Gas Pipeline Infrastructure Market Research, 2030

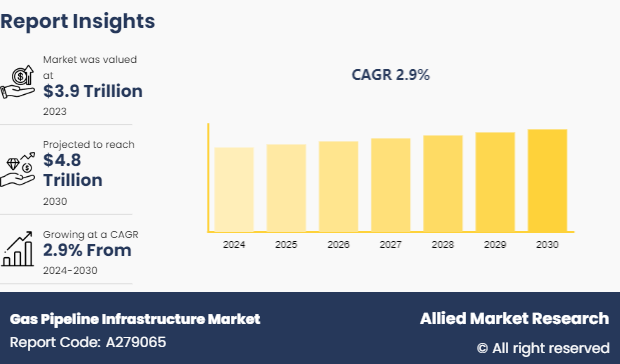

The global gas pipeline infrastructure market was valued at $3.9 trillion in 2023, and is projected to reach $4.8 trillion by 2030, growing at a CAGR of 2.9% from 2024 to 2030.

Introduction

Gas pipeline infrastructure involves a vast network of pipelines, stations, and control centers designed to transport natural gas efficiently and reliably from production sources to end-users. This infrastructure is vital for supplying natural gas for residential, commercial, industrial, and power generation purposes. Operations within gas pipeline infrastructure can be categorized into transmission and distribution segments. Transmission pipelines transport gas over long distances at high pressures, connecting production areas to distribution points, while distribution pipelines deliver gas to local communities at lower pressures. Various equipment components, including pipelines, compression stations, metering stations, and control centers, work together to ensure the seamless flow of natural gas. The abovementioned components play essential roles in maintaining the integrity, safety, and efficiency of transportation of gas through pipeline infrastructure. Furthermore, gas pipeline infrastructure serves diverse applications, including onshore and offshore transportation, catering to different geographical and operational requirements. The network of gas pipeline infrastructure plays a fundamental role in meeting the energy needs of societies and industries worldwide.

Key Takeaways

- The gas pipeline infrastructure market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major valine industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Market Dynamics

The increase in energy demand, fueled by industrial expansion, urbanization, and a growing global population, drives the need for expanded pipeline networks to transport natural gas efficiently and meet escalating energy needs. According to the International Energy Agency (IEA) , “global energy demand is projected to increase by nearly 25% by 2040, with natural gas playing a growing role in meeting this demand due to its versatility and relative cleanliness compared to other fossil fuels”. In addition, the shift towards cleaner energy sources positions natural gas as a vital alternative to coal and oil, leading to increased investments in pipeline infrastructure to support the transition to low-carbon energy solutions and reduce greenhouse gas emissions. The International Gas Union (IGU) reports that natural gas emits significantly less carbon dioxide and pollutants than coal or oil when used for power generation, making it a preferred choice in efforts to reduce greenhouse gas emissions and combat climate change.

Technological advancements play a crucial role in driving the market forward. Innovations in pipeline technology, including the use of advanced materials, sophisticated monitoring systems like SCADA, and enhanced safety measures, enhance construction efficiency, operational reliability, and overall performance of gas pipeline infrastructure. Data from the Pipeline and Gas Journal indicates that advancements in pipeline technology have led to substantial improvements in pipeline safety, efficiency, and reliability. These technological improvements not only optimize operations but also contribute to cost-effectiveness and sustainability in the industry.

The high initial investment and maintenance costs associated with constructing, operating, and maintaining gas pipeline infrastructure hinder the development of the market. According to research by the American Gas Association (AGA) shows that the “capital costs of pipeline projects can be substantial, serving as a barrier to entry, especially for developing regions and smaller market players.” In addition, environmental and regulatory challenges present another obstacle to the market. Concerns regarding environmental impact assessments, permitting processes, and stakeholder consultations can lead to project delays or cancellations, impacting market growth.

A study published in the Journal of Environmental Management emphasizes “the complexity of navigating environmental and regulatory frameworks for pipeline projects, highlighting the critical need for industry compliance and community engagement efforts.” Moreover, volatility in natural gas prices influences the profitability and feasibility of pipeline projects in developing countries, impacting investment decisions and market dynamics. Fluctuations in natural gas prices are subject to a wide range of factors such as supply-demand dynamics, weather patterns, geopolitical events, and global economic conditions, adding uncertainty to project planning and execution. The abovementioned restraints show the multifaceted challenges faced by the gas pipeline infrastructure market, requiring stakeholders to navigate financial, environmental, and market uncertainties effectively to ensure sustainable growth and operational success.

In the gas pipeline infrastructure market, various opportunities offer avenues for growth and advancement. Expansion in emerging markets presents a significant opportunity for gas pipeline infrastructure development to meet the rising energy demands in rapidly industrializing and urbanizing economies. Reports from the World Bank and the International Finance Corporation highlight “the growth potential of emerging markets in Asia, Africa, and Latin America, driving investments in energy infrastructure, including gas pipelines.” The integration of advanced technologies such as the Internet of Things (IoT) , artificial intelligence (AI) , and predictive analytics in pipeline monitoring and management presents opportunities to enhance operational efficiency, safety, and reliability. Offshore pipeline projects offer another promising opportunity for the gas pipeline infrastructure market. Increasing exploration and production activities in offshore basins create opportunities for the development of offshore gas pipeline infrastructure, expanding the market scope and catering to the transportation of gas reserves from offshore production sites to onshore processing facilities for distribution. The abovementioned provide opportunities for innovation, growth, and market expansion within the gas pipeline infrastructure sector, enabling stakeholders to leverage emerging trends and technologies to drive operational excellence and capitalize on evolving market dynamics.

Segment Overview

The gas pipeline infrastructure market is segmented into operation, equipment, application, and region. By operation, the market is classified into transmission and distribution. On the basis of equipment, the market is segregated into pipelines, compression stations, metering stations, pipeline operation control centers, cathodic protection stations, SCADA, and others. As per the application, the market is categorized into onshore, and offshore. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific Investment in the Gas Pipeline Infrastructure

In the Asia-Pacific region, both China and India stand out for their significant contributions to gas pipeline infrastructure development. China leads globally with a substantial network of major midstream pipelines under construction and proposed extensions, totaling 26,300 km and 29, 800 km, respectively, representing a noteworthy asset risk of $89.1 billion. The country's commitment to gas infrastructure, highlighted in the Five-Year Plan for 2021–2025, that shows its strategic focus on energy security and sustainability despite challenges posed by slower growth forecasts in 2022 and the need to balance fossil fuel expansion with environmental goals. On the other hand, India ranks second globally, with 16,200 km of pipelines under construction and 2,200 km proposed, signaling a stranded asset risk of $14.7 billion. Prime Minister Narendra Modi's ambition to increase the gas fraction in the energy mix and the ongoing efforts to enhance the gas pipeline network reflect India's drive to diversify its energy sources, transition towards cleaner fuels, and address infrastructure limitations impeding gas sector growth.

The future prospects for gas pipeline infrastructure in the Asia-Pacific region appear promising, underpinned by China and India's ambitious expansion plans and strategic initiatives. The integration of regional gas grids, such as China's "one nation, one gas grid" plan and India's efforts to double its pipeline length, demonstrate a concerted push towards enhancing connectivity, accessibility, and efficiency in the gas sector. As both countries navigate the complex landscape of energy transition, economic growth, and environmental sustainability, strategic investments, regulatory support, and technological advancements will play pivotal roles in shaping the trajectory of gas pipeline infrastructure development. By leveraging these opportunities and addressing infrastructure challenges, China and India are poised to play significant roles in driving the evolution of gas pipeline networks in the Asia-Pacific region, contributing to energy security, economic development, and environmental stewardship.

Competitive Analysis

Key market players in the gas pipeline infrastructure market include NOV Inc., Gazprom, CRC Evans, GAIL Limited, General Electric, APA Group, TMK Group, Welspun, Saipem S.p.A, Sinopec Group, and others such as PipeChina, Nigerian National Petroleum Corporation, China National Petroleum Corporation, Transnet, Ministry of Petroleum of Iran, Guizhou Wujiang Energy Group Co., Ltd., Moroccan National Board of Hydrocarbons and Mines, Transgaz, Alaska Gasline Development Corporation, Indian Oil Corporation Ltd., Turkmengaz, Gujarat State Petronet, TC Energy, Empresa Nacional de Hidrocarbonetos de Mozambique, Gaz-System, Jiangsu Coastal Gas Pipeline Co., Ltd., Petrobras.

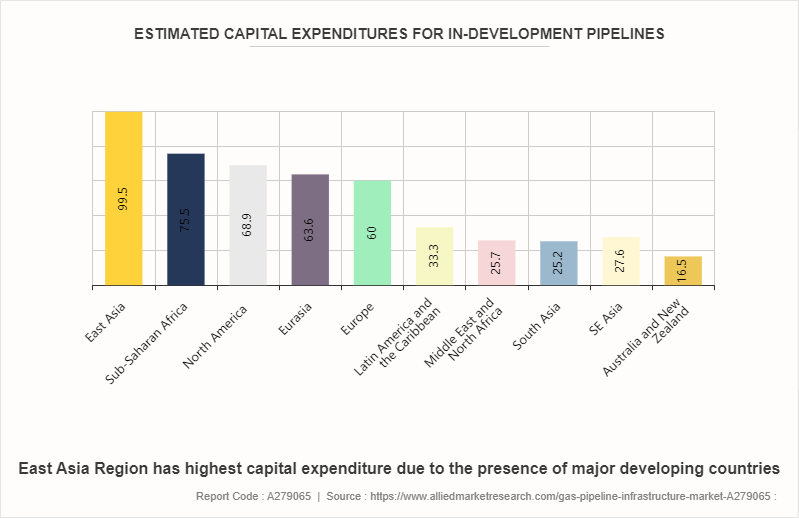

The proposed gas pipeline buildout in Asia is more than twice the size of that in any other region. In addition, the likelihood that proposed pipelines make it to operational status within the intended construction timeframe is relatively high in Asia compared to the rest of the world, and in particular in China.

Regional total km of pipeline in development worldwide (KM)

Region | Proposed | Construction |

East Asia | 32400 | 26300 |

Sub-Saharan Africa | 4100 | 17900 |

North America | 14800 | 5300 |

Eurasia | 14000 | 5500 |

Europe | 11700 | 4700 |

Latin America and the Caribbean | 9500 | 3900 |

Middle East and North Africa | 12400 | 600 |

South Asia | 11400 | 500 |

SE Asia | 5000 | 5000 |

Australia and New Zealand | 7100 | 1100 |

Gas Pipeline Ownership with Respect to Companies

Globally, 250 companies are developing gas pipelines projects. The leading 20 are building 58% of planned gas pipelines worldwide, and this list provides the global scope of the expansion. State-owned companies in Russia, China, India, and Nigeria are the largest players. Brazilian Petrobras’s high ranking is not likely to remain, as the company is offloading existing and planned assets as major reforms to the nation’s National Gas Law that took effect in January 2022. Mozambique’s Empresa Nacional de Hidro-carbonetos is associated with extensive gas pipeline expansions for which construction has yet to begin, though there is doubt that Mozambique’s planned natural gas expansion will come to completion.

Top 20 gas pipeline developers in the world in development (By KM)

Company | Proposed | Construction | In development |

Gazprom | 12100 | 4000 | 16100 |

PipeChina | 8600 | 3900 | 12500 |

Sinopec | 1600 | 8700 | 10300 |

GAIL (India) Limited | 900 | 6900 | 7800 |

Nigerian National Petroleum Corporation | 4300 | 1400 | 5700 |

China National Petroleum Corporation | 900 | 3800 | 4700 |

Transnet | 3900 | 0 | 3900 |

Ministry of Petroleum of Iran | 0 | 3800 | 3800 |

Guizhou Wujiang Energy Group Co., Ltd. | 0 | 3100 | 3100 |

Moroccan National Board of Hydrocarbons and Mines | 0 | 2800 | 2800 |

Transgaz | 2700 | 100 | 2800 |

Alaska Gasline Development Corporation | 2800 | 0 | 2800 |

Indian Oil Corporation Ltd. | 200 | 2300 | 2500 |

Turkmengaz | 300 | 2100 | 2400 |

Gujarat State Petronet | 200 | 2100 | 2300 |

TC Energy | 700 | 1500 | 2200 |

Empresa Nacional de Hidrocarbonetos de Mozambique | 2000 | 0 | 2000 |

Gaz-System | 600 | 1300 | 1900 |

Jiangsu Coastal Gas Pipeline Co., Ltd. | 1900 | 0 | 1900 |

Petrobras | 1200 | 400 | 1600 |

Industry Trends

- The expansion of natural gas infrastructure to support the growing demand for power generation. This trend is driven by the increasing use of natural gas as a cleaner alternative to coal and oil in power generation and industrial processes. According to the International Energy Agency (IEA) , “natural gas is expected to play a significant role in the transition to a low-carbon energy system, leading to investments in pipeline infrastructure to transport gas efficiently.”

- The industry is witnessing a trend towards the integration of digital technologies, such as SCADA systems and IoT devices, to enhance pipeline operations and monitoring. Digital innovations improve asset integrity management, optimize maintenance schedules, and enable real-time monitoring of pipeline conditions. This trend is supported by advancements in data analytics and automation, which enhance operational efficiency and safety in gas pipeline infrastructure.

- An industry trend focuses on enhancing pipeline safety measures and environmental protection initiatives. With regulatory bodies imposing stringent standards on pipeline operators, the industry is investing in technologies like cathodic protection systems and leak detection systems to prevent incidents and minimize environmental impact. Companies are prioritizing pipeline integrity management to ensure the safe and secure transportation of natural gas.

- With the rising interest in sustainable energy sources, the trend of integrating renewable natural gas (RNG) into existing gas pipeline infrastructure is gaining momentum. RNG, produced from organic waste sources, offers a carbon-neutral alternative to traditional natural gas. Pipeline operators are exploring opportunities to blend RNG with conventional gas supplies, contributing to decarbonization efforts and supporting a greener energy mix.

- The industry is increasingly adopting modular construction techniques for pipeline infrastructure projects to improve efficiency and reduce construction timelines. Modular components allow for off-site fabrication, minimizing disruptions to existing infrastructure and accelerating project completion. This trend is driven by the need for cost-effective and rapid deployment of gas pipeline facilities to meet evolving energy demands.

Key Sources Referred

- Pipeline Infrastructure Limited

- Cognizant: What is oil and gas infrastructure?

- Ministry of Petroleum and Natural Gas - Natural Gas Pipelines

- Gas Processing News: Natural gas pipeline systems and operations

- Pipeline Infrastructure Limited

- Petroleum and Natural Gas Regulatory Board

- ISO 15589: Cathodic Protection Systems for On-Land Pipelines

- API Standards for Pipeline Design, Construction, and Operations

- Understanding Specifications When Purchasing Pipeline Materials

- Ministry of Petroleum and Natural Gas - Natural Gas Pipelines

- International Energy Agency (IEA)

- International Gas Union (IGU) reports

- American Gas Association (AGA)

- Journal of Environmental Management

- World Bank

- International Finance Corporation

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas pipeline infrastructure market analysis from 2024 to 2030 to identify the prevailing gas pipeline infrastructure market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas pipeline infrastructure market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas pipeline infrastructure market trends, key players, market segments, application areas, and market growth strategies.

Gas Pipeline Infrastructure Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 4.8 Trillion |

| Growth Rate | CAGR of 2.9% |

| Forecast period | 2024 - 2030 |

| Report Pages | 330 |

| By Operation |

|

| By Equipment |

|

| By Application |

|

| By Region |

|

| Key Market Players | Gazprom, General Electric, Saipem S.p.A, TMK Group, Welspun Corp Ltd, Sinopec Group, NOV INC., Pipeline Infrastructure Limited, GAIL (India) Ltd, APA Group |

Gas Pipeline Infrastructure Market to Reach $4.8 Trillion, Globally, by 2030 at 2.9% CAGR.

Increased Demand for Shale Gas, Expansion of Natural Gas Distribution Networks, Technological Advancements, Focus on Reducing Carbon Footprints, Integration of Renewable Energy Sources are the upcoming trends of Gas Pipeline Infrastructure Market in the globe.

Onshore is the leading application of gas pipeline infrastructure market.

Asia-Pacific is the largest regional market for Gas Pipeline Infrastructure.

NOV Inc., Gazprom, GAIL Limited, General Electric, and Sinopec Group are the top companies to hold the market share in Gas Pipeline Infrastructure

Loading Table Of Content...