Fuel Cards Market Overview

The global fuel cards market was valued at $735 billion in 2022, and is projected to reach $2.8 trillion by 2032, growing at a CAGR of 14.4% from 2023 to 2032. Growing demand for efficient fleet management, cost-effective fuel purchasing, expense tracking solutions, advancements in digital payment infrastructure, and integration with telematics contribute to the growth of the market.

Market Dynamics & Insights

- The fuel cards industry in Europe held a significant share of 38% in 2022.

- The fuel cards industry in India is expected to grow significantly at a CAGR of 21.3% from 2023 to 2032.

- By application, the fuel refill segment is one of the dominating segment in the market, accounting for the revenue share of 44% in 2022.

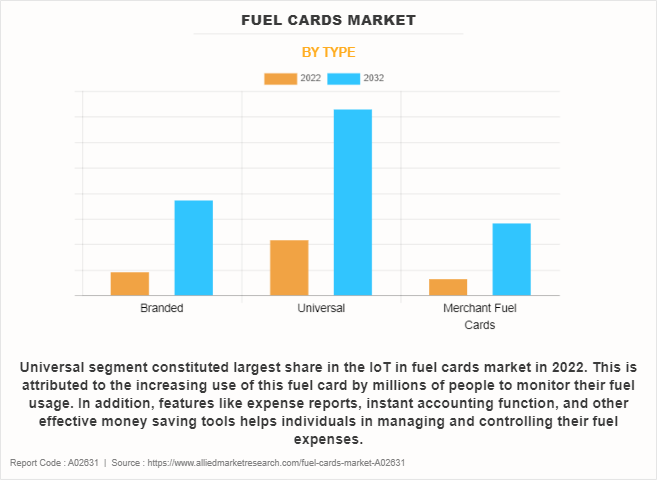

- By type, the merchant fuel cards segment is the fastest growing segment in the market, growing at a CAGR of 16.3% from 2023 to 2032.

Market Size & Future Outlook

- 2022 Market Size: $735.04 Billion

- 2032 Projected Market Size: $2760.6 Billion

- CAGR (2023-2032): 14.4%

- Europe: Largest market in 2022

- Asia-Pacific: Fastest growing market

What is Meant by Fuel Cards

The fuel card market refers to a segment of the financial services industry that provides specialized payment cards, often known as fuel cards or fleet cards, designed primarily for the purchase of fuel and related expenses. These cards are typically issued to businesses, commercial fleets, and individuals to facilitate fuel payments and manage fuel-related expenses more efficiently. The scope of the fuel card market encompasses various aspects, including card issuers, cardholders, fuel retailers, fuel purchases, additional expenses, expense management, data capture, telematics integration, fuel rewards, security features, financial services, environmental initiatives, and others.

Fuel cards provide various benefits to fleet vendors by capturing low-level data on mileage of vehicles, gallons of fuel filled, and the need for servicing the vehicle. Fuel card service providers have started to embed telematics interface and robust reporting facilities as standard product offerings to improve fleet management productivity. Moreover, fuel cards are available in various forms such as branded fuel cards, universal fuel cards, and merchant cards. Merchant fuel cards are anticipated to witness the highest growth rate during the forecast period in the fuel cards market.

The key factors that drive the growth of the fuel cards market are the necessity for improved fuel management and the penetration of digital transaction solutions. Fuel cards technology helps in cost savings by closely monitoring fuel consumption and expenses,

Furthermore, businesses can identify areas where fuel efficiency can be improved, reduce fuel waste, and negotiate better prices with fuel suppliers. The penetration of digital transaction solutions in relation to fuel card technology has been steadily increasing over the years. Digital transaction solutions offer numerous advantages in terms of convenience, efficiency, and data management, making them a natural complement to fuel card systems. Various fuel card providers offer online account management platforms and mobile apps. These digital interfaces allow fleet managers and cardholders to monitor transactions, account balances, and card usage in real time. They can also access reports and analytics related to fuel expenses.

Moreover, the lack of security measures is hampering the growth of the fuel cards market. Without robust security measures, fuel cards are vulnerable to fraud and misuse. Unauthorized individuals and employees may use the cards for unauthorized purchases, leading to financial losses for businesses. This lack of security can erode trust in the system. Furthermore, the increase in demand from developing countries is providing an opportunity for fuel cards market growth. Developing countries are experiencing rising incomes and increased access to credit, leading to higher vehicle ownership rates. As more individuals and businesses are acquiring vehicles, there is a greater need for fuel management solutions, including fuel cards, to control and monitor fuel expenses in the fuel cards market.

The report focuses on growth prospects, restraints, and trends of the fuel cards market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the fuel cards market.

The fuel cards market is segmented into Type and Application.

Fuel Cards Market Segment Review

The fuel cards market is segmented on the basis of card type, application, and region. In terms of card type, the fuel cards market is bifurcated into branded, universal, and merchant. By application, the fuel cards market is divided into fuel refill, parking, vehicle service, toll charge, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the global fuel card market was led by the universal fuel card segment in 2022 and is projected to maintain its dominance during the forecast period. Factors, such as versatility, expense tracking, convenience, cost control, flexible payment terms, rewards, and discounts, security features, data analytics, have increased the growth of this segment and has helped this segment to achieve the largest fuel cards market share in the fuel cards market size.

On the basis of region, Europe dominated the fuel card market in the year 2022. This is because of the increase in prepaid cards and the increasing acceptance of fuel cards in the region.

The report analyzes the profiles of key players operating in the fuel cards market such as BP p.l.c., Exxon Mobil Corporation, FirstRand Limited, FleetCor Technologies, Inc., U.S. Bancorp, WEX Inc., Libya Oil Holdings Ltd., Puma, Engen Petroleum Ltd. and Royal Dutch Shell PLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the fuel cards market.

Fuel Cards Market Landscape and Trends

The expansion of the fuel cards market is driven by various trends such as digital transformation, fuel cards technology integration with telematics, data analytics and reporting, eco-friendly initiatives and others. The fuel card industry is undergoing a digital transformation, with many providers offering mobile apps and online account management tools. These digital solutions allow users to track fuel expenses, monitor driver behavior, and manage their accounts more efficiently. Furthermore, fuel card providers are increasingly integrating their services with telematics systems. This integration allows fleet managers to gain real-time insights into fuel consumption, vehicle location, and driver behavior, helping to optimize operations and reduce costs. Moreover, fuel card companies are enhancing their data analytics capabilities. Growing demand for cashless payments continues to create growth opportunities for the fuel card market globally.

The market growth can be attributed to the increasing adoption of fuel management solutions by large enterprises and SMEs alike. This meant providing customers with detailed reports and insights into fuel usage, expenses, and trends, helping businesses make data-driven decisions to improve efficiency and reduce costs.

What are the Top Impacting Factors in Fuel Cards Market

Need for Improved Fuel Management

Rise in fuel management problems and the need to overcome these problems is driving the growth of this fuel cards market. Fuel cards help in providing cost efficiency by helping businesses track and manage their fuel expenses more effectively. In addition, fuel cards help to provide better control to businesses by setting limits on fuel purchases and restrictions on card usage at specific fuel stations. This leads to preventing unauthorized spending fraud. Furthermore, fuel cards generate meaningful data insights stating fuel consumption patterns. This data helps companies and businesses to make well-informed decisions regarding fleet operations and fuel efficiency. In addition, fuel cards provide convenience to fleet managers and drivers by eliminating the need for employees to utilize personal funds for paying fuel expenses and submitting expenditure reports. Therefore, all these factors drive the fuel cards market growth for the forecast period.

Penetration of Digital Transaction Solutions

Growing digitalization has resulted in increasing digital operations such as digital transactions which in turn is driving the growth of fuel cards market. The fuel cards market helps businesses to transact electronically for fuel-related transactions through digital payment gateways, thus reducing risks associated with cash handling and convenience fees for drivers. In addition, fleet managers can monitor and control. Fuel purchases and expenses in real-time through digital fuel card transactions.

Furthermore, by integrating with expense management software, digital fuel cards are simplifying expense reporting for businesses, reducing administrative overhead costs and streamlining the reconciliation process. Moreover, new payment software are being launched in the field of fuel card technology. For instance, in September 2023, Amazon collaborated with Mastercard supported company ToneTag and launched a new payment mode for vehicles that helps drivers to pay for fuel using Fastag and an infotainment system. This new solution harnesses the UPI technology linked to vehicle infotainment screen. Therefore, all these factors propel the market growth for fuel card technology in the forecast period.

Efficient Fleet Administration with the help of Enhanced Data Capture

Due to its improved capabilities, including tracking fleet spending, managing fleet expenses, and others, the use of gasoline cards has grown among fleet drivers. In addition, it gives drivers the option to monitor real-time car mileage, which stimulates market expansion. Furthermore, numerous fleet operators all over the world utilize gasoline cards to control a variety of operational expenses, such as truck repairs, truck maintenance, truck cleaning, replacement of vehicle parts, leasing of vehicles, and others. Moreover, the ability of fuel cards to store a variety of data, including fuel grades, odometer readings, fuel products, fuel quantities, driver IDs, vehicle IDs, and tax information, further contributes to the fuel card market expansion. In addition, it offers transactional information, such as the location, time, and amount spent. Therefore, all these factors escalate the fuel card market growth for the forecast period.

Lack of Security Measures

Fuel card technology is vulnerable to fraudulent activities and lacks security prevention, thus hampering the growth of the fuel card market. Unauthorized access to transactions can put cardholders and card providers at risk, thus decaying trust in fuel card technology. In addition, negative publicity about the security breach incidents related to fuel card technology easily damages the reputation of a company provider. Furthermore, to implement security measures for fuel card technology safety, high expenditure has to be incurred which is again a setback for the market growth. Therefore, all these factors are likely to hold the growth of the fuel card market for the forecast period.

Increase in Demand from Developing Countries

Developing countries are growing at an increasing rate due to rapid technological advancements. The countries are witnessing expansion in logistics, transportation, and delivery services due to growing e-commerce activities and urbanization. In addition, different countries are concerned about fuel emissions and efficiency, and hence fuel card technology is the best option for them to monitor and improve fuel management. Furthermore, the government can make effective policies, rules, and regulations in relation to fuel incentives, fuel tax, and fuel subsidies by using the fuel card technology. In addition, fuel card providers can easily enter developing countries' markets, as these countries have low fuel card adoption rates. Therefore, all these factors will provide a relevant opportunity for fuel card market growth in the forecast period.

Integration of Telematics with Fuel Cards

The rise in the integration of telematics with fuel cards is providing a golden opportunity for fuel card market growth. Telematics technology helps in reducing fuel consumption and unnecessary mileage by providing real-time insights on vehicle location, speed, and route efficiency. Furthermore, telematics technology helps in integrating real-time data with fuel card transactions, thus resulting in efficient maintenance, breakdown prevention, and fuel efficiency improvisation. Moreover, fuel card providers that embrace telematics integration can gain a competitive edge in the market. They can differentiate themselves by offering more than just fuel-related services, attracting businesses looking for comprehensive fleet management solutions. For instance, in April 2023 Uber freight partnered with transportation fintech startup AtoB to offer carriers fuel cards and spend management software. The telematics location tracking and fuel level tracking help AtoB to note both if a card is used far away from vehicle location or if it is used immediately after fueling and blocking transactions. In addition, telematics integration can open new revenue streams for fuel card providers. They can charge for the additional services and insights provided through the telematics platform. The fuel card market is highly dynamic, adapting to new technologies and shifting consumer preferences. Therefore, the above-stated factors are likely to provide lucrative opportunities for the growth of industry in the forecast period.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fuel cards market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of fuel cards market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fuel cards market segmentation assists in determining the prevailing fuel cards market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global fuel cards market trends, key players, market segments, application areas, and market growth strategies.

Fuel Cards Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.8 trillion |

| Growth Rate | CAGR of 14.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Engen Petroleum Ltd., U.S. Bancorp, FleetCor Technologies, Inc., Puma Energy, WEX Inc., Exxon Mobil Corporation, FirstRand Limited, Royal Dutch Shell PLC, BP p.l.c., Libya Oil Holdings Ltd. |

Analyst Review

The adoption of fuel cards has a profound impact on the BFSI sector revolutionizing various aspects of the industry. The technology accounts for numerous uses in different industries such as transportation and logistics, construction, delivery services, public transportation, agriculture, field sales and services, taxes and ridesharing, government and municipalities, healthcare, and corporate fleets. Fuel card systems provide detailed transaction data, allowing businesses to track fuel expenses in real-time. Comprehensive reporting and analytics tools help businesses generate expense reports, analyze spending patterns, and make informed decisions. In addition, fuel cards can be customized with spending limits, product restrictions, and usage rules. This ensures that drivers use the cards only for authorized purchases, reducing the risk of fraud or misuse. Furthermore, various fuel cards require driver identification through PINs and other security measures, ensuring that only authorized personnel can use the cards. Moreover, various fuel cards provide access to multiple fueling networks, allowing drivers to refuel at a wide range of locations, which can be particularly valuable for long-haul trucking or businesses with operations in multiple regions.

The market players are adopting strategies like product launch for enhancing their services in the market and improving customer satisfaction. For instance, in May 2021, Wex Inc. launched crossroads freight card for mixed fleets. The new offering will offer one-card access to truck stops and retail fueling stations to suit the demands of enterprises that operate all classes of vehicle. With the security and data of a closed-loop fueling network, the card enables truckers to refuel at 16,000 truck stops and 95% of retail fueling stations across the country. In addition, in September 2022, Fleetcor Technologies Inc. signed an agreement with ExxonMobil Corporation. The agreement which covers both the Comdata and Fuelman brands, improves Fleetcor North America's commercial fleet card business's market position and product variety. Therefore, such strategies are expected to boost the growth of the fuel cards market in the upcoming years.

The key players profiled in the fuel cards in BFSI market analysis are BP p.l.c., Exxon Mobil Corporation, FirstRand Limited, FleetCor Technologies, Inc., U.S. Bancorp, WEX Inc., Libya Oil Holdings Ltd., Puma, Engen Petroleum Ltd. and Royal Dutch Shell PLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the fuel cards industry.

The IoT in fuel cards market is estimated to grow at a CAGR of 14.4% from 2023 to 2032.

The IoT in fuel cards market is projected to reach $2,760.63 billion by 2032.

Need for improved fuel management, penetration of digital transaction solutions, and efficient fleet administration with the help of enhanced data capture majorly contribute toward the growth of the market.

The key players profiled in the report include IoT in fuel cards market analysis includes top companies operating in the market such as BP p.l.c., Exxon Mobil Corporation, FirstRand Limited, FleetCor Technologies, Inc., U.S. Bancorp, WEX Inc., Libya Oil Holdings Ltd., Puma, Engen Petroleum Ltd. and Royal Dutch Shell PLC.

The key growth strategies of IoT in fuel cards players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...