Gas Compressors Market Overview

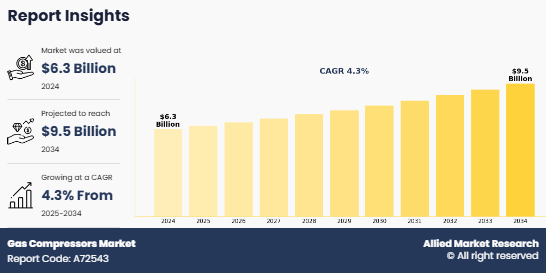

The global Gas Compressor Market Size was valued at $6.3 billion in 2024, and is projected to reach $9.5 billion by 2034, growing at a CAGR of 4.3% from 2025 to 2034.

A gas compressor is a mechanical device designed to increase the pressure of gas by compressing the gas volume. This technique includes trapping a specific volume of gas and mechanically reducing the gap it occupies, causing a growth in pressure. Gas compressors play a crucial role in diverse industries, from powering pneumatic tools and air conditioning systems to facilitating gas transportation and processing in oil & fuel operations. The compression of gases is essential for enhancing their utility and enabling their efficient use in distinctive applications.

Key Takeaways

- The Gas Compressor Market Share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives and Gas Compressor Market Outlook.

The advancement and improvement in the gas compressors equipment have drastically improved their efficiency, reliability, and applicability throughout numerous industries. Recently, the integration of smart sensors and automation technologies has revolutionized the tracking and compression of gas compression processes. These smart structures offer real-time facts on key parameters, which include pressure, temperature, and vibration, permitting proactive maintenance and minimizing downtime. In addition, using superior materials and precision engineering strategies has improved the performance and durability of compressor components, contributing to longer service life and decreased maintenance costs. Such factors are expected to augment the Gas Compressor Market Growth.

Furthermore, the initiation of digitalization and the Industrial Internet of Things (IIoT) has facilitated the development of smart compressors that can be remotely monitored and managed. This connectivity allows operators to optimize the overall performance of compressors, troubleshoot issues, and make data-driven decisions to enhance overall operational performance. Computational fluid dynamics (CFD) simulations and modeling strategies have a key role inside the layout and optimization of compressor components, leading to improved aerodynamics and power efficiency.

Environmental sustainability is increasingly influencing the development of compressor technologies, with a notable shift towards eco-friendly solutions. This Gas Compressor Market Trends is characterized by the adoption of alternative low-global-warming-potential refrigerants and the enhancement of energy recovery systems to improve overall energy efficiency These technological advancements effectively deal with environmental concerns and make a contribution to achieving higher level of energy performance in gas compression techniques. The technological evolution of gas compressors underscores a commitment to efficiency, sustainability, and flexibility to meet the evolving demands of industries such as chemical and automobile.

The surge in demand for compressed natural gas (CNG) as an alternative and cleaner gasoline source in transportation is expected to drive the gas compressors market growth. CNG has emerged as a feasible choice for powering vehicles owing to surge in emphasis on reduction of carbon emissions and transitioning toward more sustainable strength solutions. Gas compressors play a pivotal role in compressing natural gas to high pressures suitable for storage and transportation, allowing its use as a fuel for buses, trucks, and even some passenger cars.

The adoption of CNG facilitates lower greenhouse gas emissions and diversifies the power mix within the transportation sector. This factor is especially significant in regions wherein there is a concerted attempt to promote cleaner fuels and decrease dependency on traditional fuel and diesel. Gas compressor producers have an Gas Compressor Market Opportunity to capitalize in this trend by means of developing revolutionary and efficient compression solutions tailored to the particular necessities of CNG applications, thereby contributing to the broader goals of environmental sustainability and promoting cleaner transportation alternatives worldwide.

Factors such as increase in hydrogen consumption from end-user industries and construction of hydrogen pipeline infrastructure are expected to boost the growth of the Gas Compressor Market. Furthermore, there is an observed increase in demand for oil-based lubricating gas compressors in recent years. This is attributed to the fact that oil-based lubricating gas compressors are more efficient than oil-free gas compressors, as oil functions as a cooling medium, eliminating around 80% of the heat generated by the compressor during compression. Thus, this factor is expected to notably contribute toward the gas compressors industry growth during the forecast period. However, the risk of early wear and tear of gas compressor components, owing to inadequate lubrication, potentially increases the maintenance cost of oil-based lubricating gas compressors.

In addition, high purchase and maintenance costs of gas compressors hamper the market growth. Various key players in the Gas Compressor Market have adopted strategies such as an agreement to develop new hydrogen compressors with the latest technology. For instance, in February 2021, Burckhardt Compression signed an agreement with Switzerland-based company, GRZ Technologies aiming to develop new hydrogen compression technology.

Technological advancements in gas compressors system, which include improvements in compression performance and the development of compact and transportable devices, present producers with opportunities to provide more powerful solutions for numerous industrial applications. This increase in demand for gas compressors aligns with the broader tendencies of industrialization and urbanization, creating a positive environment for gas compressor manufacturers to cater to the evolving energy necessities and contribute to the improvement of strong and dependable compression systems for a huge range of programs across a couple of sectors. Such factors are expected to offer different opportunities for the growth of the gas compressors market during the forecast period.

Segmentation Review

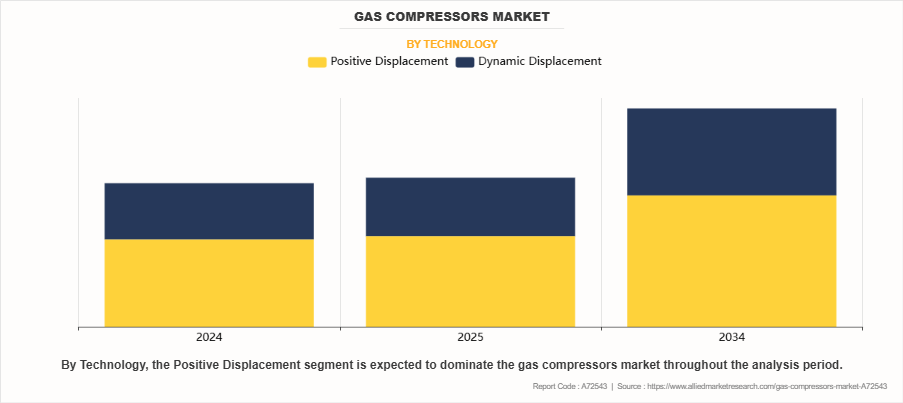

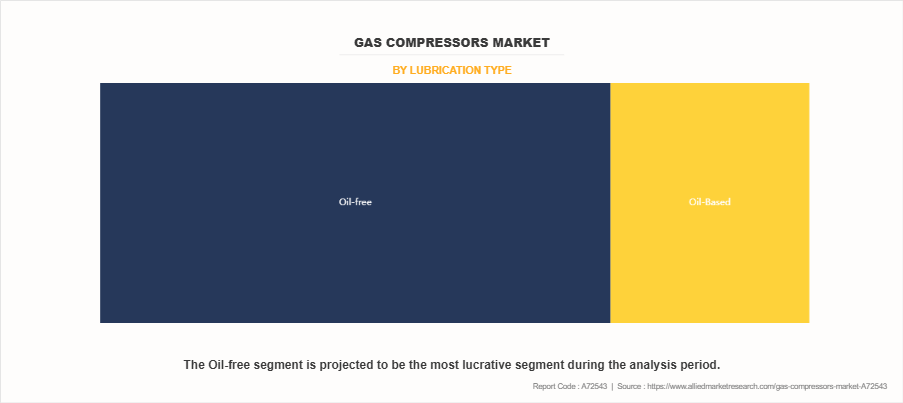

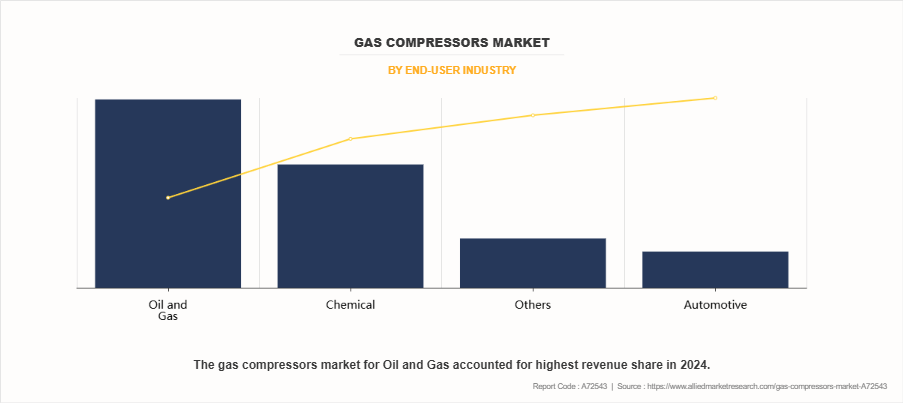

The gas compressors market is segmented on the basis of technology, lubrication type, end-user industry, and region. By technology, the Gas Compressor Marketis categorized into positive displacement and dynamic displacement. By lubrication type, it is bifurcated into oil-based and oil-free. By end-user industry, the Gas Compressor Market is classified into oil & gas, chemical, automotive, and others. Region wise, the Gas Compressor Market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Technology

The gas compressors market is divided into positive displacement and dynamic displacement. The positive displacement segment includes reciprocating compressors, rotary screw compressors, rotary vane compressors, and others. The dynamic displacement segment includes centrifugal compressors and axial compressors.

By Lubrication Type

The gas compressors market is bifurcated into oil-based and oil-free. In 2022, the oil free segment dominated the gas compressors market, in terms of revenue, and is expected to maintain this trend during the Gas Compressor Market Forecast period. It is crucial to maintain high-purity gas in applications, such as fuel cells, semiconductor manufacturing, and certain industrial processes, for optimal performance. Oil-free compressors eliminate the risk of oil contamination, ensuring the purity of compressed gas, which drives the demand for these compressors in industries that require ultra-clean gas. In addition, oil-free compressors mitigate safety concerns associated with oil-based compressors.

By End-User Industry

The gas compressors market is categorized into oil & gas, chemical, automotive, and others. In 2022, the oil & gas segment dominated the gas compressors market, in terms of revenue, and is expected to maintain this trend during the forecast period. However, the automotive segment is expected to exhibit the highest CAGR during the forecast period.

The increase in investment in the oil & gas sector is likely to boost the demand for gas compressors. In addition, surge in adoption of hydrogen fuel cell vehicles is expected to positively influence the demand for gas compressors. For instance, a Combined Hybrid Solution of Metal Hydride and Mechanical Compressors (COSMHYC), a research project funded by the Fuel Cell and Hydrogen Joint Undertaking of the European Commission, developed an innovative metal hydride compressor prototype, and started its testing. In the preliminary tests, the COSMHYC metal hydride compressor prototype achieved high-pressure values of more than 430 bar.

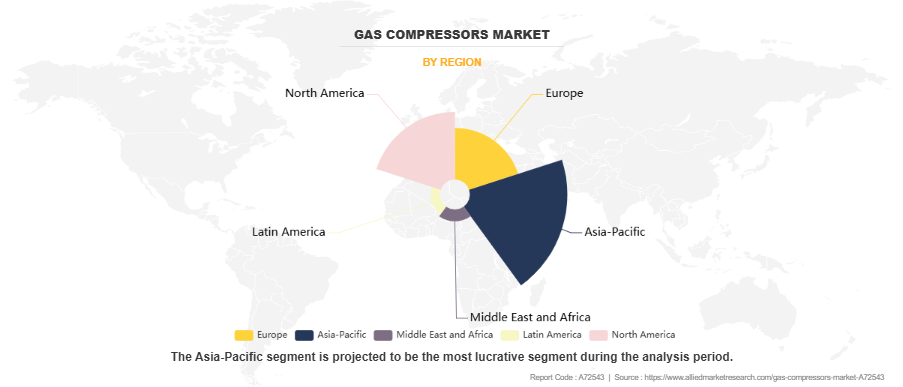

By Region

The gas compressors market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific accounted for the highest Gas Compressor Market share in 2022 and North America is expected to exhibit the highest CAGR during the forecast period. Asia-Pacific constitutes the fastest growing manufacturing hubs such as China, Japan, India, South Korea, and Thailand, which acts as a key driving force for Gas Compressor Market expansion. In addition, the availability of labor and rapid industrialization drive the Gas Compressor Market growth in the Asia-Pacific region. Moreover, China is the largest producer and exporter of hydrogen compressors in Asia-Pacific, followed by Japan and India, which are still expanding its manufacturing capabilities.

Furthermore, rapid industrialization and government initiatives for upliftment of manufacturing sector in automotive and chemical industries drive the growth of the gas compressors market share in Asia-Pacific. For instance, in March 2022, Sinopec, China’s second-largest oil company invested $476 million in hydrogen technology R&D and has planned a number of pilot green hydrogen projects. The company is expected to prioritize the development of renewable-energy projects, particularly those involving hydrogen, in its transition to a low-carbon business structure. Hence, such factors provide lucrative opportunities for the growth of the Gas Compressor Market.

Competition Analysis

Competitive analysis and profiles of the major players in the gas compressors market, such as ARIEL CORPORATION, Atlas Copco AB, BAUER COMPRESSORS, INC., Burckhardt Compression Holding AG, HAUG Sauer Kompressoren AG, Hitachi Ltd., IDEX CORPORATION, Ingersoll Rand Inc., KAESER KOMPRESSOREN, and Siemens Energy are provided in this report. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the gas compressors market.

Key Benefits For Stakeholders

- This report provides a quantitative Gas Compressor Market Analysis of the market segments, current trends, estimations, and dynamics of the gas compressors market analysis from 2024 to 2034 to identify the prevailing gas compressors market opportunities.

- The Gas Compressor Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas compressors market segmentation assists to determine the prevailing Gas Compressor Industry opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the Gas Compressor Industry players.

- The report includes the analysis of the regional as well as global gas compressors market trends, key players, market segments, application areas, and market growth strategies.

Gas Compressors Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 9.5 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 300 |

| By Technology |

|

| By Lubrication Type |

|

| By End-User Industry |

|

| By Region |

|

| Key Market Players | HAUG Sauer Kompressoren AG, Atlas Copco Group, Siemens Energy, KAESER COMPRESSORS, Ariel Corporation, IDEX Corporation, Ingersoll Rand, Hitachi Ltd., BAUER COMPRESSORS, INC., Burckhardt Compression |

Analyst Review

Gas compressors play a vital role across multiple industries, including oil & gas, chemical manufacturing, and the automotive sector, where they are used for various applications such as gas transmission, refrigeration, and fuel injection systems. The market offers several types of gas compressors tailored to specific operational needs. These include reciprocating compressors for high-pressure applications, rotary screw and rotary vane compressors for continuous operation in industrial settings, and centrifugal and axial compressors commonly used in large-scale gas processing plants due to their high efficiency and capacity.

Key industry players are continuously enhancing their product portfolios to meet evolving demands and environmental standards. For instance, in May 2021, Ariel Corporation introduced its API 618 moderate speed compressors, designed specifically for hydrogen refueling stations. These compressors operate at piston-comparable speeds akin to long-stroke, slow-speed units, offering improved efficiency and durability. This innovation supports the growing adoption of hydrogen as a clean energy source, particularly in the transportation and industrial sectors.

The development of advanced compressor technology enables end users to reduce energy consumption, enhance operational reliability, and comply with strict emission regulations. These technological advancements, along with the expanding application base of gas compressors in both traditional and emerging sectors, are expected to drive substantial market opportunities in the coming years. The demand for innovative gas compression systems is likely to grow steadily as industries shift toward energy-efficient and sustainable solutions.

The gas compressors market was valued at $6,276.2 million in 2024 and is estimated to reach $9,543.1 million by 2034, exhibiting a CAGR of 4.3% from 2025 to 2034.

2025-2034 would be forecast period in the market report.

$6,276.2 million is the market value of Gas compressor market in 2024. The market is studied across North America, Europe, Asia-Pacific, and LAMEA.

2024 is base year calculated in the Gas compressor market report. The leading companies adopt strategies such as product launch, partnership, acquisition, expansion, and collaboration to strengthen their market position.

ARIEL CORPORATION, Atlas Copco AB, BAUER COMPRESSORS, INC., Burckhardt Compression Holding AG, HAUG Sauer Kompressoren AG, Hitachi Ltd are the top companies hold the market share in Automotive Tire Market.

Loading Table Of Content...

Loading Research Methodology...