Fuel Cell Power System Market Research, 2030

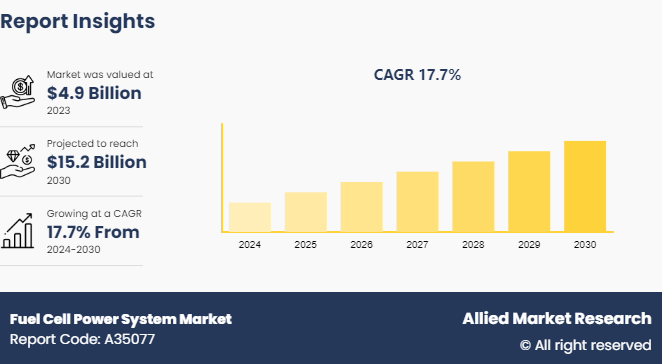

The global fuel cell power system market was valued at $4.9 billion in 2023, and is projected to reach $15.2 billion by 2030, growing at a CAGR of 17.7% from 2024 to 2030.

Market Introduction and Definition

A fuel cell power system refers to a complete setup that includes one or more fuel cells along with associated components such as fuel storage and delivery systems, air management systems, thermal management systems, and power conditioning equipment. This system is designed to generate electrical power continuously or intermittently from the chemical reaction occurring within the fuel cells. A fuel cell power system represents a sophisticated assembly meticulously crafted to extract electrical energy from the chemical reactions within one or more fuel cells. While the fuel cells serve as the heart of the system, converting fuel directly into electricity through an electrochemical process, their effectiveness relies on the seamless integration of several vital components. These components work in concert to ensure optimal performance, efficiency, and reliability of the entire system.

Key Takeaways

The fuel cell power system market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2030.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major fuel cell power system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The decreasing production costs in the fuel cell power system market have emerged as a pivotal factor driving its substantial growth. As advancements in technology and manufacturing processes continue, the cost of producing fuel cells has experienced a notable decline, making this clean energy solution more economically viable and competitive with traditional power generation methods. In addition to making fuel cell technology more cost-effective, the decreasing production costs enhance the market's competitiveness in comparison to conventional energy sources. All these factors drive the growth of the fuel cell power system market. According to India Brand Equity Foundation (IBEF) , in February 2023, oil demand rose to a 24-year high, which resulted due to a boost in the industrial activity. It was the 15th consecutive year-on-year rise in demand.

Limited hydrogen infrastructure poses a significant restraint to the growth of the fuel cell power system market. Hydrogen serves as a critical fuel source for various types of fuel cells, and its production, distribution, and accessibility are vital components for the widespread adoption of fuel cell technologies. However, the current infrastructure for hydrogen is limited compared to traditional energy sources, hindering the seamless integration and deployment of fuel cell power systems. All these factors hamper the fuel cell power system market growth.

Fuel cell technology has experienced significant advancements in recent years, particularly in the design and composition of catalysts. Innovations in catalyst materials have led to improved electrochemical reactions within fuel cells, boosting their overall efficiency and power output. In addition, advancements in materials science have led to the development of more durable and cost-effective components for fuel cell systems. These improvements address historical challenges related to the longevity and manufacturing costs of fuel cells, making them more attractive for both stationery and mobile applications. All these factors are anticipated to offer new growth opportunities for the fuel cell power system market forecast.

Market Segmentation

The fuel cell power system market is segmented on the basis of fuel cell type, application, and region. By fuel cell type, the market is classified into Solid Oxide Fuel Cell (SOFC) , Proton Exchange Membrane Fuel Cell (PEMFC) , Molten Carbonate Fuel Cell (MCFC) , Phosphoric Acid Fuel Cell (PAFC) and others. Based on application, the market is segmented into residential, commercial, and industrial. Region-wise, the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Fuel cell power system market in Asia-Pacific is experiencing significant growth and development driven by several factors. Japan stands out as a frontrunner in adopting fuel cell technology, with strong government support and substantial investments in research and development. Japanese companies such as Ballard Power Systems, Toshiba Energy Systems & Solutions Corporation, and Toyota are leading the way in fuel cell innovation, driving advancements in both stationery and transportation applications.

According to India Brand Equity Foundation (IBEF) Diesel demand in India is expected to double to 163 MT by 2029-30, with diesel and gasoline covering 58% of India’s oil demand by 2045.

In May 2022, according to the Press Information Bureau, the Indian government approved changes in the Biofuel Policy to bring forward the target for 20% ethanol blending with petroleum to 2025-26 from 2030.

In February 2022, Japan's Ministry of the Environment announced that it would support local governments and companies in the establishment of a hydrogen business consortium. The ministry has been jointly implementing a hydrogen supply chain platform that generates low-carbon hydrogen and utilizes it in the region with certain companies and local governments. It aims to realize the hydrogen supply chain platform after conducting demonstrations across Japan by around 2030.

Competitive Landscape

The major players operating in the fuel cell power system market include Ballard Power Systems, Toshiba Corporation, Panasonic Life Solutions India Pvt. Ltd, Fuji Electric Co., Ltd., Nuvera Fuel Cells LLC, Bloom Energy, JX Nippon Oil & Gas Exploration Corporation, Fuel Cell Energy Inc., Plug Power inc, and Doosan Fuel Cell Co., Ltd. Other players in the fuel cell power system market include Mitsubishi Heavy Industries Ltd., Elcore GmbH, Ultracell Corporation and others.

Recent Key Strategies and Developments

In April 2024, Ballard Power Systems has recently disclosed the receipt of numerous purchase orders amounting to 70 FCmove-HD hydrogen fuel cell engines from its customer, Wrightbus, a prominent UK-based bus manufacturer renowned for deploying hydrogen-powered buses across the UK and Europe. These orders signify a significant step forward in the adoption of clean energy transportation solutions. Anticipated to be delivered in 2024, the fuel cell engines will propel both single- and double-decker buses set to commence operations in 2025 in the UK and Germany. This collaboration underscores the commitment of both companies towards advancing sustainable mobility and reducing carbon emissions in the public transportation sector.

In May 2023, Fuel Cell Energy, Inc. and Toyota Motor North America, Inc. (Toyota) are commemorating the inauguration of the groundbreaking "Tri-gen" system at the Port of Long Beach, California. This innovative system, the first of its kind, harnesses biogas to generate renewable electricity, renewable hydrogen, and usable water. Specifically designed to support the vehicle processing and distribution center for Toyota Logistics Services (TLS) at Long Beach, this facility stands as Toyota's largest North American vehicle processing facility, receiving around 200, 000 new Toyota and Lexus vehicles annually. This collaboration underscores a significant stride towards sustainable practices, enhancing energy efficiency and reducing environmental impact in the automotive industry.

Global Fuel Cell Power System Market Patent Outlook, by Country

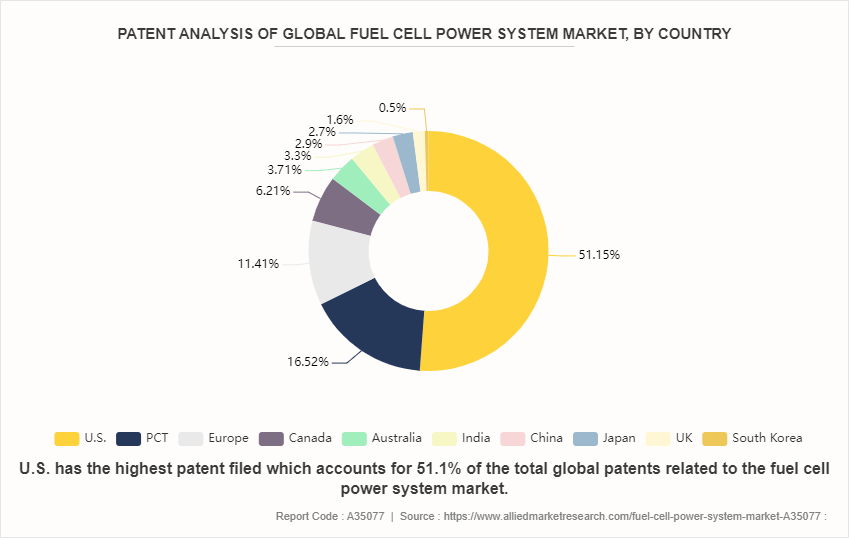

The U.S. collectively hold more than half of the total fuel cell power system patents that indicate strong innovation and investment in this technology in U.S. countries. This suggests fierce competition and a significant focus clean energy infrastructure R&D in these leading economies. U.S. has the highest patent filed which accounts for 51.1% of the total global patents related to the fuel cell power system market. Europe and PCT, although holding smaller percentages of fuel cell power system patents individually, collectively contribute to the overall Asian dominance in clean energy infrastructure innovation. The recent surge in patent filings related to fuel cell power systems underscores the significant strides made in materials science and engineering research and development within the industry. These patents highlight a concerted effort to enhance various aspects of fuel cell technology, such as electrode and membrane materials, catalyst formulations, and system design.

Key Regulations

Particulate Matter (PM) : Although fuel cells produce minimal particulate matter during operation, auxiliary power units or backup generators within fuel cell systems may emit fine particles and aerosols. Emission standards for PM typically specify limits for both PM10 (particulate matter with a diameter of 10 micrometers or less) and PM2.5 (particulate matter with a diameter of 2.5 micrometers or less) , expressed in milligrams per cubic meter (mg/m³) .

Nitrogen Oxides (NOx) : Fuel cell systems may produce nitrogen oxides (NOx) as byproducts, particularly during combustion processes in auxiliary power units or backup generators. Emission standards for NOx are typically specified as limits in parts per million (ppm) or milligrams per cubic meter (mg/m³) , varying based on jurisdiction, fuel type, combustion technology, and application.

Carbon Monoxide (CO) : CO emissions can occur during the incomplete combustion of fuels used in auxiliary power units or backup generators associated with fuel cell systems. Emission standards for CO are typically expressed in parts per million (ppm) or milligrams per cubic meter (mg/m³) , with limits varying depending on jurisdiction and application.

Volatile Organic Compounds (VOCs) : While fuel cells themselves produce minimal VOC emissions, other components of the fuel cell power system may emit VOCs during operation, such as in fuel processing or storage. However, specific emission standards for VOCs may or may not be applicable to fuel cell power systems, as regulations often focus on other pollutants such as particulate matter and nitrogen oxides.

Industry Trends

Government regulations for reducing environmental pollution encourage the adoption of fuel cells in the automotive sector. The countries are focusing on R&D and investing in fuel cell technology to improve their public transportation while reducing harmful emissions. According to SEOUL METROPOLITAN GOVERNMENT (SMG) the South Korean government plans to replace around 26, 000 CNG buses with fuel-cell buses by 2030.

Japan is at the forefront in terms of the adoption of alternative fuel technologies. The Japanese government and the local original equipment manufacturers (OEMs) focus on standardizing electrified powertrains globally. Meanwhile, the Japanese government also encouraged hydrogen fuel technology for large-scale deployments and transport applications.

In January 2022, the German government endorsed the CryoTRUCK project, focusing on advancing hydrogen-powered trucks. The initiative involves collaborative efforts between the testing specialist IABG and the Technical University of Munich, aimed at developing a CRYOGAS hydrogen gas tank paired with a refueling system tailored for long-distance transport. Spanning three and a half years, the CryoTRUCK project boasts a substantial budget exceeding EUR 25 million. Its primary goal is to pioneer and validate a first-generation technology for cryogenic compressed hydrogen gas (CRYOGAS) storage and refueling systems, specifically designed for heavy-duty fuel cell trucks.

Key Sources Referred

World Economic Forum

International Trade Administration

MDPI

Department Of Energy

Invest India

Fuel Cell & Hydrogen Energy Association

India Brand Equity Foundation

International Energy Agency

IABG

Seoul Metropolitan Government

Key Benefits For Stakeholders

This report provides a quantitative analysis of the fuel cell power system market overview, current trends, estimations, and dynamics of the fuel cell power system market analysis from 2024 to 2030 to identify the prevailing fuel cell power system market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the fuel cell power system market share assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global fuel cell power system market report.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global fuel cell power system market trends, key players, market segments, application areas, and market growth strategies.

Fuel Cell Power System Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 15.2 Billion |

| Growth Rate | CAGR of 17.7% |

| Forecast period | 2024 - 2030 |

| Report Pages | 340 |

| By Fuel Cell Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bloom Energy, Plug Power Inc., TOSHIBA CORPORATION, Doosan Fuel Cell Co., Ltd., Ballard Power Systems, Panasonic Life Solutions India Pvt. Ltd, NUVERA FUEL CELLS, LLC, Fuel Cell Energy, Inc., Fuji Electric Co., Ltd., JX Nippon Oil & Gas Exploration Corporation |

Asia-Pacific is the largest regional market for Fuel Cell Power System.

Advancements in fuel cell technology and rising demand for clean energy are the upcoming trends of Fuel Cell Power System Market in the world.

Industrial is the leading application of Fuel Cell Power System Market

$15.2 billion is the estimated industry size of Fuel Cell Power System by 2030.

Ballard Power Systems, Toshiba Corporation, Panasonic Life Solutions India Pvt. Ltd, Fuji Electric Co., Ltd., Nuvera Fuel Cells LLC, Bloom Energy, JX Nippon Oil & Gas Exploration Corporation, Fuel Cell Energy Inc., Plug Power Inc, and Doosan Fuel Cell Co., Ltd. are the top companies to hold the market share in Fuel Cell Power System.

Loading Table Of Content...