Fungicides Market Research - 2027

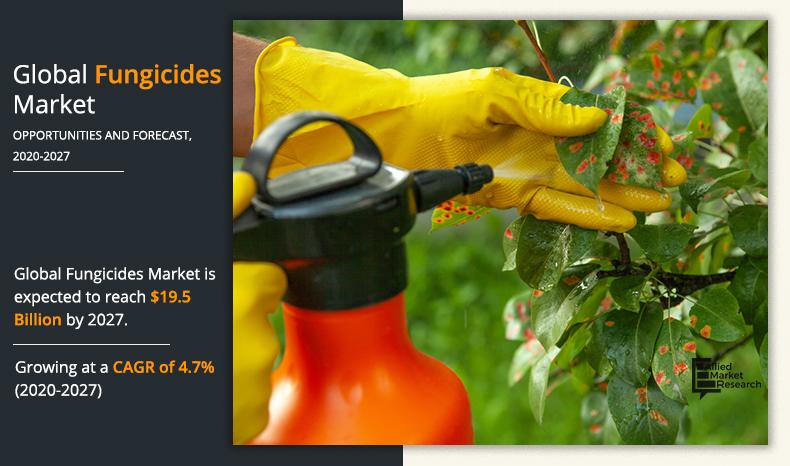

The global fungicides market size was valued at $13.4 billion in 2019, and is expected to reach $19.5 billion by 2027, registering a CAGR of 4.7% from 2020 to 2027.

Report Key Highlighters:

The fungicides market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (tons) for the projected period 2019-2027.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The fungicides market is highly fragmented, with several players including Adama Ltd., BASF SE, Bayer AG, FMC Corporation, Corteva Inc., Novo Nordisk AG, Nufarm Ltd., Sumitomo Chemical Company, Syngenta AG, and Tata Chemicals Ltd. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the fungicide market.

Growing Demand for Crop Protection

In modern farming, fungicides play a crucial role in protecting crops from fungal diseases. Changes in farming techniques and technological advancements have encouraged the farmers to engage in effective pest management. Surge in pest management practices have also increased awareness of crop saving properties of the fungicides. Integrated Pest Management focuses on using multiple pest control strategies, including fungicides, in a sustainable and environmentally friendly manner. As awareness about sustainable farming practices increases, the adoption of IPM approaches grows. Fungicides play a crucial role in integrated pest management programs, thereby driving their demand. These are used to kill the fungus spores and to improve the quality of crops. Fungicide reduces crop losses before and after harvest along with increase in crop yield. Chemical and pharmaceutical industries are the major sources of fungicides. In addition, there is an increase in the requirement of food products owing to surge in population. The losses in food crops mainly occur due to the diseases in crops during various crop development stages. There is an increase in the usage of fungicide in floriculture, horticulture, and mainly in farming to increase the yield of crops and to protect crops from several diseases. In farming, fungicides are primarily used in cereal crops.

The expansion of commercial farming, particularly in emerging economies, is fueling the demand for fungicides. Large-scale farming operations are more susceptible to disease outbreaks due to the high density of crops and monoculture practices. Fungicides provide an effective means of disease control in such intensive agricultural systems. The fungicides market has witnessed significant advancements in formulation technologies, leading to the development of more efficient and environmentally friendly products. Novel formulations offer enhanced disease control, improved residue management, and reduced environmental impact. These technological advancements drive the adoption of fungicides in modern agriculture.

Farmers are increasingly aware of the impact of fungal diseases on crop productivity and quality. Fungicides help prevent yield losses and maintain the quality of harvested produce, leading to higher market value and profitability. This awareness among farmers drives the demand for fungicides to safeguard their crops. Government policies and regulations regarding crop protection and pesticide usage significantly influence the fungicides market. Supportive regulations, subsidies, and initiatives promoting sustainable agriculture and integrated pest management practices encourage the use of fungicides. Conversely, stricter regulations on conventional pesticides can drive the demand for safer and more environmentally friendly fungicides. Developing countries are experiencing rapid urbanization and industrialization, leading to increased demand for food and agricultural products. To meet this demand, agricultural activities are expanding, resulting in a higher requirement for crop protection products like fungicides.

Apart from fungicides, there are alternative disease management practices available to farmers. These include biological control agents, cultural practices, crop rotation, and resistant crop varieties. The availability and effectiveness of these alternatives can influence farmers' choices and reduce the reliance on fungicides, impacting the fungicides market. Fungicides are composed of various active ingredients and formulations, and the prices of these raw materials can be subject to volatility. Fluctuations in raw material prices can impact the manufacturing costs of fungicides and subsequently affect their market pricing and profitability. Price volatility can create uncertainty for fungicide manufacturers and may lead to market instability. The availability of alternative disease management practices and volatility in raw material prices may hinder the growth of the fungicides over the forecast period.

Increasing Demand for Sustainable Solutions and Advancements in Formulation Technologies

However, as sustainability becomes a key focus in agriculture, there is a growing demand for fungicides that offer effective disease control while minimizing environmental impact. The development of environmentally friendly and bio-based fungicides provides an opportunity for manufacturers to cater to this demand and offer sustainable solutions. Continuous advancements in formulation technologies offer opportunities for the fungicides market. Innovations such as nanoencapsulation, controlled-release formulations, and combination products can improve the efficacy and targeted delivery of fungicides, enhancing their performance and reducing application rates. These advancements can drive market growth by offering more efficient and cost-effective solutions.

Integrated Disease Management (IDM) approaches that combine various disease control strategies, including fungicides, offer opportunities for the fungicides market. Integrated Pest Management (IPM) programs, incorporating cultural practices, biological controls, and resistant crop varieties along with judicious fungicide use, can enhance disease management efficacy while reducing chemical inputs. Fungicides remain an integral part of such IDM strategies, presenting opportunities for their adoption and development. The adoption of precision agriculture and digital technologies is on the rise, providing opportunities for the fungicide market. Advanced sensing technologies, remote sensing, and data analytics enable farmers to monitor disease incidence and severity accurately. This data-driven approach allows for targeted and optimized fungicide applications, reducing unnecessary usage and optimizing disease management practices.

The fungicides market is segmented on the basis of active ingredient, crop type, and region. By active ingredient, the market is divided dithiocarbamates, benzimidazoles, chloronitriles, triazoles, phenylamides, strobilurins, and others. On the basis of crop type, the market is divided into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Fungicide market share is analyzed across all the main regions.

The fungicides market covers in-depth information of the major industry participants. Some of the major players in the market include Adama Ltd., BASF SE, Bayer AG, FMC Corporation, Corteva Inc., Novo Nordisk AG, Nufarm Ltd., Sumitomo Chemical Company, Syngenta AG, and Tata Chemicals Ltd.

Other players in the value chain of the fungicides market include Bioworks, Inc., STK Bio-Ag Technologies, Verdesian Life Sciences, Seipasa, S.A., Ishihara Sangyo Kaisha, Ltd., Nutrichem, and others

The key players are adopting numerous strategies such as product launch, partnership, acquisition, partnership, product development,and others to stay competitive in the market.

For instance, Adama and Netherlands based Ceradis B.V.entered into an R&D agreement to develop new, innovative, and sustainable crop protection. The agreement's goal is to deliver new crop protection products to farmers with similar or better efficacy rates and ease of handling, while reducing the required dose rate of active ingredients. The agreement was aimed at improving Adama’s product offerings.

In addition, BASF launched two new fungicides for the turf market named Maxtima and Navicon .It features the new Revysol active ingredient and provides broad-spectrum control on diseases such as dollar spot, anthracnose, and spring dead spot. The new product helped BASF to reinforce its presence in the global fungicides market.

Fungicides Market, by Active Ingredient

By active ingredient, the triazoles segment holds the largest market share owing to its beneficial characteristics such as site specificity and targeted action.

By Active Ingredient

Triazoles is projected as the most lucrative segment.

Fungicides Market, by Crop Type

On the basis of crop type, the fruits & vegetables segment has garnered the highest market share. Fruit and vegetable plants areaffected by fungal disorder such as blight. This fungal disorder is observed across all regions, owing to which fungicides are majorly used for fruits and vegetables.

By Crop Type

Fruits & Vegetables is projected as the most lucrative segment.

Fungicides Market, by Region

By region, Europe has garnered the highest market share in 2019, in terms of volume as well as revenue and is anticipated to maintain its dominance throughout the analysis period. This is attributed to the presence of key players in the region. In addition, Europe is the leading producer of wheat and largest consumer of fungicides due to its increased use in cereal crops. Asia-Pacific is anticipated to grow at a faster rate. This is because of presence of countries such as India, China, and Australia. India is one of the major producers of wheat and rice along with dry fruit, sugarcane, cotton, and pulses. Factors such as increase in awareness among farmers regarding the utilization of fungicides to control diseases of the cereal crops have contributed to the growth of the fungicides market in the Asia-Pacific region.

By Region

Europe holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

The report provides an in-depth analysis of the forecast along with the current and future market trends

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the industry for strategy building

- The qualitative data in this report aims on market dynamics, fungicides market trends, and developments

- A comprehensive analysis of the factors that drive and restrain the fungicides market growth are provided

- The fungicides market size is provided in terms of revenue and volume

Fungicides Market Report Highlights

| Aspects | Details |

| By ACTIVE INGRIDIENT |

|

| By CROP TYPE |

|

| By Region |

|

| Key Market Players | NUFARM LIMITED, SYNGENTA AG, SUMITOMO CHEMICAL COMPANY, BAYER AG, TATA CHEMICALS LTD, ADAMA LTD, CORTEVA INC, NOVO NORDISK A/S, FMC CORPORATION, BASF SE |

Analyst Review

The fungicides market is witnessing significantgrowth owing to high consumption in the developed regions. The bio-fungicides market would gradually gain prominence in the Asia-Pacific region owing to the high cost of bio-fungicides. Currently, the market is dominated by synthetic fungicides, which are relatively economical and produce quick results. The synthetic fungicides segment is expected to dominate the market in future; however, the demand would eventually decline owing to their overuse. However, issues related to use of synthetic fungicides might arise in the developing regions of the world due to the lack of awareness on the adequate quantity of use and weak government regulations. Among several types of synthetic fungicides used in the market, triazoles have the largest market share owing to reasons site specificity and targeted action. Therefore, the triazoles segment is expected to continue to lead the market in near future. At present, fungicides are mainly used in fruits and vegetables farms. This would majorly contribute to the growth of the fungicides market. By region, Europe dominates the fungicides market and it would continue this trend in future mainly due to the extensive use of fungicides for wheat and vineyards as well in fruits and vegetables farms in this region. However, the Asia-Pacific is expected to emerge as a lucrative market in the future due to the popularity of agro-economic sectors in countries such as India and China.

Factors driving fungicides market growth are rise in plant disease, rise in awareness in farmer of developing economies such as India, and others.

The key trends in the fungicides market are bio-fungicides, diversified food preferences, constant pressure of increasing crop yield to meet the growing demand of food, and others.

In terms of revenue, Europe region is anticipated to garner highest market share in the fungicides market. It is anticipated to garner 42.6%.

Key growth strategies adopted by key players of the fungicides market are product launch, acquisition, business expansion, and others.

Top players in the fungicides market are FMC corporation, Syngenta AG, Bayer AG, BASF SE, and others

On the basis of crop type, fruits & vegetables segment has garnered highest market share.

Loading Table Of Content...