Gene Expression Market Research, 2031

The global gene expression market size was valued at $8,505.71 million in 2021, and is projected to reach $17,960.77 million by 2031, growing at a CAGR of 7.7% from 2022 to 2031. Gene expression is the process by which information from a gene is used in the synthesis of a functional gene product, such as a protein or an RNA molecule. These products are often essential for the cell to function normally. During gene expression, the DNA sequence of a gene is copied into a complementary RNA sequence, which can then be used to direct the synthesis of the corresponding protein or RNA molecule.

Gene expression comprises transcription and translation processes. Transcription (DNA to RNA) refers to production of RNA copies of DNA with the help of the enzyme RNA polymerase. While translation (RNA to protein) is a process that results in the synthesis of proteins based on the information on the coding genes (messenger RNA). There is a possibility of the alteration of several steps in gene expression process such as in RNA splicing, post-translational modification of proteins and others.

Historical Overview

The gene expression market size was analyzed qualitatively and quantitatively from 2018-2020. Most of the growth during this period was derived from Asia-Pacific owing to the rise in the prevalence of genetic diseases, geriatric population, chronic and acute diseases, as well as the rising awareness for personalized medicine and well-established presence of key pharmaceutical and biotechnology companies in the region.

Market Dynamics

The increase in the prevalence of genetic disorder, growing awareness for personalized medicine, and an increasing application of gene expression in drug discovery are the major factors driving the growth of gene expression market share. For instance, according to the report published by the Centers for Disease Control and Prevention, in December 2022 it has been estimated that chromosomal defect affected 531 babies with trisomy 13 (Patau syndrome) which is 1 in every 7,409 births, 1,187 babies were affected by trisomy 18 (Edwards syndrome), and 5,568 babies acquired trisomy 21 (Down syndrome) in U.S. Thus, the increasing incidences of rare genetic and chromosomal disorders are anticipated to increase the demand for gene expression therapy, thereby driving the growth of the market.

Moreover, the increase in the number of R&D activities and significant investments by the government to improve healthcare infrastructure have become vital tools for the growth of the market. The development of technologically advanced solutions is anticipated to provide gene expression market growth. For instance, in May 2020, 10x Genomics, Inc. launched 10x-targeted single-cell RNA sequencing, the company’s targeted gene expression solution for spatial genomics and single-cell analysis. This product can efficiently analyze a subset of genes of interest. Therefore, it reduces the computational & sequencing burden, streamlines data analysis, and increases sample throughput. In addition, rise in gene expression studies to analyze the COVID-19-risk variants are expected to drive the global market.

However, the high cost of instruments for gene expression and lack of skilled professional hampers the market growth. Conversely, increased investments in R&D for the development of new technologies for tissue-specific or cell-specific gene expression analysis, as well as increase in the prevalence of chronic and genetic disease may open up the new market potential for gene expression and are expected to provide a lucrative opportunity for the growth of the market during the forecast period.

Segment Overview

The gene expression market share is segmented on the basis of product, application, end-user, and region. As per product, the market is segmented into consumables and instruments. The instruments are further bifurcated into polymerase chain reaction, next generation sequencing, DNA microarrays and others. According to application, it is bifurcated into drug discovery and diagnostics. By end user, it is segmented into, pharmaceutical & biotechnology companies, academic & research institutes, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

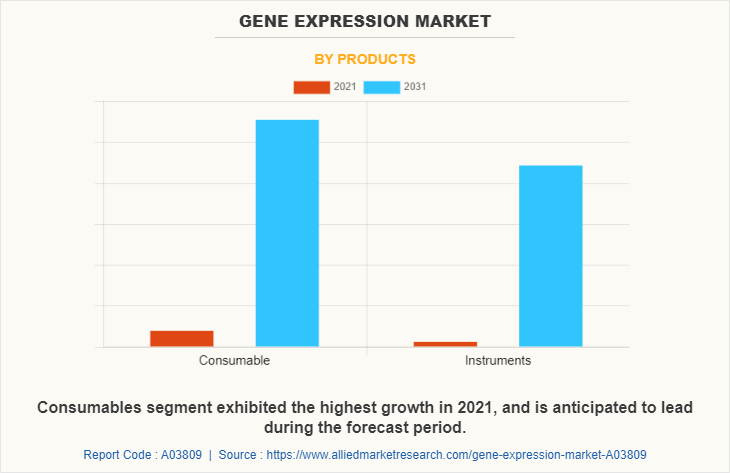

By Product

The market is segmented into consumables and instruments. The consumables segment accounted for the largest share of the market. The dominance of this segment can be attributed to the increasing volume of genetic tests in drug discovery, biomarker discovery, and pharmacogenomics applications which are driving the growth of the consumer market.

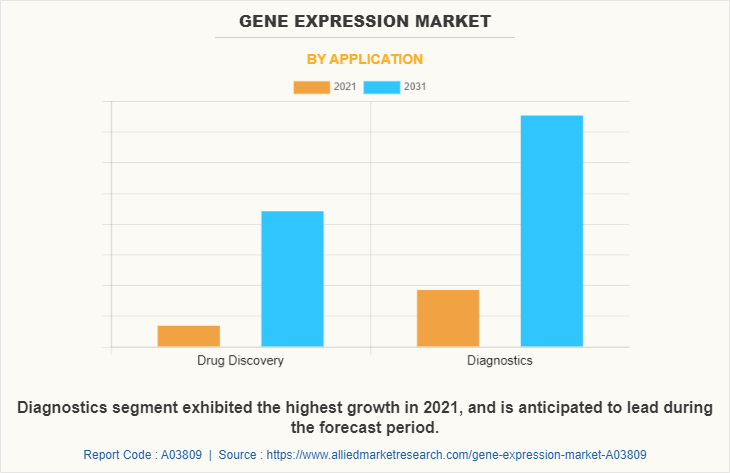

By Application

The market is segmented into drug discovery and diagnostics. The diagnostics segment accounted for the largest share of the market. The dominance of this segment can be attributed to the increasing use of gene expression analysis for early and precise diagnosis of rare genetic disorders and chronic illnesses are the major factor that propel the growth of the market.

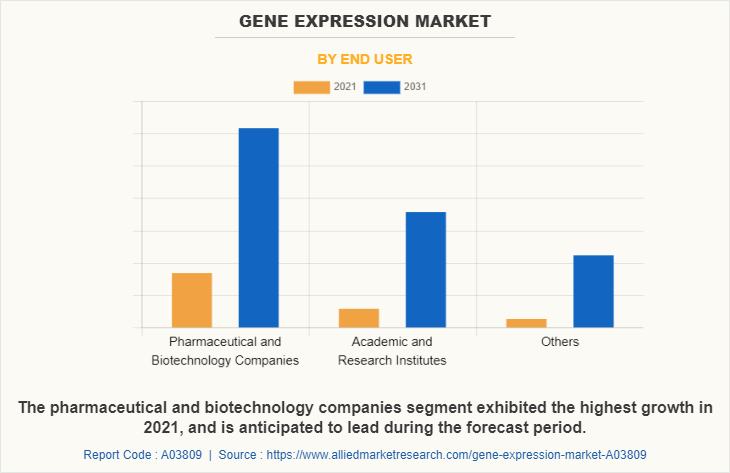

By End User

The market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, and others. The pharmaceutical and biotechnology companies segment exhibited the highest growth in 2021, and is anticipated to lead during the forecast period, owing to the fact that pharmaceutical & biotechnology companies utilized gene expression analysis products & services to achieve the clinical research goals, such as drug discovery and development. Whereas, biopharmaceutical companies focus on developing targeted therapies, especially for the treatment of cancer, complex diseases, and rare genetic disorders which are the key factors that are expected to drive the growth of the market in upcoming years.

By Region

The gene expression market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the gene expression market in 2021 and is expected to maintain its dominance during the forecast period. The presence of several major key players and the rising advancement in technology in this region drive the growth of the market. Moreover, the rising investment in latest gene expression technology and increasing research and development activities toward the development of gene therapy, especially in the U.S. propel the growth of the market. In addition, the increasing focus on gene expression studies, government initiatives, and the availability of funding for next-generation sequencing (NGS) research are driving the growth of the market in North America.

Asia-Pacific is expected to grow at the fastest rate during the gene expression market forecast. The market growth in the Asia-Pacific region is supplemented by highly populated countries along with increasing collaboration between key organizations to improve quality of healthcare and research infrastructure, availability of government funding for research activities, and growing application of gene expression profiling owing to increasing focus on personalized medicine which are some of the key factors expected to propel the growth of the market in the region.

Competitive Analysis

The report provides competitive analysis and profiles of the major players in the gene expression industry, such as Illumina Inc., Agilent Technologies, Thermo Fisher Scientific Inc., PerkinElmer Inc., Oxford Nanopore Technologies, QIAGEN, Bio-Rad Laboratories Inc., PacBio, Promega Corporation, and F. Hoffmann-La Roche Ltd. Major players have adopted product launch, product expansion, and acquisition as key developmental strategies to improve the product portfolio of the gene expression market.

Some examples of product developments in the market

Illumina, Inc. launched NovaSeq X Series (NovaSeq X and NovaSeq X Plus) new production-scale sequencers to accelerate genomic medicine. This revolutionary new technology can generate more than 20,000 whole genomes per year – 2.5 times the throughput of prior sequencers. Thus, launch of the NovaSeq X Series will help the company to gain a strong foothold in the gene expression industry market.

QIAGEN announced the expansion of its next-generation sequencing (NGS) portfolio with the launch of QIAseq Targeted DNA Pro Panels and the QIAseq UPXome RNA Library Kit, both of which set new standards in preparing samples for determining their nucleic acid sequences.

PacBio announced the launch of its Multiplexed Arrays Sequencing (MAS-Seq) kit in partnership with the Broad Institute of MIT and Harvard and 10x Genomics, Inc. The kit is a first-of-its-kind kitted solution leveraging 10x Genomics’ Single Cell Gene Expression technology to enable cost-effective long-read single-cell RNA sequencing for a more complete interrogation of the transcriptome.

Illumina Inc. announced a strategic research collaboration with AstraZeneca, a global, science-led biopharmaceutical company, to accelerate drug target discovery by combining their strengths in artificial intelligence (AI) based genome interpretation and genomic analysis techniques along with industry expertise.

Illumina, Inc. acquired BlueBee, a cloud-based software company, to accelerate processing, analysis and sharing of next generation sequencing data by the genomics analysis solutions provided by BlueBee for research and clinical customers.

Thermo Fisher Scientific and Qatar Genome Program (QGP) had entered into a partnership with the goal of accelerating genomic research and clinical applications of predictive genomics in Qatar as a step toward expanding the benefits of precision medicine across Arab populations globally.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gene expression market analysis from 2021 to 2031 to identify the prevailing gene expression market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gene expression market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gene expression market trends, key players, market segments, application areas, and market growth strategies.

Gene Expression Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 427 |

| By End User |

|

| By Products |

|

| By Application |

|

| By Region |

|

| Key Market Players | QIAGEN, PacBio, Illumina Inc., Thermo Fisher Scientific Inc., Oxford Nanopore Technologies, Bio-Rad Laboratories, Inc., PerkinElmer Inc., F. Hoffmann-La Roche Ltd., Promega Corporation, Agilent Technologies Inc. |

Analyst Review

According to the insights of CXOs, increase in the prevalence of genetic disorders. is expected to offer profitable opportunities for the expansion of the market. In addition, growing application of gene expression in drug discovery, and rise in the demand of personalized medicine for genetic disorders boost the growth of the market.

CXOs further added that the rise in genetic disorders and increase in public awareness, the demand for personalized medicine is surging which is expected to fuel the market growth. In addition, the surge in investments in R&D by pharmaceutical & biotechnology companies, the growing healthcare expenditure, and the increase in adoption of technologically advanced gene therapy are the key factors driving the growth of the market. However, the high cost of the instruments for gene expression, and lack of awareness of gene expression technology and its potential benefits hampers the growth of the market up to some extent over the forecast period.

North America is expected to dominate the global gene expression market during the forecast period, followed by Europe. In addition, emerging economies such as India, China, Mexico, and Brazil are expected to offer lucrative opportunities owing to rapidly improving healthcare facilities and the rising number of genetic disorders and cancer cases which are the key factors attributed to the growth of the market.

Gene expression is an important life process through which gene sequences are transcribed into functional gene products such as functional RNAs or proteins. It plays an important role in functioning and development of an organism and provides a connection between gene-encoded information and a functional gene end-product. It is determined by deciphering the gene information during the transcription and translation process and is very useful in identifying the molecular signature of a disease and for determining biomarker in correlation with dose dependent cellular responses on exposure to drug or therapeutic candidate.

Increase in the prevalence of genetic disorders, growing application of gene expression in drug discovery and rise in the demand for personalized medicine for genetic disorders.

Diagnostic segment dominated the global market in 2021 and expected to continue this trend throughout the forecast period. The dominance of this segment can be attributed to the increasing use of gene expression analysis for early and precise diagnosis of rare genetic disorders and chronic illnesses which are the major factors that propel the growth of the market.

The total market value of the Gene Expression market is $8,505.71 million in 2021.

The market value of Gene Expression market in 2022 is $9220.19 million.

Top companies such as Illumina Inc., Agilent Technologies, Thermo Fisher Scientific Inc., PerkinElmer Inc., Oxford Nanopore Technologies, QIAGEN, Bio-Rad Laboratories Inc., PacBio, Promega Corporation, and F. Hoffmann-La Roche Ltd held a high market position in 2021.

High cost of gene expression instruments & reagents and lack of skilled professionals are the factors that hinders the growth of the market.

The gene expression market is segmented on the basis of product, application, and end-user. On the basis of product, the market is segmented into consumables and instruments.

Loading Table Of Content...