Friction Products and Materials Market Outlook - 2025

The global friction products and materials market size was valued at $17,046 million in 2017, and is projected to reach $24,533 million by 2025, growing at a CAGR of 4.7% from 2018 to 2025.

Friction product and materials are used to induce friction in various situations where decreased or slow movement is necessary. Friction is the resistance that aims to oppose the movement of objects. It occurs when solid object comes in contact with diverging surface. Frictions products and materials majorly find their application in operating systems, brake & clutch systems, industrial machinery, and gear tooth systems that all need to slow down or stop their processes. The process of friction is required in the brake system, clutch, and grinding. In braking process, brake pads or brake shoes are pressed against the rotating brake disc or drum. Brake system is used to slow down and stop moving motor vehicles and to hold vehicle stationary when in parking position.

Friction Products and Materials Market Dynamics

The growth of the market is driven by increase in demand for friction products and materials from the automotive end-user industry. This in turn also drives the global friction materials market. In addition, manufacturers are focusing on launching new friction products as part of their business strategy to gain a stronger foothold in the friction products and materials market. For example, in July 2017, TMD Friction launched a premium brake pad with dampening shim under its brand name, Textar. This brake pad aims to provide noise reduction, thereby delivering enhanced braking performance. In addition, it prevents direct contact between backing plates and brake pistons thereby dampening the vibration transfer. Hence, increase in demand for friction products in the automotive industry is expected to fuel the growth of the global friction products and materials market during the forecast period.

Furthermore, upsurge in demand for passenger and commercial vehicles boost the demand for these products, which fuels the market growth. In addition, development of the aerospace, machinery, and construction industries is expected to drive the need for friction products and materials during the forecast period. TMD Friction deals with various brake friction technologies and aims to provide reliable, effective, and safe braking solutions for racing cars, passenger and commercial cars, and other industrial applications. Moreover, manufacturers are focusing on implementing various restrictions on substances that are used in brake friction materials. For example, in California, U.S., the use of friction materials containing more than 0.5% copper is expected to get prohibited in new vehicles from the beginning of 2025. Akebono focuses on the development, production, and distribution of friction materials to comply with the new law. Thus, compliance of law by these small players significantly contributes toward the expansion of the global market in developing countries and low-end international market.

The industry players are focusing toward creating better and cost-effective ways to develop highly efficient friction materials. For example, in April 2017, Federal-Mogul Motorparts launched Jurid replacement brake pads for German vehicles registered in North America. Jurid pads offers coverage of approximately 98% of German passenger vehicles registered in the U.S. and Canada.

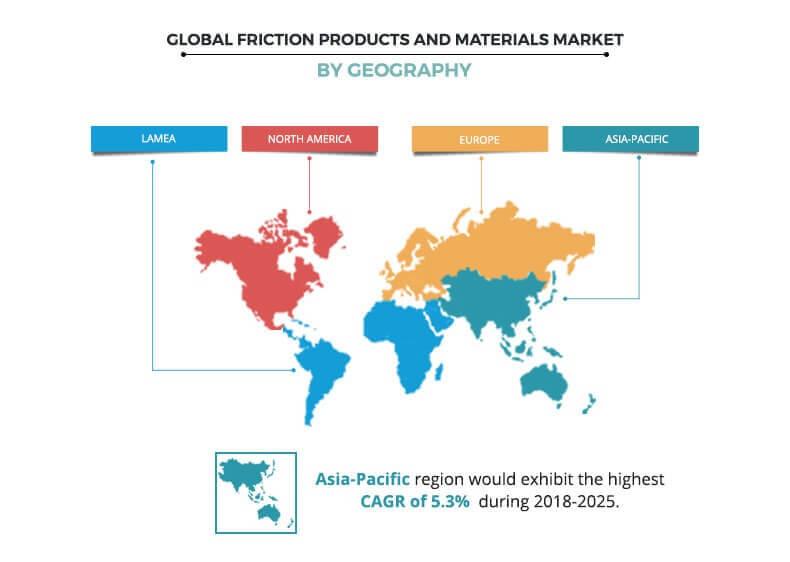

Asia-Pacific is anticipated to remain the fastest growing sector due to increase in demand for automotive vehicles.Countries such as China, India, Japan, the U.S., and Germany are expected to be the key demand areas, which supplements the global friction products and materials market growth. However, some countries such as Germany, Sweden, Austria, Netherlands, Denmark, Switzerland, and U.S. have banned the use of asbestos as friction material. Such factor is expected to hinder the growth of the global market.

Friction Products and Materials Market Segmentation

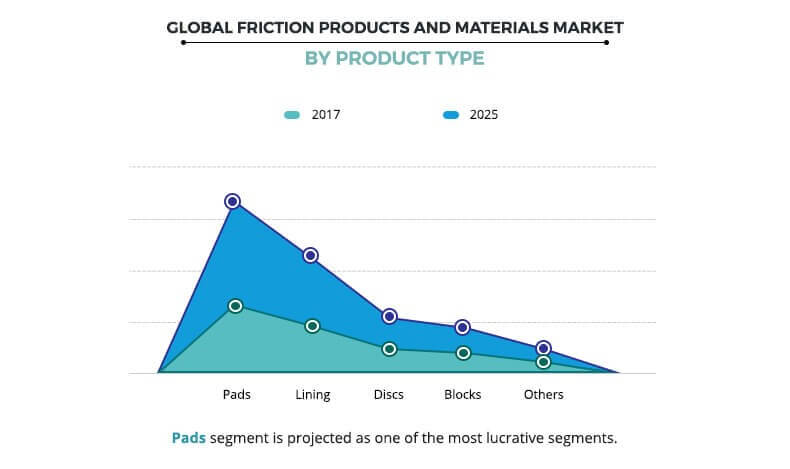

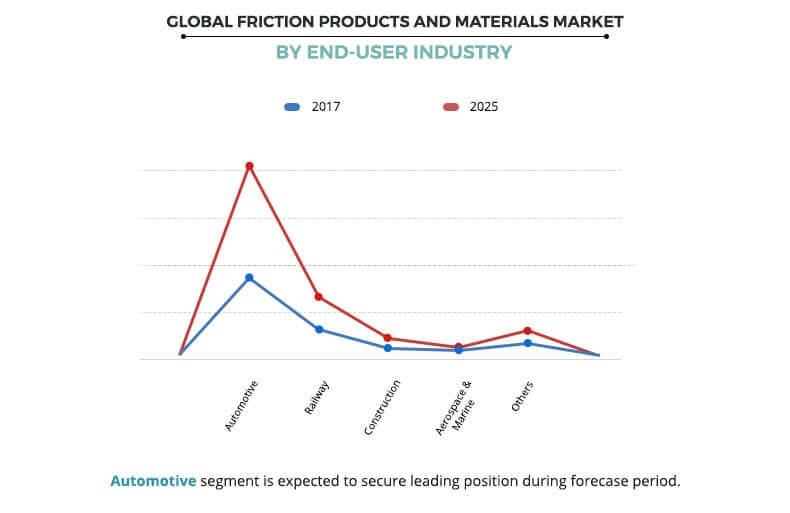

The global friction products and materials market is segmented into product, business type, application, end-use industry, and region. Based on product, the friction products and materials market is divided into pads, lining, discs, blocks, and others. In 2017, the pads segment held the largest market share due to increase in demand for various friction pads in braking systems and development of the automotive industry. On the basis of business type, the market is classified into original equipment (OE) and aftersales. In 2017, the aftersales segment garnered the highest share, due to increase in demand for lightweight carbon-free friction materials. Moreover, increase in demand for industrial and construction equipment is expected to boost the growth of the friction products market. The applications covered in the market include brakes, clutches, and industrial brakes & transmission systems. In 2017, brakes segment occupied the highest share in the market, due to growth in safety concerns, rise in vehicle production, stringent government regulations for vehicle safety & increase in road accidents. Depending on end-use industry, the friction products and materials market are fragmented into automotive, construction, railway, aerospace & mining, and others. In 2017, the automotive segment contributed significantly toward the growth of the friction products and materials market, owing to increase in demand for brake and clutch systems.

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2017, Asia-Pacific accounted for the highest share, and is anticipated to secure the leading position during the forecast period. China is a pioneer in the friction products and materials market. Therefore, global friction products and materials market share is highest among the Asia-Pacific countries.

Competition Analysis

The major players operating in the global friction products and materials market include Nisshinbo Holdings Inc., Akebono Brake Industry, Federal-Mogul Holdings, MIBA AG, Carlisle Brake & Friction (CBF), ABS FRICTION CORP., European Friction Industries Ltd., Fras-le, Hindustan Composites Ltd., and GMP Friction Products.

Key Benefits for Friction Products and Materials Market:

- The friction products and materials market report provides an extensive analysis of the current and emerging market trends and dynamics in the global friction products and materials market.

- In-depth friction products and materials market analysis is conducted by constructing market estimations for the key market segments between 2018 and 2025.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- Key market players within the friction products and materials market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global friction products and materials industry.

- Friction products and materials market forecast analysis from 2018 to 2025 is included in the report.

Friction Products and Materials Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Business Type |

|

| By Application |

|

| By End-User Industry |

|

| By Region |

|

| Key Market Players | Carlisle Brake & Friction (CBF), Tenneco Inc. (Federal-Mogul Motorparts LLC), Hindustan Composites Ltd., Fras-le, Akebono Brake Industry, European Friction Industries Ltd, Miba AG, ABS Friction, Inc., Nisshinbo Holdings Inc., GMP Friction Products |

Analyst Review

The global friction products and materials market is witnessing considerable growth in the emerging markets such as India, China, and others. This growth is attributable to the development of the automotive, aerospace, machinery, and construction industries and high demand for better brakes and linings. In addition, increase in demand for passenger cars, particularly in emerging markets, is further expected to fuel the market growth. However, rise in use of eco-friendly and nontoxic brake friction products is anticipated to hinder the market growth.

Asia-Pacific is witnessing the highest demand for friction material products, followed by Europe, North America, and LAMEA. The highest share of the Asia-Pacific market is attributable to increase in demand for increased construction activities and growth in automotive industry.

In addition, various leading manufacturers such as ABS Friction Corp, Akebono Brake Industry, Carlisle Brake & Friction (CBF), European Friction Industries Ltd, Fras-le, GMP Friction Products, Hindustan Composites Ltd., MIBA AG, Nisshinbo Holdings Inc., and Tenneco (Federal-Mogul Holding) occupy a prominent revenue share in the friction products and materials market.

Loading Table Of Content...