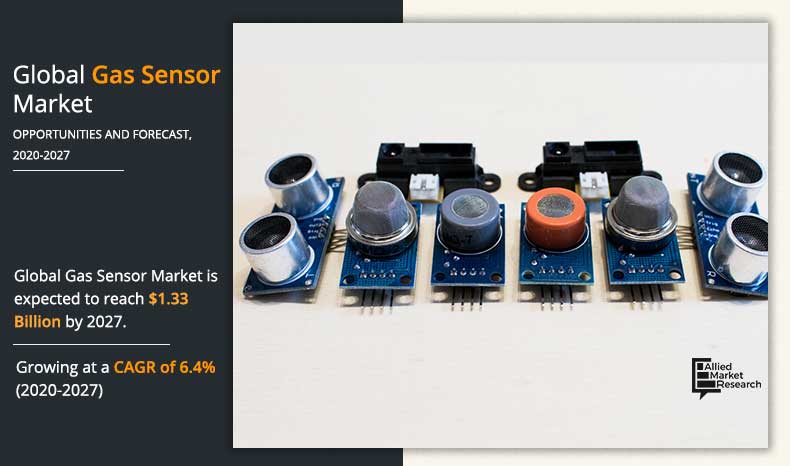

Gas Sensor Market Outlook - 2027

The global gas sensor market size was valued at $823.1 million in 2019 and is projected to reach $1,336.2 million by 2027, growing at a CAGR of 6.4% from 2020 to 2027. A gas sensor is a device that detects the presence or concentration of gases in the atmosphere or environment. Based on the concentration of gases in the environment, the gas sensor displays a change in resistance of the material used in the sensor, which in turn is used to measure output voltage. Based on this change in voltage value, the type and concentration of gas is detected. Gas sensors can detect volatile compounds such as gases and air quality. These sensors detect and measure the concentration of gas and can change the concentration of an analyte gas into an electronic or electrical signal. These sensors are used in various industries ranging from medicine, defense & military, energy, and aerospace.

The need to constantly monitor and control gas emissions by various industrial processes creates a requirement for gas sensors. The various uses of gas sensors vary across a wide range from industrial to domestic end uses. For instance, monitoring air pollution, chemical processes, and exhaust from combustion engines are the various applications for gas sensor installation. In recent years, several types of gases have been used in different industries as raw materials. It becomes important to control and monitor these gases, as there is a huge risk of damage to property and human lives. Certain gases are corrosive, explosive, or toxic to human beings. The mentioned factors assist in the market expansion of gas sensors by creating demand under various industry verticals, such as automotive and industrial, among others globally.

According to researchers at Penn State and Northeastern University, wearable gas sensors for environmental and human health monitoring are expected to be commercially available shortly. These sensors are expected to be highly sensitive due to their self-heating mechanism. The researchers are using a highly porous single line of nanomaterial for the sensors that detect gas and biomolecules, and are also expected to detect different chemicals.

Top Impacting Factors

The significant factors impacting the growth of the global gas sensor market include the increasing use of gas sensors in the defense & military industry, the emerging demand for gas sensors in consumer electronics, and favorable government regulations regarding the use of gas sensors. However, the high initial cost of the sensors acts as a major barrier to its adoption, thereby hampering the growth of the market. On the contrary, growing trends toward the Internet of Things (IoT) and rising demand for sensors in the development of smart cities are anticipated to provide lucrative opportunities for the gas sensor market during the forecast period.

By Gas Type

Oxygen gas type segment is projected as one of the most lucrative segments.

Some major factors impacting the gas sensor market growth are given below:

Emergence of gas sensors in HVAC systems

HVAC system provides fresh and pure indoor air by removing pollutants from the environment through proper ventilation and pressurization. These systems are finding their applications in the oil & gas industry, petroleum, and refineries, among others. Such industries involve processes that carry combustible or toxic materials. Therefore, to detect and analyze the level of toxic substances present in the environment, gas sensors are increasingly being used in HVAC systems in all major industries that include the presence of combustible gases and toxic elements.

By Technology

electrochemical gas sensor segment generated the highest revenue in 2019.

Gas detection in the HVAC system is one of the crucial elements. It reduces the risk of releasing toxic and combustible gases through early detection and initiating timely corrective action. Usage of gas sensors in the HVAC system monitors toxic and combustible gases and alerts the personnel before they reach a dangerous level. For instance, gas sensors are being increasingly used in HVAC systems due to a rise in compliance with government regulations, and an increase in concerns toward occupational health & safety, which drive the market growth of gas sensors globally.

By Geography

North America region would exhibit the highest CAGR of 14.9% during 2020-2027

Growing trends toward the Internet of Things (IoT)

In the current IT-dominant world, people are moving toward automation-based solutions and services. This has led to increased focus on IoT-based devices due to their innovative and advanced applications. IoT is a technology for providing internet or internetworking for almost all applications, such as smartphones, microwaves, refrigerators, defense &military, healthcare, and buildings. IoT uses electronic software, sensors, and actuators to connect all these things to a common network. IoT incorporates several sensors such as a touch sensor, a proximity sensor, a gas sensor, and a temperature sensor.

The high initial cost of the device

The addition of sensors does help to increase automation in electronic devices; however, it incurs an extra cost and is avoided in cost-effective end uses. The incorporation of sensors facilitates extra features and makes the devices more automated, although it incurs some additional cost, and therefore, it is avoided in a cost-effective application. In devices that are continuously used for a long time, such as smartphones, laptops, and cameras, sensors create heating issues and reduce their overall life, as these devices have components that are temperature-sensitive. The devices that use the battery as their power source, and sensors, reduce their battery life as they rely on device batteries for their operation.

The global gas sensor market is analyzed by gas type, technology, end-user, and region. Depending on the gas type, the market is divided into carbon monoxide, methane, hydrogen, ammonia, oxygen, and others. By technology, the market is classified into infrared gas sensors, photoionization sensors, electrochemical gas sensors, thermal conductivity gas sensors, metal oxide-based gas sensors, catalytic gas sensors, and others. As per end use, the market is categorized into defense & military, healthcare, consumer electronics, automotive & transportation, industrial, and others.

Competition Analysis

The key gas sensor market leaders profiled in the report include Honeywell Analytics, Sensirion, GASTEC Corporation, Nemoto Gas Sensors, Figaro Engineering Inc., MSA, Alphasense, Membrapor, Amphenol, and Dynament. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to enhance their market penetration.

Historical Data & Information

The global gas sensor market is highly competitive, owing to the strong presence of existing vendors. Vendors of the gas sensor market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands. The competitive environment in this market is expected to intensify as technological innovations, product launches, and different strategies adopted by key vendors increase.

Key Developments/Strategies

Honeywell Analytics, Sensirion, GASTEC Corporation, Nemoto Gas Sensors, Figaro Engineering Inc., MSA, Alphasense, Membrapor, Amphenol, and Dynament are the top companies holding a prime share in the gas sensor market. Top market players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to expand their foothold in the gas sensor market.

- In August 2022, Emerson announced the opening of a gas analysis solutions center in Scotland to help plants meet sustainability goals. The center has access to more than 10 different sensing technologies that can measure more than 60 different gas components.

- In August 2020, Sensirion AG announced the launch of SGP40 VOC, which is a sensor that predicts the air quality of indoors and monitors it. It is an automated system that keeps a check on the air quality for indoor & outdoor applications.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the gas sensor market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall gas sensor market trends analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The gas sensor market analysis is quantitatively analyzed from 2017 to 2025 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the gas sensor market forecast.

- The report includes the market share of key vendors and gas sensor market opportunities.

Gas Sensor Market Report Highlights

| Aspects | Details |

| By Gas Type |

|

| By Technology |

|

| By End Use |

|

| By Region |

|

| Key Market Players | GASTEC CORPORATION, NEMOTO SENSOR-ENGINEERING CO., LTD. (NEMOTO & CO., LTD.), FIGARO ENGINEERING INC, HONEYWELL INTERNATIONAL INC., AMPHENOL CORPORATION, SENSIRION AG SWITZERLAND, ALPHASENSE, MSA, DYNAMENT, MEMBRAPOR |

Analyst Review

EOA gas sensor is a device that detects the presence or concentration of gases in the atmosphere or environment. Based on the concentration of gases in the environment, the gas sensor displays a change in resistance of the material used in the sensor, which in turn is used to measure output voltage. Based on this change in voltage value, the type and concentration of gas is detected.

Metal oxide gas sensor over the years has witnessed rapid adoption and is lucrative to create market opportunities during the forecast period. Metal oxide gas sensor have attracted much attention in the field of gas sensing due to the factors such as low cost, flexibility in production, simple installation & operation and large number of detectable gases/possible application fields. The factors drive the market of metal oxide gas sensors. Further, the incorporation of nanomaterials in metal oxide gas sensor is creates lucrative opportunities in the market.

The key gas sensor market leaders profiled in the report include Honeywell Analytics, Sensirion, GASTEC Corporation, Nemoto Gas Sensors, Figaro Engineering Inc, MSA, Alphasense, Membrapor, Amphenol, and Dynament. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to enhance their market penetration.

Loading Table Of Content...