France unsecured business loans market has been witnessing significant growth during the forecast period, owing to the ever-evolving nature of businesses. Moreover, the rise in the need for financial resources to fund their operations, seize new opportunities, and navigate through economic fluctuations are the key factors driving the market growth.

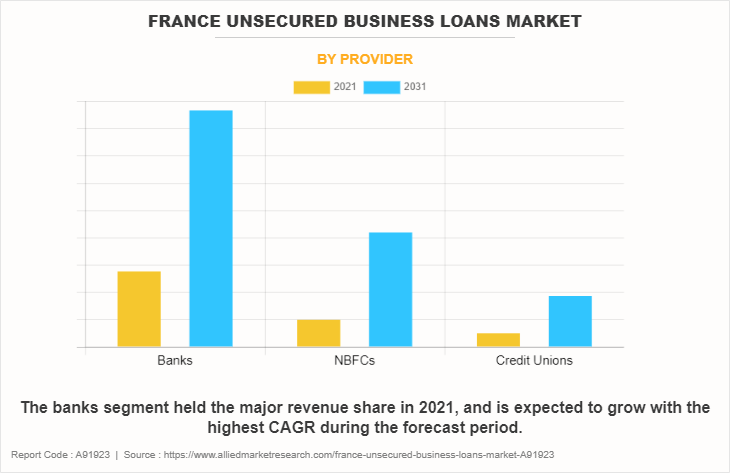

However, risks associated with unsecured loans are restraining the market growth. Lenders, often banks, non-banking financial companies (NBFCs), or credit unions, face the possibility of defaults, which leads to financial losses. Furthermore, stringent regulations and economic uncertainties are the key factors restraining the growth of the France unsecured business loans market.

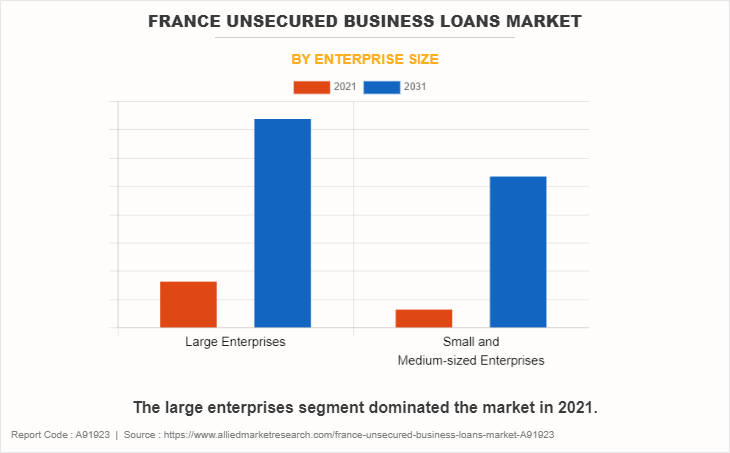

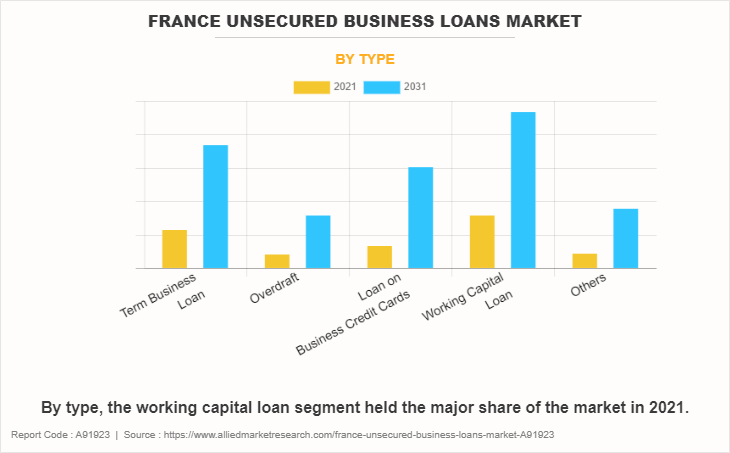

On the contrary, small & medium-sized enterprises (SMEs) are driving the market growth. In addition, SMEs seek working capital loans and other financing to sustain and expand their operations, driving the market growth. Moreover, large enterprises utilize financial instruments to diversify their funding sources and manage their capital effectively.

The France unsecured business loans market is segmented into type, enterprise size, and provider. On the basis of type, the market is categorized into term business loans, overdrafts, loans on business credit cards, working capital loans, and others. By enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises. As per the provider, it is fragmented into banks, NBFCs, and credit unions.

Furthermore, the digital transformation of financial services is a key trend driving market growth. Fintech companies are disrupting the traditional lending landscape, offering innovative loan products that are accessible and convenient. In addition, rise in peer-to-peer lending platforms allows businesses to borrow from several investors at competitive rates.

Moreover, companies are focusing on providing customized loan solutions to cater to the ever-changing economic environment. Furthermore, financial institutions are concentrating on providing personalized loan products to meet the unique demands of various sectors. In addition, stringent regulations aimed at protecting borrowers influence the terms and conditions of these loans. Lenders are adapting to comply with new requirements, potentially leading to standardized and transparent lending practices.

Moreover, lenders are constantly devising new loan products to cater to the ever-changing needs of businesses. Furthermore, the market has been witnessing a surge in non-traditional lending options, such as crowdfunding and revenue-based financing. In addition, companies are heavily investing in R&D activities to gain a competitive edge in the market. Moreover, companies are concentrating on prioritizing consumer perceptions to provide a seamless and user-friendly experience.

Furthermore, lenders in the France unsecured business loans market are implementing various pricing strategies to gain a competitive edge in the market. In addition, they offer fixed interest rates, depending on the type of loan and the risk assessment of the borrower. Moreover, some lenders charge fees for loan processing, while others rely on interest income.

The Porter's five forces analysis assesses the competitive strength of the players in the France unsecured business loans market. These five forces include the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitutes, and competitive rivalry. The threat of new entrants is moderate, as regulatory barriers are high. The bargaining power of suppliers is high, as they have the upper hand in setting terms and interest rates. The bargaining power of buyers is moderate, as they have choices among various lenders & loan types, but the terms & conditions are set by the lenders. The threat of substitutes is high, as peer-to-peer lending, crowdfunding, and alternative financing options provide businesses with viable alternatives to traditional unsecured loans. The competitive rivalry is high, as several market players compete for the market share.

A SWOT analysis of the France unsecured business loans market includes strengths, weaknesses, opportunities, and threats. The strengths include accessibility, versatility, and the ability to cater to various business needs. The weaknesses include the inherent risk for lenders due to the lack of collateral. The opportunities include an increase in technological advancements, rise in fintech companies, and surge in demand for personalized loan products. The threats include a competitive landscape with established players and increase in the popularity of alternative financing options.

The key players operating in the France unsecured business loans market include BNP Paribas, Crédit Agricole, Société Générale, BPCE Group, LCL (Le Crédit Lyonnais), Banque Populaire, Caisse d'Épargne, La Banque Postale, Natixis, and Crédit Mutuel.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in France unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of France unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the France unsecured business loans market segmentation assists in determining the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

France Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 77 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | Natixis, La Banque Postale, Société Générale, Banque Populaire, Caisse d'Épargne, Crédit Agricole, BNP Paribas, BPCE Group, LCL (Le Crédit Lyonnais), Cre?dit Mutuel |

The France Unsecured Business Loans Market is estimated to reach $735.1 billion by 2031

BNP Paribas, Crédit Agricole, Société Générale, BPCE Group, LCL (Le Crédit Lyonnais), Banque Populaire, Caisse d'Épargne, La Banque Postale, Natixis, and Cre?dit Mutuelare the leading players in France unsecured business loans market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in france unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of france unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the france unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

France Unsecured Business Loans Market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...