The global gasoline direct injection (gdi) system market was valued at $7.6 billion in 2020, and is projected to reach $20.4 billion by 2030, growing at a CAGR of 10.8% from 2021 to 2030.

Gasoline direct injection (GDI) is also referred to as petrol direct injection. GDI system directly injects fuel in combustion chamber. Gasoline gets highly compressed until being injected into the combustion chamber of each cylinder of the engine through a common rail fuel line. The main components of GDI system include fuel injectors, fuel pumps, sensors, and electronic control units.

The growth of global gasoline direct injection system market is propelling, due to rise in demand for fuel efficiency, increase in thermal efficiency & greater engine performance, surge in introduction of stringent regulations associated with emissions, and growth in inclination toward engine downsizing & reduced weight of vehicles. However, high cost of GDI system and electrification of vehicles hinder the growth of the gasoline direct injection system industry. Furthermore, incorporation of GDI system in hybrid vehicles, technological advancements (turbo GDI system), and rise in demand for passenger vehicles in developing countries are the factors expected to offer lucrative growth opportunities during the forecast period.

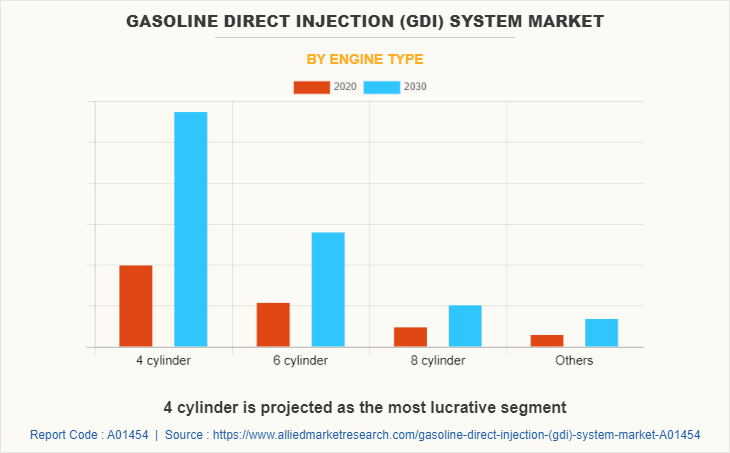

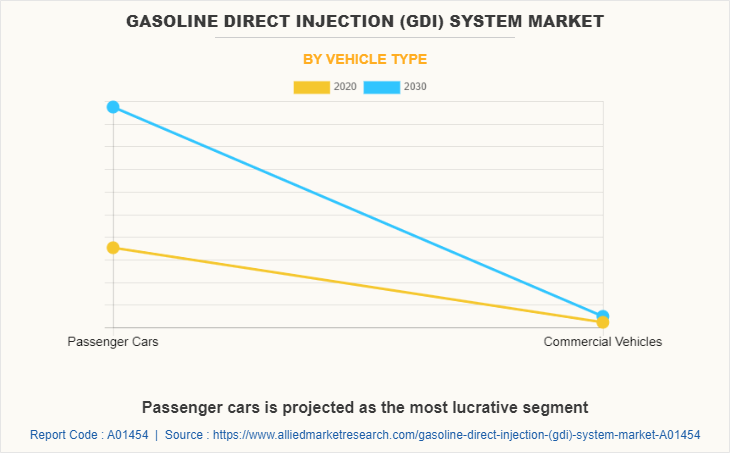

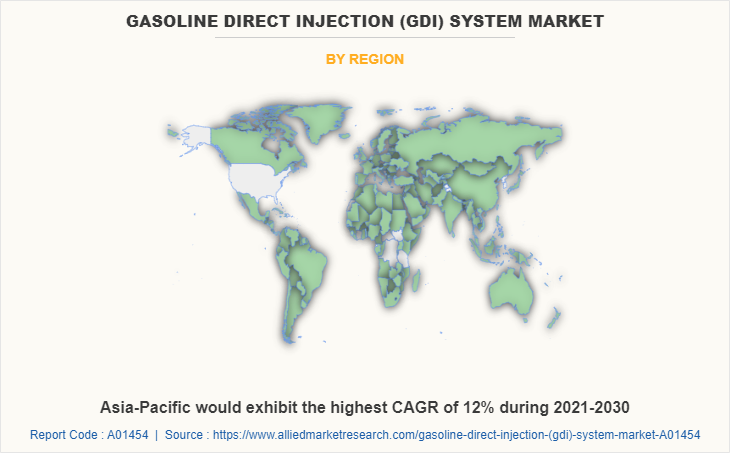

The global gasoline direct injection system market is segmented on the basis of component, engine type, vehicle type, sales channel, and region. Depending on component, it is classified into fuel injectors, fuel pumps, electronic control units, and others. Based on engine type, it is divided into 4 Cylinder, 6 Cylinder, 8 Cylinder, and others. According to vehicle type, it is fragmented into passenger cars and commercial vehicles. By sales channel, it is segmented into original equipment manufacturer and aftermarket. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the gasoline direct injection system market report comprises Borgwarner Inc., Continental AG, Denso Corporation, Hitachi Ltd., Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Motonic Corporation, Park-Ohio Holdings Corporation, Robert Bosch GmbH, and Stanadyne LLC.

Rise in Demand for Fuel & Thermal Efficiency and Enhanced Engine Performance

Several regulations have been implemented that require automobile manufacturers to reduce harmful emissions caused by automobiles. In addition, automakers are shifting towards manufacturing of vehicles with high fuel efficiency and enhanced engine performance. Therefore, automobile manufacturers adopt GDI engines as next generation platform, which, in turn, is expected to increase the demand for GDI system. Hence, rise in demand for fuel & thermal efficiency and enhanced engine performance drive the growth of the market.

Introduction of Stringent Regulations Associated with Emissions

Numerous countries across the globe have introduced stringent regulations in terms of emissions for automobiles owing to increase in level of CO2 emissions. For instance, in 2020, India introduced BS-VI emissions norms for automobile manufacturers. In addition, Europe already adopted European emissions standard “Euro 6” in 2015 and planning to adopt “EURO 7” emissions standard by 2025. Moreover, automobile manufacturers comply with these new emission standard to manufacture automobile with improved fuel efficiency and performance. Hence, introduction of stringent regulations associated with emissions is one of the factors that is expected to contribute in the growth of GDI system industry.

Growth in Inclination toward Engine Downsizing and Reduction in Weight of Vehicles

Engine downsizing is a method that aids in reducing emissions & fuel consumption of internal combustion engines. Manufacturers focus on engine downsizing to increase fuel efficiency and engine performance, owing to this reason. For instance, in 2021, Hyundai launched the new downsized engine named “SmartStream 3.5 FR T-GDI” to replace its 5.0-litre V8 engine. This inclination toward engine downsizing is expected to increase the demand for GDI system in future. Hence, growth in inclination toward engine downsizing and reduction in weight of vehicles drive the growth of the gasoline direct injection system market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gasoline direct injection (gdi) system market analysis from 2020 to 2030 to identify the prevailing gasoline direct injection (gdi) system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gasoline direct injection (gdi) system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gasoline direct injection (gdi) system market trends, key players, market segments, application areas, and market growth strategies.

Gasoline Direct Injection (GDI) System Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Engine Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Mitsubishi Electric Corporation, Denso Corporation, Continental AG, Hitachi, Ltd., Marelli Holdings Co., Ltd., Robert Bosch GmbH, Motonic Corporation, Park-Ohio Holdings Corporation, BorgWarner Inc., Stanadyne LLC |

| | Renesas Electronics Corporation(Japan), Nostrum Energy (U.S.), GP Performance(Germany), Infineon Technologies AG (Germany), Synerject LLC (U.S.) |

Analyst Review

including introduction of stringent regulations associated with emissions and technological advancements, including turbo GDI system. Increase in focus on development of turbo GDI engines is observed to comply with emission norms introduced by several governments in their region. For instance, in April 2020, the Indian government mandated vehicle engines to be upgraded to BS stage VI to reduce emissions across the nation. To comply with BS-VI emission norms, automobile manufacturers, including Hyundai, Kia Motors, and Tata Motors introduced turbo GDI engines in their vehicles across India.

Several developments have been carried out by key players operating in the GDI system industry. In November 2021, Bosch launched Bosch HDEV6 high pressure injection valve for GDI engines to expand its product offerings in the market. Moreover, in May 2019, Delphi Technologies, a subsidiary of BorgWarner Inc., unveiled a new 500-bar GDI system, which reduces gasoline particulate emissions up to 50%.

Rise in demand for GDI system from developing countries, including Asia-Pacific along with increase in consumer preference toward fuel-efficient vehicles and government measures, including engine upgrades to reduce emissions supplement the market growth. Collaborations and acquisitions are expected to enable the leading players to enhance their product portfolios and expand into different regions.

The global gasoline direct injection (GDI) system market was valued at $7.6 billion in 2020, and is projected to reach $20.4 billion by 2030, growing at a CAGR of 10.8% from 2021 to 2030.

GDI system directly injects fuel in combustion chamber. Gasoline gets highly compressed until being injected into the combustion chamber of each cylinder of the engine through a common rail fuel line. The main components of GDI system include fuel injectors, fuel pumps, sensors, and electronic control units.

The sample/company profiles for global gasoline direct injection (GDI) system market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

The drivers for the gasoline direct injection system include rise in demand for fuel efficiency, increase in thermal efficiency & greater engine performance, surge in introduction of stringent regulations associated with emissions, and growth in inclination toward engine downsizing & reduced weight of vehicles.

The different engine types using GDI system include 4 Cylinder, 6 Cylinder, 8 Cylinder, and others.

The company profiles of the top market players of GDI system industry can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the GDI system industry.

Incorporation of GDI system in hybrid vehicles, technological advancements, and rise in demand for passenger vehicles in developing countries are the factors expected to offer lucrative growth opportunities during the forecast period.

In November 2021, Bosch has launched Bosch HDEV6 high pressure injection valve for gasoline direct injection engines in order to expand its aftermarket range. In October 2021, Marelli Holdings Co., Ltd. developed a fuel injector for internal combustion engines with capabilities of reaching 1,000 bar pressure level and also won 2021 PACE Award for developing this injector.

The upcoming trends of gasoline direct injection system include increasing adoption of turbo GDI system, and engine upgrades to reduce emissions.

Some leading companies profiled in the gasoline direct injection system market report comprises BorgWarner Inc., Continental AG, Denso Corporation, Hitachi Ltd., Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Motonic Corporation, Park-Ohio Holdings Corporation, Robert Bosch GmbH, and Stanadyne LLC.

Loading Table Of Content...