world, and they are all highly reliant on fossil fuels to run their economies and transportation systems. The region produces a large amount of coal, oil, and natural gas. These factors are projected to drive the regional market growth during the forecast period.

Impact of COVID-19 on the Global Fossil Fuel Energy Industry

- COVID-19 had a detrimental influence on a number of businesses, including the fossil fuel energy sector, which resulted in a sharp fall in sales of those sectors. China was one of the most affected countries during the pandemic and being the top producer and exporter of raw materials needed for fossil fuel energy production, the entire global supply chain was hampered.

- There was a major decline in the demand for fossil fuel energy internationally due to the widespread usage of fossil fuel in the production of power and energy. Nevertheless, as China was the epicentre of the coronavirus pandemic, its export suffered, which decreased the amount of fossil fuel energy.

- The establishment of new fossil fuel energy projects was hampered by the global economic recession as the majority of government investment was directed towards the healthcare industry owing to the COVID-19 virus's quick spread, which had a significant negative influence on the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fossil fuel energy market analysis from 2021 to 2031 to identify the prevailing fossil fuel energy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fossil fuel energy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global fossil fuel energy market forecast period.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fossil fuel energy market trends, key players, market segments, application areas, and market growth strategies.

Fossil Fuel Energy Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 10.7 trillion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Sources |

|

| By End-user |

|

| By Region |

|

| Key Market Players | huaneng power international, inc., Enel Spa, AGL Energy Limited, EnergyAustralia Holdings Limited, Origin Energy Limited, State Power Investment Corporation Limited., stanwell corporation limited, Iberdrola, SA, american electric power, Engie SA |

Analyst Review

Rapid industrialization in developed & developing countries and surge in manufacturing processes & production units are the key growth factors driving the demand for fossil fuel energy. The ability of fossil fuels to produce massive amounts of electricity in a single go is one of its main advantages. However, governments of various countries are enacting restrictions to reduce the amount of electricity generated by fossil fuels due to growing environmental concerns. Power plants using fossil fuels are a significant source of harmful pollutants carbon emissions, sulfur dioxide, and mercury. Around 25% of the world's greenhouse gas emissions, or 40% of the carbon emissions produced by the energy sector, come from the power generation industry. To prevent negative environmental effects, regulatory agencies are implementing strict limits on thermal power generation. These regulations are anticipated to raise the cost of obtaining less expensive fossil fuel-based power, acting as a limitation on the market for fossil fuel energy.

Among the analyzed regions, Asia-Pacific accounted for the highest market value in 2021 and is projected to continue its dominance during the forecast period, followed by Europe, North America, and LAMEA. Rapid industrialization and urbanization are the key factors responsible for the leading position of Asia-Pacific in the global fossil fuel energy market.

The market for fossil fuel energy is anticipated to be significantly influenced by the rising demand for energy. Increase in population and economies, particularly in developing countries like China, India, Brazil, is anticipated to boost the demand for fossil fuel energy further creating better growth opportunities in the market.

The major growth strategies adopted by fossil fuel energy market players are investment and agreement.

The report provides an extensive qualitative & quantitative analysis of the current trends and future estimations of the global fossil fuel energy market from 2021 to 2031 to determine the prevailing opportunities.

The commercial segment of end user acquired the maximum share of the global fossil fuel energy market in 2021.

Asia-Pacific is expected to provide more business opportunities for the global fossil fuel energy market in the future.

Iberdrola, SA, Huaneng Power International, Inc, Engie SA, and Enel SpA are the major players in the fossil fuel energy market.

Loading Table Of Content...

Loading Research Methodology...