Geophysical Services Market Research, 2033

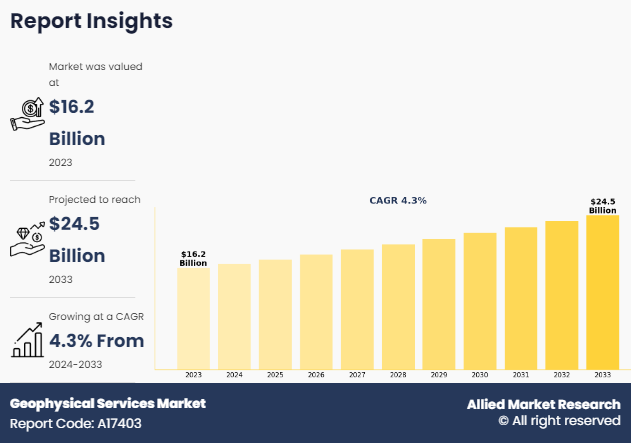

The global geophysical services market was valued at $16.2 billion in 2023, and is projected to reach $24.5 billion by 2033, growing at a CAGR of 4.3% from 2024 to 2033. Environmental concerns and regulatory challenges act as a restraint for the geophysical services market due to the stringent regulations governing environmental protection. These services often involve activities such as seismic surveys and drilling that can have significant impacts on ecosystems and biodiversity. For example, seismic activities in marine environments can affect marine life, leading to restrictions on such activities to protect these ecosystems. In addition, increase in emphasis on sustainability and conservation means that geophysical service providers must comply with a rise in environmental regulations. These regulations can delay projects, increase costs, and limit the scope of exploration activities, thereby restraining the market growth.

Introduction

Geophysical services collect systematic data from the earth surface for monitoring various electric magnetic fields, site characterization, and exploration of potential mines, oil & gas minerals. Geophysical services are widely carried out in oil & gas, mining, and other industries to exploit potential reserves. It is one of the most economic methods for discovering natural resources to meet the rising demand for energy and consumer goods.

Market Dynamics

The increasing demand for oil & gas has led to the search for hydrocarbon exploration, which includes oil and natural gas deposits below surface by geophysicists. The major advantages of geophysical services are the through this process it is possible to estimate the oil and gas volume in place and the government or private individual can plan the field developed and production of a reservoir oil & gas.

In recent years, the global demand for crude oil has shown significant growth, with varied projections suggesting continued upward trends. In 2022, according to IEA “The global demand for crude oil surged by 2.3 million barrels per day (mb/d). Specifically in India, fuel demand was projected to increase by 5.5% in 2022. Moving into 2023, the demand was anticipated to further rise by 2.2 mb/d to 102.2 mb/d, with another estimate slightly lower at a 2 mb/d increase to 101.9 mb/d”.

According to EIA, “The non-OECD countries were expected to see a growth in consumption of petroleum and liquid fuels by 1.6 million b/d, reaching an average of 55.1 million b/d in 2023”. For 2024, according to IEA “The global oil demand is expected to grow by only 1.2 mb/d, essentially halving the growth rate seen in 2023. Similarly, non-OECD production was also expected to increase by 1.6 mb/d, continuing to highlight the significant role these regions play in the global energy landscape”. These trends reflect the dynamic nature of global energy consumption patterns, driven by both developing and developed economies.

The government and corporate companies are investing heavily to locate untapped hydrocarbon sources to meet the growing demand for oil and gas in the power generation and transportation sector. The presence of the abovementioned factors will provide ample opportunities for the development of the geophysical services market. For instance, in April 2024, Venterra Group company Gavin & Doherty Geosolutions (GDG), a global offshore wind services provider, secured a contract to provide geophysical services for a Polish offshore wind farm.

Most industries across the globe started to use the Internet of Things (IoT) to improve the efficiency of production. The oil & gas industries have begun to adopt digital technologies that focus on the understanding of reservoir resources, improve the health and safety standards, and improve the efficiency of the production at the oil fields. Most oil companies are shifting toward the use of digital technologies in oil wells, which has resulted in a demand for detection technology equipment, which is expected to fuel the demand for the geophysical services market.

Offshore exploration activities represent a significant opportunity for the geophysical services market primarily due to the continuous need to explore new hydrocarbon reserves. As onshore oil and gas resources become more depleted, companies are progressively moving towards offshore regions which often remain underexplored. Offshore fields are expected to contain larger, untapped reserves, offering substantial rewards. Geophysical services are essential in these environments to provide accurate data on seabed geology and to help optimize the exploration and development processes. This shift not only expands the market for geophysical services but also drives innovations in technology adapted to the unique challenges of marine environments.

In 2022 and 2023, oil exploration activities demonstrated a significant variance across different regions, reflecting a dynamic landscape in the global oil sector which has significant impact on geophysical services industry. In India, the Indian Oil Corporation Limited maintained a continuous pace of exploration and production, extending activities both domestically and internationally. This ongoing commitment indicates a robust strategy to enhance oil recovery and secure new reserves. On a global scale, the exploration scene was quite active with a total of 178 new-field wildcat (NFW) discoveries reported by the end of November 2022, illustrating a vigorous exploration effort worldwide. By the end of 2022, this number had grown to 280 conventional discoveries, highlighting a fruitful year for oil exploration globally. Norway, specifically, showcased consistency in its exploration efforts, with 33 exploration wells completed in both 2022 and 2023.

Segments Overview

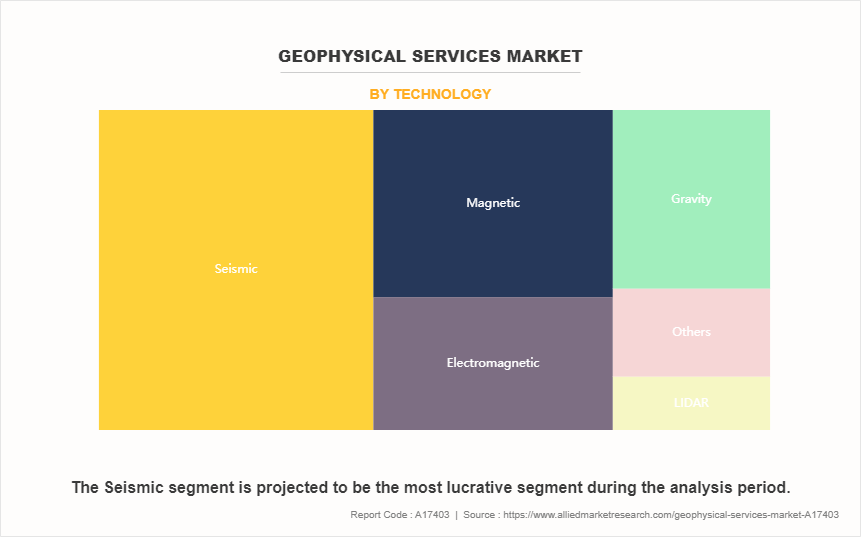

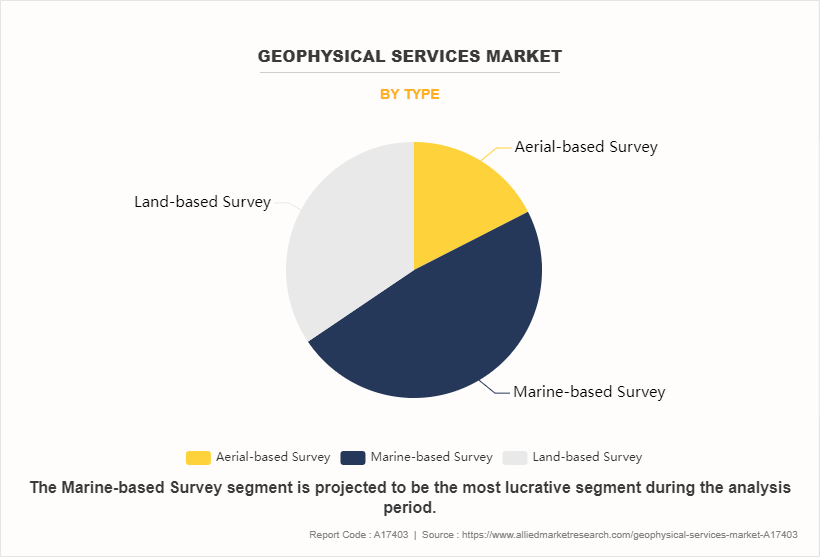

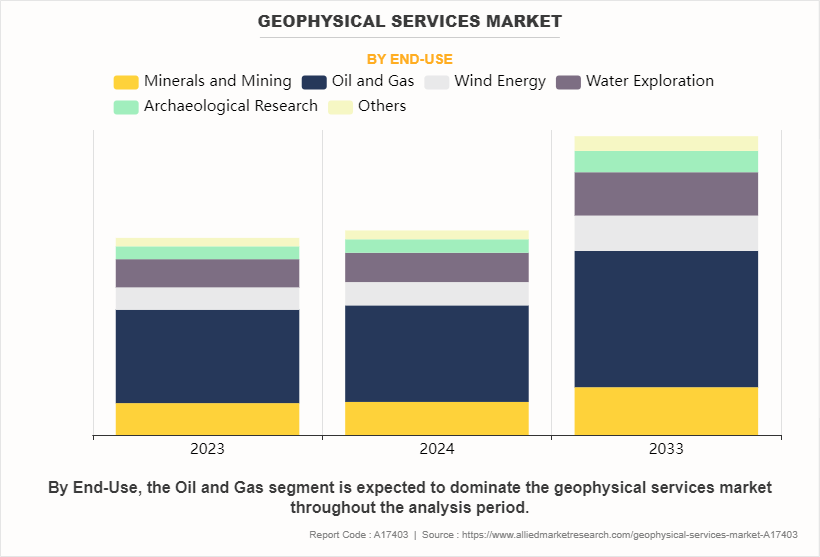

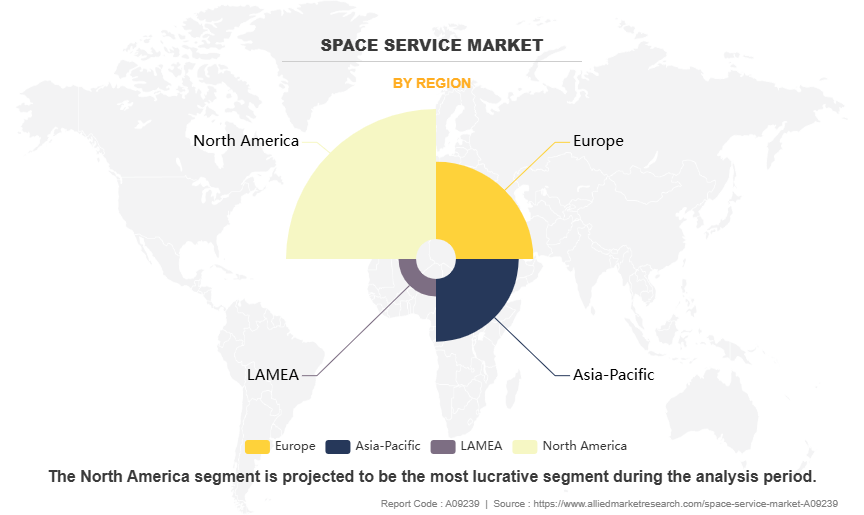

The geophysical services market overview is segmented on the basis of technology, type, end-use, and region. On the basis of technology, it is segmented into seismic, magnetic, electromagnetic, gravity, LiDAR, and others. On the basis of type, the market is segmented into aerial-based survey, marine-based survey, and land-based survey. In addition, on the basis of end-use, the global geophysical service market is segmented into minerals & mining, oil & gas, wind energy, water exploration, archaeological research, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, North America accounts for the largest share of the market, followed by Europe, and Asia-Pacific.

By technology, seismic segment dominates the geophysical services market share. A seismic survey is a method used to investigate the geological properties of the earth and is majorly used to explore natural gas, petroleum, and mineral deposits. This technique determines the time interval between the initiation of waves at a shot point and the arrival of reflected or refracted waves by the seismic detectors. The increase in demand for oil & gas is a major driving factor for the growth of the global seismic survey. The presence of advantages of seismic survey services such as the reduction of probability of drilling dry wells, hence preventing further drilling and minimizing environmental effects of oil & gas exploration is propelling the growth of seismic technology in the geophysical services market. Furthermore, this technology has a wide range of applications in the mining sector and disaster management such as in earthquakes, as this technology can save lives by giving early warning to the people living in the earthquake zone. The presence of these advantages and the demand for minerals and oil & gas in modern society are expected to provide ample opportunities for the development of the market.

By type, the marine-based survey segment dominates the global geophysical services market size. A marine survey is also known as a hydrographic survey. It is the process of measuring several factors such as depth, stability, and ocean waves & minerals under the surface of water. The survey can be performed on still water as well as running water. The scope of application of marine-based surveys is in the construction of sea defense works and harbors. The rise in the industrial hubs and growth in foreign direct investment in all major manufacturing sectors across emerging economies such as China, India, Brazil, and Southeast Asian countries, are projected to fuel the demand for various mineral resources. The decline in land surface resources has led to an increase in the exploration of mineral resources in the marine areas. The increase in investment from the government and top mineral giants for marine exploration has driven the demand for marine-based surveys. The presence of the above-mentioned advantages is expected to drive the growth of the market.

By end-use, the oil & gas segment dominates the global geophysical service market. In oil & gas industries, geophysics plays a critical role where data are used by geophysical scientists to understand the presence, nature, and size of subsurface rock layers and potential reservoirs with oil wells. This industry has a huge demand for geophysical methods such as gravity, magnetics, and 2D seismic. These technologies are used for subsurface geohazards characterization, leak location and monitoring, and other related data. Increase in demand for the oil & gas industry-based products in the power and transportation sector is expected to drive the demand for the geophysical services market. Decline in resources on the surface of the landmass has led to exploration of oil resources in the seabed, which led to an increase in the demand for marine-based geophysical services. The demand for oil & gas products in various sectors such as fuel in power generation or as fuel for engines in transportation. The rapid development of the above-mentioned sectors is expected to drive the demand for oil and gas, which is projected to provide ample opportunities for the development of the geophysical services market.

North America is analyzed across the U.S., Canada, and Mexico. U.S. and Canada are the major players in this region. The North America geophysical services market statistics revenue is estimated to surpass $8.6 billion by 2031. The availability of abundant & affordable natural gas along with a shift in focus toward clean energy generation will foster the market outlook. The adoption of geophysical services on account of growing investments in mineral & mining industries, rising instability in crude oil prices, and increasing usage of aerial-based geophysical surveys have a positive impact on the geophysical services market growth. Moreover, minerals are being excavated at a faster rate to meet the needs of the rising population. The mining of precious metals such as gold, copper, silver, and iron is further fueling the market for geophysical services in this region. The above-mentioned are major factors driving the growth of the market in this region during the geophysical services market forecast period.

Competitive Analysis

The major companies profiled in this geophysical services market report include Schlumberger, CGG, Petroleum Geo-service, TGS, Shearwater Services, Dawson Geophysical Company, Fugro, SGS SA, EON Geosciences, Ramboll Group A/S, Getech, NUVIA Dynamics Inc., Spectrum Geophysics, Abitibi Geophysics, and Xcalibur Multiphysics.

Recent Developments in the Geophysical Services Market

- In April 2024, Shearwater Services entered into a strategic collaboration with Mondaic for full waveform inversion to enhance high-resolution subsurface imaging and optimize seismic acquisition surveys.

- In February 2023, CGG entered into a strategic agreement with 2CRSi to launch a high-performance computing (HPC)-as-a-service (HPCaaS) offering to meet the needs of HPC clients globally.

- In November 2022, TGS, a global provider of energy data and intelligence, announced today a strategic cooperation agreement with SAND Geophysics and Norwegian Geotechnical Institute (NGI) to provide early-phase ground condition and geohazard evaluations for offshore wind farm development.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the geophysical services market analysis from 2023 to 2033 to identify the prevailing geophysical services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the geophysical services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global geophysical services market trends, key players, market segments, application areas, and market growth strategies.

Geophysical Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 24.5 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 330 |

| By Technology |

|

| By Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Getech, Abitibi Geophysics, TGS, Schlumberger Limited, Petroleum Geo-service, Spectrum Geophysics, EON Geosciences, Dawson Geophysical Company, CGG, Fugro, Ramboll Group A/S, SGS SA, Xcalibur Multiphysics, Shearwater Services, NUVIA Dynamics Inc. |

Analyst Review

The global geophysical services market is expected to witness increased demand during the forecast period, due to a surge in the demand for various accurate data for the geophysicist of the mineral and oil & gas exploration companies.

The rapidly growing investment of individuals in oil & gas, and manufacturing industries has led to a surge in the demand for raw materials such as metal minerals and crude oil. The decline in surface resources has led to an increase in the exploration of offshore and marine resources.

Geophysical services are provided using air, land, and marine-based technology to accurately calculate the data according to individual utilization. Aerial-based drones, planes, helicopters, and satellites are used to map the topography using various advanced technologies such as electromagnetic, magnetic, gravity, LiDAR, and other technologies to determine the valuable minerals under the rocks and seabed.

Increase in the construction of residential, commercial, and industrial buildings in developing countries has led to a surge in the utilization of geophysical services in the construction sector. The increase in investment of the government and private individuals towards archaeology to solve various mysteries of ancient humans and civilization has positively impacted the demand for the geophysical services market.

$24.5 billion is the estimated industry size of geophysical services market in 2033.

The key upcoming trends in the geophysical services market: Integration of AI and Machine Learning Increased Use of Non-Seismic Methods Growth in Offshore Exploration Demand for Sustainable Practices Renewable Energy Projects

Oil and Gas is the leading end-use of geophysical services market in 2023;

North America is the largest regional market for geophysical services market in 2023.

Schlumberger, CGG, Petroleum Geo-service, TGS, Shearwater Services, Dawson Geophysical Company, Fugro, SGS SA, EON Geosciences, Ramboll Group A/S, Getech, NUVIA Dynamics Inc., Spectrum Geophysics, Abitibi Geophysics, and Xcalibur Multiphysics are the top companies to hold the market share in Geophysical Services.

Loading Table Of Content...

Loading Research Methodology...