France IVD Market Overview:

France IVD Market accounted for $2,943 million in 2016, and is estimated to reach $4,509 million by 2023, growing at a CAGR of 6.2% during the forecast period (2017-2023). In vitro diagnostics is a medical procedure employed to detect diseases, conditions, or infections using samples such as blood, urine, and tissue to analyze the diseased conditions. These tests are mainly executed in stand-alone laboratory, hospital based laboratory, clinical laboratories, and point-of-care centers for the diagnosis of various diseases. IVD tests involve various technologies such as polymerase chain reaction used for selective replication of specific DNA and RNA sequences in the test tube. Other techniques include protein purification for the isolation of a specific protein, in vitro fertilization, microarray techniques, and sequencing technology.

Rapid increase in chronic and infectious diseases, technological advancements, and increase in growth in geriatric population are the factors expected to fuel the market growth during the analysis period. However, stringent regulatory policies and unclear reimbursement policies restrict the growth.

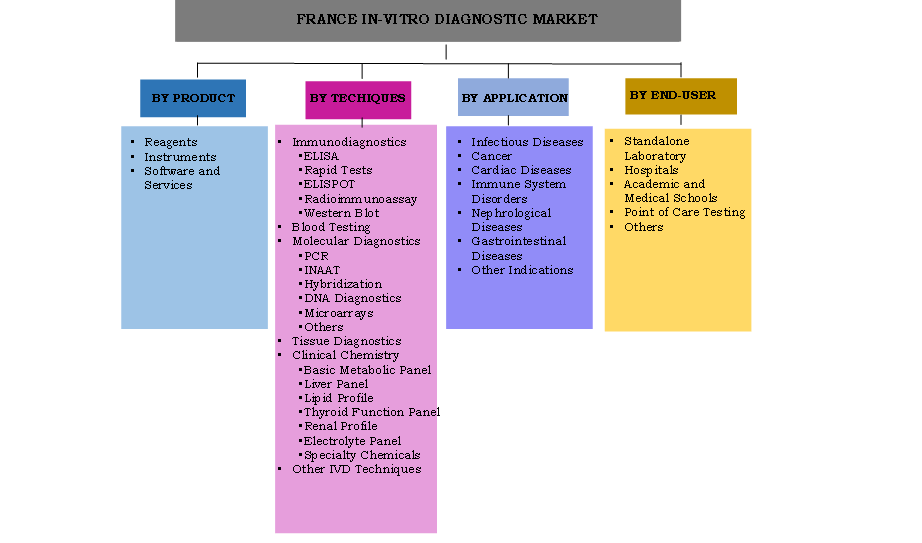

France IVD Market Segmentation

Segment Review

Based on product type, the market is categorized into reagents, instruments, and software & services. The reagent segment accounted for the highest market share in 2016, and the software & services is expected to grow at the highest growth rate during the forecast period. The growth of the reagent market is attributed to the recent introduction of new novel reagents and wide availability of effective and cost-efficient reagents. On the basis of technique, the immunodiagnostics segment captured the highest market share in 2016, owing to the increase in demand for personalized medicines. On the basis of application, infectious diseases segment captured the highest market share in 2016, owing to the increase in prevalence of infectious diseases and growth in preventive healthcare awareness among the population. Based on end users, the standalone laboratory segment captured the highest market share in 2016, primarily due to non-availability of complex tests in hospitals and commercial clinics.

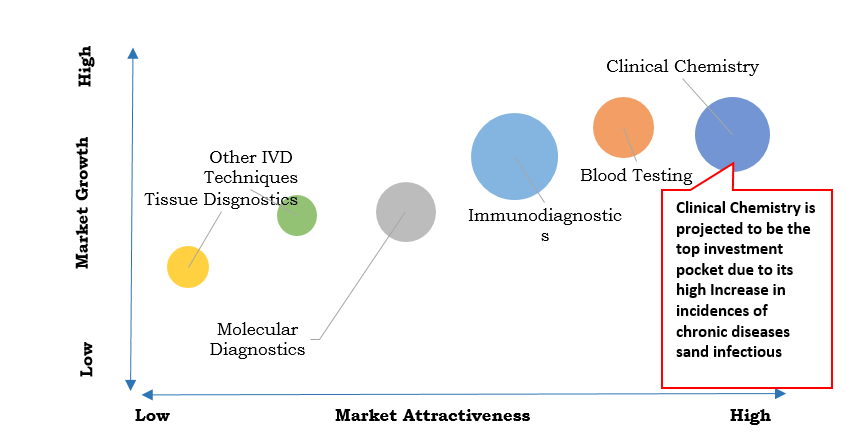

Top Investment Pocket

Increase in Prevalence of Infectious Diseases

The IVD market in France is in its growth phase due to increase in incidences of infectious diseases such as tuberculosis, HIV, AIDS, malaria, rabies, ebola virus, and pertussis. Due to increase in infectious disease there is rise in the demand for IVD market, for instance, 357 generic infectious diseases are spread of which 225 is contributed by France.

Rising Aging Population

The France IVD market is on an increase due to increase in geriatric population. The number in volume of chronic and infectious diseases increases as the aging population increases. For instance, according to the European commission about 16% of the population are above 65-year-old, which is greater in number in comparison of other countries such as Ireland (11%), and Netherlands (13%). Which shows that Europe has larger percent of aging population which is anticipated to increase by2050.The demographic number of people aged 85 and older is on a rise, increasing from about 1 million people in the mid-2000s to about 2.5 million in 2030.

Technological Advancement in IVD

Advancement in technology of IVD products such as, minimally invasive techniques, digital pathology solutions, selfcare care tests such as glucose, pregnancy, and others, is on an increase. This factor fuels the growth of the France IVD market.

Key Benefits

- The study provides an in-depth analysis of the France IVD market with current trends and future estimations to elucidate the imminent investment pockets

- The report provides a quantitative analysis from 2016 to 2023 to enable the stakeholders to capitalize on prevailing market opportunities

- Extensive analysis by technology and application helps understand various trends and prevailing opportunities in the respective market

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which predict the competitive outlook of the France IVD market.

France IVD Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By TECHNIQUE |

|

| By APPLICATION |

|

| By END USERS |

|

| Key Market Players | JOHNSON & JOHNSON, DANAHER CORPORATION, THERMO FISHER SCIENTIFIC INC, HOFFMANN-LA ROCHE AG, SYSMEX CORPORATION, ALERE INC, BIO-RAD LABORATORIES, BAYER AG, BECTON DICKINSON AND COMPANY, BIOMERIEUX |

Analyst Review

In vitro diagnostics tests determine the various diseased conditions and are utilized in management of several diseases. In this procedure, biological samples such as blood, urine, stool, tissues, and other body fluids are taken to analyze the various diseases and conditions. Moreover, IVD tests are mainly performed in stand-alone laboratory and hospital based laboratory. IVD tests involve various technologies such as polymerase chain reaction used for selective replication of specific DNA and RNA sequences in the test tube.

The France IVD market is in its growth stage due to rapid increase in chronic and infectious diseases, technological advancements, and advent of point of care diagnostics.

Major companies involved in the France IVD market are Thermo Fisher Scientific Inc., Alere Inc., Biomerieux, Danaher Corporation, F. Hoffmann-La Roche AG, Becton Dickinson and Company, Bio-Rad Laboratories, Bayer AG, Sysmex Corporation, and Johnson & Johnson.

Loading Table Of Content...