Fusion Energy Market Research, 2040

The global fusion energy market is estimated to be $429.6 billion in 2030 and is projected to reach $840.3 billion by 2040, growing at a CAGR of 6.9% from 2031 to 2040.

Key Report Highlighters:

- The fusion energy market size has been analyzed in terms of value ($billion) covering more than 15 countries.

- For growth prediction, we have looked into historical fusion energy market trends including present and future activities of key business players.

- The report covers detailed profiling of the major 14 market players.

- The report covers new market entrants for the last 3 decades

- The fusion energy market share is owned by merely 30-35 companies as it is highly consolidated in nature.

Fusion energy is energy produced from nuclear fusion. It is the same as what happens in the sun. The continuous reaction of nuclei powers the sun and thus despite there being no oxygen, the sun radiates energy. Energy is a basic need in today’s world. When two or more light nuclei fuse together, it forms a reaction that produces tremendous amounts of energy. This energy is generated due to differences in mass during the process. The energy produced is clean, safe, and environmentally friendly. The energy if commercialized can diminish the use of fossil fuel or any other source of energy generation owing to its potential.

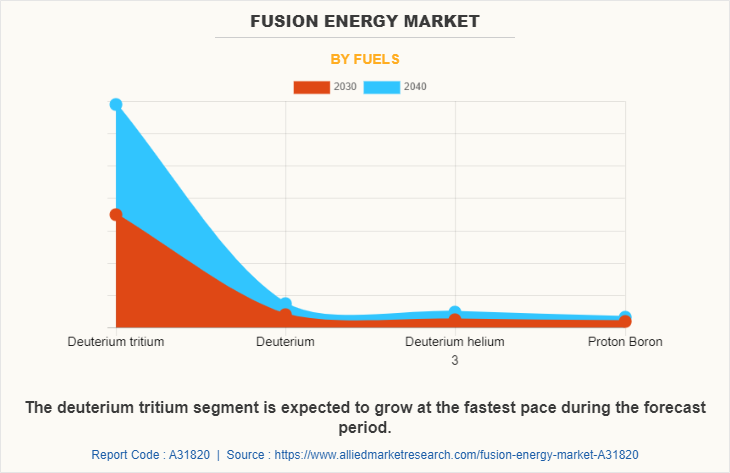

For instance, according to an article from International Energy Forum, nuclear fusion is capable of producing energy that is 4 million times more than energy generated from coal, oil, and gas. Further, it is four times more capable than nuclear power plant that uses fission reaction to generate energy. The energy produced from deuterium atoms fuses together. Deuterium is considered a high-potential fuel for a fusion reactor, a gallon of seawater could produce as much energy as 300 gallons of gasoline. However, the energy produced is relatively lower and thus the combination with other nuclei is preferred over d-d fusion which is deuterium/tritium.

Currently, the nuclear power plant is the cleanest form of energy that is it has zero emissions. Uranium and plutonium are most used for fission reactions in nuclear power reactors because they are easy to initiate and control. However, the chain reaction that can cause way greater harm and radioactive waste discourages reliance on them. Several incidences where power plants blasted and caused harm to humans and nature have made government and market players to look for alternate sources of clean energy. The alternate sources are coal, oil, gas, and clean energy sources are mostly renewable sources such as hydro, solar, wind, biofuel, and hydrogen fuel. There are several advantages that can be listed if the electricity baseload is shifted to fusion energy.

2021-2029 Outlook:

The concept of fusion energy is being experimented with on larger scales to attain its theoretically feasible outputs into practical. Power generation through fusion reaction is expected to be in its experimental stage in the coming 8-10 years. The fusion energy market is still in the phase where it has money invested and will for a few years need investments on regular basis. This means no revenue will be generated during the said period.

For example, a privately funded U.S. fusion company demonstrated its prototype 20-tesla high-temperature-superconducting magnet, opening up an exciting new high-field, compact approach to commercial fusion energy. The first central-solenoid magnet was delivered for the international collaborative fusion experiment ITER, illustrating the fusion-scale manufacturing capability of the U.S. industry. The Joint European Torus (JET) in the UK doubled its 24-year-old record with a five-second, high-power pulse, limited only by the experimental hardware and not the plasma stability.

Lawrence Livermore National Laboratory’s National Ignition Facility (NIF) in California achieved an energy yield eight times higher than its previous record and reached the cusp of ignition, providing us with a second fusion approach with similar physics performance as the tokamak, and China’s Experimental Advanced Superconducting Tokamak (EAST) sustained fusion reactions for 17 minutes at 126 million degrees Fahrenheit – five times hotter than the sun. Such examples cast light on the progressing field of fusion energy and simultaneously provide an insight that it still will require a few years to commercialize the source. Thus, the market size in the report is projected for the year 2030 which is expected to be the beginning of fusion energy commercialization.

Growth factors:

The current population of 7.6 billion people and the ever-growing need for energy have led to a trial for different sources of energy. The demand for primary energy increased by 5.8% in 2021 and is expected to grow further in 2022. The present demand for primary energy is ever-growing and still, around 11% of the population has no access to electricity. The demand for electricity is growing which can be attributed to rapid urbanization, and electrification of end users, including transportation, space cooling, large appliances, ICT, and other sectors. In a report from United Nations (UN), it is estimated that by 2050, the population of the world will grow to 9.7 billion. To meet the ever-increasing energy consumption, a long-running solution is fusion power. The aforementioned reasons are the main driving factors for the market growth.

The energy from the nuclear fusion power plant is not renewable. Though, it can become possibly sustainable by using fusion and breeder reactors. By controlling atomic fusion similar to the sun, we can have an unlimited energy source. At this point in time, reactors are suffering serious difficulties to be used on a larger scale. The controlled fusion of atoms releases bulk amounts of energy. The base load required for electricity generation is offered by fusion energy. It is clear that the capacity of nuclear energy is much more when compared to other sources of energy and thus acts favorably in market growth.

Market restraints:

However, the fusion reaction cannot be sustained for a longer time period. The code to sustain the reaction has not been cracked yet. It is projected that by 2030, commercialized fusion energy will be available for use, and by 2050, fusion energy will shoulder the maximum base load for electricity generation. This remains a negative factor for the fusion energy industry. Moreover, the initial costs required for building a fusion reactor are quite high. The infrastructure for creating such reactors will only be possible from collaboration not only between government and private players, but several nations combined, billions of dollars are being invested in different technologies in various series of fundings. Holding the plasma and maintaining the millions of degrees of Celsius heat required to keep the plasma in its ion state is practically difficult. The maximum energy generation target by 2025 is set to 500 MW despite there being no such approach that guarantees sustained fusion reactions. The magnetic approach shows the applicable possibility to keep the plasma in its state, however, still scientists are struggling to sustain it. Thus, it hampers market growth.

The International Thermonuclear Experiment Reactor (ITER) project has 35 member nations including U.S., China. India, Japan, South Korea, and the European Union is being built in southern France. The objective is the investigation and demonstration of burning plasmas—plasmas in which the energy of the helium nuclei produced by the fusion reactions is enough to maintain the temperature of the plasma, thereby reducing or eliminating the need for external heating. The goal is to establish fusion as a large-scale and carbon-free source of energy.

Fusion energy opens numerous opportunities. In the last 30 years of the fusion industry, there has been growth in market players with most of the companies starting in the last decade. The race to fusion energy is old but the industry is still at the experimental stage. The current market players are experimenting and collecting funds through funding series with no revenue. So, there is no such consumption value in the market. Although there are billions of investments being made.

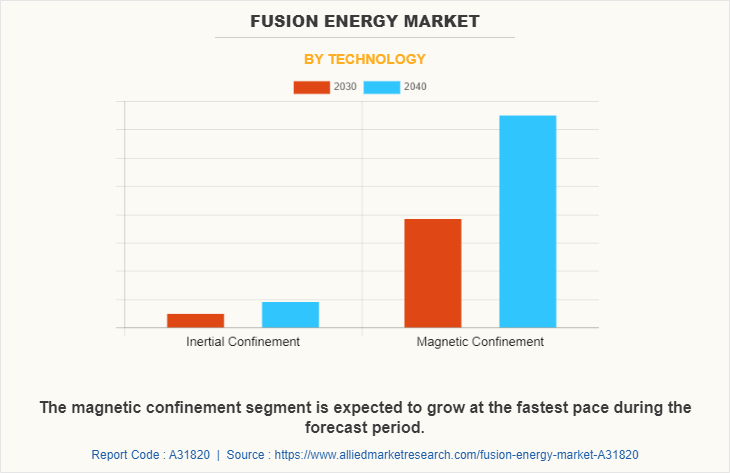

The fusion energy market is segmented on the basis of technology, fuel, and region. By technology, the market is divided into inertial confinement and magnetic confinement. The magnetic confinement segment is expected to garner a higher market share and to continue dominating the fusion energy market growth during the projection period. This is owed to advances in experimentation, theory, modeling, and simulation activities. Moreover, plasma can be controlled and withheld through magnetic forces and the output energy is higher which further adds to the growth in the magnetic confinement approach.

Depending on the fuel, the market is divided into deuterium/tritium, deuterium, deuterium-helium 3, and proton boron. The deuterium/tritium fuel will be dominating the market share for 2030. Deuterium/tritium fuels are widely used for fusion energy production. When deuterium and tritium fuse, they create a helium nucleus, which has two protons and two neutrons. The reaction releases an energetic neutron which further releases a high amount of energy. Thus, the aforementioned reason will further encourage the dominance of deuterium/tritium fuel during the forecast period.

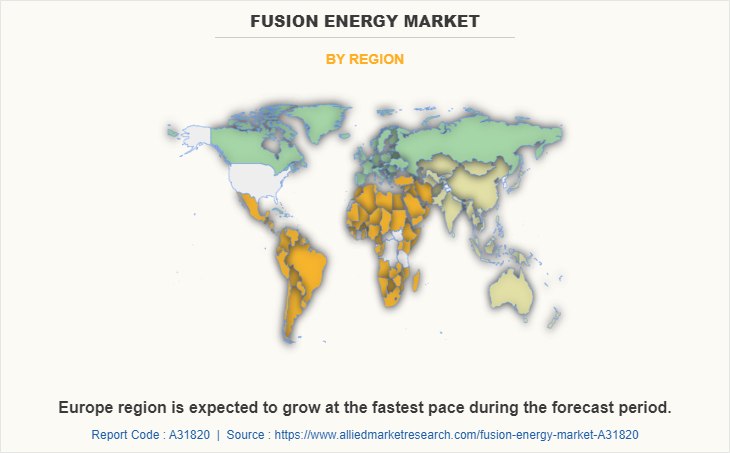

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). North America will hold the major share in fusion energy market owing to early recognition, the presence of technology, and investments in the industry. Moreover, the largest deuterium-extracting plant is based in Canada which also facilitates the growth of the market in the region. However, Europe is expected to grow at a higher pace during the fusion energy market forecast period owing to new entrants in the market in Europe who are capable of securing funding.

Key market players are Agni Fusion Energy, TAE Technologies, Helion Energy, Commonwealth Fusion Systems, General Fusion, Tokamak Energy, Zap Energy, First Light Fusion, Lockheed Martin, Hyperjet Fusion, Marvel Fusion, HB11, Renaissance Fusion, and Kyoto Fusioneering.

Recent scenario and developments in the industry:

In January 2022, the EAST reactor in China broke the record for the longest sustained nuclear fusion with temperatures of 126 million degrees Fahrenheit - roughly five times hotter than the sun – sustained for 17 minutes. China’s EAST reactor is being used to test the technology for the ITER reactor in the south of France, with some estimates now forecasting it could begin working as soon as 2025.

A month later in the UK, scientists at the Joint European Torus laboratory (JET) announced they’d generated a record-breaking 59 megajoules of sustained fusion energy – double the previous record energy output and a further boost for their partners at the ITER project.

The UK has also recently launched the STEP project (Spherical Tokamak for Electricity Production), aiming to develop a reactor that will connect to the national energy grid in the 2040s.

California-based TAE Technologies, the world’s largest private fusion company, has announced it will have a commercial nuclear fusion power plant by 2030, after raising $880 million in funding.

In August 2021, the Lawrence Livermore National Laboratory announced a major breakthrough in nuclear fusion, using powerful lasers to produce 1.3 megajoules of energy – about three percent of the energy contained in one kilogram of crude oil.

There are total 37 government & private players in the industry that are working towards same goal. The challenges faced are same regardless of the different approaches. Around two-third are located in North America. However, nuclear fusion technology is still some way off from being ready to be scaled up for commercial use, but innovation is moving at pace facing toughest challenges in science.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fusion energy market analysis from 2030 to 2040 to identify the prevailing fusion energy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fusion energy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fusion energy market trends, key players, market segments, application areas, and market growth strategies.

Fusion Energy Market Report Highlights

| Aspects | Details |

| Market Size By 2040 | USD 840.3 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2030 - 2040 |

| Report Pages | 182 |

| By Technology |

|

| By Fuels |

|

| By Region |

|

| Key Market Players | Lockheed Martin Corporation, Agni Fusion Energy, HB11 Energy Holdings Pty Ltd, Zap Energy Inc., General Fusion, Hyperjet Fusion Corporation, Tokamak Energy Ltd., Renaissance Fusion, Commonwealth Fusion Systems, Helion Energy Inc., TAE Technologies, Inc., Marvel Fusion, First Light Fusion, Kyoto Fusioneering Ltd. |

Analyst Review

The fusion energy market is highly consolidated in nature. The recent trends in the market show a sharp growth in new entrants and different approaches for fusion energy generation. The market is taking momentum due to growing concerns over carbon emissions. Several policies and regulatory guidelines are pushing toward reducing carbon emissions or else incurring penalties. Moreover, increased activities and experiments leading to new records for sustained fusion energy generation have attracted many private and government institutions to invest in fusion energy projects, which further promotes the market growth for fusion energy. The funding for 2022 alone was around $4.2 billion. The market growth is hampered by delays in achieving practical approaches, energy results, and the ongoing Russo-Ukrainian war.

The leading application of the market is power generation.

The largest regional market for fusion energy is North America.

The estimated industry size of fusion energy is $429.6 billion in 2030

The top companies are TAE Technologies, Helion Energy, Commonwealth Fusion Systems, General Fusion, Tokamak Energy, Zap Energy, First Light Fusion, Lockheed Martin, and Hyperjet Fusion

Loading Table Of Content...