Gas Insulated Transformer Market Research, 2033

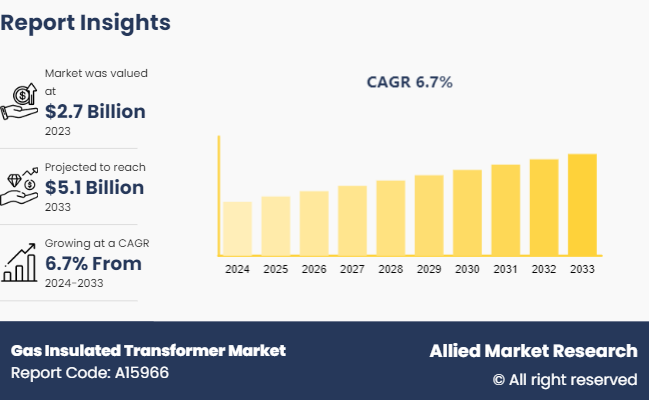

The global gas insulated transformer market size was valued at $2.7 billion in 2023, and is projected to reach $5.1 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Market Definition and Overview

A Gas Insulated Transformer (GIT) is a type of electrical transformer that uses gas, typically sulfur hexafluoride (SF6) , as the insulating medium instead of traditional oil. These transformers are designed to be compact, highly reliable, and safe for use in confined spaces, making them ideal for urban environments and indoor installations. The gas insulation provides excellent electrical insulation and arc-quenching properties, reducing the risk of fire and ensuring long-term stability. GITs are particularly advantageous in environments with high humidity or pollution, where traditional oil-filled transformers might suffer from performance degradation. They also require less maintenance and have a lower risk of leakage compared to oil-insulated transformers, contributing to their rising popularity in modern power systems.

Key Takeaways

- The gas insulated transformer market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major gas insulated transformer industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Market Dynamics

Rising energy demand and the need for stable and efficient power supply systems are significantly boosting the adoption of Gas Insulated Transformers (GITs) in various industries and utilities. With urbanization and industrialization on the rise, especially in developing regions, there is an increasing pressure on existing power infrastructure to handle higher loads, reduce transmission losses, and ensure reliable energy distribution, necessitating advanced technologies like GITs. GITs offer a compact, reliable solution with superior insulation and reduced fire risk, making them ideal for densely populated areas. In addition, their low maintenance requirements and resilience in harsh environmental conditions further drive their adoption. Consequently, the gas insulated transformer market is experiencing robust growth as industries seek to enhance energy efficiency and stability. All these factors are projected to drive market growth during the forecast period.

The gas insulated transformer market faces a significant restraint in the form of high initial costs. GITs are more expensive upfront compared to traditional oil-filled transformers, primarily due to the costly materials and advanced technology required for their construction. This includes the use of sulfur hexafluoride (SF6) gas for insulation and complex manufacturing processes. These higher initial costs can deter potential buyers, particularly in regions or industries with budget constraints, thus slowing the widespread adoption of GIT technology.

The gas insulated transformer market growth is witnessing significant expansion due to technological advancements and innovations in gas insulation technology and materials. These innovations enhance the performance and cost-efficiency of GITs, making them more attractive for various applications. Improved materials offer better insulation properties, reducing the risk of electrical failures and extending the lifespan of transformers. In addition, advancements in gas insulation technology contribute to smaller, more compact designs, allowing for easier installation in urban and confined spaces. These developments not only lower operational and maintenance costs but also support the rising demand for reliable, efficient, and sustainable power solutions in modern power systems.

Parent Market Overview

The global power transformers market serves as the parent market for gas insulated transformers. This market includes a variety of transformers essential for adjusting voltage levels in power transmission and distribution networks. Power transformers, including GITs, are critical for ensuring efficient energy transfer across long distances and varying voltage requirements. The market growth is driven by increasing electricity demand, expanding renewable energy projects, and the need for modernizing aging grid infrastructure. Technological advancements, such as smart grid integration and improved energy efficiency, further boost market growth. GITs specifically cater to urban areas with space constraints and require minimal maintenance, making them a preferred choice for such areas. The overall power transformers market is poised for significant growth due to ongoing global electrification efforts and the shift towards more sustainable energy solutions.

Market Segmentation

The market is segmented into voltage, installation, end user, and region. On the basis of voltage, the market is classified into low voltage (up to 72.5 KV) , medium voltage (72.5 KV - 220 KV) , and high voltage (above 220 KV) . As per installation, the market is divided into indoor and outdoor. On the basis of end user, the market is classified into industrial, commercial, and utility. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific gas insulated transformer market share growth is driven by rapid urbanization and infrastructure development across the region. Rising demand for reliable and space-efficient electrical systems in densely populated cities boosts the adoption of gas-insulated transformers. In addition, increasing investments in smart grid technologies and renewable energy integration further boost the regional market growth. Governments and utilities in the region prioritize modernization of power infrastructure to enhance efficiency and reduce environmental impact, creating a robust demand for advanced gas-insulated transformer solutions.

- In December 2021, the Indian Government approved 23 interstate transmission system (ISTS) projects with a total investment of approximately $2.1 billion. Among these, 13 projects will be developed under a tariff-based competitive bidding (TBCB) scheme, costing around $1.78 billion. The remaining ten projects will follow a regulated tariff approach, requiring an investment of $0.14 billion. These initiatives aim to enhance India’s transmission and distribution infrastructure significantly.

Competitive Landscape

The major players operating in the gas insulated transformer market report include Meidensha Corp., Mitsubishi Electric Corporation, Trench Group, Chint Group, Toshiba Corp, Takaoka Toko Co. Ltd, Shihlin Electric and Engineering Corp., Nissin Electric Co. Ltd, Arteche Group, Hyosung Heavy Industries Corp., and others.

Recent Key Strategies and Developments

- In August 2022, Hitachi Energy released the EconiQ 420kV circuit breaker, which complements Gas Insulated Transformers (GITs) by providing enhanced protection and reliability in high-voltage systems. This circuit breaker integrates seamlessly with GIT technology to optimize performance and safety.

- In December 2021, Pfiffner and Trench, AIS Instrument Transformer manufacturers, announced their focus on SF6-free transformers. While SF6 is traditionally used for its safety properties in AIS High Voltage Instrument Transformers, it is a potent greenhouse gas. This shift towards SF6-free technology aligns with the rising trend in Gas Insulated Transformers (GITs) to improve environmental sustainability and reduce global warming impacts.

Industry Trends

- In November 2021, Goa's Power Minister announced plans to build the state's first gas-insulated substation, costing around $4.3 million. The substation will serve residents in Davorilm, Navelim, and parts of Margao and Curtorim. In addition, there are plans to extend gas-insulated substation (GIS) technology throughout the state to enhance power infrastructure and reliability.

- In October 2021, Egypt and Greece finalized a $2.77 billion deal for the EU-backed EuroAfrica Interconnector subsea cable. The HVDC project will have an initial capacity of 1 GW, linking Egypt to Greece via Cyprus. The Egypt-Cyprus segment of the EuroAfrica Interconnector became operational in December 2022, while the Cyprus-Crete connection was completed by December 2023.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Government Publications

- Industry Publications and News Outlets

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas insulated transformer market analysis from 2023 to 2033 to identify the prevailing gas insulated transformer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas insulated transformer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global gas insulated transformer market trends, key players, market segments, application areas, and gas insulated transformer market forecast period growth strategies.

Gas Insulated Transformer Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.1 Billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Voltage |

|

| By Installation |

|

| By End User |

|

| By Region |

|

| Key Market Players | Toshiba Corp, Shihlin Electric and Engineering Corp., Trench Group, Nissin Electric Co. Ltd, Takaoka Toko Co. Ltd, Mitsubishi Electric Corporation, Hyosung Heavy Industries Corp., Meidensha Corp., Chint Group, Arteche Group |

Upcoming trends in the global gas insulated transformer market include increasing demand for compact and efficient energy solutions, advancements in smart grid technologies, and rising investments in renewable energy infrastructure.

The leading application of gas insulated transformer is in urban infrastructure development, where compact and reliable transformers are essential for efficient power distribution in densely populated areas.

Asia-Pacific is the largest regional market for gas insulated transformer.

The gas insulated transformer market is estimated to reach $5.1 billion by 2033, exhibiting a CAGR of 6.7% from 2024 to 2033.

The major players operating in the gas insulated transformer market include Nissin Electric Co. Ltd, Arteche Group, Hyosung Heavy Industries Corp., Meidensha Corp., Mitsubishi Electric Corporation, Trench Group, Chint Group, Toshiba Corp, Takaoka Toko Co. Ltd, and Shihlin Electric and Engineering Corp.

Loading Table Of Content...