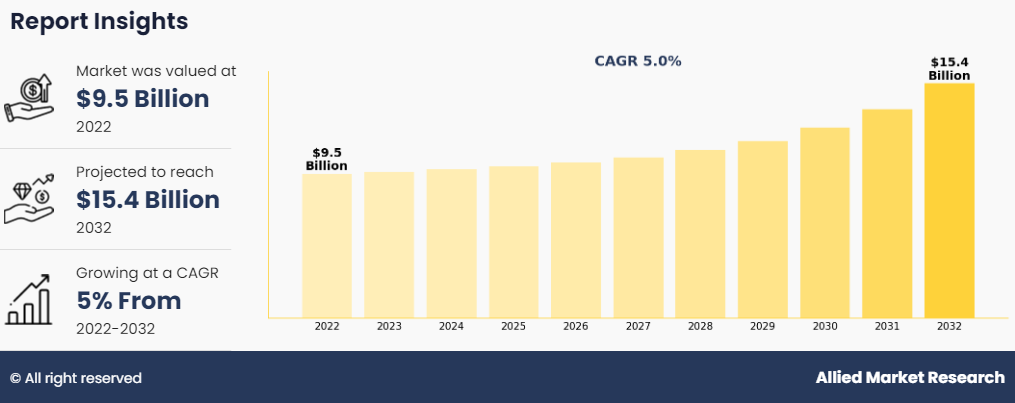

The global fuselage market size was valued at $9.5 billion in 2022, and is projected to reach $15.4 billion by 2032, growing at a CAGR of 5% from 2022 to 2032.

The fuselage is an aircraft's primary structure, often elongated and cylindrical in shape, which houses the cockpit, passenger or cargo compartments, and other critical components. The fuselage is the aircraft's backbone, responsible for structural integrity, aerodynamic stability, and providing room for humans & payload. Its design is impacted by many criteria's, including aerodynamic efficiency, weight constraints, and operating needs. The fuselage is made up of structural components that are frequently made of lightweight materials, including aluminum, composites, or titanium alloys to provide strength without adding too much weight. This framework serves as the fuselage's skeleton, supporting the aerodynamic covering that protects the whole structure. The skin, commonly constructed of aluminum panels or composite materials, provides the aerodynamic form required for effective flight while protecting the interior components from the environment.

The cockpit is located within the fuselage and acts as the aircraft's command center, containing the flight crew and vital controls for navigation, communication, and flight management. The nose cone or radome, is located ahead of the cockpit and carries radar equipment used for weather detection or navigation assistance, depending on the aircraft's role.

Enhancing Efficiency, Safety, and Passenger Comfort in Modern Aviation Drive the Market Growth

Optimized fuselage designs & curves minimize drag, increase fuel economy, and extend the aircraft's range. Streamlined designs help to smooth out the airflow above the aircraft, reducing turbulence and increasing flying stability. Incorporating modern materials, including CFRP improves the fuselage's structural strength while lowering weight. This increases fuel efficiency and improves the aircraft's capacity to absorb mechanical stress & collisions, hence raising safety requirements. Innovative fuselage designs prioritize passenger comfort with bigger cabin layouts, wider windows, and better noise insulation.

Passengers have a more relaxing and enjoyable travel experience, resulting in better levels of customer satisfaction & loyalty. Modern fuselage designs incorporate various safety measures, including strengthened cabin components, emergency escape systems, and improved crashworthiness. These characteristics reduce the hazards connected with in-flight crises and improve overall aviation safety. Advances in fuselage design make it easier to integrate advanced technology such as in-flight entertainment systems, Wi-Fi connection, and cabin automation. Passengers stay connected and engaged during their flight, which improves the entire in-air experience. All thses factors are anticipated drive the fuselage market trends in upcoming year.

Challenges and Considerations in Fuselage Design for Modern Aircraft

Weight is a major restricting element in fuselage. To attain an ideal balance, aircraft designers constantly strike a compromise between structural integrity and weight considerations. Each additional kilogram of weight increases fuel consumption, operational expenses, and cargo capacity. Engineers utilize lightweight materials and new design strategies to reduce the fuselage's weight while preserving strength & durability. Regulatory restrictions and certification processes provide additional limits on fuselage design.

Aircraft adhere to a slew of norms and standards established by aviation authorities, including structural integrity, crashworthiness, fire safety, and electromagnetic compatibility. Meeting these standards demands considerable testing, documenting, and validation throughout the design and manufacturing processes, which increases the complexity, duration, and expense of the development cycle. Human considerations play an important role in fuselage, especially in terms of passenger comfort, ergonomics, and accessibility. Designing a fuselage that maximizes passenger comfort while maintaining safety and convenience is a multidimensional task. Seat configuration, cabin layout, noise levels, air quality, and accessibility for disabled passengers carefully addressed to provide a good aboard experience.

Enhancing Aircraft Dependability and Efficiency through Advanced Fuselage Design Strategies and Integrated Systems to Drive Excellent Opportunities

Improving the durability and maintainability of fuselage structures opens considerable prospects for increasing aircraft dependability and lowering lifetime costs. Engineers reduce the effects of environmental deterioration and maintenance downtime by using improved coatings, corrosion-resistant materials, and modular maintenance-friendly designs. Furthermore, predictive maintenance technologies, such as health monitoring systems and sensor-based diagnostics, enable early detection of structural flaws & proactive maintenance interventions, resulting in optimal fleet availability & safety.

Engineers now do complex structural analysis and optimize fuselage designs due to advancements in computer modelling, simulation, and optimization techniques. They enhance fuselage components' structural layout, material distribution, and load-bearing properties using finite element analysis (FEA), computational fluid dynamics (CFD), and topology optimization tools. This results in lighter, stronger, and more aerodynamically efficient fuselage structures, which improve aircraft performance and fuel efficiency. The move toward integrated systems design presents potential to improve the functionality and efficiency of fuselage structures. Engineers optimize space utilization, save weight, and simplify maintenance by integrating components such as fuel tanks, electrical systems, and environmental control systems directly into the fuselage.

Key players profiled in fuselage market report include Latécoère,, Safran Landing Systems, GKN Aerospace, Aernnova, Goodrich Corp, Easterline, Ostseestaal GmbH & Co., Airbus, Lockheed Martin Corporation, and Triumph Group Inc. Market Diversification and strategic partnership are common strategies followed by major market players. For instance, in Jun 12, 2023, Agritech startup Fuselage Innovations had been selected for the UK Government's Global Entrepreneurship Programme (GEP), making the Kerala-based company eligible for relocation to the European nation.

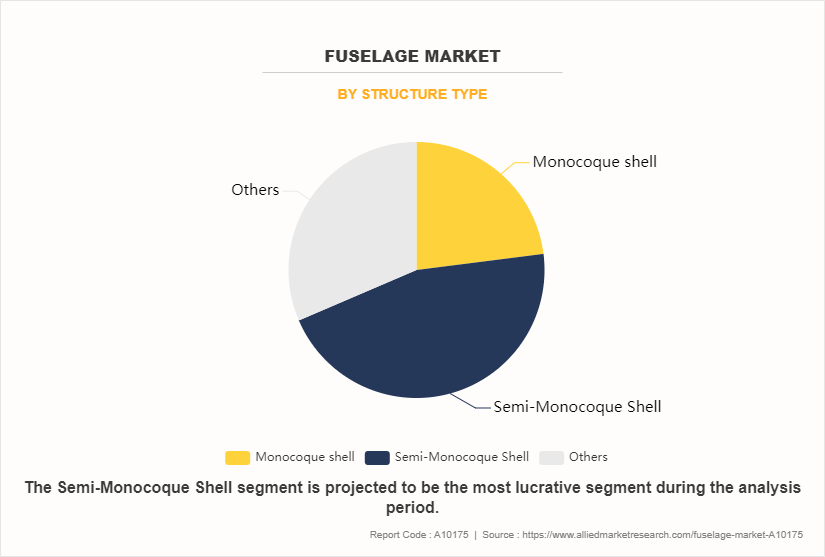

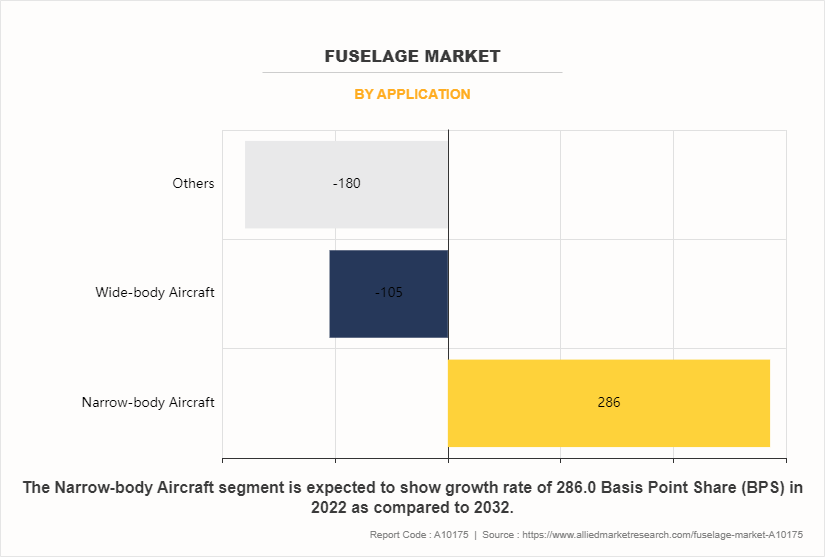

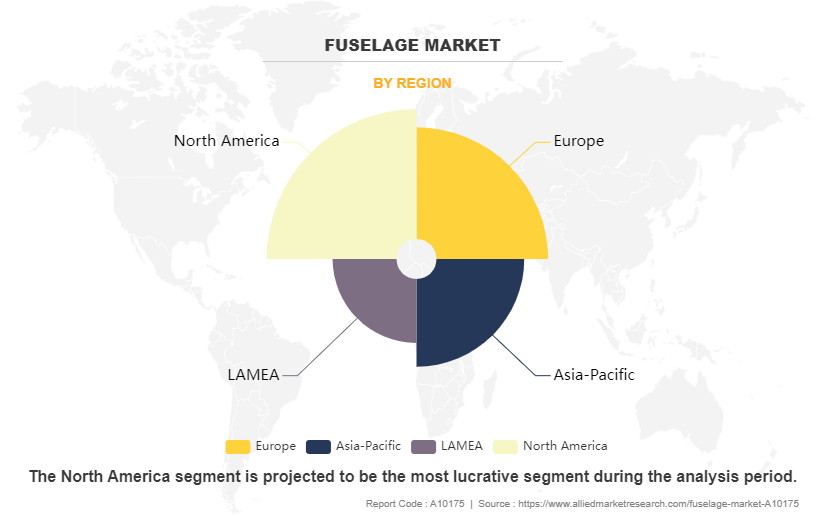

The fuselage industry is segmented into structure type, application, and region. By structure type, the market is divided into monocoque shell, semi-monocoque shell, and others. Depending on application, it is classified into narrow-body aircraft, wide-body aircraft, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The fuselage market is segmented into Structure Type and Application.

By structure type, the semi-monocoque shell dominated the global fuselage market share in 2022. Semi-monocoque shell structures offer a lighter alternative to traditional monocoque designs, which rely solely on the skin for structural integrity. Reduced weight leads to improved gas efficiency and performance, making semi-monocoque shells pleasing to plane producers looking for to meet stringent gasoline consumption rules and decrease working costs. Semi-monocoque designs provide first-rate strength-to-weight ratios, making them appropriate for withstanding the stresses and loads experienced during flight. This structural integrity enhances aircraft security & longevity, attractive to both industrial and military plane manufacturers. Semi-monocoque shell structures regularly allow for greater efficient use of substances and manufacturing strategies compared to monocoque designs. This results in lower production charges except compromising on performance or safety, making semi-monocoque fuselages economically attractive to aircraft manufacturers and operators.

Depending on application, the narrow-body aircraft dominated the global fuselage market share in 2022. The increasing demand for air travel, particularly in emerging markets and regional routes, is a significant driver for narrow-body aircraft. As more people travel by air for commercial enterprise and leisure purposes, airlines require smaller, greater fuel-efficient aircraft to serve these routes effectively. Narrow-body planes are designed to be fuel-efficient, making them low in cost for airlines to operate, specifically on short to medium-haul routes. With fuel expenses being a significant cost for airlines, the demand for planes with better gasoline efficiency continues to drive the market for narrow-body aircraft. Many airways are changing to older, much less fuel-efficient narrow-body planes with more modern models that provide better performance, greater passenger comfort, and lower running costs. Fleet renewal initiatives force demand for the cutting-edge narrow-body aircraft models, stimulating boom in the market.

By region, North America dominated the global market in 2022. North America is a major hub for aircraft manufacturing, with leading companies such as Boeing and Airbus operating production facilities in the region. The demand for new aircraft, including narrow-body, wide-body, and regional jets, drives the fuselage industry in North America. As airlines in the region renew their fleets and expand their operations, there is a continuous need for fuselage components and assemblies. The North American region has a significant military aerospace sector, with a focus on advanced fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs). Military aircraft require robust and durable fuselage structures to withstand high-stress environments and demanding mission profiles. This presents opportunities for fuselage manufacturers and suppliers catering to the defense sector.

North America is at the forefront of aerospace innovation, with ongoing advancements in materials, manufacturing processes, and design technologies. Companies in the region are investing in R&D to improve the performance, efficiency, and safety of aircraft fuselages. Opportunities exist for suppliers of advanced materials, composites, and technologies that enhance fuselage design and production.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fuselage market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Fuselage Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.4 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Structure Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Airbus, Goodrich Corp, Ostseestaal GmbH & Co., Triumph Group Inc, Messier-buggati-Dowty, Easterline, Latécoère,, Aernnova, Lockheed Martin Corporation, GKN Aerospace |

The global fuselage market size was valued at $9,482.9 million in 2022 and is projected to reach $15,417.8 million by 2032, growing at a CAGR of 5.0% from 2023 to 2032.

Atécoère,, Safran Landing Systems, and GKN Aerospace, are major players in the fuselage market.

There is a growing emphasis on using lightweight materials such as carbon fiber composites and advanced alloys in fuselage construction. These materials offer improved fuel efficiency, performance, and durability, contributing to lower operating costs for airlines.

North America is the largest regional market for fuselage.

The leading application of the fuselage market is in the manufacturing of commercial aircraft. Commercial aircraft represent the largest segment of the aerospace industry, accounting for a significant portion of global air travel. Fuselages are a critical component of commercial aircraft, providing the main body structure and housing essential systems, equipment, and passenger cabins.

Loading Table Of Content...

Loading Research Methodology...