Fraud Management In Banking Market Research, 2032

The global fraud management in banking market was valued at $6.5 billion in 2022, and is projected to reach $48.4 billion by 2032, growing at a CAGR of 22.6% from 2023 to 2032.

Fraud management in banking is a set of techniques used by financial institutions to reduce risk and protect assets, systems, and customers. These techniques may rely on forensic and statistical analysis, pattern recognition, or anomaly detection. The primary objective of fraud management is to safeguard the assets and interests of both the bank and its customers, maintaining the integrity and security of the financial system.

The rise in adoption of online banking applications & mobile banking services and increase in incidences of financial fraud boost the growth of the global fraud management in the banking market. In addition, the increase in the use of digital transformation technology positively impacts growth of the fraud management in banking market. However, rise in incidents of false positive rates and growing fraud complexity hamper fraud management in banking market growth. On the contrary, rise in innovations in the fintech industry are expected to offer remunerative opportunities for the expansion of fraud management in banking market during the forecast period.

Segment Review

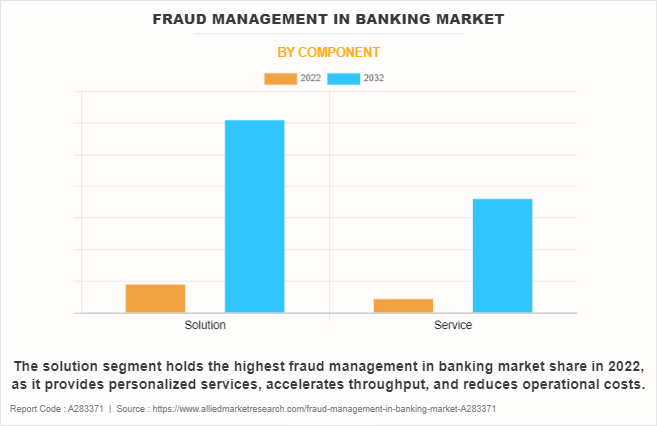

The fraud management in the banking market is segmented on the basis of component, fraud type, application, and region. On the basis of component, the market is bifurcated into solution and service. On the basis of fraud type, the market is categorized into payment fraud, loan fraud, identity theft, money laundering, and others. By application, it is classified into fraud detection & prevention systems, identity & access management (IAM), customer authentication, transaction monitoring, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of component, the solution segment holds the highest fraud management in banking market size as it provides personalized services, accelerates throughput, and reduces operational costs. However, the service segment is expected to grow at the highest rate during the forecast period. These services reduce management concerns efficiently with personalized assistance and optimized performance development.

Region wise, the fraud management in banking market share was dominated by North America in 2022, and is expected to retain its position during the forecast period, owing to rise in adoption of fraud management in banking in small & medium enterprises to ensure effective flow of financial activities. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the growing adoption of web-based and mobile-based business applications in the sector of fraud management in banking industry.

The key players that operate in the fraud management in banking market are IBM Corporation, SAS Institute Inc, SAP SE, NICE Actimize, ACI Worldwide Inc, Experian PLC, BAE Systems, FIS global, LexisNexis Risk Solutions, and BioCatch Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the fraud management in banking industry.

Competition Analysis

Recent Partnerships in the Fraud Management in Banking Market

September 28, 2022: Deutsche Bank partnered Visa to help prevent online retail fraud. Merchants who process their e-commerce payments via Deutsche Bank can now use ‐Decision Manager‐, an automated fraud detection system from Visa-owned company Cyber source. The solution works like a risk management system and calculates a risk value for each individual transaction using artificial intelligence and specified rules.

Recent Product Launches in the Fraud Management in Banking Market

In October 11, 2023, Jack Henry, launched Jack Henry Financial Crimes Defenderâ„¢, a cloud-native fraud and anti-money laundering (AML) solution designed with real-time capabilities at the forefront. This new solution allows community and regional financial institutions to proactively combat financial crimes across channels.

Recent Collaboration in the Fraud Management in Banking Market

On June 09, 2022, Greater Bank, collaborated with SAS to deliver powerful fraud detection/prevention and anti-money laundering (AML) solution that bolsters the protection of its 270,000-plus customers.

Top Impacting Factors

Growing Adoption of Online Banking Applications and Mobile Banking Services

The increased use of online applications and mobile banking services has resulted in an increase in the number of illegitimate domains and mobile apps. Fake websites and online apps are on the rise in other industries, including retail & eCommerce, manufacturing, banking, and healthcare. These websites and apps imitate real retail stores and home delivery services, luring clients into making fraudulent online transactions. Customers in the banking industry use mobile applications for a variety of purposes, including online payment, statement review, complaint registration, and feedback. According to the Boston Consulting Group (BCG), almost 70% of urbanites worldwide are digitally persuaded to buy financial products and services through online banking apps or mobile banking websites. In the current economic climate, many firms have integrated solutions across their business units to progress their business road maps. During the forecast period, the surge in number of internet users, increase in acceptance of digital payment methods, and rise in number of start-ups are likely to boost the global fraud management in banking market.

Increasing Incidences of Financial Fraud

The increase in incidences of financial fraud drives the growth of the fraud management in banking market, owing to rise in awareness of financial frauds with advanced technology that keep up with evolving fraudulent techniques. In addition, the banking sector along with other units that deal in different types of monetary transactions has become highly prone to cyber-attacks and financial fraud. Factors such as rapid digitization, lack of security awareness amongst consumers, insider threats, rise in complexity, and economic instability are the leading causes of the increase in digital cyber-crimes including financial fraud. In addition, the rise in rate of digital payment systems makes consumers more vulnerable to becoming victims to financial fraudsters causing a greater need to have fraud-detecting software programs in place, which in turn drives the growth of the market.

Restraints

Growing Incidents of False Positive Rates

False positive rates are incidents in which the program concludes legitimate transactions as fraudulent activities. The rise in the rate of such incidents is a major challenge for global industry players to tackle. Moreover, false-positive rates occur due to multiple human or mechanical errors such as the input of wrong data, along with lack of context & integration, and several other types of human error in understanding. Furthermore, software programs are also highly prone to collapse under certain situations hampering the growth of the market.

Rise in Fraud Complexity

With the widespread adoption of EMV cards, identity fraud has significantly shifted from offline to online domains. This transaction has resulted in heightened sophistication in fraudulent activities, as evident from the rise in fraudulent accounts. Fraudsters have become adept at executing their attacks, often exploiting the vast amount of personal identifiable information (PLL) available on the dark web. In addition, the surge in demand for round-the-clock digital access has compelled organizations, particularly financial institutions, and merchants, to prioritize swift account opening processes, sometimes at the expense of total manual application reviews. This inadvertently creates vulnerabilities that criminals exploit. As a result, the increase in prevalence of complex fraudulent schemes requiring specialized expertise is expected to impede the market growth of fraud management in banking industry solutions in the foreseeable future.

Opportunities

Rise in Innovations in the Fintech Industry

BFSI companies have increased investment in machine learning and AI solutions to transform financial institutes‐™ management for providing enhanced services to the end users and to automate the necessary solutions. In addition, with the rise in complexity and competition in the BFSI market, the demand for industry-specific solutions increased to meet the goals of the companies. Moreover, AI-based financial solutions help Fintech and other industries to enhance their security and increase their revenue opportunity, which fosters the growth of the market. For instance, in March 2021, IBM announced that it had launched a new fraud detection and prevention solution for the financial services industry. The solution, called IBM Financial Crimes Insight, is built on IBM Cloud Pak for Data, and leverages advanced analytics, AI, and machine learning technologies. The solution is designed to help financial institutions detect and prevent fraud across a range of channels, including mobile, web, and call centers. IBM Financial Crimes Insight offers real-time monitoring and analytics, enabling businesses to quickly respond to potential fraud attempts. Furthermore, AI and machine learning assist financial institutes at various stages of the risk management process ranging from identifying risk exposure, measuring, and estimating, to assessing its effects. Moreover, increase in investments in AI and machine learning offer the potential to transform the area of automation for time-consuming, mundane processes, and offer a far more streamlined and personalized customer experience, which enhances the growth of the market. In addition, major financial institutes such as Bank of America, JPMorgan, and Morgan Stanley, invest heavily in ML technologies to develop automated investment advisors and train systems to detect flags such as money laundering techniques and for other fraud cases, which in turn is expected to provide lucrative opportunity for the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fraud management in banking market analysis from 2023 to 2032 to identify the prevailing fraud management in banking market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fraud management in banking market segmentation assists to determine the prevailing fraud management in banking market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global fraud management in banking market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the fraud management in banking market outlook players.

- The report includes the analysis of the regional as well as global fraud management in banking market trends, key players, market segments, application areas, and market growth strategies.

Fraud Management in Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 48.4 billion |

| Growth Rate | CAGR of 22.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 269 |

| By Component |

|

| By Fraud Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | BioCatch Ltd., NICE Actimize, ACI Worldwide Inc, Experian PLC, LexisNexis Risk Solutions, IBM Corporation, SAP SE, FIS Global, SAS Institute Inc, BAE Systems |

Analyst Review

Fraud management in banking market has grown at an exceptional rate as the world moves toward digitizing every aspect of financial transactions that occur at the business or personal level. The software programs make use of different types of solutions such as authentication solutions, fraud analytics, risk & compliance solutions governance, and solutions that monitor transactions across the consumer group of the financial unit using the software. These programs are essential in detecting any abnormal payment patterns and transactions and are useful in avoiding irreparable damage to the entity using the software.

Key providers in the fraud management in banking market are BAE Systems, FIS global, LexisNexis Risk Solutions, and BioCatch Ltd. With rise in demand for fraud management in banking solutions, various companies have established acquisition strategies to increase their solutions offerings in AI solutions. For instance, in October 2022, Levio, a leader in digital transformation acquired Indellient, a consulting firm based in the Greater Toronto Area. This acquisition is part of Levio’s strategic growth plan and brings the firm one step closer to becoming best-in-class as a North American digital transformation service provider, and a unique positioning in the emerging field of real-time payments. Further, such strategies drive market growth.

In addition, with the surge in demand for fraud management in banking, several companies have expanded their current product portfolio to continue with the rising demand for fraud detection solutions in the market. For instance, in March 2023 Equifax Canada launched FraudIQ Manager, a fraud prevention solution powered by advanced analytics and rich data sources. The cloud-based platform offers seamless integration into customer application processes and empowers businesses to mitigate risk in real time and prevent future fraud losses.

For instance, in December 2022, Deutsche Bank partnered with NVIDIA to accelerate the use of artificial intelligence (AI) and machine learning (ML) in the financial services sector to improve risk management, boost efficiency, and enhance customer service using NVIDIA AI Enterprise software.

Continued advancements in artificial intelligence (AI) and machine learning (ML) technologies are the upcoming trends of Fraud Management in Banking Market in the world.

Fraud Detection and Prevention Systems are he leading application of Fraud Management in Banking Marke.

North America is the largest regional market for Fraud Management in Banking.

$48,370.38 million by 2032 is the estimated industry size of Fraud Management in Banking.

The key players that operate in the fraud management in banking market are IBM Corporation, SAS Institute Inc, SAP SE, NICE Actimize, ACI Worldwide Inc, Experian PLC, BAE Systems, FIS global, LexisNexis Risk Solutions, and BioCatch Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...

Loading Research Methodology...