The France augmented analytics in BFSI market has been witnessing significant growth during the forecast period, owing to rise in need for augmented data analytics. Moreover, companies in the BFSI industry are increasingly adopting augmented data analytics solutions to gain insights in the customer base, to drive customer satisfaction, to reduce cost, to meet regulatory compliance, and to drive innovation.

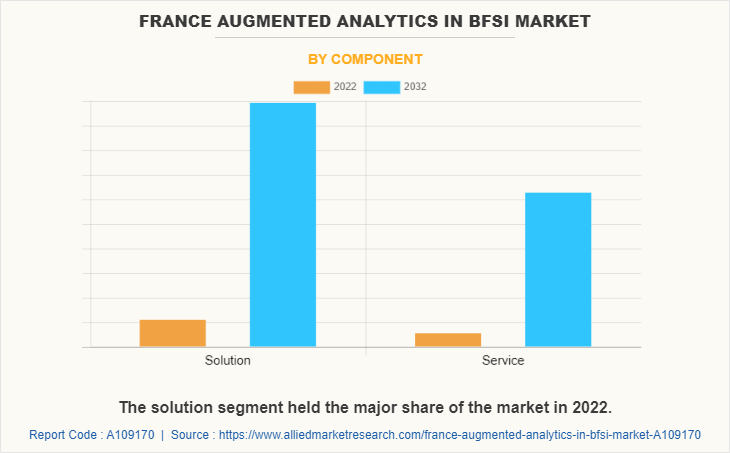

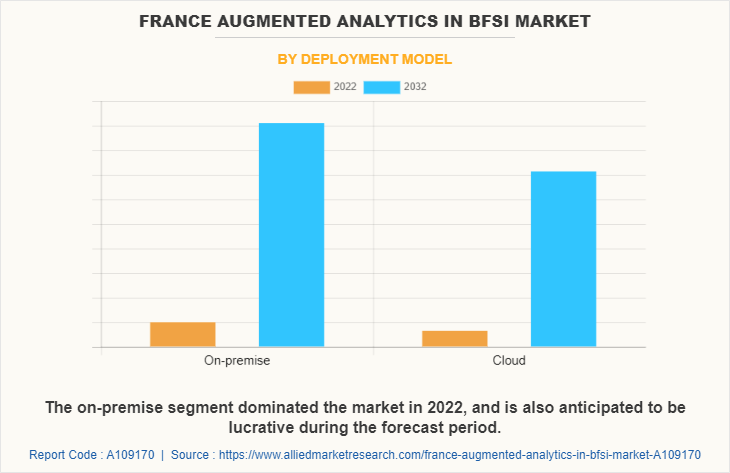

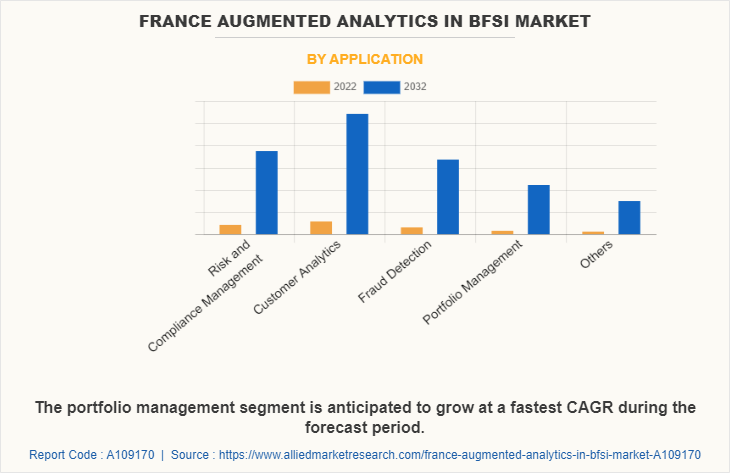

The France augmented analytics in BFSI market is segmented into component, deployment model, and application. On the basis of component, the market is bifurcated into solution and service. By deployment model, it is bifurcated into on-premise and cloud. As per application, it is segmented into risk & compliance management, customer analytics, fraud detection, portfolio management, and others.

However, increase in concerns regarding data security is one of the key factors restraining the growth of the France augmented analytics in BFSI market. Moreover, as the BFSI industry relies on sensitive consumer data such as banking and credit card information, there is an increased risk of cyber-attacks, which restricts the adoption of augmented analytics solutions. Furthermore, high cost associated with the implementation and operation of these solutions is a key factor restraining the growth of the France augmented analytics in BFSI market.

On the contrary, companies are investing in blockchain, cloud computing, mobile applications, and artificial intelligence to gain a competitive edge in the market. Moreover, surge in demand for customized customer experiences and augmented analytics assists companies to offer customized solutions for their customers. Furthermore, blockchain, artificial intelligence & machine learning, augmented data analytics, cloud computing, and mobile applications are the key technology trends driving the growth of the France augmented analytics in BFSI market. These technologies are driving better customer engagement, predictive analytics, cost reductions, regulatory compliance, and innovation.

The key players operating in the market include Deloitte, Microsoft, Accenture, IBM, Oracle, PwC, Capgemini, KPMG, CGI, and Sopra Steria. These companies are investing in product advancement, R&D, customer engagement, pricing strategies, and cost reduction initiatives.

In recent years, Deloitte has launched services such as AI-powered marketing solutions and automated data management solutions to enhance customer satisfaction. Microsoft has launched Azure-based artificial intelligence service packages to simplify data management in the BFSI industry. Accenture is developing advanced analytics solutions such as Risktech and Regtech to assist companies to meet their risk & compliance objectives.

IBM has been focusing on utilizing its Watson AI platform and machine learning solutions to assist companies in the BFSI industry to drive cost-efficiency and customer engagement. Oracle has launched new offerings such as cloud-based analytics solutions and predictive analytics services to increase customer engagement.

PwC has developed comprehensive analytics solutions to assist companies to meet regulatory compliance and to reduce operational costs. Capgemini is concentrating on AI-based solutions such as AI-powered customer insights and automated fraud detection solutions to drive customer satisfaction.

KPMG has developed state-of-the-art customer experience solutions and digital transformation solutions to enable organizations to engage with their customer base. CGI has been investing in solutions such as consumer analytics, robotic process automation, and AI-powered services to drive cost-efficiency. Sopra Steria has launched a number of data management solutions, AI-powered solutions, and digital risk management solutions to assist companies optimize their operations.

In addition, the emerging companies in the market include Infosys, Mindtree, Wipro, Hexaware Technologies, EY, Clarivate Analytics, and McAfee.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in France augmented analytics in BFSI market.

- Assess and rank the top factors that are expected to affect the growth of France augmented analytics in BFSI market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the France augmented analytics in BFSI market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

France Augmented Analytics in BFSI Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 88 |

| By Component |

|

| By Deployment Model |

|

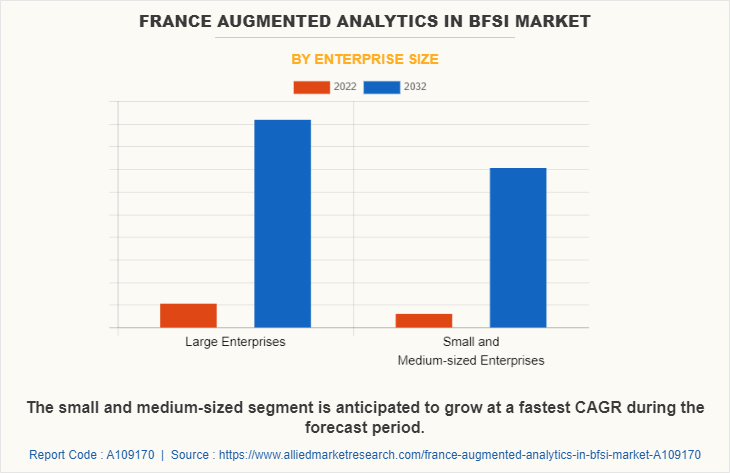

| By Enterprise Size |

|

| By Application |

|

| Key Market Players | IBM, Microsoft, Oracle, CGI, Capgemini, Accenture, KPMG, Deloitte, Sopra Steria, PwC |

The France Augmented Analytics in BFSI Market is projected to grow at a CAGR of 26.2% from 2022 to 2032

Deloitte, Microsoft, Accenture, IBM, Oracle, PwC, Capgemini, KPMG, CGI, Sopra Steria are the leading players in France Augmented Analytics in BFSI Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in france augmented analytics in bfsi market.

3. Assess and rank the top factors that are expected to affect the growth of france augmented analytics in bfsi market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the france augmented analytics in bfsi market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

France Augmented Analytics in BFSI Market is classified as by component, by deployment model, by enterprise size, by application

Loading Table Of Content...

Loading Research Methodology...