Geospatial Solutions Market Summary

The global geospatial solutions market size was valued at $432 billion in 2021, and is projected to reach $1,457.7 billion by 2031, growing at a CAGR of 13.1% from 2022 to 2031. Growth of the global market is attributed to increase in penetration of artificial intelligence based geographic information system (GIS), and increase in use of location-based services integrated with geographic information system.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2023.

The global geospatial solutions market share was dominated by the solution segment in 2023 and is expected to maintain its dominance in the upcoming years

The network & location analytics segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 432 Billion

- 2031 Projected Market Size: USD 1,457.7 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 13.1%

- North America: Generated the highest revenue in 2023

Geospatial refers to any type of data related to a geographic location. Geospatial data is usually procured from remote sensing, satellites, and global positioning systems (GPS). Geospatial solutions utilize geospatial data, gathered through geospatial technology such as geographic information system (GIS), global positioning system and RS (remote sensing) to set-up geospatial data models and solutions across several sectors. They integrate real-time communication, sensors, apps, field, and back-office processing, modeling, and analytics to provide productive workflow, high-quality, and data exchange to drive productivity, efficiency, and safety.

Lack of awareness regarding benefits of geospatial solutions is the factor that hampers the geospatial solutions market growth. Furthermore, development of 4D GIS software is the factor expected to offer growth opportunities during the forecast period.

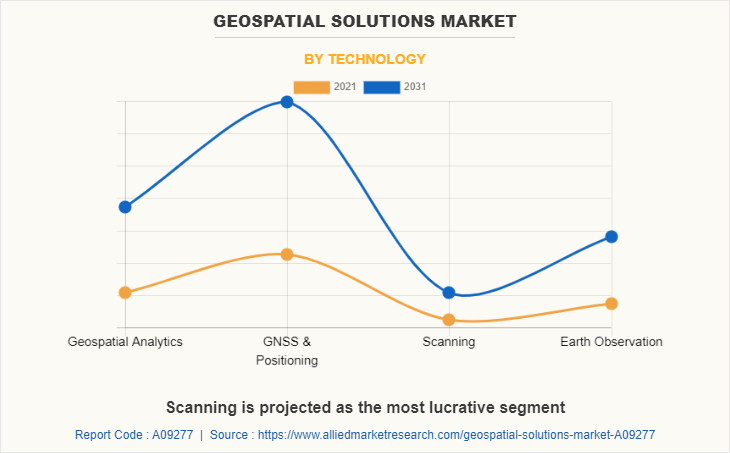

Global navigation satellite system (GNSS) refers to a constellation of satellites, which provides signals from the space that relays positioning, navigation, and timing data to the GNSS receiver. It provides accurate real-time positioning and timing services to users across the globe. Numerous companies are introducing GNSS chipset equipped devices to provide enhanced positioning-as-a-service to several geospatial professionals and to support several geographic information system field applications, which supplements growth of the segment.

For instance, in September 2021, Trimble TRMB introduced Trimble DA2 Global Navigation Satellite Systems (GNSS) receiver for Trimble Catalyst positioning service. The DA2 is second-generation receiver and antenna for catalyst service, which includes Trimble ProPoint GNSS engine for enhanced performance. DA2 is Bluetooth enabled and provide iOS support to catalyst service. The catalyst service is a subscription-based service, which offers accurate positioning to location-based workforce and supports various geographic information system field applications.

The collection and analysis of geospatial data are essential for proper management of earth’s resources and for creating sustainable economies across the world. To understand and enhance living conditions on the planet, analysis of agriculture, water resources, urban planning, rural development, mineral prospecting, environment, forestry, ocean resources, and disaster management become crucial.

Few companies are raising funds to expand the reach of their products globally and to develop their earth observation software to deliver earth observation data, which boosts the segmental growth. For instance, in 2022, Earth Box secured $1.83 million from Archangels to develop its earth observation (EO) software. The new EO software will aid in meeting growing needs of a wide range of sectors, businesses, and users for earth observation insights as part of strategic planning, monitoring, and reporting.

The North America region accounted for a major share in 2021. The North America geospatial solutions market is studied across the U.S., Canada, and Mexico. Large number of companies operating in the market have their headquarters in these countries. The geospatial solutions market in this region experienced notable growth, owing to increase in geospatial applications in defense and transportation sectors.

Geospatial mapping applications based on location-based service (LBS) are gaining popularity as a base for NASA and the United States Geological Survey (USGS) activities. Government and military organizations use satellite images for map creation, military reconnaissance, and disaster management. These images are captured depending on the location provided by geospatial solutions.

Rise in investments in the defense sector and technological advancements in the telecommunication industry acts as key driving forces for the geospatial analytics market in North America. In addition, implementation of LBS-enabled drones for border security and monitoring high-risk situation by federal agencies, government, and nongovernment organizations is expected to boost the geospatial solutions industry investment for these services. Advanced sensors onboard satellites provide reliable, cost-effective, and impartial information about variety of vegetation and hydrological parameters at various spatial resolutions.

The U.S. is one of the leading countries in the North America geospatial solutions market as a majority of companies like Apple, Microsoft and Google have headquarter in U.S. These major companies made improvement in geospatial solution used in various sector. These major companies made partnership with start-ups and acquired small companies increasing their market presence world-wide.

In July 2022, Oracle Corporation and Microsoft Corporation announced the availability of Oracle Database Service for Microsoft Azure. Customers of Microsoft Azure can now use a familiar interface to provision, access, and monitor enterprise-grade Oracle Database services in Oracle Cloud Infrastructure (OCI).

In June 2021, Microsoft has announced a strategic alliance with Euclideon, a leading 3D data specialist and plans to construct the world's largest geospatial data platform on the Azure cloud, containing more than 100 petabytes of 3D data. This assures a high-performance, durable platform that allows businesses across many industries to use 3D data to optimize business processes and develop new goods and services.

Increase In Penetration Of Artificial Intelligence-based Geographic Information System (Gis)

Artificial intelligence is being utilized in medical and healthcare, geospatial technologies, business solutions, and other industries. In recent years, there has been a significant improvement in artificial intelligence and machine learning capabilities. These capabilities, coupled with geospatial data provide enhanced insights to organizations.

Geospatial solution providers such as ESRI and SAP, are deploying artificial intelligence-based solutions to provide enhanced insights to organizations. For instance, in 2020, MicroMultiCopter (Shenzhen) deployed more than 100 drones in different Chinese cities to patrol areas and efficiently detect crowds and traffic during the COVID-19 pandemic.

In addition, integration of artificial intelligence with geospatial solutions saves time and resources as well as it allows performing tasks such as object detection, instance segmentation, and image classification. Thus, increase in penetration of artificial intelligence based geographic information system is expected to drive growth of the geospatial solutions market forecast.

Increase In Use Of Location-based Services Integrated With Gis

Location-based services (LBSs) are a set of services that use real time geo-data through internet capable devices to provide information about current location. LBSs are greatly dependent on geographical mapping, which is carried out with the help of satellite imagery received through navigation satellites.

LBSs help during floods, rescue events, natural calamities, and for weather forecasting to develop future programs to simplify situational events. Therefore, most countries are mandating use of LBSs as it helps in decision making for civil defense operations.

In addition, several organizations utilize location-based services integrated with geographical information system (GIS) for a wide range of applications such as geospatial modelling, asset tracking, and route optimization to provide improved consumer-focused services. For instance, in the transportation sector, location-based service integrated with GIS are utilized for accident analysis, route planning, highway maintenance management, and traffic modelling.

Moreover, various mobile applications such as business and communication apps, gaming apps, health & wellness apps, and personal convenience apps majorly use real-time positioning information. Thus, increase in trend of navigation and location-based services integrated with geographic information system (GIS) across various sectors is expected to drive growth of the geospatial solutions market.

Lack Of Awareness Regarding Benefits Of Geospatial Solutions

Geospatial solutions have a wide range of applications in various sectors such as construction, government, military, mining, and others. Over the years, traditional methods of landscape mapping have transformed with integration of advanced technologies such as satellite imaging, information technology, and GIS. Land-use pattern, environmental condition analysis, and spatial data of the earth’s surface are studied and mapped with the help of images taken through satellites, geographic information systems, and remote sensing.

However, several organizations and businesses are unaware of the benefits of geospatial solutions, which can be utilized in numerous business applications. Several non-government agencies and public & private sectors still have no information on geographic information system (GIS) and spatial data infrastructure (SDI), therefore, these organizations and sectors are not using geospatial solutions, which results in low adoption of geospatial solutions.

Segments Overview

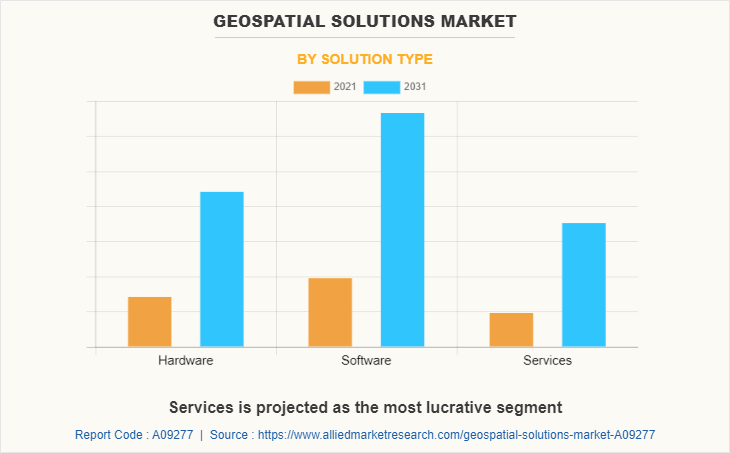

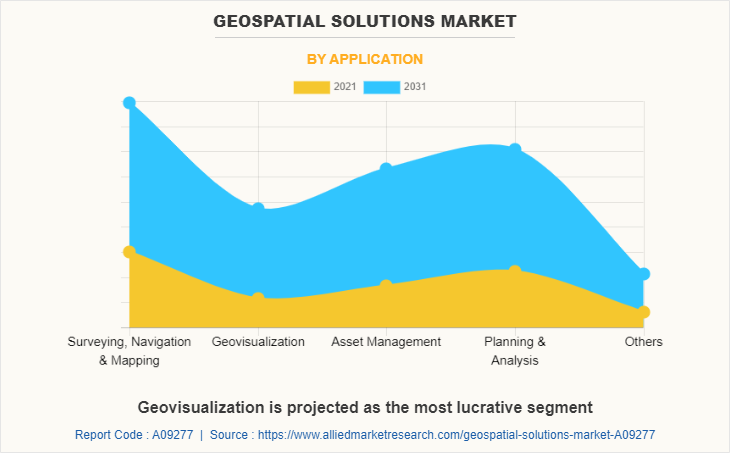

The geospatial solutions market is segmented on the basis of solution type, technology, application, end-use, and region. By solution type, it is segmented into hardware, software, and service. By technology, it is classified into geospatial analytics, GNSS & positioning, scanning, and earth observation. By application, it is fragmented into surveying, navigation, & mapping, geovisualization, asset management, planning & analysis, and others.

By end-use, it is categorized into utilities, defense & intelligence, transportation and logistics, infrastructural development, natural resources, agriculture, and others. By region, the geospatial solutions market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Some leading companies profiled in the geospatial solutions market report comprises Apple Inc., Bentley Systems, Inc., General Electric, GIS Cloud Ltd., Google Inc., L3Harris Geospatial Solutions, Inc., Oracle Corporation, Living Map, Mappedin, Microsoft Corporation, Pix4D S.A., SAP SE, Telenav Inc., TomTom International BV, and Uber Technologies, Inc.

By Region

Asia-Pacific would exhibit the highest CAGR of 14.9% during 2022-2031

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the geospatial solutions market analysis from 2021 to 2031 to identify the prevailing geospatial solutions market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the geospatial solutions market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the geospatial solutions industry players.

The report includes the analysis of the regional as well as global geospatial solutions market trends, key players, market segments, application areas, and market growth strategies.

Geospatial Solutions Market Report Highlights

| Aspects | Details |

| By Solution Type |

|

| By Technology |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, L3Harris Geospatial Solutions Inc., Apple Inc., Oracle Corporation, Living Map, Mappedin Inc., General Electric Company, Pix4D S.A., Telenav Inc., GIS Cloud Ltd, Uber Technologies Inc., TomTom International BV, Bentley Systems Inc., SAP SE, Google LLC |

Analyst Review

The global geospatial solutions market is expected to witness significant growth owing to increase in penetration of artificial intelligence based geographic information system (GIS) and increase in use of location-based services integrated with geographic information systems.

4D GIS integrates, manages, and analyzes spatial and non-spatial information to provide quality visualization, simulation, and communication. It supports better decision making by providing a geographic representation of full scope of a project.

In addition, 4D GIS aids project planners visualize the progress of a project at all levels. Both spatial and non-spatial information can be integrated into the GIS platform for analysis, easy management, and to create the final visualization. 4D models can also increase understandability of schedule of a project and force users to acknowledge risks during project execution. 4D GIS models also reduce cost by early identification of potential issues such as time conflicts and safety concerns. Moreover, 4D GIS is currently being utilized in construction and forestry sectors and is expected to be utilized in other sectors in upcoming years, which is expected to create opportunities for the market during the forecast period.

To gain a fair share of the market, major players adopted different strategies, such as partnership, product launch, and product development. Among these, product launch is the leading strategy used by prominent players such as Apple, Baidu, Bentley, General Electric, and GIS Cloud. These companies launched cutting-edge geospatial solution products seeking to grab a fair share of the market.

The global geospatial solutions market was valued at $432.0 billion in 2021 and is projected to reach $1,457.7 billion in 2031, registering a CAGR of 13.1%.

The global geospatial solutions market to register a CAGR of 13.1%.

The North America region accounted for a major share in 2021.

Some leading companies in the market include Apple, Baidu, Bentley, General Electric, GIS Cloud, Google Inc., L3Harris Corporation, Living Map, Mappedin, Microsoft Corporation, Oracle Corporation, SAP, Telenav, and TomTom International B.V.

Rise in investments in the defense sector and technological advancements in the telecommunication industry acts as key driving forces for the geospatial analytics market.

Loading Table Of Content...