Game Engines Market Research, 2032

The global game engines market size was valued at $2.8 billion in 2023, and is projected to reach $11.4 billion by 2032, growing at a CAGR of 17.1% from 2024 to 2032.

Market Introduction and Definition

A game engine is a software development environment, often known as "game architecture" or "game framework, " comprising settings and configurations that optimize and ease the production of video games across a number of programming languages. A gaming engine may include a 2D or 3D graphics rendering engine that supports various import formats, a physics engine that simulates real-world activities, artificial intelligence (AI) that automatically responds to the player's actions, a sound engine that controls sound effects, an animation engine, and a variety of other features.

Game developers, that are immensely in demand, may simplify and speed up the game production process by employing commercially produced game engines to build new games or to adapt existing games to other platforms.

Key Takeaways

The game engines market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major game engines industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value game engines industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends:

In April 2024, Epic Games and Unity launched Unreal Engine pack of features, a bunch of support, and a community sharing tips and tricks. Unreal Engine and Unity have revolutionized the way video games are developed, making it more accessible for both seasoned studios and aspiring developers.

In March 2024, Jabali raised a $5 million investment which will be used to expand the Jabali team, refine proprietary models, and accelerate the product launch. Jabali is creating a purpose-built, closed-loop feedback workflow and technology for video games and interactive experiences, utilizing the advances in multimodal generative AI.

Key market dynamics

The global game engines market share is growing due to several factors such as growing number of game development schools and courses, advancement in technologies and the growing popularity of esports and online gaming. However, high cost of game engine software act as restraints for the game engines market. As more developers become proficient in this technology, they can create more advanced and sophisticated games, driving demand for a more powerful platform for games. In addition, growing integration of augmented and virtual reality technologies will provide ample opportunities for the market's development during the forecast period.

Augmented and virtual reality technologies have transformed the way consumers engage with digital information, including video games. The market has embraced these technologies and integrated AR and VR capabilities into game engines, allowing developers to create immersive user experiences.

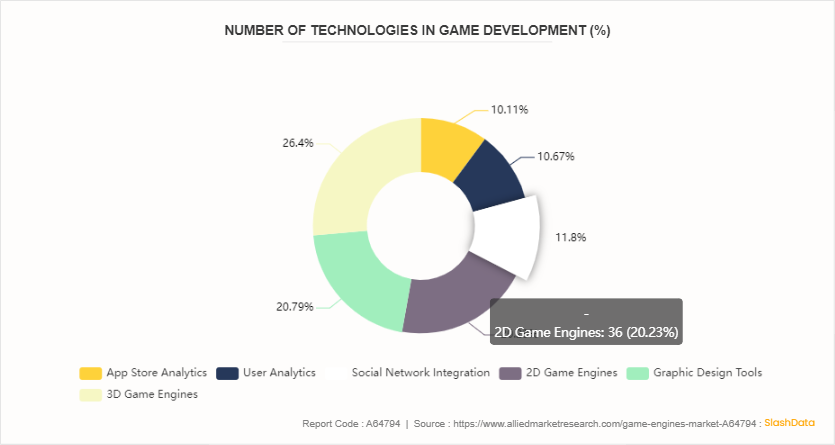

Technologies Used in Game Development Global Game Engines Market

The game engines solutions are growing globally, as approximately 42% of the developer population is active in the gaming sector—whether as a professional, student, or enthusiast. Some of these developers use both 3D and 2D, leading to a total usage of 60% of the game developer population. In addition, the difference between 2D and 3D games lies in the number of axes of motion available to the players. In 2D games, there is no perspective, fewer possible movements, and therefore, fewer interactions with other characters or objects in the game—resulting in these games being typically less complex than 3D games.

Market Segmentation

The game engines market size is segmented into component, type, platform, genre and region. On the basis of component, the market is divided into solution and services. As per type, the market is segregated into 2D game engines, 3D game engines and others. On the basis of platform, the market is classified into mobile, console, computer and others. According to genre, the market is divided into action & adventure, multiplayer online battle arena (MOBA) , real-time strategy (RTS) , role-playing games (RPG, ARPG, CRPG, MMORPG, TRPG, etc.) , sandbox, shooter (FPS & TPS) , simulation and sports and others (puzzle games, survival & horror games, etc.) . Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

In the U.S., game engine development entails using tools like Callgrind to analyze call graphs and understand engine design. Moreover, the expansion of consumer video game technology has led to increasingly sophisticated games, requiring larger project teams, and driving the adoption of software development processes from the large industries. According to the survey from Unity Technologies, in September 2022, it has built a rapidly growing business serving creators in China through its talented local team, robust support for local gaming technology platforms, and by nurturing a highly engaged local community.

In April 2024, the UK government-funded over $3 million for supporting the local gaming startups for the development of 22 games. The money was received by such studios as GLITCHERS, Tiny Rebel Games, Triangular Pixels, Nyamyam, Fumb Games, Spilt Milk Studios, Blazing Griffin, Variable State, Warp Digital Entertainment, Companion Group and others.

In April 2023, the Saudi Arabian government planned to invest $38 billion into the country's gaming sector, betting on the potential for the country to become the next hub for the video game industry.

In June 2023, the UK government allocated an additional of over $5 million to the UK Games Fund, allowing it to provide more support to game companies in the region, to grow the UK economy, and boost creative industries.

Competitive Landscape

The major players operating in the game engines market include Buildbox, Clickteam, Cocos, Crytek GmbH, GameSalad, Marmalade Technologies Ltd., Phaser (Photon Storm Ltd.) , RPG Maker, Scirra Ltd. (Construct 3) , and Stencyl LLC.

Recent Key Strategies and Developments

In February 2024, Disney acquired a massive $1.5 billion equity stake in Epic Games. It also plans to collaborate on an "all-new games and entertainment universe" with the Fortnite developer.

In March 2024, Discord launched its Embedded App SDK, allowing developers to build apps and games that can be played directly within the platform. In addition to the new SDK, Discord is also experimenting with allowing users to add apps to their accounts for use across the platform, rather than being confined to individual servers.

In May 2023, NetEase Games launched a new game studio in Canada called Bad Brain Game Studios. This move represents the expanding commitment to the game development industry in Canada and gives Canadian creators the support they need to build high quality interactive entertainment experiences for a global audience.

Key Sources Referred

Godot Foundation

World Economic Forum

Worcester Polytechnic Institute

University of Calgary

Academia.edu

International Journal of Interactive Multimedia and Artificial Intelligence

Key Benefits For Stakeholders

This report provides a quantitative analysis of the current trends, estimations, and dynamics of the game engines market analysis from 2023 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the game engines market forecast segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global game engines market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global game engines market trends, key players, market segments, application areas, and game engines market growth strategies.

Game Engines Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.4 Billion |

| Growth Rate | CAGR of 17.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 286 |

| By Component |

|

| By Type |

|

| By Platform |

|

| By Genre |

|

| By Region |

|

| Key Market Players | Buildbox, Marmalade Technologies Ltd., Crytek GmbH, RPG Maker, Stencyl LLC, Phaser (Photon Storm Ltd.), Cocos, ClickTeam, GameSalad, Scirra Ltd. (Construct 3) |

Loading Table Of Content...