Gas Insulated Substation Market Research, 2033

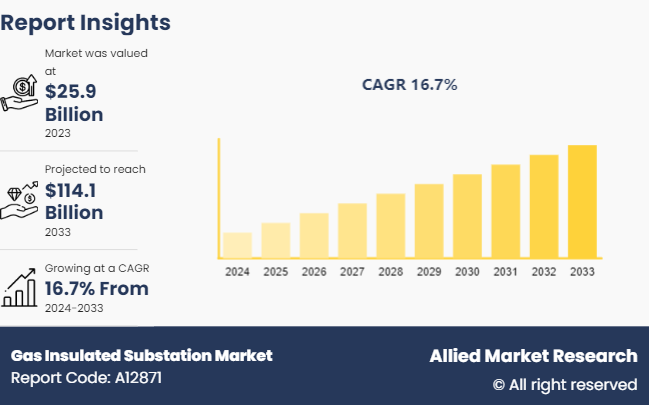

The global gas insulated substation market size was valued at $25.9 billion in 2023, and is projected to reach $114.1 billion by 2033, growing at a CAGR of 16.7% from 2024 to 2033.

Market Definition and Overview

A gas insulated substation (GIS) is a compact, high-voltage substation in which the major electrical components are encapsulated in a gas-insulated metal enclosure, typically filled with sulfur hexafluoride (SF₆) gas. This gas serves as an insulating and arc-quenching medium, enabling the substation to operate at high voltages with minimal space requirements. GIS technology is used in areas where space is limited, such as urban environments or rugged terrains, and provides enhanced reliability and safety compared to conventional air-insulated substations. Its compact design reduces maintenance needs and exposure to environmental factors, making it ideal for high-voltage transmission and distribution networks where space, environmental impact, and system stability are critical considerations.

Key Takeaways

- The gas insulated substation market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major gas insulated substation industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Market Dynamics

The growing global energy demand is a key driving factor in the gas insulated substation market growth. As energy consumption rises, particularly in urban and industrial areas, the need for efficient, reliable, and compact power distribution systems becomes increasingly critical. GIS technology offers a space-saving solution with enhanced safety and reliability, making it ideal for high population-density regions and areas with limited space. Additionally, GIS's ability to operate under harsh environmental conditions with minimal maintenance further supports its adoption. As countries expand their power grids to meet increasing energy needs, the demand for GIS is expected to surge significantly.

The gas-insulated substation (GIS) market faces a significant restraint due to high initial costs associated with installation and setup. GIS systems, while offering advantages such as compact design and enhanced safety, require substantial investment compared to traditional air-insulated substations. This high capital expenditure can be a barrier for adoption, particularly in cost-sensitive markets or projects with tight budgets, potentially limiting their widespread implementation.

Technological advancements in gas-insulated substations (GIS) are significantly expanding market opportunities. Innovations such as enhanced insulation materials and advanced digital monitoring systems are driving the evolution of GIS technology. These improvements offer higher reliability, efficiency, and safety, making GIS solutions increasingly attractive for modern power grids. The development of SF6-free alternatives and more compact designs further boosts their appeal by addressing environmental concerns and space limitations.

Public Policies in the Global Gas Insulated Substation Market

Public policies in the global gas insulated substation (GIS) market can significantly influence its development and adoption.

- Environmental Regulations: Policies aimed at reducing greenhouse gas emissions encourage the adoption of SF6-free technologies, like GE's g3 circuit-breaker, to meet stricter environmental standards.

- Energy Efficiency Standards: Regulations promoting energy-efficient infrastructure boost demand for GIS solutions, which offer improved performance and reduced footprint compared to traditional systems.

- Renewable Energy Integration: Supportive policies for integrating renewable energy sources into the grid drive the need for advanced GIS technologies to manage and distribute power efficiently.

- Modernization Grants and Incentives: Government grants and incentives for upgrading aging infrastructure can accelerate GIS adoption, offering financial support for the transition to modern, compact solutions.

- Urban Development Policies: Urban planning policies that prioritize space-saving infrastructure solutions favor GIS installations, as they require less physical space than traditional substations.

Market Segmentation

The market is segmented into voltage, installation, end user, and region. On the basis of voltage, the market is divided into medium, high, extra-high, and ultra-high. As per installation, the market is divided into indoor and outdoor. On the basis of end user, the market is divided into power distribution, transmission, generation, and infrastructure. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific gas insulated substation market share is driven by rapid urbanization, industrial growth, and increasing demand for reliable and compact power infrastructure. The region's growing focus on upgrading aging electrical grids and integrating renewable energy sources further fuels GIS adoption. Additionally, the need for space-efficient solutions in densely populated urban areas and the emphasis on reducing environmental impact support the market's expansion, making GIS a key component in enhancing power distribution and reliability.

- In April 2023, Eaton acquired a 49% stake in Jiangsu Ryan Electrical Co. Ltd., a key player in China's power distribution and sub-transmission transformer market. This strategic move enhances Eaton's presence in the transformer sector, complementing its gas-insulated substation (GIS) offerings. By integrating Ryan’s expertise, Eaton aims to bolster its GIS solutions with advanced transformer technology for improved power distribution.

Competitive Landscape

The major players operating in the gas insulated substation market include General Electric Company, Hitachi Ltd., ABB Ltd, Larsen & Toubro Limited, Siemens AG, Mitsubishi Electric Corporation, Eaton Corporation PLC, Toshiba Corp, CG Power and Industrial Solutions Ltd, and Schneider Electric SE.

Recent Key Strategies and Developments

In April 2019, J. Murphy & Sons Ltd. secured a $31 million contract from National Grid to design and construct a new energy substation in Barking, London. The project includes a gas-insulated switchgear (GIS) substation and the installation of new cables to integrate with the national power grid. This development enhances the region's power infrastructure with advanced GIS technology.

Industry Trends

- In March 2023, the Kerala State Electricity Board (KSEB) inaugurated its first 220 kV gas-insulated substation in north Malabar, funded by the Kerala Infrastructure Investment Fund Board (KIIFB) under the Trans Grid 2.0 project. The substation, equipped with two 100 MVA 220/110 kV transformers, ensures consistent electricity supply, highlighting the reliability and efficiency of gas-insulated substations in modern power infrastructure.

- In March 2022, GE Renewable Energy's Grid Solutions introduced the world's first 420 kV, 63 kA g³ gas-insulated substation (GIS) circuit-breaker prototype, a significant breakthrough in the power sector. This SF6-free technology, unveiled to European transmission utilities, paves the way for a more sustainable high-voltage GIS. The commercial launch of GE's 420 kV fully g³ GIS is expected in 2023.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Government Publications

- Industry Publications and News Outlets

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas insulated substation market analysis from 2024 to 2033 to identify the prevailing gas insulated substation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas insulated substation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Gas Insulated Substation Market Forecast period.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas insulated substation market trends, key players, market segments, application areas, and market growth strategies.

Gas Insulated Substation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 114.1 Billion |

| Growth Rate | CAGR of 16.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Voltage |

|

| By Installation |

|

| By End-User |

|

| By Region |

|

| Key Market Players | CG Power and Industrial Solutions Ltd, Eaton Corporation plc, Hitachi Ltd., Schneider Electric SE, Larsen & Toubro Limited, Mitsubishi Electric Corporation, General Electric Company, ABB Ltd, Toshiba Corp, Siemens AG |

Upcoming trends in the global gas-insulated substation (GIS) market include increased adoption of SF6-free technologies, advancements in digitalization for real-time monitoring, and growing demand for compact, high-efficiency solutions.

The leading application of the gas-insulated substation (GIS) market is in urban and industrial environments where space is limited. GIS technology offers compact, reliable, and efficient power distribution solutions.

Asia-Pacific is the largest regional market for gas insulated substation.

The gas insulated substation market was valued at $25.9 billion in 2023 and is estimated to reach $114.1 billion by 2033, exhibiting a CAGR of 16.7% from 2024 to 2033.

The major players operating in the gas insulated substation market include General Electric Company, Hitachi Ltd., ABB Ltd, Larsen & Toubro Limited, Siemens AG, Mitsubishi Electric Corporation, Eaton Corporation PLC, Toshiba Corp, CG Power and Industrial Solutions Ltd, and Schneider Electric SE.

Loading Table Of Content...