Genome Editing Market Research Report, 2030

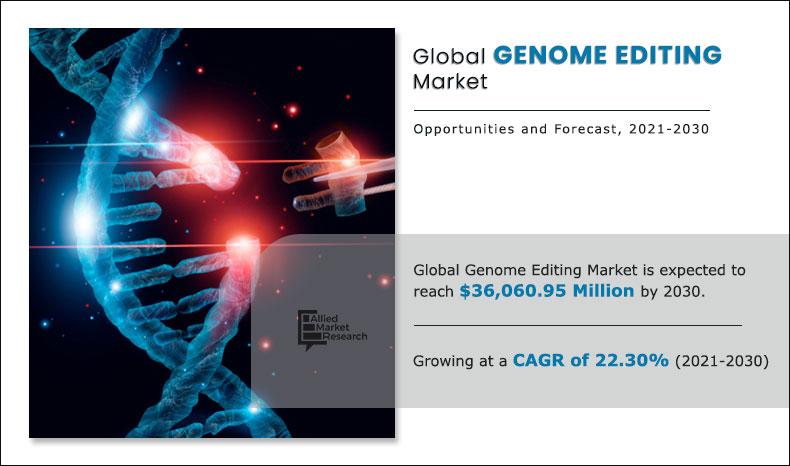

The global genome editing market size was valued at $4,811.04 Million in 2020 and is projected to reach $36,060.95 Million by 2030 registering a CAGR of 22.30% from 2021 to 2030. Genome editing is also referred to as gene editing, a group of technologies that enables researchers to change the DNA of an organism. These technologies allow addition, removal or alteration of genetic material at specific locations in the genome. In addition, various approaches have been developed for genome editing. A recent one is called CRISPR-Cas9, short for regularly clustered regularly interspaced short palindrome repeats and CRISPR-associated protein9. Furthermore, a lot of excitement has been generated in the scientific community through the CRISPR-Cas9 system, which is faster, cheaper, and more efficient than other existing genome editing methods.

Moreover, the prevention and treatment of human diseases is of great importance to genome editing. Most research is currently being done on genome editing to better understand diseases using cell and animal models. Scientists are still investigating whether this approach is safe and effective for human use. It is being explored in research on a wide range of diseases, such as single-gene diseases like hemophilia, cystic fibrosis, and sickle cell disease. It also has the potential to treat and prevent complex diseases such as heart disease, cancer, human immunodeficiency virus (HIV) infection, and mental illness.

Continuous technological advancements in gene-editing tools is a major factor driving the growth of the market. Furthermore, availability of government funding & growth in number of genomics projects and rise in prevalence of cancer & other genetic disorders are projected to also drive the market growth. In addition, development of CRISPR -based novel diagnostic tools to mitigate the adverse impact of the COVID-19 pandemic also boost the genome editing market growth. Conversely, high cost of genomic equipment and increase in concerns about the risks and ethical issues associated with genome editing are some restraints that hinder the growth of the market to some extent. On the other hand, presence of key players in emerging economies and applications in several drug discovery processes are few of the factors create lucrative opportunities for the genome editing market in the near future.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector across the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of healthcare. Moreover, there has also been a moderate effect on various healthcare services, including the including genome editing market. When COVID-19 was first identified, many researchers redirected their focus to the study of this novel virus and the disease it causes. Individuals working with CRISPR were no exception, and the gene editing tool was soon taken to the frontlines in the worldwide war against COVID-19. Furthermore, with the technology based upon a naturally occurring bacterial gene editing system that plays a key role the prokaryotic defense against viral infection, the CRISPR—Cas system is designed to fight viruses. The challenge researchers are facing now is how best to utilize its natural ability and optimize it for human benefit. At this time, scientists have certainly risen to the occasion and CRISPR technology has been successfully used to develop rapid diagnostic tests for COVID-19 – gaining its first US FDA (MD, USA) approval in the process.

Furthermore, development of CRISPR -based novel diagnostic tools to ease the adverse impact of the COVID-19 pandemic is driving the market. For instance, in March 2021, a team of researchers from the Nanyang Technological University developed a diagnostic test - VaNGuard (Variant Nucleotide Guard) based on CRISPR technology. This test can detect mutated SARS-CoV-2 strains, thereby increasing the adoption of CRISPR genome editing technology in the diagnostics field. Hence, the overall impact of COVID-19 on genome editing market is positive, which will further drive the market growth.

Genome Editing Market Segmentation

The global genome editing market is segmented on the basis of application, technology, end user and region. On the basis of application, the market is further classified into cell line engineering, genetic engineering, drug discovery, gene modified cell therapy & diagnostics and other applications. By technology, it is divided into CRISPR, TALEN, ZFN and other technologies. Based on end user, it is subdivided in to academics & government institutes, biotechnology & pharma companies, contract research organizations. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Application

Genetic Engineering application segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By Technology

By technology, the CRISPR segment accounted for the largest share of the genome editing market in 2020. The large share of this segment can be attributed to the ease of use associated with CRISPR, which gives it a significant advantage over ZFN and TALEN.

By Technology

Unisex segment is projected as one of the most lucrative segment.

Pharmaceutical companies segment accounted for the largest share of the genome editing market in 2020. The increasing prevalence of infectious diseases and cancer is driving research activities worldwide. This is expected to drive the demand for genome editing in biotechnology & pharmaceutical companies.

By Region

North America is projected to account for a major share of the global genome editing market during the forecast period. The market in the region is anticipated to grow in the future, owing to development of gene therapy in the U.S., rise in use of genetically modified crops, surge in prevalence of infectious diseases and cancer, and the availability of research grants and funding are propelling market growth in North America.

By Region

Asia-Pacific region would exhibit the highest CAGR of 25.2 % during 2021-2030.

Competitive Analysis

The key market players profiled in the report include Agilent Technologies, CRISPR Therapeutics, Danaher, Eurofins Scientific, Editas Medicine, GenScript, Horizon Discovery Limited, Lonza, Merck and Thermo Fisher Scientific.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global genome editing market along with the current trends and future estimations to elucidate the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the market growth is provided in the report.

- Comprehensive quantitative analysis of the industry from 2020 to 2030 is provided to enable the stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the key segments of the industry helps to understand the application and products the market used across the globe.

- Key market players and their strategies have been analyzed to understand the competitive outlook of the market.

Key Market Segments

By Application

- Cell line engineering

- Genetic Engineering

- Drug Discovery

- Gene-modified cell therapy and Diagnostics

- Other Applications

By Technology

- CRISPR

- TALEN

- ZFN

- Other technologies

By End User

- Academics & Government Institutes

- Biotechnology & Pharma Companies

- Contract Research Organizations

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Genome Editing Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | AGLIENT TECHNOLOGIES, INC., PERKINELMER, INC., MERCK KGAA, THERMO FISHER SCIENTIFIC, INC., DANAHER CORPORATION, EUROFINS SCIENTIFIC, CRISPR Therapeutics AG, EDITAS MEDICINE, INC, .LONZA GROUP LTD., GENSCRIPT BIOTECH CORPORATION |

Analyst Review

Genome editing market growth includes increase in implementation of CRISPR genome editing technology coupled with rising synthetic gene demand in diverse biotechnology domains has primarily driven the market growth over the past few years. Moreover, continuous technological advancements in gene-editing tools are a major contributing factor for revenue generation in this market. Moreover, the market is witnessing intensified competition among the market players owing to the expanding applications of genome editing tools. There has been an increased focus on the highly adaptable CRISPR technology. Genome editing has indicated a good potential for the treatment of genetic disorders, infectious diseases, and cancer. Along with the advantages, there are growing concerns about the risks and ethical issues associated with genome editing that affect the market. The major ethical issues, include the off-target mutation development, imbalance of the environment, and illegal usage of genome editing.

Furthermore, genome editing market is dominated by North America due to the strong growth trend in the pharmaceuticals and biotechnology industries and is followed by Europe. The large share of North America can be attributed to factors such as the development of gene therapy in the U.S., the rising prevalence of infectious diseases and cancer, and the availability of research grants and funding, which are propelling the market growth in North America.

The total market value of Genome Editing market is $4,811.04 million in 2020.

The forcast period for Genome Editing market is 2021 to 2030

The market value of Genome Editing market in 2021 is $5,893.53 million.

The base year is 2020 in Genome Editing market

Top companies such as Agilent Technologies, CRISPR Therapeutics, Danaher, Eurofins Scientific, Editas Medicine ,GenScript, Horizon Discovery Limited, Lonza, Merck and Thermo Fisher Scientific held a high market position in 2020.

Based on technology, the CRISPR segment accounted for the largest share of the genome editing market in 2020. The large share of this segment can be attributed to the ease of use associated with CRISPR, which gives it a significant advantage over ZFN and TALEN

Continuous technological advancements in gene-editing tools is a major factor driving the growth of the market. Furthermore, availability of government funding, growth in the number of genomics projects and rise in prevalence of cancer & other genetic disorders will also drive the market growth. In addition, development of CRISPR-based novel diagnostic tools to mitigate adverse impact of the COVID-19 pandemic also boost the genome editing market growth

North America is projected to account for a major share of the global genome editing market during the forecast period. The market in the region is anticipated to grow in the future, owing to development of gene therapy in the U.S., increase in use of genetically modified crops, rise in prevalence of infectious diseases and cancer, and the availability of research grants and funding are propelling the market growth in North America.

Genome Editing products that are dry and used as primary or secondary dressings to protect the wound from infection

Gene editing has indicated a good potential for the treatment of genetic disorders, infectious diseases, and cancer.

Loading Table Of Content...