Functional Apparel Market Research, 2032

The global functional apparel market was valued at $345.6 billion in 2022, and is projected to reach $623.2 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

Market Dynamics

Functional apparel performs multiple functions to provide comfort and protection to the wearer in different environments, unlike fundamental garments which have limited purpose. It incorporates a variety of specially developed fabrics and layered designs, which enable it to perform functions such as protection from radiation, fire, and extreme weather conditions. Consumers find activewear comfortable and flexible, which is attributed to the kind of material used to design such as Synthetic fabrics such as polyester, nylon, cotton, wool, and graphene. Polyester and nylon are the most used materials in athleisure apparels, which altogether tend to provide the best combination of the required properties.

Advancements in fabric technologies lead to more innovative and functional apparels, such as moisture-wicking, temperature-regulating, and odor-resistant fabrics, enhancing comfort and performance for consumers, thus driving functional apparel market demand. The emergence of technologies such as membrane and nano spinning, which allow manufacturers to produce garments by reducing waste during production processes, delivers more sustainable products such factors surge the functional apparel market size.

Companies has increased investment in the smart textile industry, which has further introduced opportunities to develop more advanced functional clothing. This includes incorporation of electronic components in garments. Using these technologies, manufacturers deliver new functionality to the consumers, such as increase in durability and protection from abrasion. GRDXKN, which developed 4D printing technology that enables development of cloths with functions such as abrasion resistance, shock absorbent and light weight. This trend continues as companies are increasing investment in research and development, to set their products apart from competitors with more unique attributes results in functional apparel market growth.

The demand for functional apparel among the working population is rising, as it provides an easier way to transition from one activity to another. More people realize the time taken for changing clothes, especially in the areas such as hospitals where people must wear special clothes for hygiene and safety reasons, or in corporate spaces where formal wear is needed. According to Nicole Winhoffer, a fitness artist and coach, women prefer cloths that provide more convenience as it saves time and eliminates the need to for changing cloths again for different activities. Functional clothes offer an efficient way to change from activities like yoga or exercise to casual wear. This helps people in overcoming time concerns. It also reduces the need to spend extra money just to meet certain prerequisites in such activities.

Athleisure wear, which is one of the fast-growing categories, has become highly popular due to mass social media influence. Athleisure, which combines the term athletic and leisure, is one of the highly preferred choices among the young generation. This has resulted due to the surge in importance about a fitness-conscious lifestyle. Numerous fitness influencers have been promoting active wear brands that have caught the attention of target customers. This has brought an athleisure cult, with active wear being worn on runways, social gatherings as well as gyms surge the functional apparel market share.

Consumers look toward celebrities such as actors, athletes, and singers to gain more fashion sense. Athletic brands such as Nike, Adidas, and Puma use marketing strategies to fuse celebrity perception in their marketing strategies to attract new consumers. These brands also collaborate to create highly fashionable apparel. Notable collaborations include Puma X Coca-Cola, Fila X Roksanda, and Adidas X Gucci, which introduce luxury fashion lines with sporty functionality, combining style and performance.

Manufacturers are also focusing on developing strategies to address the growing concerns about supply chain, geopolitical unrest, and sustainability. These factors affect the growth of the functional apparel market and demand attention from various stakeholders to manage uncertainties. Thus, companies are making use of recycled fabrics to reduce environmental impact. For instance, 437, which is a swimwear and activewear brand is using recycled polyester to reduce dependency on synthetic yarns subsequently its environmental impact. Furthermore, rising inflation and energy costs contribute to elevating selling prices making products more costly for people to purchase, thus reducing demand. Girlfriend Collective launched a sustainable line of athletic wear including leggings and sports bras, to strengthen its brand perception with environment-conscious consumers.

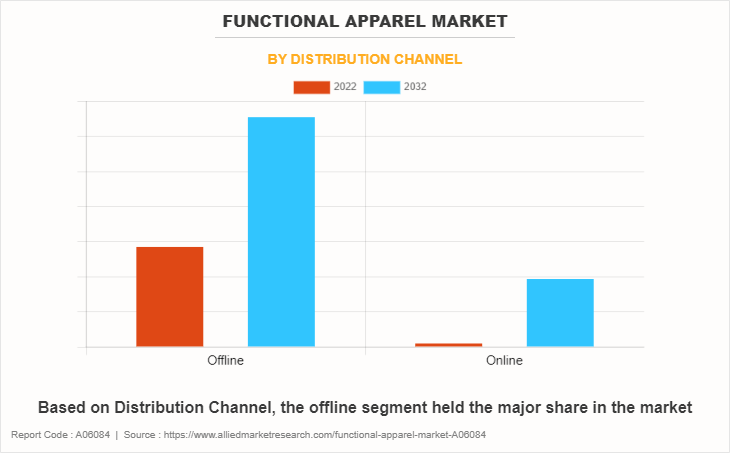

The functional clothing market has witnessed a balanced adoption of online and offline sales channels. Manufacturers focus on improving apparel distribution. With widespread information through internet, consumers often utilize online reviews, and available information regarding their products to make best choices. This helps consumers make inform decisions regarding their purchase and shows how digital information is influencing. This increases the share for online retail as it offers a more convenient way for consumers to make a purchase. Furthermore, offline retail channels are also making improvements through integration of technologies in to enhance consumer buying experience is adding new consumers from Millennial and Generation Z. This includes the addition of artificial intelligence for analyzing customer buying patterns and contactless payments.

Segmental Overview

The functional apparel market forecast into product type, application, distribution channel, and region. By type, it is classified into sportswear, activewear, protective clothing, and others. As per application, it is divided into sports industry, outdoor clothing, healthcare, and others. On the basis of distribution channel, the market is categorized into online and offline. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

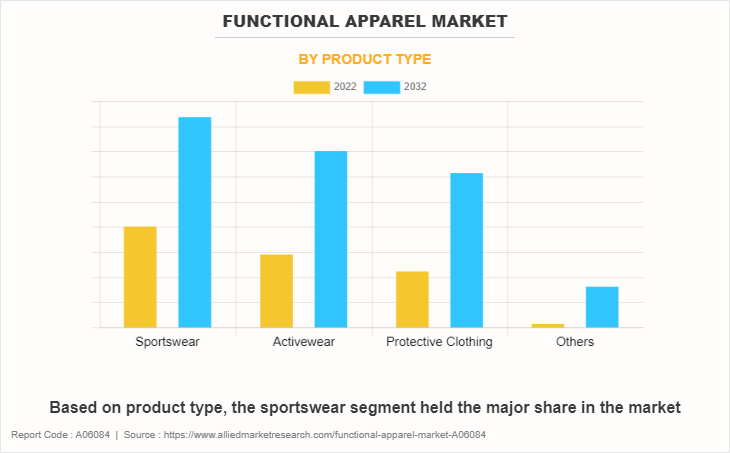

By Product Type

Based on product type, the sportswear segment held the major share in the functional apparel industry in 2022. Advanced materials and technologies aimed at boosting athletic performance, such as moisture-wicking fabrics and compression garments surge the market demand for the sportswear segment. Moreover, the protective clothing segment is expected to grow with the highest CAGR during the forecast period. manufacturers are adopting advanced materials like nano fabrics and smart textiles for enhanced protection, also surge in customization to cater to specific industry needs and a growing focus on sustainability with the use of eco-friendly materials surge the demand for protective clothing in the market.

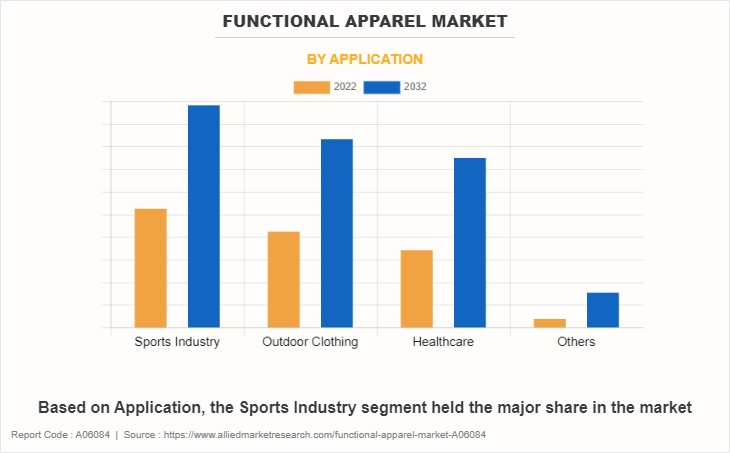

By Application

Based on application, the sports Industry segment held the major share in the market in 2022, Functional sports clothing features a high-level of breathability and moisture/vapor transfer combined with heat insulation and/or wind-proofing, waterproofing, and UV protection. Moreover, the healthcare segment is expected to grow with the highest CAGR during the forecast period. The growing emphasis on infection control and hygiene, antimicrobial and fluid-resistant textiles surge the demand for the healthcare segment in the functional apparel market.

By Distribution Channel

The offline segment held the major share in the functional apparel industry in 2022. In the functional apparel market, offline stores are adapting to changing consumer preferences. They offer personalized shopping experiences, expert guidance, and in-store events to engage customers. Moreover, the healthcare segment is expected to grow with the highest CAGR during the forecast period. E-commerce continues to expand, offering consumers convenience and an extensive product range. Enhanced virtual try-on experiences and augmented reality tools are gaining popularity, providing a more immersive and informative shopping experience.

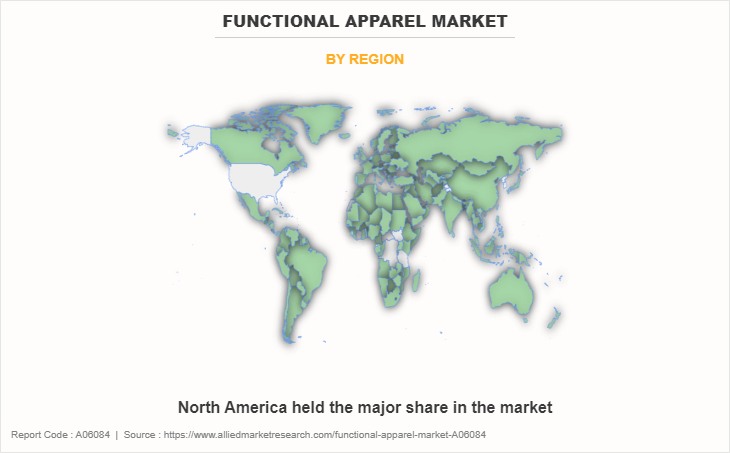

By Region

North America held the major share in the functional apparel market in 2022. In North America, ongoing trend of having a fit body and healthy lifestyle are some of the major factors driving the growth of the North American region. However, Asia-Pacific is expected to grow with the highest CAGR during the forecast period. This region is a significant hub for producing and consuming functional apparel, driven by a growing middle-class population, increasing health and fitness awareness, and a surge in outdoor recreational activities.

Competition Analysis

The players in the functional apparel market have adopted acquisition, business expansion, partnership, collaboration, and product launch as their key development strategies to increase profitability and improve their position in the market. Some of the key players profiled in the market analysis include Puma SE, Adidas AG, PVH Corp., Under Armour, Inc., Columbia Sportswear Company, VF Corporation, Nike, Inc., ASICS Corporation, lululemon athletica inc., and The Gap, Inc.

Recent Developments in the Functional Apparel Market

- In 2023, Nike, Inc. launched the EK Umoja Collection that contains running footwear and apparel such as Nike Alphafly 2 and Windrunner jacket to increase consumer base.

- In 2023,Nike, Inc. inaugurated Jordan World of Flight Shibuya, a retail store in Japan featuring Jordan Brand products that contain footwear and apparel products for men's, women's, and kids.

- In 2023, Puma SE collaborated with absorbent apparel brand, Modibodi to launch a new collection of active period underwear range that allows women to focus on sports during their period.

- In 2023, Puma SE collaborated with lemlem, the ready to wear and swimwear brand made in Africa to combine collection of lemlem signature aesthetics with Puma.

- In 2022, Adidas AG and Foot Locker, Inc. , the New York-based specialty athletic retailer announced partnership to establish Foot Locker as the lead partner for development and expansion of key franchises across women's, kids, and apparel.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the functional apparel market analysis from 2022 to 2032 to identify the prevailing functional apparel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the functional apparel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global functional apparel market trends, key players, market segments, application areas, and market growth strategies.

Functional Apparel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 623.2 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Product Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Puma SE, Columbia Sportswear Company, The Gap, Inc., Adidas AG, Lululemon Athletica Inc., PVH Corp., Nike, Inc., ASICS Corporation, VF Corporation, Under Armour, Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the rise in health and wellness awareness is one of the key factors that drives demand in the functional apparel market.

With the rise in demand for various functional apparel products incurring from the target segments, companies have been initiating several key mergers and acquisitions in the view of generating revenue from the athleisure segment Finish Line is one the largest retailers of premium multi-branded athletic footwear, apparel, and accessories in the U.S. Apart from merger and acquisition, companies have also been strategizing on expanding their operations in the view of catering to the surging demand for athleisure products. For instance, high-end athleisure company Hylete has agreed to acquire rival Gracedbygrit in an all-stock transaction.

Increasing health and fitness consciousness, technological advancements in material innovation, and a rising demand for versatile, performance-enhancing clothing. Sustainable practices and digital retail channels also contribute to the industry's expansion, with athleisure continuing to dominate as an everyday fashion choice, emphasizing the market's vitality and potential.

Rise in sustainability emphasis are the upcoming trends of Functional Apparel Market in the world

Sportswear is the leading product type of Functional Apparel Market

North America is the largest regional market for Functional Apparel.

The global functional apparel market was valued at $345,621.4 million in 2022, and is projected to reach $623,234.5 million by 2032, registering a CAGR of 6.1% from 2023 to 2032.

Some of the key players profiled in the market analysis include Puma SE, Adidas AG, PVH Corp., Under Armour, Inc., Columbia Sportswear Company, VF Corporation, Nike, Inc., ASICS Corporation, lululemon athletica inc., and The Gap, Inc.

Loading Table Of Content...

Loading Research Methodology...