The France insurance chatbot market has witnessed notable growth in the recent years. This is attributed to technological advancement in insurance chatbots such as the emergence of artificial intelligence AI and machine learning. They offer a dynamic platform for interaction between insurers and policyholders, streamlining customer service, sales, claims processing, and underwriting. The growth of the France insurance chatbot market is majorly driven by ever-increasing demand for enhanced customer service. Chatbots have the capacity to provide real-time assistance, answer customer queries, and resolve issues with unparalleled efficiency. This, in turn, augments customer satisfaction, making it a primary driving factor.

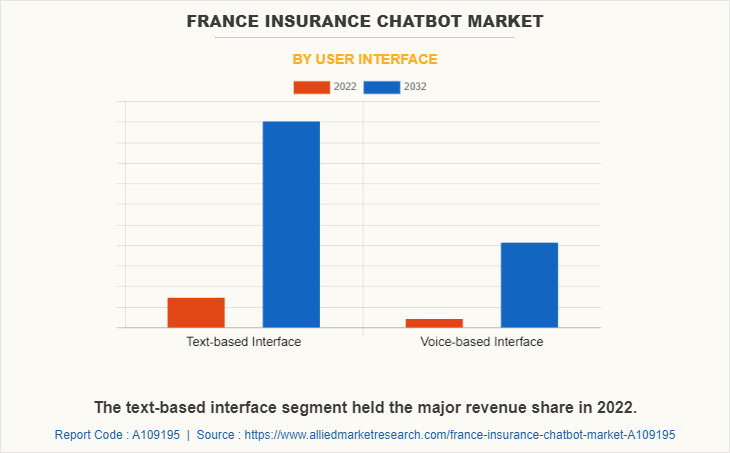

However, rise in concerns regarding data privacy and security act as a significant constraint. In addition, an increase in difficulties in integrating chatbots into existing systems is expected to restrict market development. On the other hand, technological advancements in the insurance chatbot such as the emergence of AI are expected to create lucrative opportunities for market growth in the coming years. In addition. integration of voice-based interfaces into chatbots is projected to offer significant opportunities for the market players to strengthen their foothold in the market.

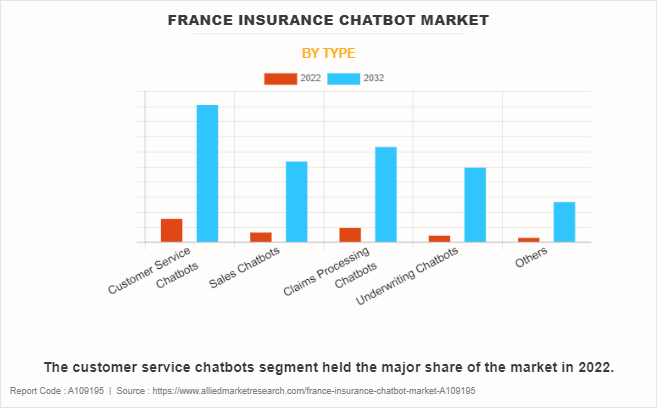

The France insurance chatbot market is segmented into type and user interface. Based on type, the market is classified into customer service chatbots, sales chatbots, claims processing chatbots, underwriting chatbots, and others. By user interface, the market is bifurcated into text-based interface and voice-based interface. The France insurance chatbot market is expected to witness several trends in the future. One of the future trends lies in the growing adoption of chatbots for insurance claims processing.

In addition, market players are focused on AI-driven solutions, due to this the government has established several guidelines to ensure data protection and compliance with ethical standards. This presents an avenue for legal experts & policymakers to influence the market's evolution. Moreover, companies are focused on new product development. In addition, manufacturers operating in the market are collaborating with technology experts to enhance chatbot functionalities. They are heavily investing in R&D activities to boost chatbot capabilities and assist them in handling complex insurance activities.

Furthermore, consumer and end-user perceptions play a crucial role in the development of the insurance chatbot market in France. In addition, pricing strategies further influence these perceptions, as cost-effective chatbot solutions are more likely to be adopted by insurance companies.

The Porter's five forces analysis of the France insurance chatbot market states that the threat of new entrants is significant, given the dynamic nature of the industry. As technology continues to evolve, new players are constantly entering the market with innovative solutions, challenging established companies.

The bargaining power of suppliers is moderate. Chatbot developers and technology providers hold a considerable position in negotiating terms with insurance companies. The insurance sector relies heavily on their expertise, making them key players in the market. The bargaining power of buyers is high as their preferences & feedback drive the market direction. Insurers must cater to customer demands and ensure excellent user experience to maintain their market presence. The SWOT analysis identifies and analyzes the strengths, weaknesses, opportunities, and threats of the France insurance chatbot market. The strengths of the market lie in the ability of chatbots to streamline processes and enhance customer service. They represent a technological advancement that insurance companies can leverage for competitive advantage.

Weaknesses of the market include integration challenges and concerns regarding data security & privacy. Overcoming these weaknesses is critical for chatbots to reach their full potential. Opportunities abound, particularly in the integration of voice-based interfaces and the automation of claims processing. These avenues offer the potential for market expansion.Threats are inherent in the dynamic nature of the industry. The emergence of new players and rapid technological advancements can threaten the market position of existing companies. Moreover, regulatory changes could impact on the market trajectory.

The key players operating in the France insurance chatbot market include IBM, Microsoft, Oracle, SAP, Salesforce, Google, Nuance Communications, Pegasystems, Artificial Solutions, and Kore.ai.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the france insurance chatbot market analysis from 2022 to 2032 to identify the prevailing france insurance chatbot market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the france insurance chatbot market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the country report market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as country report france insurance chatbot market trends, key players, market segments, application areas, and market growth strategies.

France Insurance Chatbot Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 110 |

| By Type |

|

| By User Interface |

|

| Key Market Players | SAP, Oracle, Nuance Communications, Microsoft, IBM, Kore.ai, Pegasystems, Artificial Solutions, Google, Salesforce |

The France Insurance Chatbot Market is estimated to reach $141.6 million by 2032

SAS, IBM Watson, Microsoft Azure, Oracle, Nuance, IPsoft, Google Cloud, Verint, Rasa, Xappia Solutions are the leading players in France Insurance Chatbot Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in france insurance chatbot market.

3. Assess and rank the top factors that are expected to affect the growth of france insurance chatbot market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the france insurance chatbot market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

France Insurance Chatbot Market is classified as by type, by user interface

Loading Table Of Content...

Loading Research Methodology...