France Cooking Equipment Market Outlook: 2025

The France cooking equipment market size was valued at $60.7 million in 2018,and is expected to grow at a CAGR of 2.1% to reach $70.4 million by 2025. Cooking equipment is popularly used in restaurants, hotels, and fast-food centers. In addition, they facilitate easy preparation and preservation of food.

Commercial cooking equipment are easy to operate, safe & secure, avoid expensive breakdowns, provide improved functionality and efficiency, scale back every kind of wastage, and help save energy. There has been an increase in the demand for commercial cooking equipment over the past decade as new product-types and innovative cooking styles have permeated the food industry. The France cooking equipment market has constantly evolved in the recent years. Rise in preference for quick service restaurants over full service restaurants has been identified as an important driver for growth of the market. Change in food habits and busy lifestyle of consumers have led to increase in demand for ready-to-eat meals. Busy lifestyle of consumers and change in food habits have augmented the demand for ready-to-eat meals. Furthermore, the rise in number of restaurants and hotels is attributed to rapid urbanization and globalization, which in turn is expected to boost the growth of the commercial cooking equipment market. In addition, rapid changes in the supporting factors such as disposable income, consumer preferences, increase in working women population, and digitization have resulted in rise in number of quick-service, pop & shop, and other types of restaurants. However, volatile prices of raw materials and higher installation cost of equipment are anticipated to hamper the growth of the France cooking equipment industry.

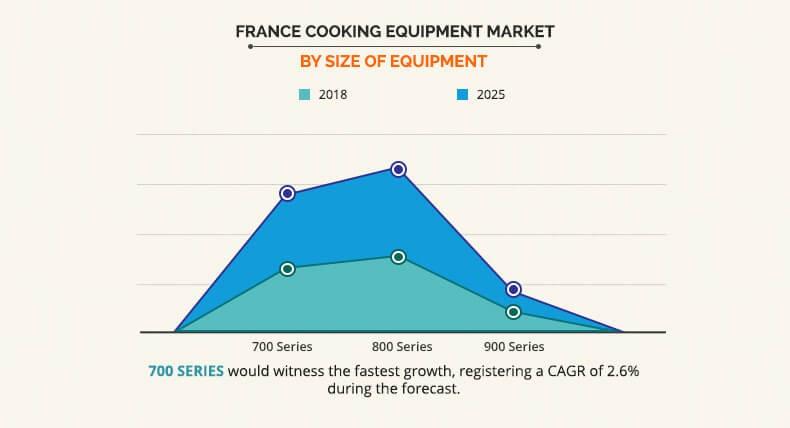

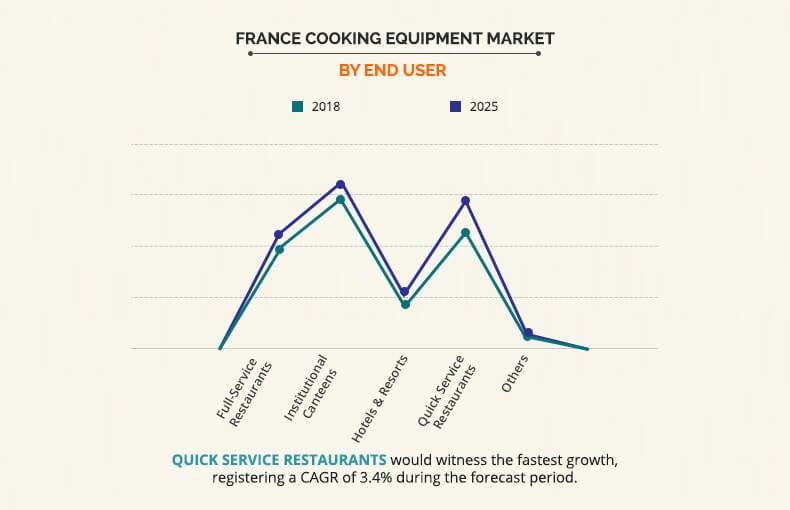

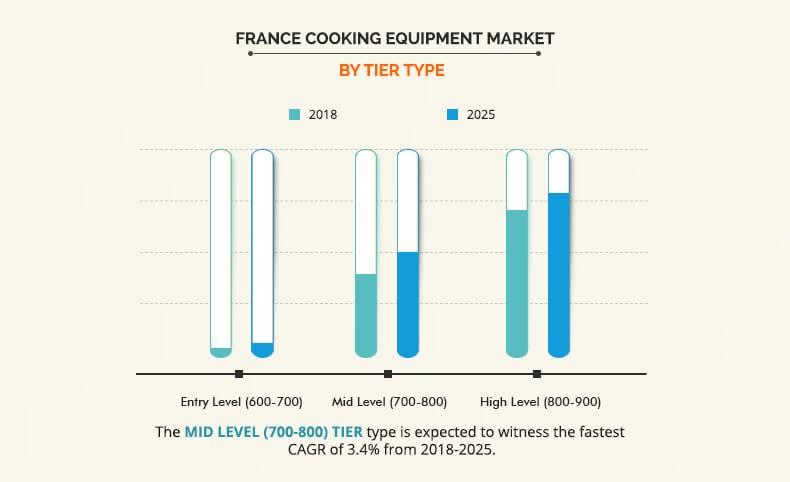

The France cooking equipment market is segmented by size of equipment, end user, and tier-type. Based on size of equipment, the market is divided into 700 series, 800 series, and 900 series. By end user, it is segmented into full-service restaurants, institutional canteen, hotels & resorts, quick service restaurants and others. According to tier-type, the market is classified into entry level (600-700), mid-level (700-800), and high level (800-900).

In 2018, the 800 series category accounted for the highest revenue in the France cooking equipment market share and is expected to maintain its dominance throughout the forecast period. This is attributed to the widespread application of such equipment in food service industries. In addition, increase in the number of quick service restaurants and rise in inclination of people to opt for convenient food drive the market growth of this segment.

However, the 700 series segment is estimated to have the highest CAGR of 2.6% through 2018-2025. This growth is attributed to the rise in the consumption of fried food from small food outlets and quick service restaurants. Also, the rise in the working population coupled with an increase in the disposable income in the country boost the growth of the food & beverage industry, which in turn positively impacts the growth of cooking equipment of various size including the 700 series.

In 2018, based on end user, the institutional canteen category held the highest share in the France cooking equipment market owing to an increase in the demand for prepared food in public places and institutions due to busy lifestyle of people and rise in the disposable income of people. However, the quick service restaurants segment is estimated to witness the fastest CAGR growth of 3.4% through the France cooking equipment forecast period. There is a rise in the demand for quick service restaurants due to the increase in demand for fresh, tasty, and appealing food available at an affordable cost. Moreover, changes in lifestyle and increase in affinity of the consumers toward fast food also boosts the market growth.

In 2018, based on tier type segment, the mid-level category is expected to experience growth at the fastest CAGR of 3.4% owing to the higher application of this segment in the quick service restaurants as well as some of the full service restaurants. Furthermore, the growth in the hospitality sector has also added to the popularity of this category.

Launch of eco-friendly and energy efficient cooking equipment for commercial kitchen due to stringent government regulations related to emission controls and the concerns of depletion of natural resources such as LPG and others, are anticipated to open new avenues for the manufacturers, thereby driving the France cooking equipment market growth.

The key players operating in the France cooking equipment market focus on expansion as the prominent strategy to overcome competition and to maintain as well as improve their market share. The key players profiled in the report include Bonnet International, Charvet, Sofinor, Ali Group, Capic, and AB Electrolux.

Key Benefits for France Cooking Equipment Market:

- The report provides a quantitative analysis of the current market estimations, trends, and dynamics of the market size from 2018 to 2026 to identify the prevailing France cooking equipment market opportunities.

- The key countries in all the major regions are mapped based on the market share and France cooking equipment market trends.

- In-depth analysis of the France cooking equipment market segment and size assists to determine the prevailing France cooking equipment market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industry.

- Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of market players.

- The report includes the France cooking equipment market analysis, key players, market application areas, market size, and market growth.

France Cooking Equipment Market Report Highlights

| Aspects | Details |

| By End User |

|

| Key Market Players | CAPIC SAS, SOFINOR, ALI GROUP SRL, CHARVET PREMIER RANGES LTD, ILLINOIS TOOL WORKS INC. (ITW) (BONNET INTERNATIONAL), AB ELECTROLUX |

Analyst Review

The France cooking equipment market has constantly evolved in the recent years. Rise in preference for quick service restaurants over full service restaurants has been identified as an important driver for growth of the market. Change in food habits and busy lifestyle of consumers have led to increase in demand for ready-to-eat meals. Rapid changes in the supporting factors such as disposable income, consumer preferences, increase in working women population, and digitization have resulted in rise in number of quick-service, pop & shop, and other types of restaurants. This in turn drives the growth of the France cooking equipment market. Factors such as growth of hospitality industry and increase in tourism also supports the growth of this market.

However, higher installation cost of equipment and volatile prices of raw materials are anticipated to restrain their adoption. Irrespective of these challenges, launch of eco-friendly and energy efficient cooking equipment for commercial kitchen due to stringent government regulations related to emission controls and the concerns of depletion of natural resources such as LPG and others, are anticipated to open new avenues for the manufacturers, thereby driving the market growth.

Loading Table Of Content...