Gas Water Heater Market Research, 2032

The global gas water heater market was valued at $7.8 billion in 2022, and is projected to reach $12.8 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

A gas water heater is a heating device where natural gas and LPG are used as fuel sources to heat water for various purposes. An increase in hot water requirements across both commercial and residential buildings, coupled with a rise in demand from off-grid areas is expected to accelerate the market expansion. Furthermore, a shift in consumer awareness toward advanced technological and product development is projected to propel market growth.

The growth of the global gas water heater market is driven by major factors such as favorable government subsidies encouraging the use of water heaters. Governments of different countries offer incentives and subsidies on water heating systems, therefore boosting their adoption. In addition, the hotel and hospitality industry has a lot of demand for hot water. Hospitals require enough hot water for washing the patients, cleaning buildings, and laundry.

It also requires hot water to clean and sanitize many surfaces within the facility. Tankless gas water heaters are used in hospitals for patients with aging or sensitive skin as they require precise heating. The risk of inconsistent heating can be reduced by installing a tankless water heater with built-in temperature control. On the other hand, demand for gas water heaters is constantly rising with an increase in the number of hotels. Small or luxury hotels provide hot water to customers every time they demand it.

Electric water heaters require a lot of electricity that affects both environments and triggers bills. Therefore, gas water heaters are used widely in hotels as they run on natural gas and LPG. It is also a clean energy source compared to electricity generated from coal-fired power plants. Furthermore, there is a rise in the disposable income of consumers and a surge in concerns among consumers toward natural resources and energy has a significant positive impact on the market.

Moreover, with the rise in population and improved infrastructure in rural areas, demand for water heaters is significantly growing, especially gas water heater systems. Consumers mostly prefer gas water heaters, owing to electricity shortages in most rural areas. Furthermore, the moderate transformation of rural areas into semi-urban areas is changing the lifestyle of people. They are adopting new technologies and methods to improve their lifestyle. Therefore, such factors are expected to boost the global gas water heater market growth in the future.

Moreover, favorable government subsidies encouraging the use of gas water heaters, and the inclination of consumers toward the adoption of energy-efficient systems have led to the growth of the gas water heater market. Furthermore, the rise in the number of hospitals and hotels, an increase in population, and improved infrastructure in rural areas are anticipated to fuel the growth of the global gas water heater market. Rise in electricity prices and high operating costs of electric water heaters, frequent outages & electricity shortages (in developing countries), and technical issues propel the gas water heater market growth.

"Technological Advancements and Innovation in Gas Water Heaters”

Technological advancements and innovation in gas water heaters industry have led to a new era. With a strong emphasis on the enhancement of energy efficiency, manufacturers have implemented cutting-edge technologies such as advanced combustion systems, improved insulation materials, and smart thermostats. The integration of the Internet of Things (IoT) has enabled remote monitoring and control, which provide users with increased convenience and energy management capabilities.

Moreover, tankless gas water heaters with instant hot water solutions have gained popularity, offering on-demand heating without the need for bulky storage tanks. Hybrid gas water heaters with the combination of heat pump technology, have also emerged as energy-saving alternatives. In addition, safety features and smart controls, employing sensor technologies and artificial intelligence, have improved user protection and overall functionality. As environmental sustainability gains prominence, industry has responded with eco-friendly innovations to reduce carbon footprints.

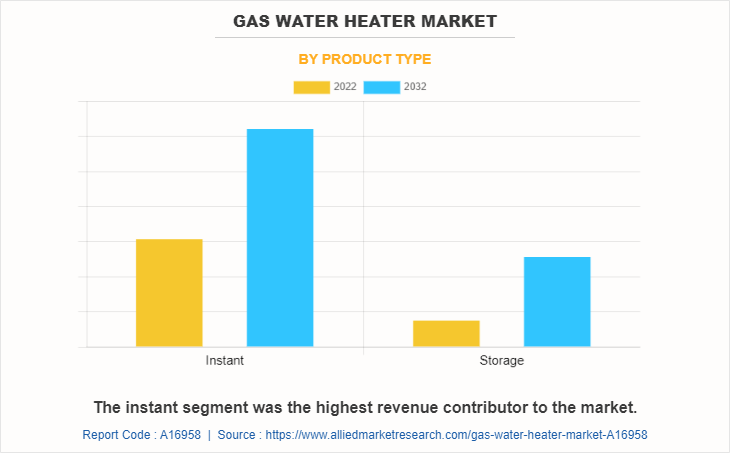

The gas water heater market is segmented on the basis of product type, installation type, fuel type, application, and region. On the basis of product type, the market is segmented into instant and storage. On the basis of installation type, it is bifurcated into indoor and outdoor. On the basis of fuel type, it is segmented into natural gas and LPG. On the basis of application, it is segmented into residential, commercial, and industrial. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest share of the market, followed by North America and Europe.

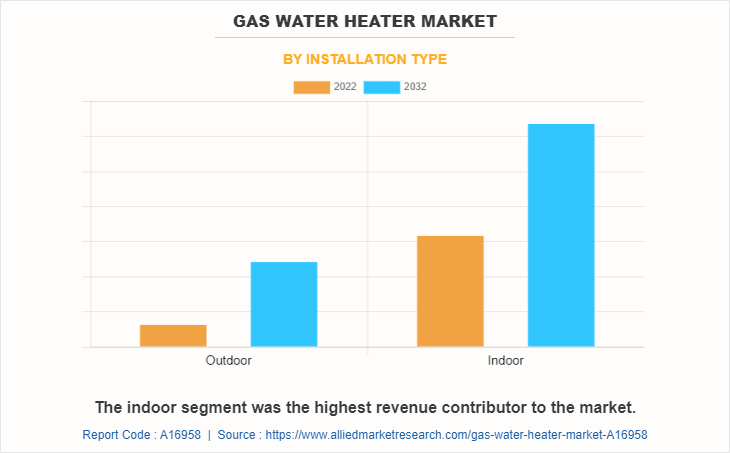

The indoor segment dominates the global gas water heater market. Indoor gas water heaters can be installed in bedroom or bathroom closets, if preferred only they are electric, direct vent or sealed combustion chamber unit. Indoor gas water heater is ideal for cold and windy climates, as it is a far lower risk that a heater can suffer from freezing damage. Advantages of indoor tankless gas water heater are lower energy costs and, no risk of weather damage which increases the resale value of the real estate. The presence of above mentioned advantages will drive the growth of the market. However, the need for necessary maintenance, need for venting space, and risk of leaks are major factors hampering the sales of indoor gas water heater market.

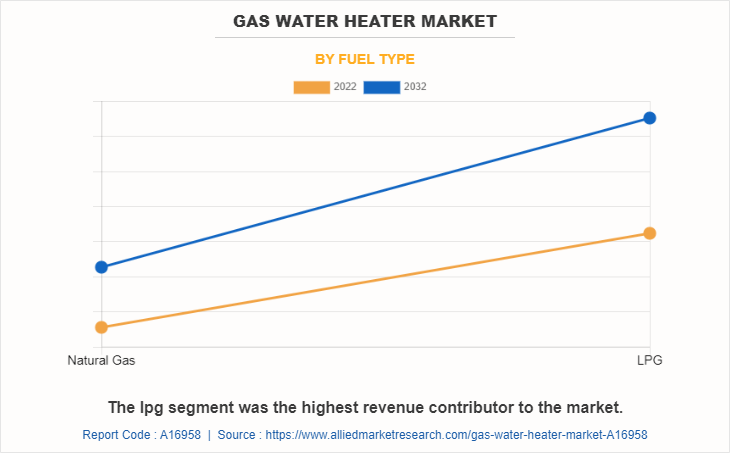

The LPG segment dominates the global gas water heater market. LPG is one of the best alternatives to replace traditional electric water heaters that use up way more energy than they should to heat up water. Gas water heaters are custom made to use LPG to instantly heat up water used at any specific moment. Increase in demand for comfort and on-demand hot water services in luxury hotels, and other recreation centers drive the growth of the market. Extreme and adverse climatic conditions across various geographies with availability of multiple government incentives are set to enhance the market growth. The availability of LPG cylinders to refuel is another major factor driving the growth of gas water heater market size.

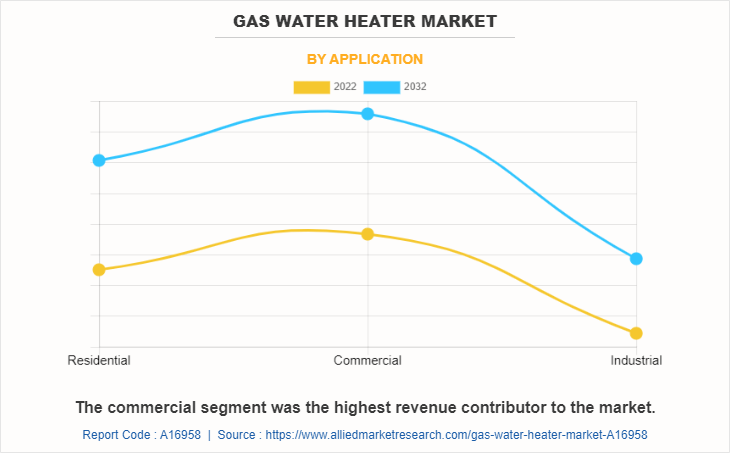

The commercial segment dominates the global gas water heater market. Commercial water heaters are designed for large-scale requirements. They are characterized with unique designs, efficient performance, large capacity, safe-use, and easy adaptability. They are widely used by commercial users including, schools, corporate offices, hotels and hospitals, and other commercial infrastructures: thereby, leading to healthy growth of the market. The presence of above mentioned wide range of utilization of gas water heater panels in various commercial applications due to rise in number of commercial set-ups including schools, corporate offices, hotels, and others for hot water to clean and sanitize many surfaces within the hospital building, washing of the patient, and laundry will provide ample opportunities for the market.

The instant gas water heater segment dominates the global gas water heater market. Instant water heaters, also known as tankless water heaters supply hot water instantaneously. These water heaters are used in washbasins and kitchens where usage of water is less. They do not have any storage, which results in no wasting of hot water or heating extra water. In addition, they need to be switched on before use and switched off immediately after use. This leads to very less or no waste of electricity and the unit consumption is quite appropriate. These water heaters mostly operate on electricity or gas. Growth in consumer awareness toward sustainable use of energy is expected to propel the market growth of instant water heater. Instant water heaters are gaining popularity among consumers, owing to their energy-saving attribute. It provides hot water on demand rather than storing the heated water. It ensures a continuous supply of hot water by saving energy. It’s higher efficiency and innovation in design fuels the market growth.

Asia-Pacific region is analyzed across countries such as China, Japan, India, South Korea, Australia, and the Rest of Asia-Pacific. India and China are major players in this region majorly due to huge population and due to their demand for hot water during the winter season. Asia-Pacific is the highest revenue generating region of the global water heater market owing to huge demand from urban and rural regions. These developing countries are characterized with population growth, rise in income, and improved lifestyle. The surge in the leading players who are engaged in introducing innovative and affordable gas water heaters to address demand of hot water in this region is another driving factor. The above mentioned initiatives are major factor driving the growth of the market in this region during the forecast period.

Major companies profiled in this report include A.O. Smith, Ariston Thermo S.p.A, BDR Thermea Group, Bosch Thermotechnology, Bradford White Corporation, Haier Electronics, HTP Comfort Solutions LLC, Lennox, Racold, and Rheem Manufacturing Company. Apart from the companies mentioned earlier, the gas water heater industry includes companies that are not profiled in the report (Noritz America Corporation, Rinnai Corporation, Navien Inc., State Industries, Inc., American Water Heaters, Takagi Industrial Co. Ltd., Ferroli S.p.A., Stiebel Eltron, Whirlpool Corporation, and Ariston Thermo S.p.A).

The rapid development of industrialization, modernization, and the spread of information through the internet led to the development of the tourism industry has created great demand for hot water in cold regions, which had led to a rise in demand for gas water heaters. In addition, growth strategies such as the expansion of production capacities, acquisition, partnership, and research & innovation in water heaters application are key development trends in the global gas water heater market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas water heater market analysis from 2022 to 2032 to identify the prevailing gas water heater market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas water heater market share, segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas water heater market trends, key players, market segments, application areas, and market growth strategies.

Gas Water Heater Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.8 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 342 |

| By Installation Type |

|

| By Fuel Type |

|

| By Application |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | HTP LLC, A.O. Smith Corporation, Bradford White Corporation, Lennox International Inc., Ariston Group, BDR Thermea Group, Bosch Thermotechnik GmbH, Haier Inc., NORITZ Corporation, Ecosmart Green Energy Products, Inc. |

Analyst Review

CXOs in the gas water heater industry recognize the immense growth potential and opportunities that lie ahead during the forecast period. The global gas water heater market is poised for increased demand, primarily driven by the escalation of hot water among consumers worldwide. The rising trend of on-demand hot water in luxury hotels and commercial leisure areas further fuels this growth trajectory, which creates a favorable market landscape.

In pursuit of innovation and market leadership, CXOs acknowledge the significance of gas water heaters as versatile heating devices that efficiently transfer energy from external sources to heat water. With a variety of types available, including instant water heaters and storage water heaters, the industry offers solutions that cater to diverse customer needs.

CXOs are confident in their ability to capitalize on several market drivers, which includes the strong consumer inclination towards the adoption of energy-efficient systems. Furthermore, the support of favorable government subsidies which encourage the use of gas water heaters boosts market adoption. The steady increase in the number of hospitals, hotels, and improved infrastructure in rural areas presents lucrative opportunities for growth and expansion.

According to the historical trends in 2022, the instant gas water heater segment emerged as a significant player, which captured the majority of the market share due to its energy-saving attributes and heightened consumer awareness towards sustainable energy usage. In particular, the dominance of the LPG segment, which accounted for more than half of the market share in 2022, highlights the continued demand for this fuel source in the gas water heater market throughout the forecast period.

CXOs are attentive to market dynamics, and the forecast predictions that the indoor installation type gas water heater segment is expected to experience the highest growth rate. Recognizing this potential, CXOs are strategically positioning their sales or production capacity to cater to this demand and capture a significant share of the market growth. The commercial segment has proven to be a vital contributor, holding the maximum market share in 2022. CXOs expect this trend to continue in coming years mostly driven by rapid urbanization and an increase in consumer income levels, especially in emerging economies.

$12.8 billion is the estimated industry size of Gas Water Heater.

Energy efficiency and eco-friendly solutions, smart and connected water heaters, and digital water heating solutions are the upcoming trends of gas water heater market in the world.

Instant is the leading product type of Gas Water Heater Market

Commercial is the leading application of Gas Water Heater Market.

Asia-Pacific is the largest regional market for Gas Water Heater.

Ecosmart Green Energy Products, Inc., HTP LLC, Bradford White Corporation, Haier Inc., and Bosch Thermotechnik GmbH are the top companies to hold the market share in Gas Water Heater

Loading Table Of Content...

Loading Research Methodology...