Gaming Software Market Overview

The global gaming software market was valued at USD 127.1 billion in 2022, and is projected to reach USD 301.5 billion by 2032, growing at a CAGR of 9.3% from 2023 to 2032.

Gaming software is a term that refers to computer programs and apps that are designed for playing video games on various platforms such as personal tablets, computers, mobile devices, gaming consoles, and internet platforms. These programs help the industry flourish by providing developers diverse game engines, development tools, and graphics software that simplify game design and allow for increasingly sophisticated and aesthetically appealing experiences.

Gaming software is a term that refers to computer programs and applications that are designed specifically for playing video games, managing game-related material, or supporting gaming experiences across a variety of devices and platforms. Gaming software is essential for game development, allowing game designers and developers to create, program, and optimize every aspect of a video game, from its storyline and characters to its gameplay mechanics and visual effects. It plays a pivotal role in shaping the gaming industry, offering players a diverse array of gaming experiences across various platforms and genres.

The expansion of competitive gaming and e-sports has been considered a key growth factor for the worldwide gaming software industry. Skilled video gamers participate in a growing global sector. In actuality, e-sports are watched by more than 380 million viewers globally, both online and offline. "Streamers" are gamers who broadcast themselves playing video games live. In its largest e-sports commitment to date, YouTube has partnered with gaming platform Faceit on a multi-year broadcasting deal.

For Sony Playstation Vue, a 24-hour TV network devoted to e-sports, Sony is collaborating with gaming championship organizer ESL. E-sports competitions, where pro gamers play online games like Counter-Strike, Dota 2, and League of Legends, have grown in popularity around the world. This growth is projected to enhance viewership on platforms such as Twitch and YouTube Gaming, attracting sponsorships, advertising income, and even traditional sports investments.

Furthermore, as this sports environment grows, so will the necessity for advanced gaming software. Developers are being driven to build cutting-edge titles with improved visuals, smooth multiplayer capabilities, and spectator-friendly features, which is boosting the need for high-quality gaming software market forecast period.

Cybercriminals view gaming as a lucrative avenue for stealing and selling data or coercing users into sharing banking info through social engineering. High-profile platforms like Sony PlayStation Network, Microsoft Xbox Live, and Steam are prime targets. Globally, gamers have faced numerous credential-stuffing attacks, hampered online transactions, and impacted vendors' revenues. Moreover, games often require social media access, demanding stringent data privacy adherence from vendors. Breaches can erode trust and operational efficiency, posing challenges to market growth. Data synchronization as well as complexities in customer management software & security issues of these integrated platforms may act as market restraints over the forecast period.

The growth drivers for the market are the commercialization of 5G technology, a rise in the number of gamers, an upsurge in immersive and competitive gaming on mobile devices, and an increase in the number of internet users. Virtual reality headsets make it easier to create games that give players a realistic experience. It is possible to create 3D graphics that more closely resemble reality using a combination of VR headsets, modern VR tools, and game engines.

The gaming industry’s business potential, as well as its exciting new technologies, are driving interest in experimenting with virtual reality game development. Cloud gaming is expected to be transformed by 5G internet. Game developers will be able to experiment with high definition and high-quality graphics for internet gaming thanks to high-speed internet. The rise of 5G will have the greatest impact on mobile gaming, as it will allow game developers to experiment with cloud gaming for mobile game users, as well as console-level graphics. Thus, increased popularity of cloud gaming in multiplayer scenarios, greater utilization of cloud gamification, and improved cross-platform gaming experience are among the major factors that are projected to offer growth opportunities for market players during the forecast period.

Segment Overview

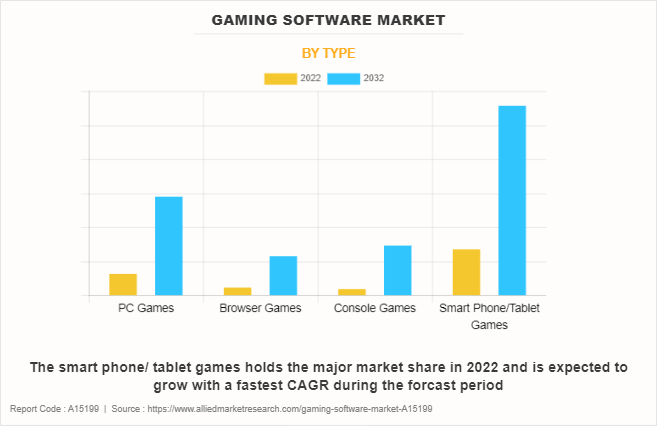

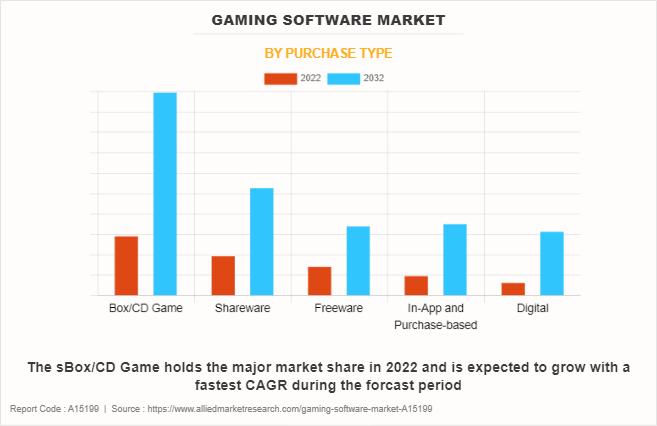

The gaming software market is segmented on the basis of purchase type, type, and region. By purchase type, the market is sub-segmented into box/CD game, shareware, freeware, in-app and purchase-based, and digital. By type, the market is classified into PC Games, browser games, console games, and smart phone/tablet games. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the smartphone/tablet games sub-segment dominated the global gaming software market share in 2022. Smartphones are a good device for video game software programs because they are portable, and it is easier to download games on a mobile phone. During the rise of COVID-19, people started to prefer smartphone gaming apps because new, more immersive games could be played while sitting at home. New technologies like AR, VR, and cloud games have also helped the smartphones sector grow. AR technology is usually used for mobile gaming because it is engaging and can be used in many different types of games.

By purchase type, the box/CD game sub-segment dominated the market in 2022. The box/CD game segment remains a strong and influential component of the gaming software market, driven by a combination of factors that sustain its enduring popularity. box/CD games provide a reliable gaming experience without the need for constant internet connectivity. This makes them a preferred choice for individuals in areas with unreliable or limited internet access. It also ensures that players can enjoy their games even when online servers may be down, contributing to their enduring popularity. The box/CD has ability to cater to a diverse audience, offering a tangible connection to gaming's past while meeting the practical needs of gamers in various regions, all while sustaining a sense of excitement and discovery through limited editions and collectibles. These are predicted to be the major factors affecting the gaming software market size during the forecast period.

By region, North America dominated the global gaming software market in 2022. The growing usage of mobile devices has boosted the North American market for gaming software. Diverse devices with varying screen sizes and graphics enhance user experiences, aligning with evolving technology trends that heighten gaming appeal and demand for software. This anticipates continued growth in the regional gaming software industry throughout the forecast period.

In North America, the gaming software market is a dynamic and thriving industry that continues to evolve with the advancement in technology and changing consumer preferences. North America has a rich gaming heritage, strong e-sports events, and a massive player base. The trend of playing mobile games in the region is driven by the widespread use of smartphones and affordable data plans.

Key Market Players

The key players profiled in this report include Sony Corporation, Valve Corporation, Ubisoft Entertainment S.A., Rockstar Games Inc., Nintendo Co., Ltd., Nexon Co, Ltd., Gameloft, Microsoft Corporation, Nvidia Computer Game Company, and Electronic Arts Inc. Investment and agreement are common strategies followed by major market players. For instance, May 2022 saw the release of Warcraft Arclight Rumble, an action-packed mobile strategy game from Blizzard Entertainment. In some areas, both Android and iOS devices will be compatible with this action-packed mobile approach. The alliance has many advantages, including the ability for gamers to gather over 60 characters from the whole Warcraft universe.

Impact of COVID-19 on the Global Industry

The COVID-19 pandemic led to a significant surge in the demand for gaming software as people sought entertainment and social connection while adhering to lockdowns and social distancing measures. With individuals staying at home, the gaming software market witnessed a substantial increase in remote gaming and online multiplayer games. Platforms like Steam and PlayStation Network experienced higher user engagement.

Online gaming communities and forums flourished during the pandemic, providing a platform for gamers to share experiences, tips, and strategies, further contributing to the gaming software market's vitality.

The gaming software market experienced accelerated growth post-COVID-19, as people continued to seek entertainment and social interaction through video games. Gaming software market growth expanded into emerging markets, as more people gained access to affordable smartphones and reliable internet, creating new opportunities for developers.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gaming software market analysis from 2022 to 2032 to identify the prevailing gaming software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the gaming software market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global gaming software market trends, key players, market segments, application areas, and market growth strategies.

Gaming Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 301.5 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Purchase Type |

|

| By Region |

|

| Key Market Players | Nintendo Co., Ltd., Sony Corporation, GAMELOFT, Nexon Co, Ltd., Nvidia Computer Game Company, Activision Blizzard, Inc., Electronic Arts Inc., Rockstar Games Inc., Valve Corporation, Bethesda Softworks LLC. |

Continuous advancements in hardware and software technologies, including graphics, processing power, and AI, enable more immersive and realistic gaming experiences. VR and AR technologies present opportunities for creating more immersive gaming experiences, attracting new players and enhancing existing ones is estimated to generate excellent opportunities in the gaming software.

The major growth strategies adopted by gaming software market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global gaming software market in future.

Sony Corporation, Valve Corporation, Ubisoft Entertainment S.A., Rockstar Games Inc., Nintendo Co., Ltd., Nexon Co, Ltd., Gameloft, Microsoft Corporation, Nvidia Computer Game Company, and Electronic Arts Inc. are the major players in the gaming software market.

Box/CD game sub-segment of the preaches type acquired the maximum share of the global gaming software market in 2022.

Gamers and game developers’ industries are the major customers in the global gaming software market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global gaming software market from 2022 to 2032 to determine the prevailing opportunities.

Gaming software can be integrated with IoT devices and smart appliances to create interactive and entertaining experiences within the smart home ecosystem. The rise of content creators on platforms like Twitch and YouTube drives the need for gaming software for recording, streaming, and editing gameplay videos is estimated to drive the adoption of gaming software.

The demand for gaming software that can enable smooth gaming across various devices is increasingly urgent as more gadgets are linked to the internet, which is anticipated to boost the gaming software market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...