Free Space Optic Communication Market Overview, 2031

The global free space optic communication market was valued at $347.5 million in 2021, and is projected to reach $4.8 billion by 2031, growing at a CAGR of 31.3% from 2022 to 2031. Free space optic (FSO) communication is the wireless transmission of data via a modulated optical beam directed through free space, without fiber optics or other optical systems guiding the light. These types of communication systems are uniquely valuable in enabling fast and secure connectivity, both in terrestrial and non-terrestrial networks. The general idea of free-space optics relies on the transmission of invisible, eye-safe light beams. They are transmitted by a laser with light focused onto a highly sensitive photon detector, which serves as a receiver, equipped with a telescopic lens. FSO links have quite a simple construction, typically consisting of two identical heads enabling duplex data transmission. These heads are connected via interfaces directly to computers or with a telecommunications network.

The free space laser communication is driven by the increase in demand for high-speed data transmission in military sector. Demand for bandwidth on the battlefield has been increasing significantly since the last two decades, as communication between subordinates and higher commands has shifted from radio and voice to email and chat messages. Furthermore, data-rich multimedia content such as high-definition pictures, video files, video, chat, and PowerPoint briefings are being sent at every level of the chain of command. Military communications need the highest level of broadband security in an extremely dense RF operating environment.

Security qualities and bandwidth of FSO make it an attractive technology for military communications. The technology is also being adopted for data transmission. The free space laser communication plays a vital role in data transmission as it uses lasers and LED to deliver high bandwidth connection to transfer data that include voice, video, and document over a light beam for telecommunication and computer networking. Furthermore, the technology in FSO communication allows the development of new types of components that are capable of transmitting data such as documents and videos.

On the other hand, the free space optic communication industry is held back by the weakness of laser beams towards atmospheric interference such as fog, rain, and snow. the performance of FSO systems is limited by air conditions, which is one of the key challenges that these optical wireless communication links confront. Meanwhile, superior data transmission security is expected to boost the adoption of FSO communication in IT and telecommunication industry. The wireless communication system is currently available at a premium, and optical fiber systems are often expensive and difficult to install, while free-space optical communication (FSOC) systems are an attractive alternative for point-to-point telecommunications. This is driving the IT and telecommunication segment of the free space optic communication market. Increase in development of private LTE networks, as well as the necessity for secured and high-speed optical communications, are projected to fuel market growth throughout the forecast period.

Key Takeaways

The global free space optic communication market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major free space optic communicationmarket industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global free space optic communication markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The Free Space Optic Communication Market is witnessing significant growth, due to increasing demand for high-speed data transmission and the proliferation of wireless communication technologies. Key factors include advancements in optical technology, the need for secure communication in military and defense applications, and the rise of smart cities and IoT devices.

However, challenges such as atmospheric conditions affecting signal quality and high installation costs may restrain market expansion.

Despite challenges, expanding applications in telecommunications, enhancing data security measures, and integrating FSO with existing communication infrastructures presents significant opportunity for the free space optic communication market. In addition, emerging markets in developing regions present new avenues for growth as the demand for reliable connectivity rises.

Segment Overview

The free space optic communication market size is segmented into Platform, Component and Application.

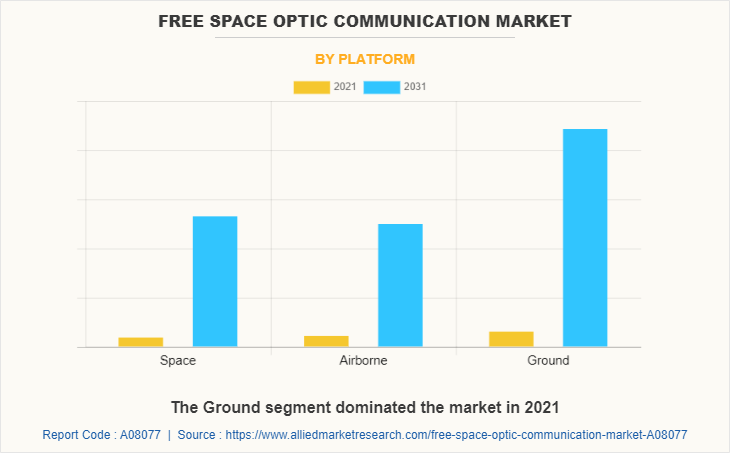

On the basis of platform, the free space optic communication market share is segmented into ground, space, and airborne. In terms of market segmentation by platform, the market was dominated by ground segment in 2021, whereas the space segment is expected to witness a higher growth rate during the forecast period. Free space optic technology also plays a vital role in establishing communication links between ground platforms, including buildings, towers, and other fixed structures, which acts as a major advantage for it.

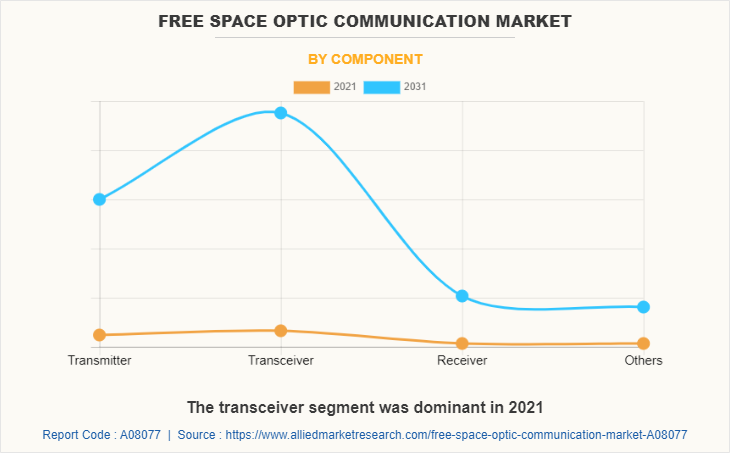

On the basis of component, the free space optic communication market is segmented into transmitter, transceiver, receiver, and others. In terms of market segmentation by component, the market was dominated by the transceiver segment in 2021, whereas the receiver segment is expected to witness a higher growth rate during the forecast period. The performance of the transceiver is critical to the overall performance of the free space optic communication system. Thus, major players are investing heavily in developing advanced transceivers to gain a competitive advantage in the market.

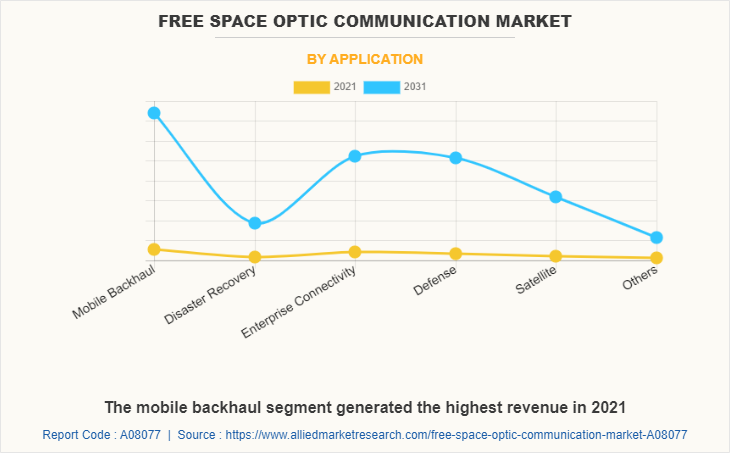

In terms of application, the free space optic communication market is segmented into mobile backhaul, disaster recovery, enterprise connectivity, defense, satellite, and others. In terms of market segmentation by application, the market was dominated by mobile backhaul segment in 2021, whereas the defense segment is expected to witness a higher growth rate during the forecast period. Free space optic communication can be used as a wireless backhaul solution for mobile networks. It provides a high-bandwidth, low-latency, and secure wireless connection, which makes it ideal for mobile backhaul applications.

In terms of region, the free space optic communication market is divided into North America, Europe, Asia-Pacific, and LAMEA. In terms of region, the market was dominated by North America in 2021, which is also expected to grow at a faster rate during the forecast period. North America is one of the major regions in the global free space optic communication market forecast, in terms of revenue generation and market share. Key players operating in this region have been adopting various strategies to provide advanced solutions, which is expected to fuel market growth.

Regional/Country Market Outlook

The global free space optic communication market share is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by the presence of major technology companies, substantial investments in advanced communication infrastructure, and a growing demand for high-speed, secure data transmission. The region's robust military and defense sector, alongside rapid advancements in telecommunications and IoT, further drive the adoption of FSO technologies. Further, The Asia Pacific Free Space Optic Communication Market is witnessing rapid growth due to increasing demand for high-speed data transmission, the expansion of telecommunications infrastructure, and the rise of smart cities and IoT applications. Additionally, government initiatives promoting advanced communication technologies, along with a growing focus on secure communication solutions in military and defense sectors, are driving free space optic communication market expansion.

Competitive Analysis

Competitive analysis and profiles of the major free space optic communication market players that have been provided in the report include EC System, FSONA Networks Corp., Axiom Optics, Wireless Excellence Limited, QinetiQ, ViaSat, Inc., Mostcom JSC, Mynaric, Collinear and Plaintree Systems Inc. These key players adopt several strategies such as new product launch and development, acquisition, partnership and collaboration and business expansion to increase their market share in the global free space optic communication opportunity market during the forecast period.

Top Impacting Factors

The free space optic communication market outlook is driven by the increase in demand for high-speed data transmission, need for secure communication channels, and rise in adoption of 5G technology. FSO communication systems can achieve data rates of up to several gigabits per second, making them suitable for applications such as mobile backhaul, enterprise connectivity, healthcare, defense, and security. The free space optic communication market growth is expected to take place at a significant pace during the forecast period owing to the surge in need for reliable and quick wireless communication as well as increase in demand for widespread digital connectivity.

Historical Data & Information

According to free space optic communication market analysis, the market is fairly competitive, owing to the strong presence of existing vendors. Market vendors are expected to gain a competitive advantage over their competitors because they can cater to free space optic communication market demands with a wide range of products. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies are adopted by key vendors.

Report Coverage & Deliverables

This report delivers in-depth insights into the free space optic communication market covering platform, components and application employed by major players. It offers detailed market forecasts and emerging trends.

Platform Insights

The Space segment focuses on satellite communications, enabling high-speed data transmission in remote areas. Airborne platforms are used for drone and aircraft communications, while Ground platforms cater to urban and rural connectivity, enhancing data transmission efficiency and reducing latency in terrestrial applications.

Component Insights

Transmitters convert electrical signals into optical signals, while Transceivers combine transmission and reception capabilities. Receivers detect incoming optical signals and convert them back to electrical signals, with "Others" encompassing accessories like lenses and mounts that enhance system performance.

Application Insights

The Free Space Optic Communication Market applications include Mobile Backhaul, which facilitates high-speed data transfer between cell towers; Disaster Recovery, providing rapid communication in emergencies; Enterprise Connectivity for seamless corporate networks; Defense applications ensuring secure military communications; Satellite connections for remote areas; and "Others," which encompass applications in education, healthcare, and smart city initiatives, enhancing connectivity across diverse sectors.

Regional Insights

North America, driven by technological advancements and military applications. The Asia Pacific region is rapidly expanding due to increasing urbanization and IoT adoption. Europe is focusing on regulatory compliance and smart city initiatives, enhancing free space optic communication market opportunities across regions.

Key Developments/Strategies

FSONA Networks Corp., Axiom Optics, Wireless Excellence Limited, and QinetiQ are among the top companies which hold a prime share in the free space optic communication market. Top market players have adopted various strategies such as product launches, contracts, and others to expand their foothold in the market, considering the free space optic communication market trends.

- In March 2023, Viasat Inc. VSAT has secured provisional approval from Britain's competition regulator CMA for its proposed acquisition of Inmarsat, paving the way for the likely closure of the deal. The transaction, inked in November 2021, is valued at $7.3 billion comprising $850 million in cash, approximately 46.36 million Viasat shares valued at $3.1 billion (based on the closing price as of Nov 5, 2021) and the assumption of $3.4 billion of net debt.

- In March 2022, Mynaric make an agreement with Northrop Grumman for delivery of optical communication terminals in the framework of a U.S. government space program led by the Space Development Agency.

- In August 2021, Mynaric launched its next generation space terminal at the 36th Annual Space Symposium for laser communication technology for the aerospace market. The CONDOR Mk3 will expand the company's current product portfolio by providing a mass-manufacturable, smaller, lighter and low-power option, which has evolved in response to feedback that customers and the industry have given to the new product's SDA-compliant Mk2 predecessor.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the free space optic communication market analysis from 2021 to 2031 to identify the prevailing free space optic communication market opportunity.

- The free space optic communication market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the free space optic communication market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global free space optic communication market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the free space optic communication market players.

- The report includes the analysis of the regional as well as global free space optic communication market trends, key players, market segments, application areas, and free space optic communication market growth strategies.

Free Space Optic Communication Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.8 billion |

| Growth Rate | CAGR of 31.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 235 |

| By Platform |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | FSONA Networks Corporation, Collinear, Axiom Optics, QinetiQ Group plc, Plaintree Systems Inc., Wireless Excellence Limited, ViaSat, Inc., mynaric, Mostcom JSC, EC System |

Analyst Review

The free space optic communication market exhibited development potential across different sectors including aerospace, defense and the electronics industry. Furthermore, technological advancements, such as the development of new materials and manufacturing processes, are driving the demand for more precise and free space optic communication.

Free space optic communication market is highly competitive, owing to the strong presence of existing vendors. The free space optic communication market vendors are investing substantially in R&D and skilled workforce and are anticipated to gain a competitive edge over their rivals. The competitive environment in the market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The last-mile connectivity, alternative solution to overburdened RF technology for outdoor networking, and no licensing are some of the other key factors augmenting the product demand. In addition, due to rise in innovation in the technology and communication sector, FSO communication is anticipated to create immense growth opportunities for the industry players.

The free space optic communication market size was valued at $347.54 million in 2021, and is projected to reach $4,787.96 million by 2031, registering a CAGR of 31.26%.

The Ground segment is the leading platform of the free space optic communication market.

The mobile backhaul segment is the leading application of the free space optic communication market.

North America is the leading region of the free space optic communication market.

The top companies in the free space optic communication market are EC System, FSONA Networks Corp., Axiom Optics, Wireless Excellence Limited, QinetiQ, ViaSat, Inc., Mostcom JSC, Mynaric, Collinear and Plaintree Systems Inc.

Loading Table Of Content...

Loading Research Methodology...